'Little Tech' Riding Hood (and the SBC Recyclers)

The Blind Squirrel's Monday Morning Notes, 26th August 2024.

The 🐿️ has some thoughts on that (cuddly) “Little Tech Agenda”

We are on the hunt for fugitive unicorns - the publicly listed profitless recyclers of stock-based compensation!

‘Little Tech’ Riding Hood (and the SBC Recyclers)

The 🐿️ has been holding off on writing this piece for a while. However, some (slightly disingenuous) cries of foul play emanating from Silicon Valley have become deafening. It came to a head with the recent publication of The Little Tech Agenda by a16z cofounders Marc Andreessen and Ben Horowitz. Cuddly right?

Call this rodent a cynic, but is it possible that the “glory of a Second American Century” is at risk of being thwarted, not by the stifling hand of regulation but by the fact that capital markets are losing patience with startups that fail to show any signs of delivering a decent return on invested capital?

Silicon Valley, which few ‘locals’ would admit would not be the same without Bell Labs, DARPA and the awesome US university research system, seldom wastes an opportunity to rail against ‘big government’ interference and regulatory capture in Washington. Yes, that would be the same ‘Planet Palo Alto’ boy band that was screeching for a Federal bailout of Silicon Valley Bank last March.

To be clear, the 🐿️ is no fan of the regulatory capture (by large cap tech or other industries) that the a16z manifesto rails against. Regulatory capture has a habit of delivering harmful (and expensive) outcomes for consumers. However, regulatory capture’s very close cousin, regulatory arbitrage, can be equally damaging. In ‘Seeing Red over Red Tape’, we contemplated how leveraging anachronistic legislation to skirt employment laws or local real estate / lodging regulation and taxes can also cause significant societal side effects.

Often enough, this regulatory arbitrage is little more than a short cut in the path to a glorious ‘rent seeking’ future. Just think about the proliferation of ‘blitz-scaled’ e-commerce and SAAS businesses that effectively ‘sell dollar bills for 50 cents’ with a view to building monopolistic market positions from which rents can be sought from consumers down the line. At the end of the day, the monopolist sits at the apex of the pyramid of capitalism.

Failure to deliver economic returns (in the short term) was a ‘crack’ that could be ‘papered over’ in a world of zero interest rate policies. We have now entered the third year in which money actually costs money and during this time those cracks have become chasms!

This rodent has been known to mock Californian dog-walking apps in the past and is generally bemused by the number of cash incinerating businesses that have managed to escape the intravenous drip of cheap capital in ‘VC land’ only to be unleashed on to the unsuspecting capital markets via SPACs or low [free] float IPOs. This may no longer now be possible.

We will come back to the public markets in a second, but we need to first address the other exit for VC portfolio companies, M&A. This 🐿️ is old enough to remember when the primary goal of the shareholders and management team of pretty much every software startup was to make enough noise to attract the attention of the business development team at Microsoft or Google.

If first prize for every ‘Little Tech’ startup is to become a monopoly in its own right, a decent second prize is for it to find a new home within one of the ‘Big Tech’ monoliths.

There is no doubt that FTC / anti-trust concerns have acted as a brake on bolt-on acquisitions by large cap tech. Regulatory scrutiny has raised the bar and led to creative alternatives to outright acquisitions. Look no further than the recent acqui-hires (aka ‘synthetic acquisitions’) of Adept or Character AI by Amazon and Google or indeed Microsoft’s ‘strategic minority’ stake in OpenAI and its close ‘alumni relationships’ with the likes of Lumen Technologies).

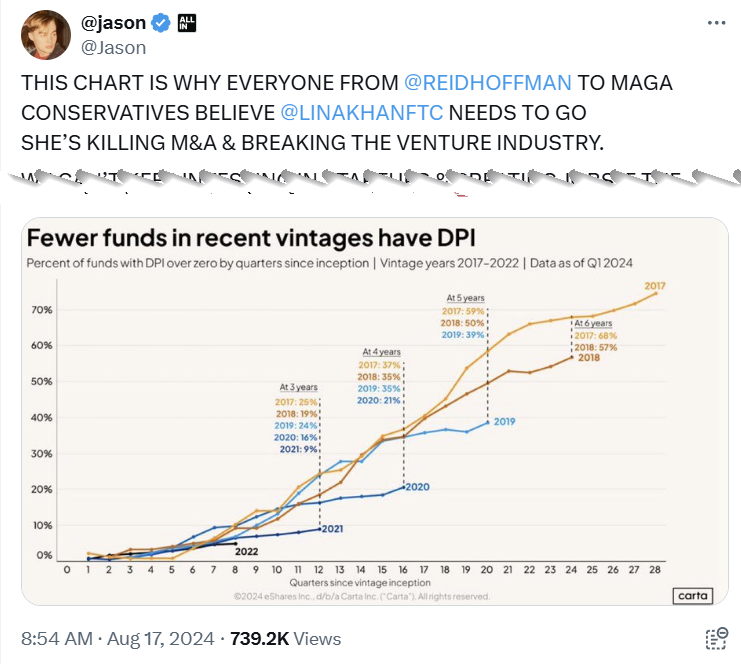

Sure ‘JCal’, FTC scrutiny will be having an impact on Tech M&A activity, but the more prosaic reality is that the unicorn stable is simply not delivering enough free cash flow in its own right. Top line growth at all costs and the “vision and disruption pitch thing” is no longer enough.

Hat tip to

for the video below. It’s pretty funny, and any reminder of Tarantino’s “Royale with Cheese” line is a good one. However, given the shocking state of many US public companies originally backed by brand name Bay Area VCs, perhaps those German VCs with their 10-year financial projection requirements may be on to something… 🤷♂️This brings us neatly back to the unicorns that did manage to escape from the stable in IPO cycles past.

These fugitive unicorns have something in common - an almost universal inability to make money (at least under US GAAP!). This lack of returns is glossed over via the re-presentation of financial statements with those now infamous non-GAAP adjustments.

The non-GAAP adjustment game reached its zenith with the ‘Community Adjusted EBITDA’ of WeWork’s 2018 IPO prospectus. However, the main culprit - the refusal to recognize stock-based compensation (‘SBC’) as an operating expense - is still prevalent. Frankly, the 🐿️ regards this matter as ‘settled science’. Prof. Damodaran puts it most succinctly:

“While depreciation and amortization are truly non-cash, stock-based compensation is more of an in-kind expense, where you give away shares of equity in the company instead of paying cash. If you estimate free cash flows (to the firm or to equity), with the intent of valuing that firm, adding back stock-based compensation is equivalent to arguing that you can either stop paying employees in the future (and still hold on to them) or that you can keep giving away equity stakes in your company with no consequences for value per share.” Aswath Damadoran, Professor of Finance at the Stern School of Business at NYU

The SBC phenomenon is not some kind of small accounting rounding error. In many cases SBC entirely eliminates the cash flow generated by the operating businesses. In many cases, the business model of some of these escapee unicorns appears to be little more than the recycling of SBC into public markets!

While this practice is commonplace among enterprise software businesses, I want to zero in on the universe of consumer-facing business ‘disruptors’ that position themselves as building positions in vast ‘total addressable markets’ that at some stage will be harnessed to deliver monopolistic returns for shareholders.

Takeaways:

With 3 exceptions (Airbnb, Etsy and Taskus), this universe is issuing SBC at a level greater than 100% of GAAP EBITDA. These 3 companies (plus Pinterest) are at least neutralizing the SBC dilution with share repurchases.

On average, this group is issuing SBC at rate greater than 50% of free cash flow!

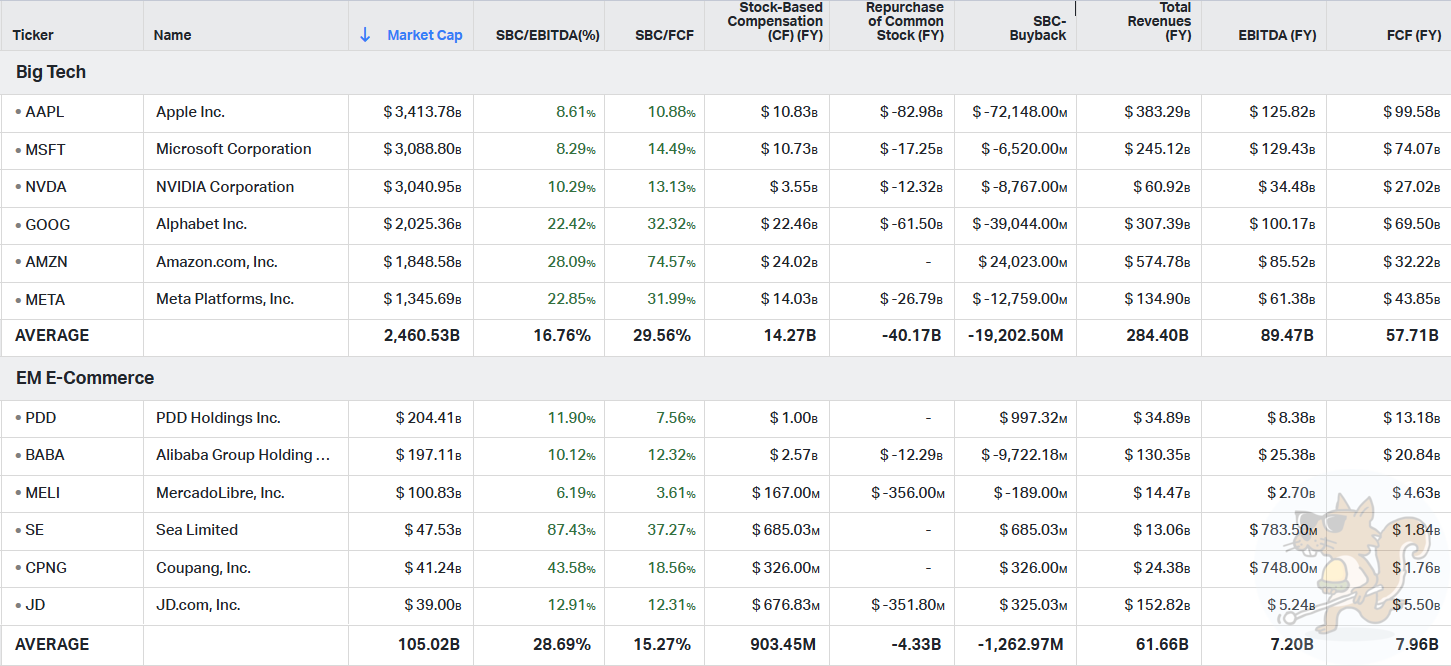

It is interesting to contrast these levels of SBC with US large cap tech and the larger e-commerce platforms in emerging markets.

With large cap tech, SBC is still almost 30% of free cash flow. Yet, with the exception of Amazon, the dilution is more than sterilized by share buyback activity.

The level of SBC is far more modest for the EM names (with the exception of Sea and Coupang).

Back to our ‘recyclers’. A great number of this cohort have seen their market caps crushed to levels where the stocks have become little more than the playthings of meme stock traders trying to engineer short squeezes (over half of this list have short interest of over 10%).

Nevertheless, nearly two-thirds of the list still have market capitalization that put them in the top 10% of the Russell 2000 small cap index, i.e. highly relevant to passive flows. Larger names like Zoom Video (ZM 0.00%↑) - a value stock on a 12.7x forward PE by comparison with the rest of this group! - have in excess of $2.5bn of stock in (mainly passive) ETFs.

ARK’s Cathie Wood may have chosen - until recently - to own Covid’s overnight video-conferencing sensation (remember her ‘$1500 per share by 2026’ price target?). However, a huge proportion of the company’s share register is holders there simply as a result of the company’s position in various cap-weighted indices.

I am sure that it is not just this rodent that feels the fact that the passive machines are effectively (albeit indirectly) funding all of this stock-based compensation to be somewhat ironic.

I do, however, believe that some of the worst offenders in this SBC racket are vulnerable. The 🐿️ has a plan. We are on the hunt for fugitive unicorns!

Don’t miss out! Please consider becoming a paid subscriber to receive that unicorn hunting plan, as well as the other 60% of 🐿️ content, member Discord access (The Drey) and even merch!

Keep reading with a 7-day free trial

Subscribe to Blind Squirrel Macro to keep reading this post and get 7 days of free access to the full post archives.