Meet ShinyAcorns™: The 🐿️'s Curated Gold Equity Basket

The Blind Squirrel's 'Monday' Morning Notes. Year 4; Week 7 of 2026.

In last week’s note ‘Did I buy GDX in a Safari Suit?’, I mentioned that part of the reason I wanted to perform a full attribution analysis of the returns from our holding in AFK 0.00%↑ (the VanEck African ETF) was that I was trying to take stock of what precious metals mining exposure I had via AFK before developing further thoughts on the topic.

The 🐿️ was never traditionally a huge fan of gold mining stocks. My mates and I used to snigger at our fathers for their obsession with the junior mining market and the associated newsletters that spewed off the fax machines in their studies back in the early 1990s.

The irony is not lost on me that - 30 years on - the WhatsApp chat group containing that very same circle of friends - all active or retired finance types - now avidly debates the pearls from Fred Hickey’s monthly “High Tech Strategist” as soon as it hits inboxes. I have been a subscriber to Fred for many years but tend to read the letter for his macro and ‘hard tech’ thoughts and then skim over his detailed analysis on the results of miners.

The reason for this is that, as with biotech, I have always tended to outsource my investing in the mining sector to specialists in the field. The 🐿️ is not a geologist and would not know one end of a drug lab from the other. Somehow, not being a meteorologist does not prevent me from regularly losing money trading natural gas and agricultural commodities. A personal growth opportunity?

Several years ago, I decided to allocate 100% of a stranded pension pot that I had to Ned Naylor-Leyland’s Merian (now Jupiter) Gold & Silver Fund. You may have caught Ned on Grant Williams’ podcast last October in the middle of silver’s meteoric rise - Ned’s last reported allocation was VERY silver-heavy! He and his team absolutely nailed 2025 with that bias.

A key selling point of the fund was that it would take care of the relative asset allocation decisions between physical metals and miners (as well as individual miner selection).

It’s easy to be a cynic about miners - especially the junior ones. BTW - this article (linked below) from Macro-Ops’ Brandon Beylo made me laugh out loud several times. The 🐿️ shares many of his beliefs.

Another valuable benefit of my ‘Ned allocation’ is that it gives me the perfect polite response to any friends that want to pitch me their favorite “hot” stock tip - the citizens of my adopted homeland absolutely LOVE ‘a punt’ on junior miners!

🐿️: “really? how interesting! I leave my gold/silver miner allocation to Ned”.

…only about 2% of the time do I get that “you really should have followed me into XYZ” phone call or text…

Starting around the time of Covid fiscal stimulus, I began adding gold exposure directly to the funds that I manage for myself via GLD 0.00%↑ and the occasional call spread exposure on the same. The ‘Ned allocation’ was feeling insufficient on its own.

2025 - A Wild Year in Metals for the 🐿️

I guess we all morph into our fathers at some stage. In 2024, I actually started reading the second section of Fred Hickey’s letter more closely. In February 2025, I bought my first single stock miner in years. From The Drey at that time:

“I do not think that reaching for expensive SLV LEAPs makes sense here but am about to buy my first single stock PM miner in a while. HL 0.00%↑. Hecla - I like the chart and Hecla is the only decent PM miner that ever (to my recollection) became a WallStreetBets meme (back in 2020). Buying common. Also I have no view on a timing catalyst. Stop at $5.69 (200 MA).”

That stop was hit literally the next day when a surprise miss on earnings took Hecla down 14.6%! I had not even bothered to check if HL was one of Fred’s names or one of Ned’s disclosed holdings! Idiot rodent! I was once again sworn off from stock picking miners!

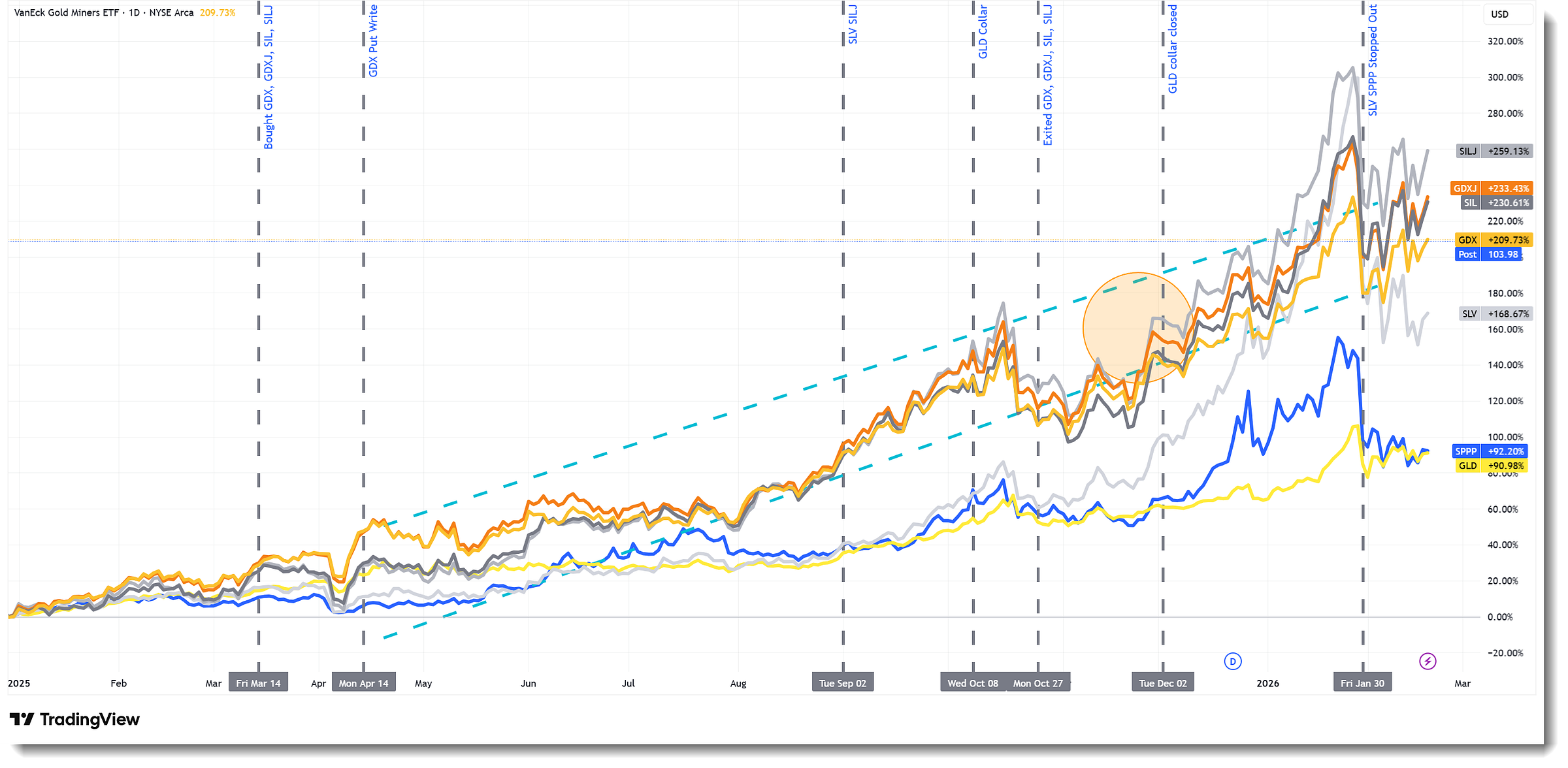

I remained convinced however that we were at the stage of the cycle in which miners would outperform the metals. In early March, I made a grab for ‘miner beta’ and bought the (senior and junior) index - an equal weight basket of GDX 0.00%↑ GDXJ 0.00%↑ SIL 0.00%↑ and SILJ 0.00%↑.

Since these ETFs were already up on average 20% on the year, I placed the orders with gritted teeth - with full expectation of another schooling from the Market Gods as punishment for breaking my own outsourcing rules.

In April, I took advantage of a spike in price and volatility to sell some GDX puts. In September, I added physical silver (SLV) and junior silver miners (SILJ) to BUSHY™.

I collared my gold exposure between early October and early December. I exited all of the miner ETFs during late October correction and trailing stops in Silver (SLV 0.00%↑) and PGMs (SPPP 0.00%↑) kicked me out of those exposures in late January.

It had been my intention to add back that strip of miner ETFs once they had recaptured that turquoise hand-drawn channel in the chart above. But I had a change of heart when they did, musing that there may be some profit-taking sellers waiting for the new tax year in January. Those sellers ended up selling a lot higher - if they did indeed sell at all!

The other reason for pausing was that I wanted to be more surgical about my re-entry into the mining trade. If 2025 was all about mining beta, my suspicion was that plenty of unworthy miners would have been dragged higher by the macro flows. The next leg of the PM mining bull market could benefit from some more active management.

Critique of ‘Own all 4’ ETFs Approach

The 🐿️’s impulsive reach for ‘miner beta’ was done without the benefit of a full research exercise.

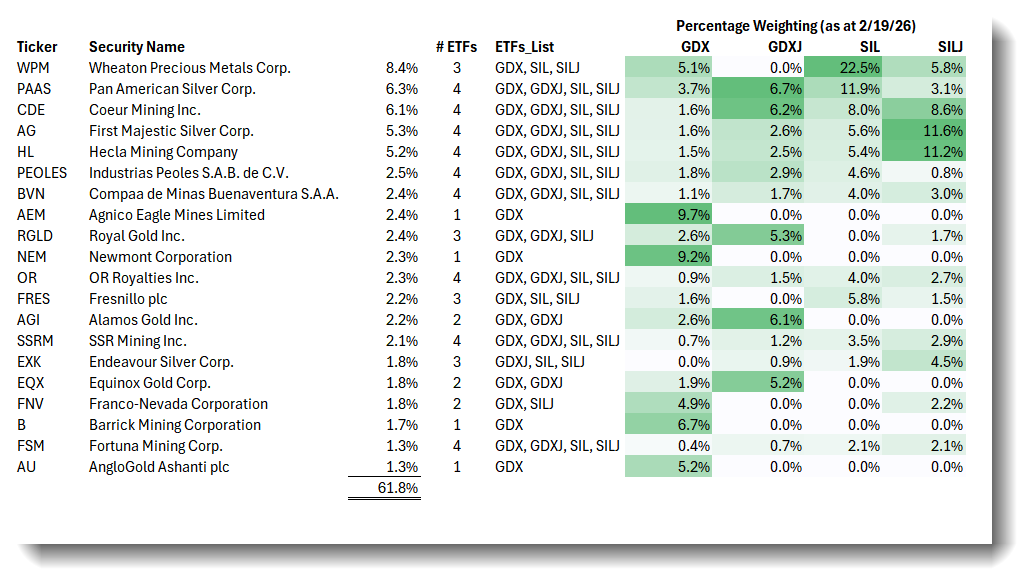

I had failed to appreciate quite how much overlap there is between the 4 ETFs. Out of 136 unique tickers, just under half of them appear in more than 1 ETF (35 in 2, 16 in 3 and 9 of them in all 4!).

The result of my equal weight approach was that, by the end of the year:

My Top 5 holdings were basically pure silver plays: Wheaton Precious Metals, Pan American Silver, Coeur, First Majestic and Hecla - collectively over 30% of my exposure!

The largest blended position, Wheaton (8.4%), was a royalty streamer - an asset class with much less leverage to a precious metals bull market.

In weighting terms, senior gold miners (GDX) had a significant overlap with junior silver miners (SILJ). Not what I thought I was buying.

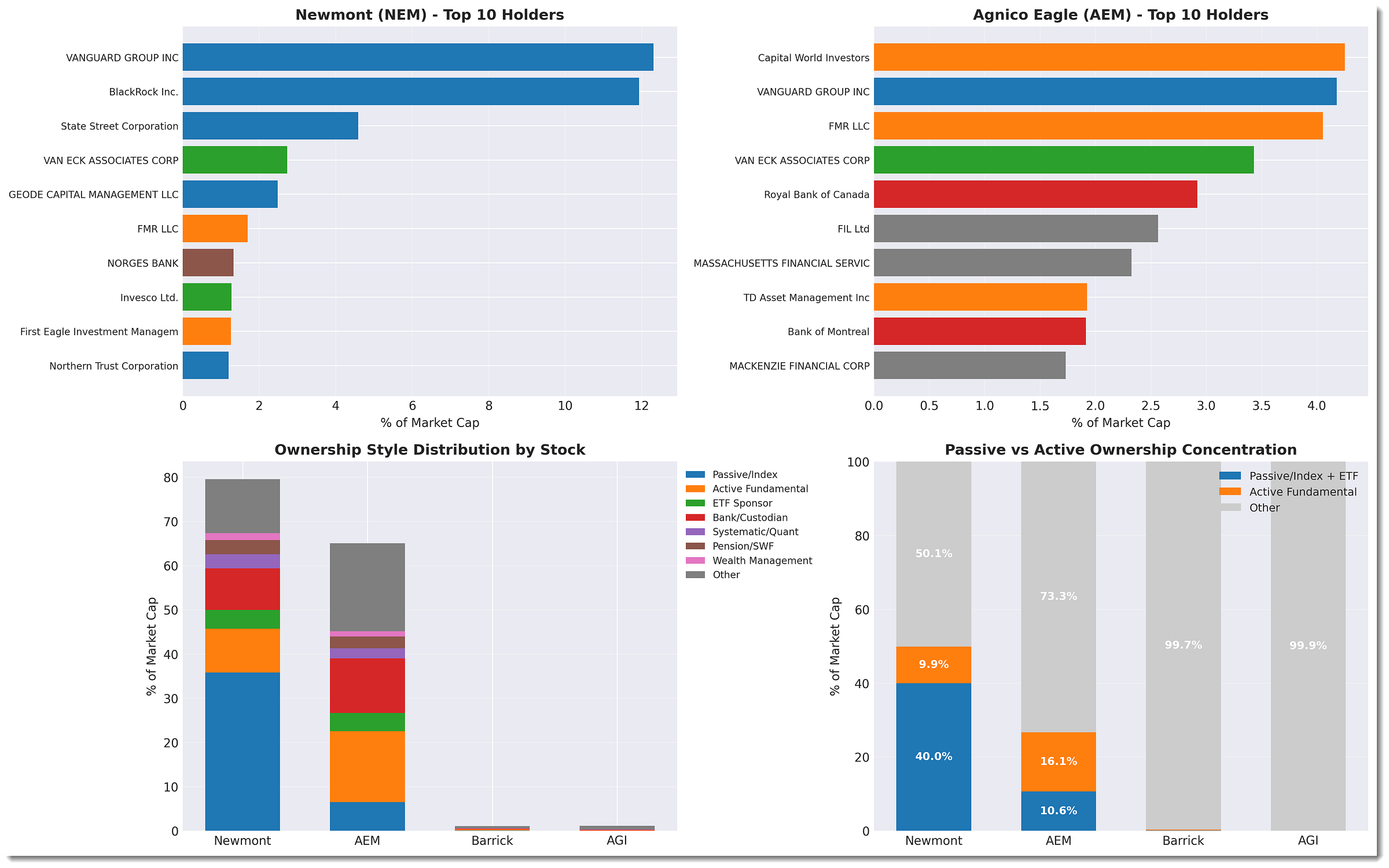

I had negligible exposure to the institutional beta effect. Big liquid names like Newmont, Agnico Eagle, Alamos and Barrick are the only names that large institutional allocators can realistically touch. If - and I don’t think they have yet (more on that later) - the giant funds of Fidelity, Capital etc. had been reallocating big money into the move last year, we would have been chronically underweight (less than 9% in the equal weight ETF book) the names that would be first to receive that flow.

12 stocks outperformed the (booming) GDX/GDXJ by over 100% in the past 12 months (see spreadsheet). Our ETF sleeve did not own enough of them in any meaningful size.

My strategy had the effect of giving my miner portfolio sleeve much greater leverage to the explosive move in silver relative to gold last year. Great, but that had not necessarily been my plan. Again, I had not been paying enough attention to the ‘Ned allocation’!

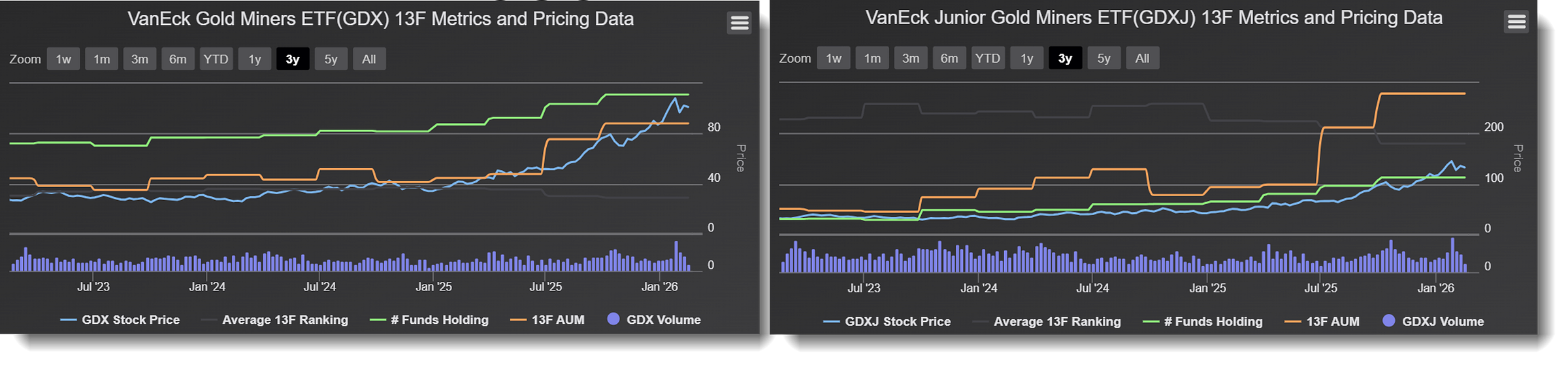

One crumb of comfort. The 🐿️ was in good company - according to 13F data, the amount of institutional money ‘renting beta’ (is that why we pay them the big bucks?) via the main miner ETFs accelerated dramatically during 2025.

A much more scientific approach is required going forward.

So naturally I have hopped on to Amazon to order myself a copy of ‘Geology for Dummies’ and logged on to a few Reddit and HotCopper1 junior mining retail forums…

I think my readers know me well enough to know that is not how this rodent rolls. UK politician Michael Gove famously declared that ‘people have had enough of experts’ during the Brexit debate. This 🐿️ is firmly on Team Expertise.

How did the Experts do last Year?

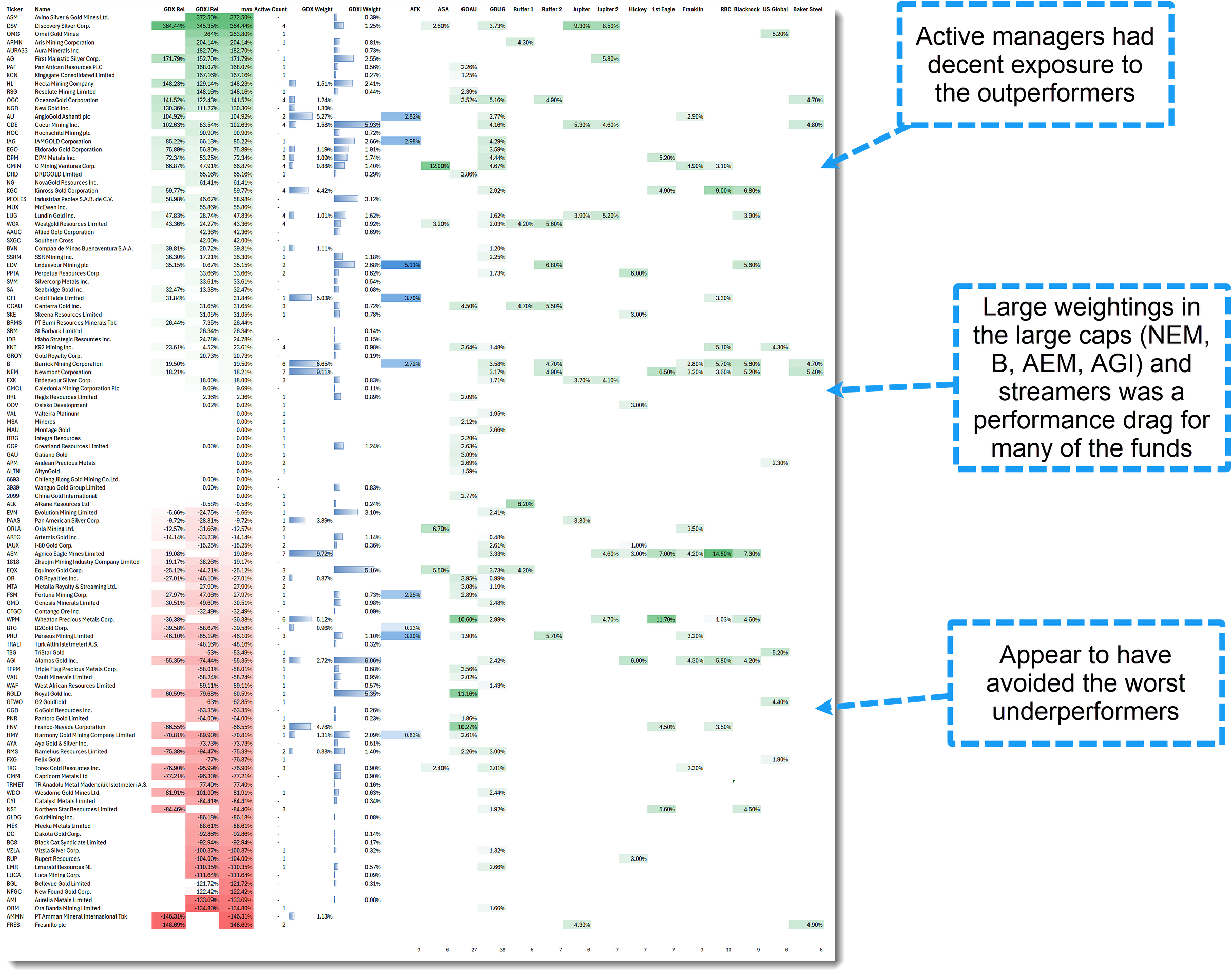

I decided to check-in on the broader universe of actively-managed PM miner ETFs and mutual funds. In fact, I reviewed the latest fact sheets of 14 of them in the US, Canada, UK and Australia and compared their top (active) picks to the biggest winners and losers in GDX 0.00%↑ and GDXJ 0.00%↑ over the past 12 months.

Key takeaways:

Many of the active managers only need to disclose their top holdings periodically according to their local regulations. As such we do not get a complete picture - and often with a significant time lag (except for the ETFs).

Based on the ‘heatmap’ below, the active PMs had a decent hit rate on selecting outperformers and dodged some bullets with the underperformers

As you would expect, there was a decent concentration of ownership among the sector giants (Newmont etc. plus the big royalty companies) - none of which were in the top (or bottom) quartiles of relative performance (versus the mining indices).

The image above is a bit of an eye test. You can download the full spreadsheet via the link below:

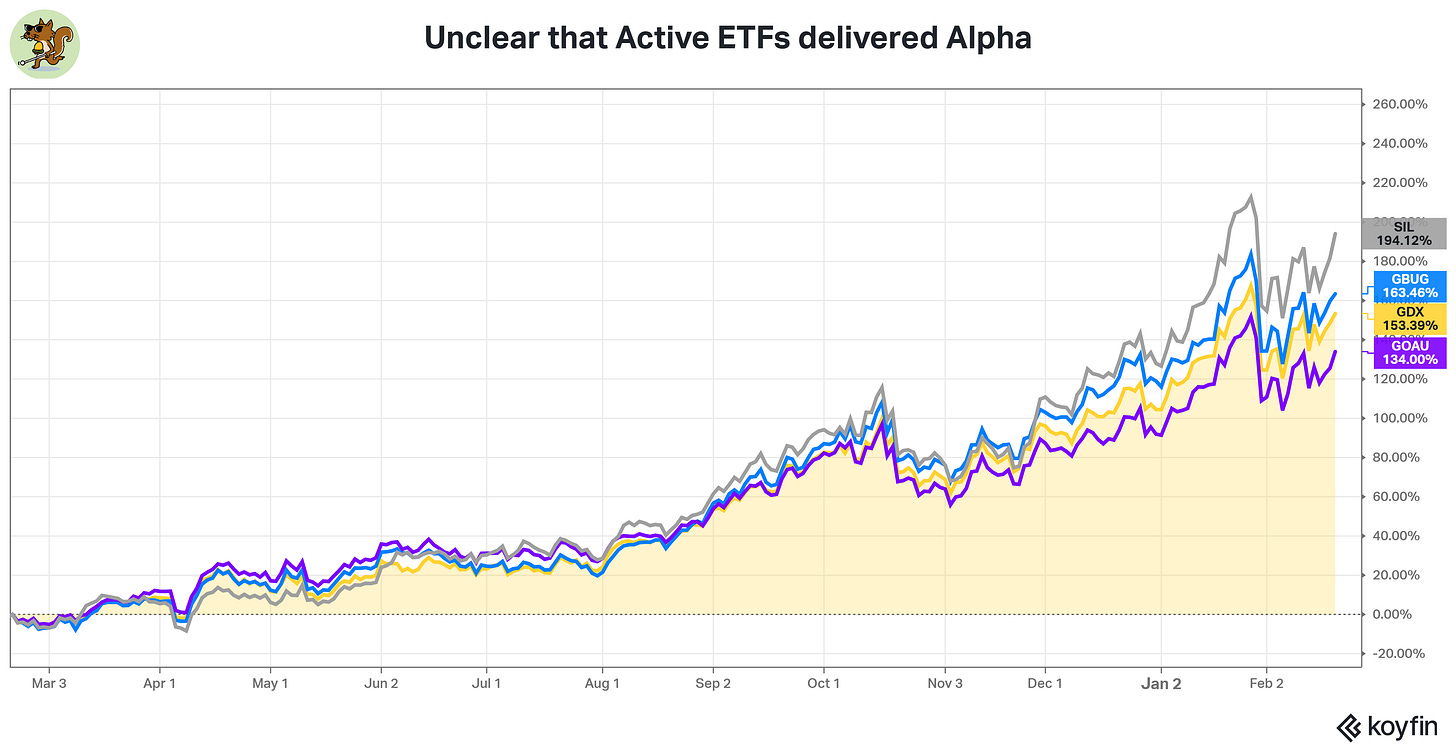

In my group of funds, I included 2 active ETFs - GBUG 0.00%↑ from Sprott and US Global’s GOAU 0.00%↑. Both have great tickers but it is not clear that you got much in return for the higher fees.

GBUG has 41 names which I guess almost guarantees index like returns

GOAU with over 30% allocated to the big royalty companies (with less leverage to the metals move) underperformed the GDX

The Allocators Have Not Arrived

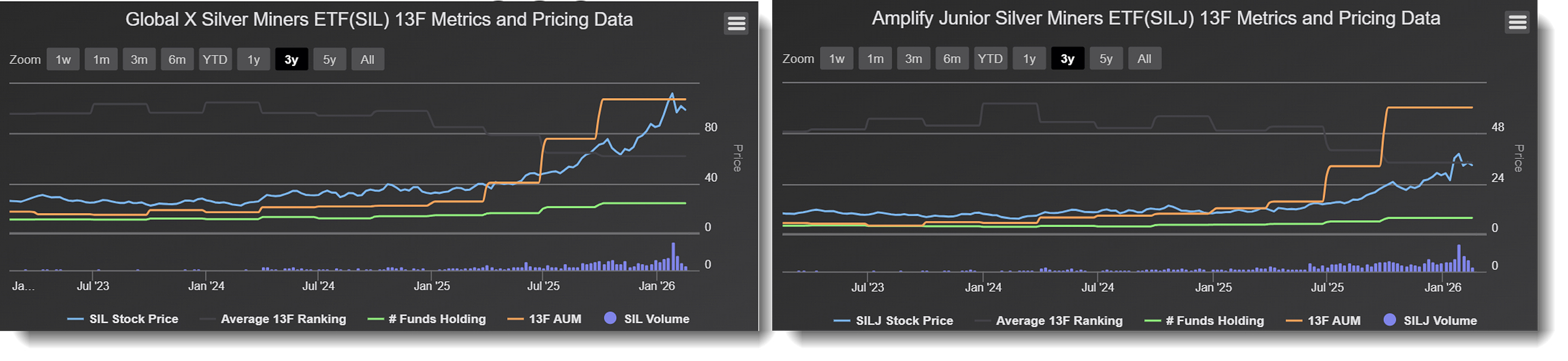

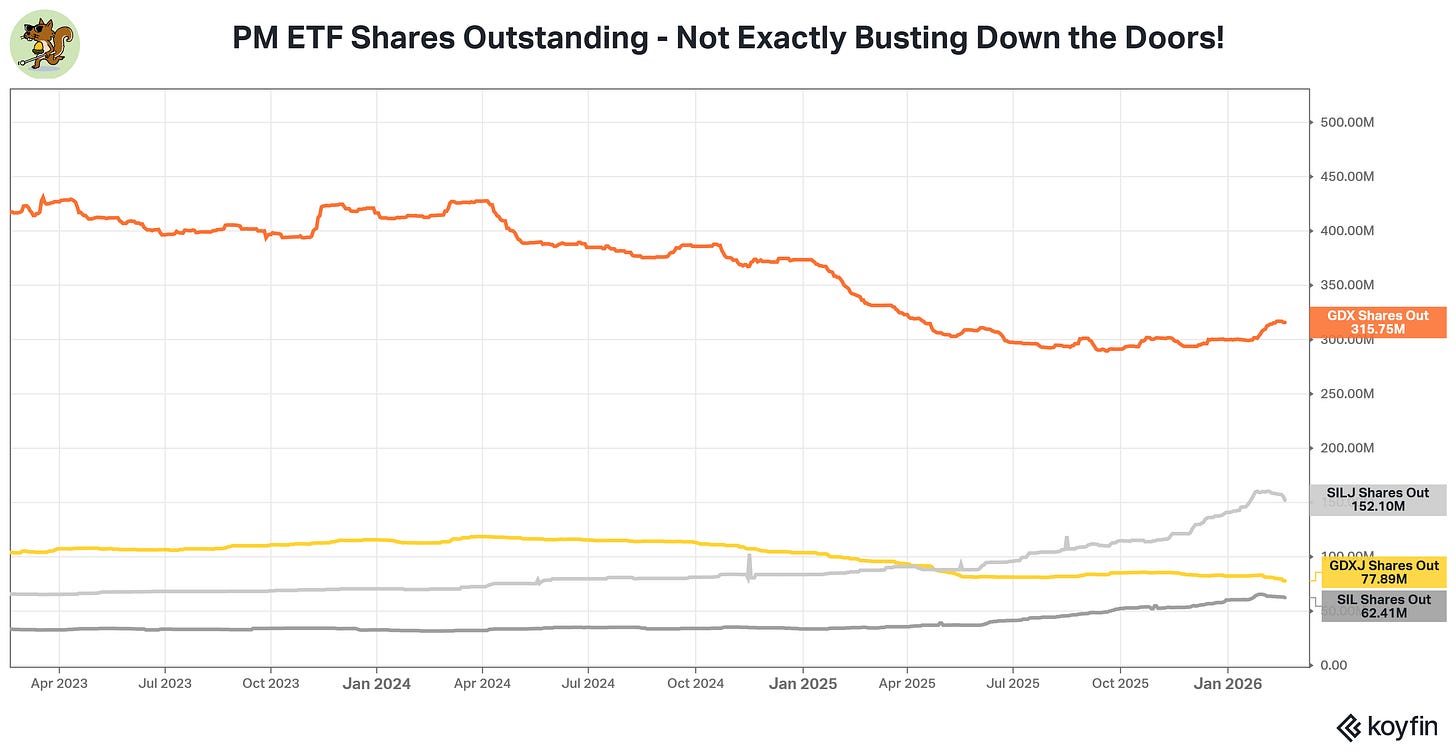

We established earlier (via the 13F data) that institutions are guilty of renting beta via the main gold ETFs. However, when I went to measure that impact in terms of additional AUM for these ETFs I was pretty underwhelmed.

Only Amplify’s junior silver play saw meaningful inflows. VanEck’s GDX and GDXJ actually saw outflows!

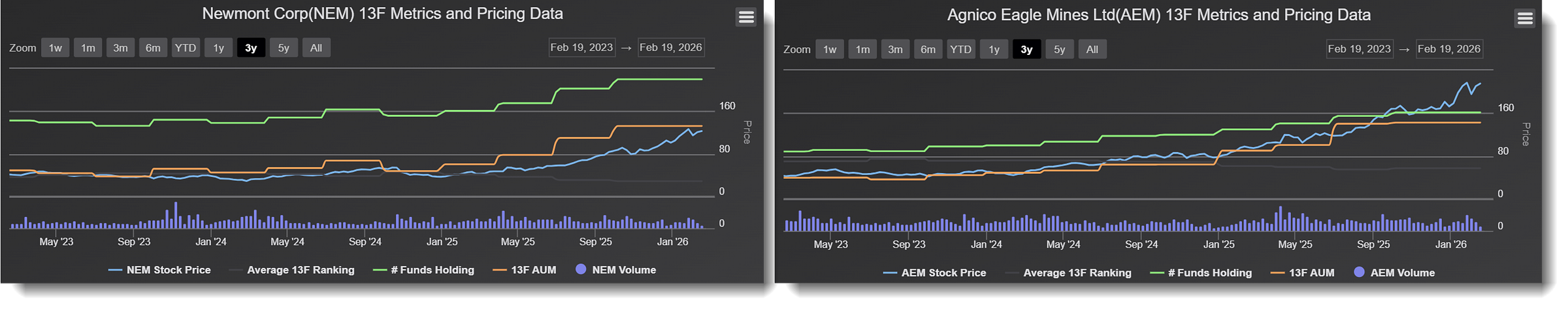

They were not exactly ripping into the stocks either. Large caps like Newmont and Agnico Eagle saw noticeable but modest institutional accumulation.

Newmont’s weighting in the S&P 500 may only be 0.23%, but you would have thought that there would be clearer evidence of institutional chasing of a stock that was up 173% in 2025.

Basically, it is only retail and robots that own the large miners. 13F data is less informative for the Canada-domiciled miners but you can see directionally how few of the residents of these companies’ share registers have chosen to be there.

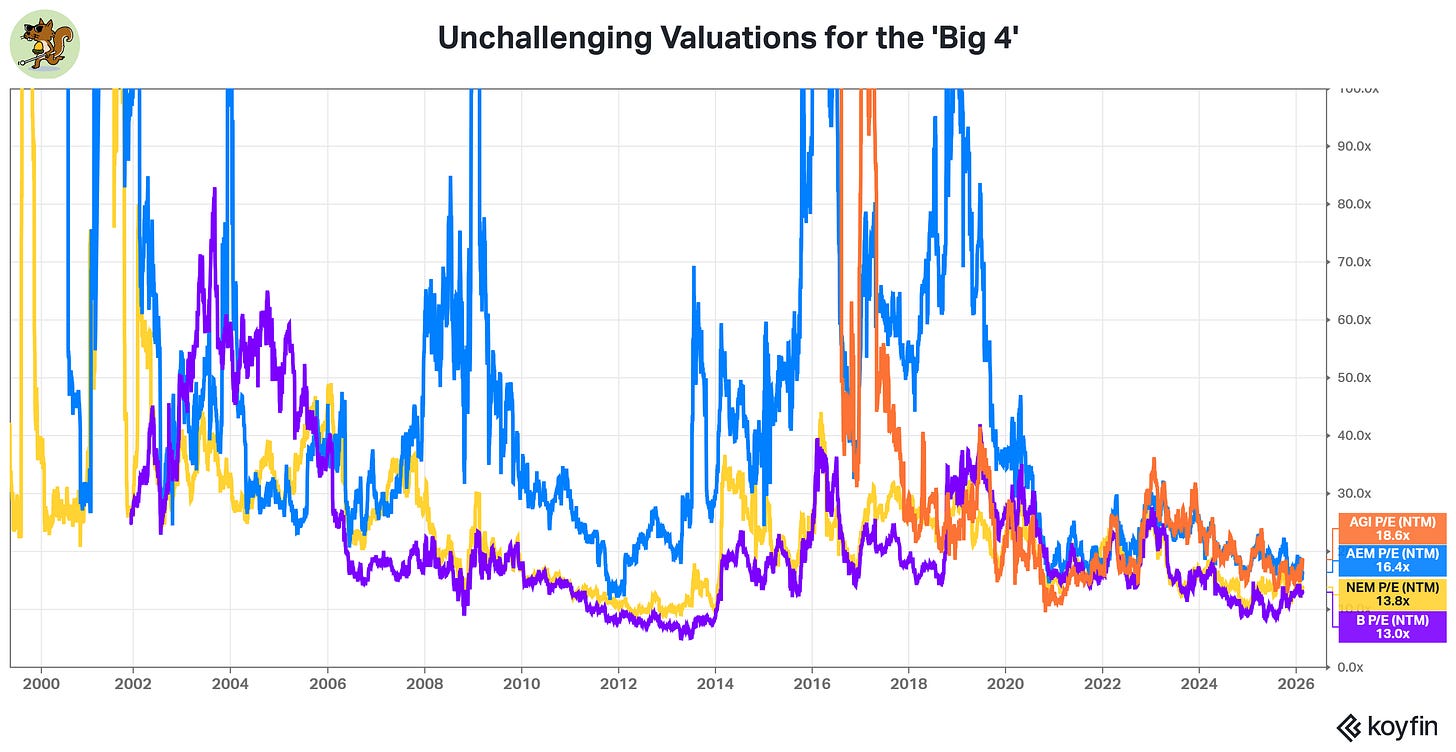

Given the earnings growth that the sector is likely to see over the next few years, I think it is only a matter of time before the allocators arrive.

Benny and I interviewed macro shop Trium Capital’s Tom Roderick on Thursday. We spent the last 5 minutes of the show talking about PMs.

I agree with Tom that the miners look as cheap as they ever have done (even after the big moves of the past year).

Strong cash generation at these companies will soon allow them to compete for stock (via buybacks) with those under-allocated institutional investors.

If this is what the tape looked like before real allocator money showed up, the next leg could be driven far more by positioning than by metal price moves alone.

Introducing the🐿️’s ShinyAcorns™ Portfolio

A few years ago, I would have simply concluded that I should just send some more money to Ned. But, these days I am in the ideas business and I know that my readership contains a lively community of gold bugs. We are picking gold stonks people! Welcome to the 🐿️’s ShinyAcorns™ portfolio.

First some ground rules.