Losing My Religion

The Blind Squirrel's Monday Morning Notes, 6th May 2024.

This week, the 🐿️ started to sense some important shifts in many ‘articles of faith’ that are central to various corners of the world of markets and macro.

Is the economy in fact rolling over? Do higher rates really kill inflation? Can debt really be ‘inflated away’? Some articles of faith require further interrogation!

In Section 2 this week (for paid subs), we add a new rates position as a ‘change of religion’ hedge. We also update our views (post-earnings) on US oil refiners, our offshore services basket and Mercedes Benz. We have also been having some fun in Japan.

Welcome! I'm Rupert Mitchell aka The Blind Squirrel and this is my weekly newsletter on markets and investment ideas. While much of this letter is free (and I promise not to cut off any punchlines), please consider becoming a paid subscriber or gifting it to a friend!

Losing My Religion

It may have been just a truly vicious ‘man cold’ that was blurring this🐿️’s thinking, but last week I started to sense some important shifts in many central ‘articles of faith’ in the various corners of the world of markets and macro.

Financial Justice Warriors, bond vigilantes and Austrian economists started the week screaming from the rooftops about the need for higher rates to dampen reaccelerating inflation (evidenced by a convincing rap sheet of a full quarter’s worth of hot inflation and growth data so far this year).

These cries were met with a Fed Chairman that adamantly does not acknowledge “the ‘stag’ or the ‘flation” and conspicuously did not appear to want to leave the worrying specter of a potential rate hike (that was beginning to be priced by the interest rate futures markets) on the table.

A blowout earnings jumbo buyback announcement from Apple (more on that later) on Thursday evening, and a weaker than expected payrolls number on Friday was enough to give risk assets the greenlight to get going on a robust Q2 advance.

The Ministry of Finance in Tokyo was quick to take advantage of the dip in US Treasury yields to launch another intervention in the currency markets. Despite the usual chorus from the ‘FX intervention never works’ naysayers, Friday’s ‘Yentervention’ looks to have been much more successful than the one at the beginning of the week.

I suspect that Japan has now done enough to inject a sufficient note of caution into the minds of currency speculators that wish to press what is now a (very) crowded short position in the Yen. Ultimately it will be interest rate differentials that trump all other factors, but perhaps it is no longer a world of greed with no fear for the carry traders. I am staying long the Yen.

On the topic of crowding, we need to talk about crowded narratives. 2024 has been a story of market participants unwinding all (and more) of the rate cuts that were priced once the Fed signaled an end to the hiking cycle last October.

Universal ‘received wisdom’ that ‘the Fed and Mrs. Yellen’s Treasury will prime liquidity and the markets in an election year’ was replaced with ‘the economy and inflation remain robust, and we therefore need to brace for high rates for longer’ in the collective belief system.

The inflation bulls and bond bears are suddenly not enjoying all the new company joining them on ‘their side’ of the boat. My friend PauloMacro has been booking gains on his bearish long bond bets; Chase Taylor is sensing a turn and Kevin Muir, the trader who (famously!) traditionally only has 2 positions in bonds (short or flat!) has rejected this article of faith - even penning a terrific note this week titled “Time to lever up 2s!” (2-year Notes)!

The 🐿️’s own bond positioning has been a bit more passive. We had a great run with shorter duration Treasuries from November to mid-January (“Sorry Harley, the 2-Year’s not for babies”) and our approach to the long bond has been via low-cost ‘fire insurance’ on the TLT 0.00%↑ ETF (“Coming off the fence on bonds”).

I am comfortable to stick with my insurance policy against a long duration accident. It functions as a very cheap lottery ticket on what I hope is an unlikely event. Nevertheless, I certainly see what Paulo, Chase and Kevin clearly see as the potential for another pivot in bond market positioning.

Outside of a few rate-sensitive sectors like commercial real estate, I have been faithfully in the camp that the US economy has been thriving on the nitro of fiscal dominance. However, this fantastic graphic from Brent Donnelly’s Wednesday AM/FX leaped off the page at me (he also put it in his (free) Friday Speedrun mail).

For the past 2 years, bearish “soft” economic data (sentiment surveys and consumer confidence indicators) has failed to be properly confirmed in the growth and employment “hard” data. However, if you squint your eyes at the table above, the traffic lights certainly appear to be turning much more amber. Are rates finally starting to bite on the economy here?

I do not feel a strong urge to load up the portfolio with bonds, but ways to bet that rate cuts start to get re-priced back in (via options on the SOFR futures) are beginning to tempt this rodent. I can see a scenario in which being positioned for both aggressive cuts to the Fed Funds rate and higher long-term rates makes sense.

Another article of faith that many in the market hold dear is that fiscal profligacy by politicians is solely to blame for the inflation that we have endured since the pandemic. The belief that high interest rates could also be to blame is a very hard pill for the disciples of Paul Volcker, whose creed incorporates a view that the only way to slay the inflation dragon is via aggressive rate hikes that stifle demand in the economy.

I really enjoyed listening to Chase Taylor and Zach Abraham address this topic on this weekend’s ‘Know your risk radio’ podcast. They riffed on David Einhorn’s ‘jelly donut’ theory of monetary policy (listen from minute 11 here for a full explanation of that). Both Zach and Chase would confess to being (reformed) financial justice warriors. Chase coined the term! Their collective realization that lower rates could potentially be the panacea to delivering slower growth and lower inflation was almost Damascene!

Another popular article of faith in the markets revolves around the belief that the only way that economies can escape from the debt burden created by fiscal deficits is for sustained inflation to shrink the debt pile in real terms (as populist politicians have no intention to stop spending and start balancing budgets).

Not so fast! (says The Inflation Guy Michael Ashton). In ‘You Cannot Inflate the Debt Away’, via some very persuasive modelling Michael performs a brutal and effective Auto de Fé on this belief system. He concludes (cheerily!):

“We can find no realistic way to inflate our way out of debt, other than moving toward hyperinflation (and the faster, the better). And even with these simulations, I am making a very unrealistic assumption about how the deficit evolves when the interest costs of the debt blow up. Hyperinflation, with a balanced budget, is what you need. Good luck with that. The only way that happens is if the dollar collapses and no one will lend us any more money anyway. And there is no one in government today, I feel confident in asserting, who thinks that outcome is a decent tradeoff in order to get out from under the mountainous debt. At least…let’s hope not.” Michael Ashton, The Inflation Guy.

Hey 🐿️! Are you done with religious analogies yet? Not quite! I mentioned Apple’s Q1 earnings earlier. Last August, in ‘'Aaa'-pple! The best bond in the world?’, I speculated that the Cupertino fruit company’s pivot from innovation to financial engineering would probably have the late Steve Jobs spinning in his grave.

To be honest, AAPL 0.00%↑ role as a ‘funding short’ for the hedge fund community had probably been overdone. However, the company’s Q1 earnings (great summary thread here from the team at The Transcript) further underscored the fact that this market stalwart can certainly no longer be viewed a growth company. Will Apple hold on to its near Messianic role in retail and institutional equity portfolios?

The announcement of a whopping $110bn share repurchase was enough to excite the buy algorithms and terrify funds out of their short positions. This is only speculation on the part of a rodent, but this buyback bazooka was probably vital ahead of another quasi-religious gathering that was kicking off 2 days later - Berkshire Hathaway’s annual shareholder meeting!

It was revealed on Saturday that the ‘Sage of Omaha’ himself, Warren Buffet, has been selling down Apple (his largest public equity position) significantly year to date. Hosting the meeting for the first time without his long-term partner (RIP Charlie 🙏), Uncle Warren assured the crowd in Nebraska that Apple would likely continue to be a top holding for some time.

However, it looks like that for the world’s most successful living value investor, continued faith in share buybacks is dependent on those repurchases continuing to be value accretive! The ‘gaming’ of passive investment flows is probably of less interest to this nonagenarian. For now, he is happy to pay his taxes while the capital gains tax rate on the stake is still 21% (in my view indirectly quantifying how he sees potential upside in the shares from here!).

That’s enough loss of religion for one Sunday! The Financial Justice Warriors may prefer the earlier “It’s The End of the World as We Know It” but it was REM’s 1991 classic “Losing My Region” (which the executives at Warner Brothers apparently urged the band against using as the lead single on the album) which ended up truly putting the band on the global stage.

Ironically, even though REM lead singer Michael Stipe came from a long line of Methodist ministers, the song was never intended to have religious connotations. Losing my religion is in fact an old Southern expression meaning to be at the end of one’s tether and on the point of losing one’s cool! Reminds me of bond vigilantes!

In case you were wondering why the cover image for this note shows a confused 🐿️ in front of a pitcher of milk on a windowsill, the image is a screenshot from the original video for ‘Losing my religion’. The Tarsem Singh directed scene was inspired by a Gabriel García Márquez short story called ‘Un señor muy viejo con unas alas enormes’ (‘A very old man with enormous wings’). Trippy.

That’s all for front section this week. In Section 2 (for paid subscribers), we add a new rates position as a ‘change of religion’ hedge. We also update our views post-earnings on US oil refiners, our offshore services basket and Mercedes Benz. We have also been having some fun in Japan.

Section Two

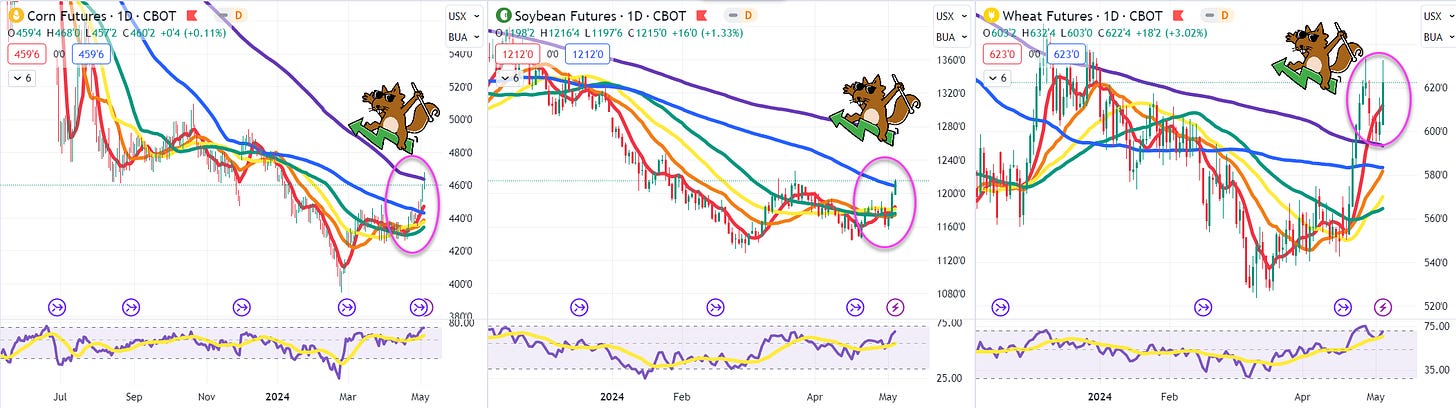

As alluded to above and last week in The Drey, I am afraid that the ‘man cold’ completely wiped me out last week and the work on the implementation plan for our new Acorn basket in Agribusiness equities is still work in progress.

I am also looking to do a bit more work on the numbers for the basket’s two nitrogen fertilizer names CF 0.00%↑ and LXU 0.00%↑ - both reported last week (CF with a big miss, LSB Industries with a big beat!).

As I mentioned in the front section, I am not over excited about piling back into 2-Year notes. It remains my core view that the Fed does not yet have the growth and inflation evidence it needs to start cutting. However, oil and broader commodity moves are making me want to take Brent Donnelly’s ‘traffic light’ hard and soft data chart more seriously.

So, let’s buy an inexpensive option that benefits in the scenario that economic conditions do in fact dictate that rate cuts are necessary (or, more precisely, that the weighted average of market opinion considers them to be necessary).

We are going to buy an out of the money call option on December 2024 3-month SOFR futures. OptionStrat worksheet here and via the image below.

The strike price of the call is at 96 (the pink dotted line below), a level at which this December contract was trading at as recently as early February.

Last year, we employed a SOFR call spread as our ‘kicker’ in ‘Sorry Harley, the 2 Year note is not for babies!’. We were looking for leverage on a core view (at the time!) that the Fed was on a firm cutting path that would see Fed Funds at 2.5% by the end of 2024.

This time we are making a small investment in a simple outright call option that acts as a ‘tail hedge’ that pays out in the event that is not in line with this rodent’s core view. We will track this position as an Acorn.

As ever, please message me or ping me in The Drey if you have any questions.