Going nuts with digital payments

The Blind Squirrel's Monday Morning Notes, 25th November 2024.

Last week’s coverage of mobile banking in the context of Africa, triggered further 🐿️ exploration down the fintech rabbit hole. This week, we lift the hood on digital payments.

Why have the Charlie Munger fans started salivating over Square and PayPal? Is fintech now a value play, or are recent moves just some kind of crypto momentum slipstream effect?

Going nuts with digital payments

For the majority of the 🐿️’s adult life, the idea of leaving home without a wedge of folding cash in the hip pocket was right up there with not wearing trousers! However, my transition to a cashless world bore no similarity to a Hemingway ‘slowly then suddenly’ bankruptcy. It was very sudden indeed.

After nearly 3 years in Australia, I now handle cash so infrequently I think I would end up panicking and using up one of my lifelines on the ‘Who Wants to be a Millionaire’ game show if I got a question on the color of the various denominations of local banknotes.

I will spare you the tales about the early morning panics in the 🐿️household to find a A$5 bill for the school charity day (Melbourne’s schools would appear to be the final holdouts when it comes to digital wallet adoption). This week we dive into the world of financial technology.

It has not escaped this rodent’s notice that some of my favorite ‘value investor’ follows have started making noises about the main protagonist of the greatest ever mugging performed on Silicon Valley by ‘Team Australia’. I refer of course to Square (now Block) and its 2021 purchase of Afterpay.

To be honest, this rodent brackets Afterpay’s BNPL (‘Buy Now Pay Later’) business along with ‘payday loans’ and other forms of predatory credit. It just comes with much better public relations and fewer broken kneecaps.

AI-powered credit underwriting algorithms may sound very clever but are yet to be fully tested. Post election, BNPL players may now be less worried about Elizabeth Warren et al and regulatory scrutiny, but let’s see what a proper credit down cycle does to them.

This week’s piece will not be focusing on the crypto side of fintech, and this rodent is even less interested in loan sharking.

Instead, I want to dive into the opportunity among players within the processing plumbing of the digital fiat payments system.

Plumbing

This universe boxed in pink in Quartr’s excellent infographic below is a world of jargon that is worthy of unpicking (skip down to ‘Outlook for Payments’ if you are already familiar with the payments alphabet soup!).

Frankly, the buzzwords and acronyms of the world of digital payments are confusing. Let me try and help you distinguish between digital wallets, ISVs, ISOs, MSPs, PSPs and PayFacs.

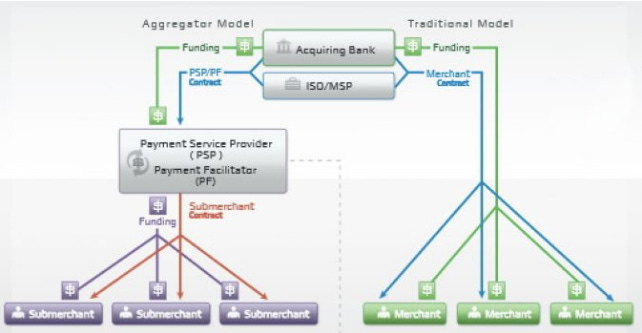

The terms ISO (Independent Sales Organizations) and MSP (Member Service Providers) come from the traditional world of the Visa (ISO)/ MasterCard (MSP)’s credit and debit card issuance duopoly. They are merchant account providers that act as the interface between merchants and acquiring banks. Familiar names would be brands like Clearent, EVO Payments and Fidelity Payment Services.

PSPs (Payment Service Providers or Processors) and PayFacs (Payment Facilitators) come from the modern world in which ‘submerchants’ are aggregated and have no direct ISO/MSP relationship.

PSPs are companies like Fidelity National Information Services, Fiserv and Global Payments. PayFacs are where the fintech household names come in, think PayPal (who invented the aggregator model) Square, Stripe and Adyen.

The advantage of the aggregator model for merchants is that they were created in and designed for the digital world. Streamlined onboarding with lite/zero documentation and no requirement for separate bank accounts means that individuals and small businesses can be set up to receive payments almost instantaneously.

Getting set up directly with a traditional MSP/ISO is a bureaucratic headache but usually means that you at least have a phone number to call if something goes wrong. Submerchants under the PSP and PayFac models do not have this facility and are also exposed to risks created by their fellow submerchants if breaches are deemed (by the compliance teams of the ultimate acquiring bank) to have been made.

The relationship between acquiring banks and the world of fintech has not been smooth sailing. By way of example, Wells Fargo recently ‘debanked’ Square, Stripe and PayPal. This is a fairly nerdy topic, but 2 good blogs here and here provide good further color for readers that want to dig in further.

To confuse matters further, many of these companies operate in multiple functions. ISVs (Independent Software Vendors) are a SaaS layer on top of the payment processing experience. Stripe, Square and PayPal as well as Toast (for restaurants) are examples of this category but there are plenty of ISVs that operate a SaaS front-end without the payment processing ‘back end’.

These new financial intermediaries are taking market shares (and margin) from the legacy payment processors. ISVs and PayFacs are creating ‘one stop shop’ apps and platforms customized for the point-of-sale (POS) and customer relationship management (CRM) systems of SME merchants.

For online shopping (platforms and marketplaces) and in-person shopping and dining these value-added software services are sufficiently sticky and profitable that some ISVs end up outsourcing the ‘messy’ process of actual payment processing to the merchant acquirers - at wholesale prices of course!

Outlook for Payments

The area of payments is well covered by ‘Big Consulting’. Never let it be forgotten that industries such as banking with wide moats to defend are a target rich environment for those in the business of selling billable hours! The world’s banks are also burdened with a patchwork of legacy accounting and payment software that cannot be ‘switched out’ overnight.

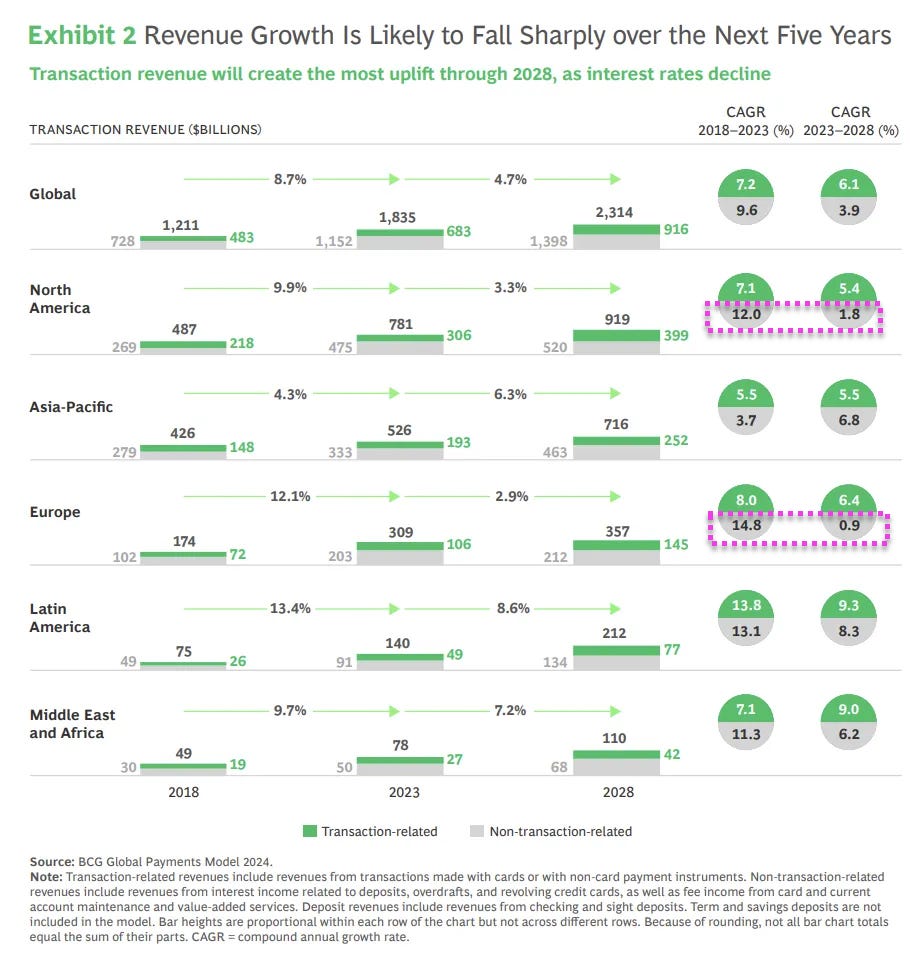

The good news about this focus on the sector from consultants is that they put together some great data for us! According to Boston Consulting, global payments transaction revenue compounded at 8.7% over the 5 years from 2018 to 2023.

Growth in developed markets (North America and Europe) is expected to decelerate to a low single digit rate between now and the end of the decade. However, a significant continued growth runway is still forecast for emerging markets.

The DM/EM distinction is understandable. The market position of legacy digital payments systems is much more entrenched in more developed markets that have been using credit and debit cards for years. Transaction revenue growth in the emerging world should continue to outstrip broader economic growth as a function of digital payments taking share from cash transactions.

We listen to a lot of hot air from VCs and fintech evangelists promising transformative productivity and growth vectors, but let’s never forget that payments are -at their core - a simple fee plus float business.

What really caught the 🐿️’s eye from the BCG forecast was the collapse in growth of ‘non-transaction-related’ revenue (the grey parts of their chart above). Most of this component of revenue is interest income on merchant ‘float’ / cash balances. I cross checked this number with McKinsey’s data, which estimates that net interest income contributes roughly 47% of total payments revenues.

It strikes me that this forecast is baking in some fairly significant assumptions for cuts in interest rates without saying so explicitly. In a ‘higher for longer’ rates world, I suspect we should see much higher overall transaction revenue volumes for payment processors.

The industry may end up needing that growth:

There is plenty of competition for the revenue pool. BCG is tracking more than 6,500 active payments-focused fintech businesses globally.

Financial crime and cyber risks are growing even faster than fintech startups! Regulators are demanding that both incumbent and insurgent players in the payments space raise their game in response - a further headwind to payments margins unless AI can do much of the compliance heavy lifting in a cost-effective manner.

In terms of investment in the future of payments, the 🐿️ senses that a fair degree of selectivity is warranted both in terms of geographical and market segment focus. In Section Two this week, we review the investable landscape in the hunt for our payment ‘acorn’.

Don’t miss out! On the topic of payment plan, please consider becoming a paid subscriber to Blind Squirrel Macro to receive the other 60% of 🐿️ content (including the rest of this week’s letter), member Discord access (The Drey) and even ‘limited edition’ merch!