Lurking in the Shadows

The Blind Squirrel's Monday Morning Notes, 3rd June 2024.

A handful of investors want to pay 64% of AUM for Bill Ackman’s Pershing Square. Amazingly, that is not the strangest thing going in the world of alternative investments at the moment.

Allocators are demanding cash hurdle rates for their hedge fund investments. Are they in fact ‘rolling the pitch’ to explain further (forced) over allocation to private asset markets.

In private credit, the sanctity of collateral now appears to be under threat. What else is lurking in the shadows of shadow banking?

In Section 2 this week (for paid subs), with Saudi Aramco kicking off its jumbo $12bn follow-on offering we turn our attention to energy markets. Lots to think about with our US refiner and drill ship exposure.

Welcome! I'm Rupert Mitchell and this is my weekly newsletter on markets and investment ideas. While much of this letter is free (and I will never cut off any punchlines), please consider becoming a paid subscriber to receive the other 60% of my content and plenty of other good stuff!

Lurking in the Shadows

Strange things are going on in the world of alternative investments. A group of institutions have puzzlingly decided to break with conventional asset management valuation metrics and put a price tag on Bill Ackman’s Pershing Square equivalent to 64% of AUM.

I am being assured that somehow this deal makes sense for all involved. I can certainly see how it makes sense for Bill! Heigh ho, it’s a free market and I guess a billion dollars is not what it used to be. Ultimately, the plan appears to be to take the business public. No shade on Ackman, he has compounded that fund at over 16% since its inception in 2004. We shall, however, keep an eye on the ultimate market value for this business with interest.

While Pershing Square has delivered strong consistent returns for its investors over a 20-year period. Elsewhere in hedge fund land, pension funds and consultants are getting frustrated that many of their hedge fund investments are struggling to offer returns that are superior to money market funds that have now been yielding over 5% for more than a year.

It is well understood that allocators have happily sacrificed absolute returns in return for low volatility of those returns for quite some time. In fact, the entire multi-strategy hedge fund industrial complex is built upon this premise. But to borrow my favorite catchphrase from Ben Hunt’s Epsilon Theory, ‘why am I reading this now?’

Your rodent has a theory. Hedge funds with their holdings of largely liquid public securities have more transparent returns that, shall we say, cannot be presented differently. I will come back to this point later. But might it be possible that the pension funds are distracting us from bigger problems that they are having to deal with elsewhere?

Long standing readers will know that the 🐿️ has long had his sniper scope trained on the excesses that exist within the venture capital / private equity / private credit space.

Last October, we wrote the following: “You do not have to spend too long scrolling through the marketing literature from ‘Big PE’ and its enablers at the investment banks and asset allocation advisors before coming up on chart crimes such as this particular gem:

The industry pitch is clear. We can offer superior returns without that annoying thing called volatility which you have to endure with your liquid investments in the stock, bond and REIT markets (i.e., that change in value every minute of every trading day).”

Ultimately, we determined that ‘ground zero’ (or Omar) for the volatility laundering and other excesses within the private asset complex was Blackstone BX 0.00%↑. We outlined their ‘rap sheet’ in this November 2023 piece.

The Fed pivot at about that time deterred us from taking any action. It was the right call. The hope of looser monetary policy (and, more importantly I think, greatly reduced treasury market volatility) has driven the shares of Blackstone and their peers in ‘Big PE’ back to new highs in some cases.

The other reason for failing to pull the trigger was a niggling concern that the strategy of owning assets with borrowed fiat currency may ultimately be one of the best protections if we are in fact entering a sustained inflationary environment.

Erik of YWR: Your Weekend Reading put this concept beautifully in his terrific conversation with Kevin Muir the other day (60 second clip via the image below).

Calling time on the Big PE playbook is however an itch which the 🐿️ remains keen to scratch. Their playbook will certainly cease to work if some of the private asset world’s practices trigger an ‘event’ that causes the market to take away the ‘borrowed fiat currency’ part of the equation. I am always on watch for the catalyst.

A few more PluralSights would be a catalyst!

Late on Friday, Axios broke this story about a software business called PluralSight. It produced a few threads to pull on.

It caught my eye as I had just seen the following article in Bloomberg that got this rodent’s whiskers twitching:

I have written previously about the use of continuation funds and NAV loans by private equity world to ‘print’ transactions in existing investments that are, shall we say, getting a little stale in legacy PE portfolios. I also took a look at the practice of private credit funds providing the financing to deals by LBO funds managed within the same group.

‘Dropdowns’ are, however, a complete doozy! I have negotiated the terms and conditions of multiple bond deals and secured loans in my past, but the innocuous sounding ‘dropdown’ structure requires some further exploration.

The idea of a borrower having the ability to remove collateral from an existing credit facility to support the financing of a new deal would appear to break with all the historical norms of credit markets.

This is the type of transaction which should (but is sadly unlikely to) infuriate the regulators. I sincerely hope that not too much of this behavior lurks in the corners of the shadow lending world. It should also ENRAGE the limited partners of the private credit funds that provided the original LBO financing. Surely too much more of this nonsense from private asset world starts to make fundraising even harder than it already is.

The 🐿️ had not heard of PluralSight (‘PS’) before last week, but $3.5bn seemed like a chunk of change to drop in under 3 years so I decided to dig a little further. According to its website, PS “is the leading technology workforce development company that helps companies and teams build better products by developing critical skills, improving processes and gaining insights through data, and providing strategic skills consulting”. 🐿️ Translation: the company sells online IT courses and some workflow management software.

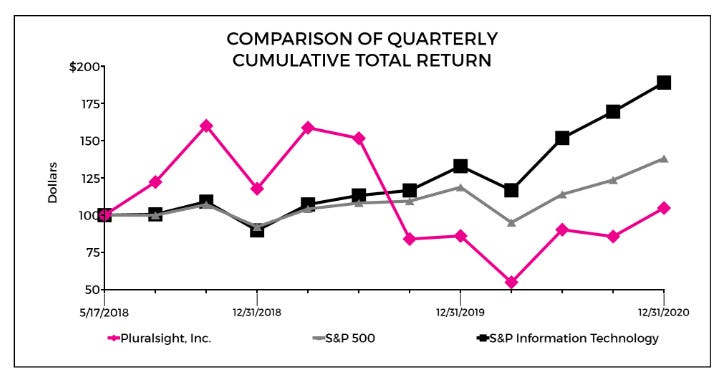

Having IPO’ed in 2018, PS’ $3.4bn leveraged buyout by Vista Equity was announced in December 2020. Of course, 6 months earlier PS managed to complete a secondary offering, in which insiders raised a tidy $233m…

Great quotes from Monti Saroya, co-head of the Vista Flagship Fund and senior managing director at Vista Equity in the deal’s completion announcement: "We have seen firsthand that the demand for skilled software engineers continues to outstrip supply, and we expect this trend to persist as we move into a hybrid online-offline world across all industries and interactions, with business leaders recognizing that technological innovation is critical to business success,”

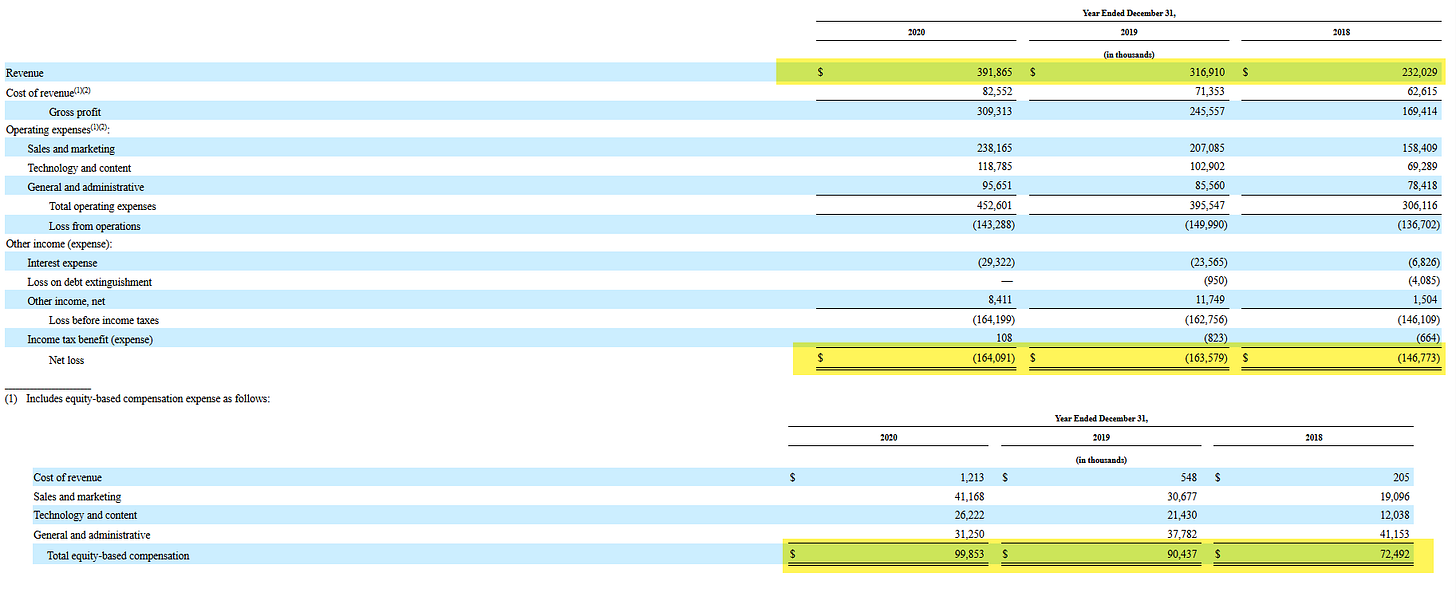

Let’s have a look at PS’s final 10-K as a public company.

So, let me get this straight, Vista paid almost 9x trailing revenues for a business that had delivered no value to investors in the public markets, and which was losing 42 cents for every dollar of revenue that it booked. It also looks as though much of PS’ growth was inorganic (11 bolt-on acquisitions in 8 years).

Incredibly, a syndicate of private credit funds lent $1.3bn in support of the acquisition. Friday’s Axios article charitably refers to PS’ 26% FY 2020 EBITDA margin (of course with $100m of stock-based comp added back!). A casual glance of the real (US GAAP) PS cashflow statement would tell you that this debt burden was barely affordable based on PS’ free cashflow with base interest rates fixed at zero. What on earth were they thinking? The lenders did not even think to negotiate a loan agreement that actually safeguarded their collateral (which itself appears to be not much more than a library of online training material)!

What could go wrong? There was even an AI angle! Apparently, PS’ ‘secret sauce’ was ‘Iris’: “Pluralsight Skills is powered by Iris, our machine learning intelligence underlying our skill assessments algorithm, user gap analysis and personalized content recommendations that guide users on how to develop desired skills.”

It turns out that PS’ machine learning capabilities was to identify skills gaps that would be end up being replaceable by AI ‘co-pilots’ within 24 months. Surely any platform touting machine learning capabilities would be more than aware of the potential applications of AI’s Large Language Models?

Then it struck me that PS’s pricing plan page seemed eerily familiar. Cue the next path / mini digression that this Pluralsight story took me down. The 🐿️ is currently trialing an AI tool called Recall that provides short summaries of articles, podcasts and videos. It has a very clean user interface and appears to work reasonably well (provided, sadly, that it is not summarizing something that you have already listened to!).

A myriad of these types of products have emerged and it is still too early for me to review the product properly, but if, for a mere $10 per month, the 🐿️ has the unlimited ability to send 1-hour videos and podcasts to a power-hungry LLM for summarizing, someone is losing a LOT of money on that deal.

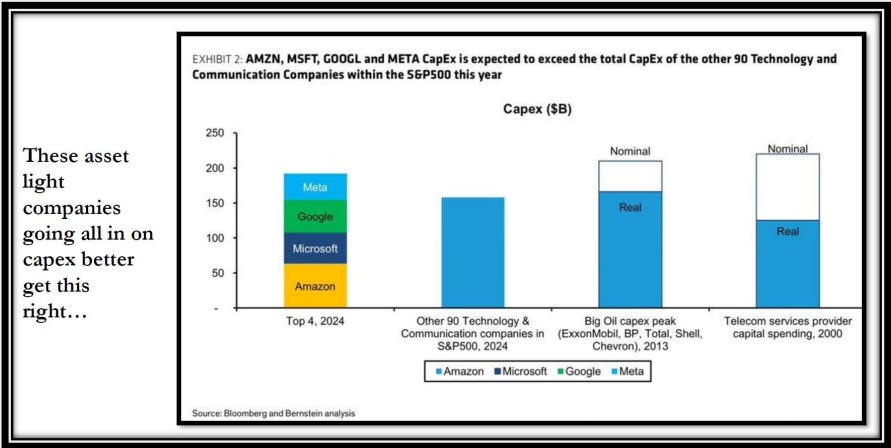

Chase Taylor shared this remarkable chart is his weekly. The capital being deployed by the hyperscalers to build out these AI data centers is mind boggling.

I doubt that my $10 per month ($7 if paid annually!) for AI podcast summaries covers even a fraction of the power usage, let alone its share of all of this capex. Either the next generation of LLMs will be infinitely more efficient than the current one or else the price of my new AI toy tool will soon be adjusted to a level whereby I end up going back to listening to and watching podcasts in full on 1.5x speed!

Bernstein was the source of the data behind Bloomberg’s capex chart. Bernstein’s Toni Sacconaghi also provided the AI ‘zinger of the week’ question at the DELL earnings call last Thursday:

Let us ignore Nvidia’s current market dominance for one moment. Surely the Big Tech giants will figure out a way to design Jensen’s margins out of their data centers soon enough. Is anyone else beginning to wonder who the big financial winners of the AI revolution are? Most steps in the value chain from data center hardware to consumer applications would appear to be subsidizing end usage at the moment.

AI digression over. This is supposed to be a note about malinvestment elsewhere …in the alternatives markets. Let me take you back to my theory on why the allocators have started to make noise about the returns on their hedge fund allocations. At the request of the same allocators, the strategies of these funds have been optimized for minimal volatility. However, this low vol, low return profile looks frankly embarrassing in a 5% interest rate environment.

In the meantime, the pensions and endowments are developing a major problem with their private market allocations. On paper, these investments have been delivering double digit returns with minimal volatility. The dirty little secret however is that they have not been realizing any of these returns.

Erik’s excellent The University Endowment Train Smash highlights how the combination of long-term capital commitments to private equity and credit funds and shrinking distributions by the legacy private asset funds is creating a funding crunch for these types of investors.

Illiquid private asset allocations for many institutions are already in excess of 30% of AUM. It already looks like they will need to sell more of their liquid investments to fund their budgets. I think I know why they have started moaning publicly about their hedge fund returns. A smokescreen ahead of a forced liquidation perhaps?

Big PE knows that their traditional pension fund and endowment clients are more stuffed with their product than a foie gras goose. As such they are casting the net ever wider to replace them at the top of the fund-raising funnel. I cringe when I read the copious headlines about Australia’s superannuation funds’ new obsession with private credit.

I know that Jamie Dimon is, to a certain extent, ‘talking his own book’ when he warns of ‘hell to pay if private credit sours’. However, his point about retail exposure is particularly true. Big PE seems desperate to expand the channels by which their product can be directed down retail channels.

If what happened in Canada last week is repeated south of the border (hot on the heels of redemption suspensions by the likes of Blackstone’s BREIT and Starwood’s SREIT), Big PE has a political problem; the levee will break; we will have a real catalyst for ‘Taking on Omar’; and the 🐿️ has an excuse to turn one of his favorite Led Zep tracks ‘up to 11’.

That’s all for front section this week. In Section 2 (for paid subscribers), with Saudi Aramco kicking off its jumbo $12bn follow-on offering we turn our attention to energy markets. Lots to think about with our US refiner and drill ship exposure.