Low Energy

The Blind Squirrel's 'Monday' Morning Notes. Year 3; Week 43.

Low Energy

There is a lot of scar tissue when it comes to the 🐿️’s investment history in the energy space. I largely round-tripped the great energy bull market of 2020 to 2022. I suspect that I am not alone. In fact I know that I’m not alone. Many of my readers will remember ‘those baseball caps’1 that the 🐿️ ponders above.

In no way was the Russian invasion of Ukraine in 2022 ever central to the bullish energy thesis adopted by many in 2020 and 2021. For the bulls, OPEC spare capacity was ‘a myth’ and ‘triple digit crude’ [per barrel] was likely to be medium term fixture that the global economy would just have to suck up.

The 🐿️ has stoically taken his lumps and has also been vocal with his ‘mea culpas’ over the past 3 years. If some of us got carried away with our bullish energy narratives back in 2022, it is not hard to argue that the pervasive bearish narrative we are living through today is now pitched at extreme crescendo levels.

But of course it is! Narratives always follow price and the performance of crude oil - notwithstanding a highly fraught geopolitical environment - has been very supportive of the bears’ case.

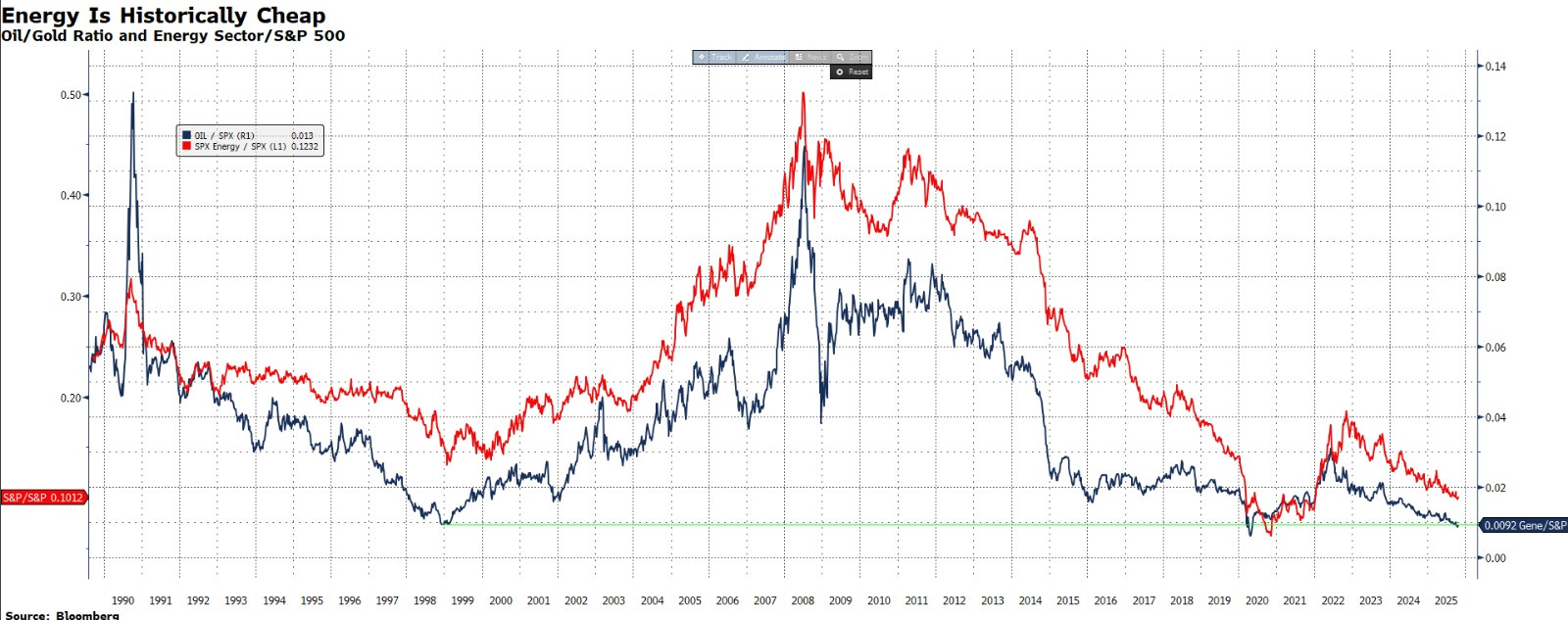

To be honest, it could be worse. If you compare the drawdown in oil and in oil equities versus the S&P over the past 3 years, it barely registers relative to the bigger picture declines since the GFC (thanks to my pal Ben Brey (of Capital Misallocation) for the chart below).

While I have made some tactical retreats from overweight positions in energy, this rodent’s continues to be - at heart - an energy bull.

But let’s hear out the bears

The (close to consensus) bearish narrative on oil is centered around the following arguments: