Hot for Hot Pot!

The Blind Squirrel's Monday Morning Notes. Year 3; Week 7.

Staying in the Orient this week. As hot money scrambles for the ‘usual suspect’ Big China Tech ADRs, the 🐿️ dives into the world of Chinese consumer stocks and launches his ‘Guochao’ 国潮 Basket.

Hot for Hot Pot!

The 🐿️ was a reluctant adopter of China’s WeChat ‘Super App’. During my banking days, clients on the mainland looked puzzled when I did not participate in the QR code exchange ritual at the end of meetings. Swapping WeChat contacts had largely replaced the exchange of analog business cards. I suspect that they thought that I might be about to scribble down a fax number!

This was many years ahead of regulatory fines being slapped on banks for that heinous crime of unofficial electronic client communication. While I take issue to this policy - chats on a golf course would strangely appear to be just fine - it’s a topic for another day! However, I do want to attribute this principled stance as impeccable foresight on the part of your favorite rodent. The truth is that my stance did have a certain element of self-preservation and risk management about it.

I had witnessed my Chinese colleagues subjected to the tyranny of WeChat groups for deals and simply preferred that the deal teams seek me out on the phone or in person for a sign off or opinion rather than assume that I had passively consented to a plan simply by dint of my presence in a chat group!

Upon joining a Chinese corporate several years later, I had no choice in the matter. The entire business ran on the app. However, WeChat only ever amounted to being ‘WhatsApp for work’ for the 🐿️. Calls and texts only. Linking my bank account to the app kept on dropping to the bottom of the ‘to do’ pile.

As a result, I was locked out of the world of electronic payments and ‘mini programs’ and receiving quizzical looks from Shanghai baristas whenever I attempted to pay for my morning coffee with a grubby ¥100 note.

The 🐿️’s rationale for sharing this historical luddite behavior (regular readers know that I am now a reformed rodent when it comes to digital payments) is that China’s advanced payments and ecommerce architecture lies at the core of the country’s recent attempts to boost domestic consumption.

China’s Consumption Problem

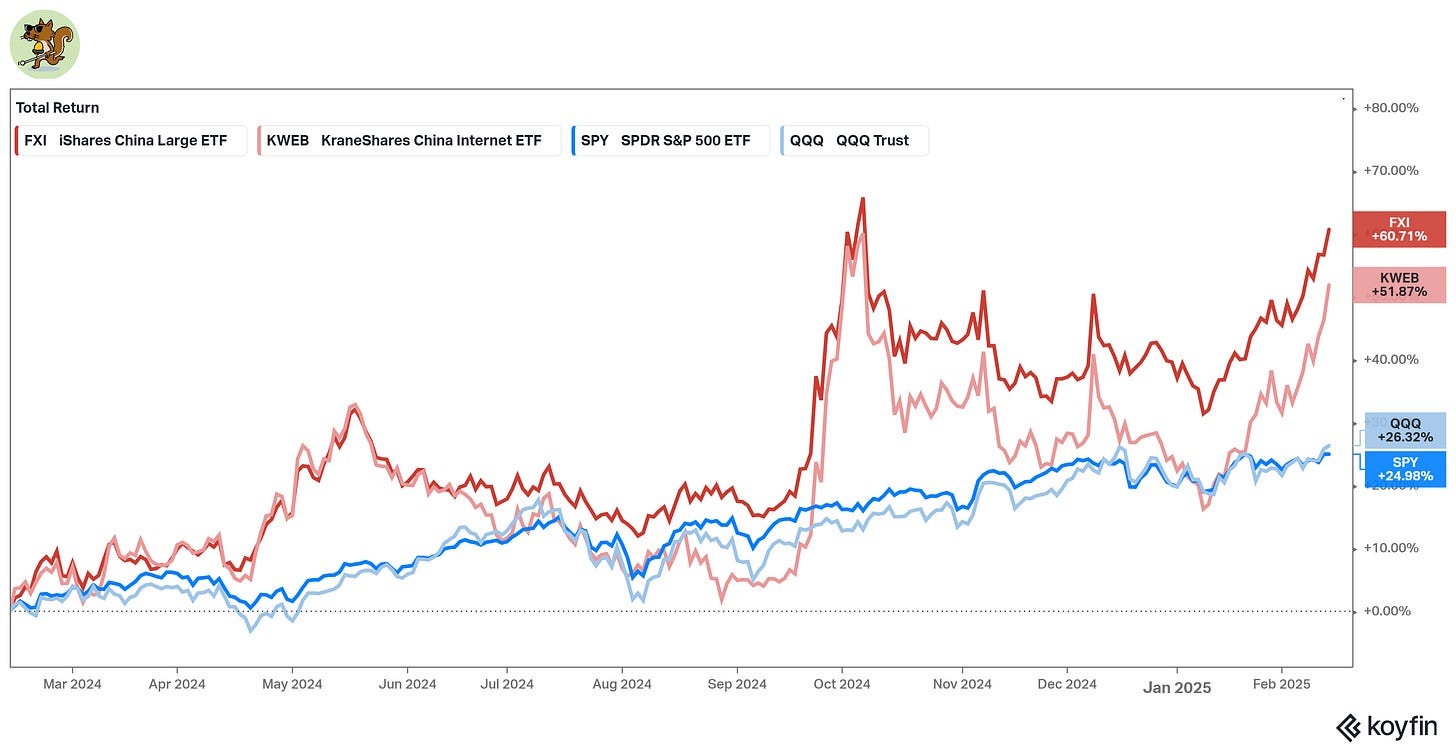

As the cries of “USA!, USA!” continue to echo from the trading floors of Lower Manhattan, those “uninvestable” Chinese equities have started 2025 with intent to leave ‘American Exceptionalism’ in their wake for a second year in a row.

It has been nearly 5 years since President Xi placed consumption as a key policy driver of the next leg of China’s economic development. His ‘dual circulation’ strategy aims to leverage China’s huge market size and unlock the potential of domestic demand, pivoting (partially) away from its reliance on industrial investment and exports.

Understanding the low levels of Chinese consumption behavior is relatively straightforward. Household savings rates have topped 30% for the past 2 decades. This is 5 or 6 times higher than levels seen in the West. China’s lack of a robust social safety net ensures that provisioning for retirement, healthcare and education expenditure makes a major dent in real disposable incomes.

Aggressive measures to stabilize the housing market are finally beginning to pay off. Reversing this negative wealth effect is critical (according to Fidelity, a 1% increase in house prices correlates with a 0.6% rise in discretionary spending). Gradual reforms to, and relaxations of, the hukou residency system in certain geographies are also assisting. Giving migrant workers access to public services delivers a near ‘1 for 1’ transmission to local discretionary spending.

For many commentators, eager anticipation of a China stimulus bazooka announcement has spawned many a Charlie Brown / Lucy / Football meme on social media. Those expecting of Western style fiscal largesse in the form of ‘helicopter money’ or ‘stimmie checks’ were always likely to be disappointed in a nation whose leader has warned against “slipping into the trap of welfarism that feeds the lazy”.

Direct cash transfers have also been resisted by authorities on anti-corruption grounds. This is where the system of sales incentives, trade-in programs and consumption vouchers come in. A system in which purchase subsidies (whether for EVs, energy efficient home appliances or new smart watches) come in the form of discounts from OEMs (who then reclaim those discounts from the state) creates a closed loop payment system that is relatively immune to grift and graft.

Similarly, the use of consumption vouchers, effortlessly administered by the UnionPay/ WeChat Pay/ Alipay digital architecture described above, ensure that subsidies for everything from restaurant bills to movie tickets are taken up with next to zero risk of ‘leakage’ with even the smallest of businesses able to easily participate in the schemes.

Incidentally with one of the Shanghai government’s ¥40 ($5.50) Spring Festival movie vouchers (available via your Maoyan or Taopiaopiao mini program on WeChat) you can afford to take a date to see the ‘Ne Zha 2’ blockbuster even with your paltry Randolf and Mortimer Duke Christmas bonus.

You might even have some money left over to splash out on some salted or candied dry plums (popcorn is less of a thing in Chinese movie theaters) …

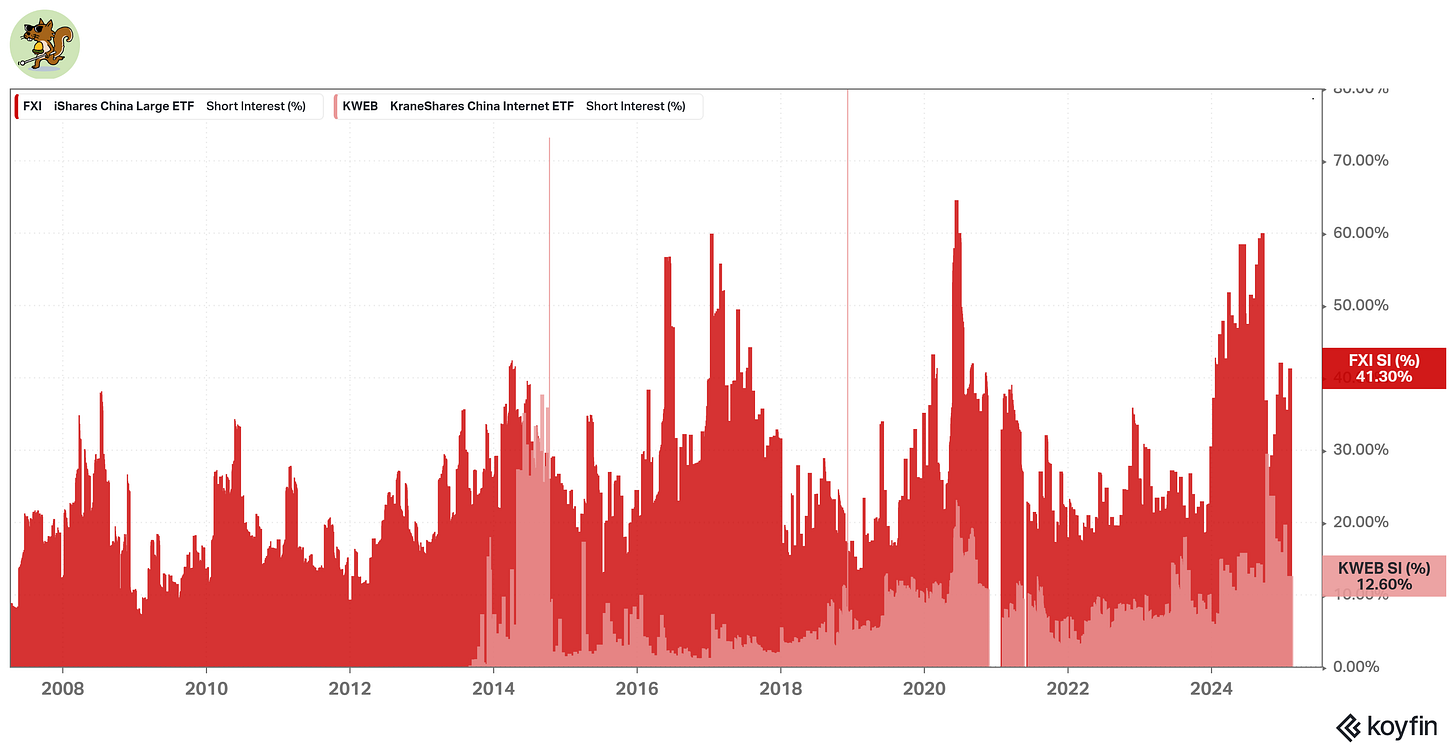

Back to the markets. The reaction of international investors to China’s strong start to the Year of the Snake has been to do the one thing they know best when they think they are dealing with one of China’s “tradeable rallies” (their words, not the 🐿️’s!). They reach for their favorite ‘trading sardines’ - usually, low delta call options in Alibaba BABA 0.00%↑.

By comparison, the direct drive plays on improved Chinese consumption have had a slower start to this year. The 🐿️ has constructed a basket of Chinese consumer stocks that he thinks are very well positioned to take advantage of a consumption recovery in China.

Yes, this basket has put in strong returns since the October 2022 lows, but it has done so with a much more attractive drawdown profile versus owning the ‘usual suspects’ in China. As you know, the 🐿️ prefers ‘lower beta’ exposures in Asia and other emerging markets. I hate being shaken out of trades by the volatility created by hot money flows.

Oh, and did I mention that they were cheap? Chinese consumer equities trade at a significant discount to global peers, with the MSCI China Consumer Discretionary Index trades at 12.4x forward earnings versus 24.7x for the US equivalent (which I do concede includes Tesla).

I have written on numerous occasions that I think that equities will play an increased role in the domestic savings culture in China in the future. I hear much ‘doomer (deflation is coming!) talk’ around the rally in Chinese rates (falling yields).

The way I like to think of this is as a China domestic savings risk continuum or waterfall. Property --> Bank Deposits ($18 trillion of them yielding basis points!) --> Bonds ---> Equities ---> FartCoin. Well, maybe not the last leg!

Chinese (in fact most Asian) investors are momentum investors and domestic governments bonds have indeed been trending. As Chinese equities carry on exhibiting momentum, more savers will move out the risk spectrum and join that party. In addition, these savers have also been given repeated ‘green lights’ from Beijing that it backs a new equity investment culture in China.

I suspect that this new equity culture will reflect the trends that we are seeing in recent Guochao 国潮 (literally ‘nation trend’ or ‘China chic’) consumption activity. A new cohort of equity investors could well go ‘full Peter “buy what you know” Lynch’ on the market. We could even end up seeing a ‘flywheel’ (accelerating organic consumption and earnings growth plus multiple expansion) effect on our hands.

In Section Two this week, we introduce the 🐿️’s ‘Guochao’ basket of consumer stocks. Spicy Hot Pot included. Come and join us!

Join hundreds of smart investors, market watchers and upstanding citizens by becoming a paid subscriber to Blind Squirrel Macro and receiving the other 65% of 🐿️ content, members’ Discord access (The Drey) and even ‘limited edition’ merch!).