Hong Kong Bound

Review of the 🐿️'s BUSHY™ Multi Asset ETF Portfolio and live Acorn trade ideas. 2025, Week 43.

The 🐿️’s weekend note (published on Sunday) revisited the portfolio’s energy positioning. We are initiating a new short position in the sector. Link below in case you missed it.

Hong Kong Bound

The ‘start the week’ note comes to you a day early as I will be spending most of Monday flying up to Hong Kong. Am very excited to be spending a few days sharing ideas with a group of self-styled ‘macro misfits’ and visiting a handful of Chinese companies. I look forward to reporting back!

With the 4th CCP Plenum wrapping up on Thursday in Beijing, I was pretty convinced that this weekend’s thematic note would be focused on China. As it turns out, the communique was a bit of a disappointment. I found myself nodding vigorously as I read this piece from Stephen Roach.

I agree with Stephen that it feels as though an opportunity may have been missed around re-balancing the economy away from global manufacturing powerhouse and towards domestic consumption. For now, it looks as though they are doubling down on factories and local innovation.

An economic pivot by China is something that the US administration also wants badly. Could this possibly be a card being held back until trade tensions settle down? Perhaps we find out more with Trump’s Asian tour this week.

We made a further adjustment to the China consumer basket this week. The shift towards a lower beta approach to Middle Kingdom investing continues. More in the Acorn Review below.

Let’s see if EEM 0.00%↑ can break out of its ratio chart with the S&P by the time I get back from China next week. At 28% of the EM index (add another 20% for Taiwan), Greater China needs to be working to avoid a quadruple top!

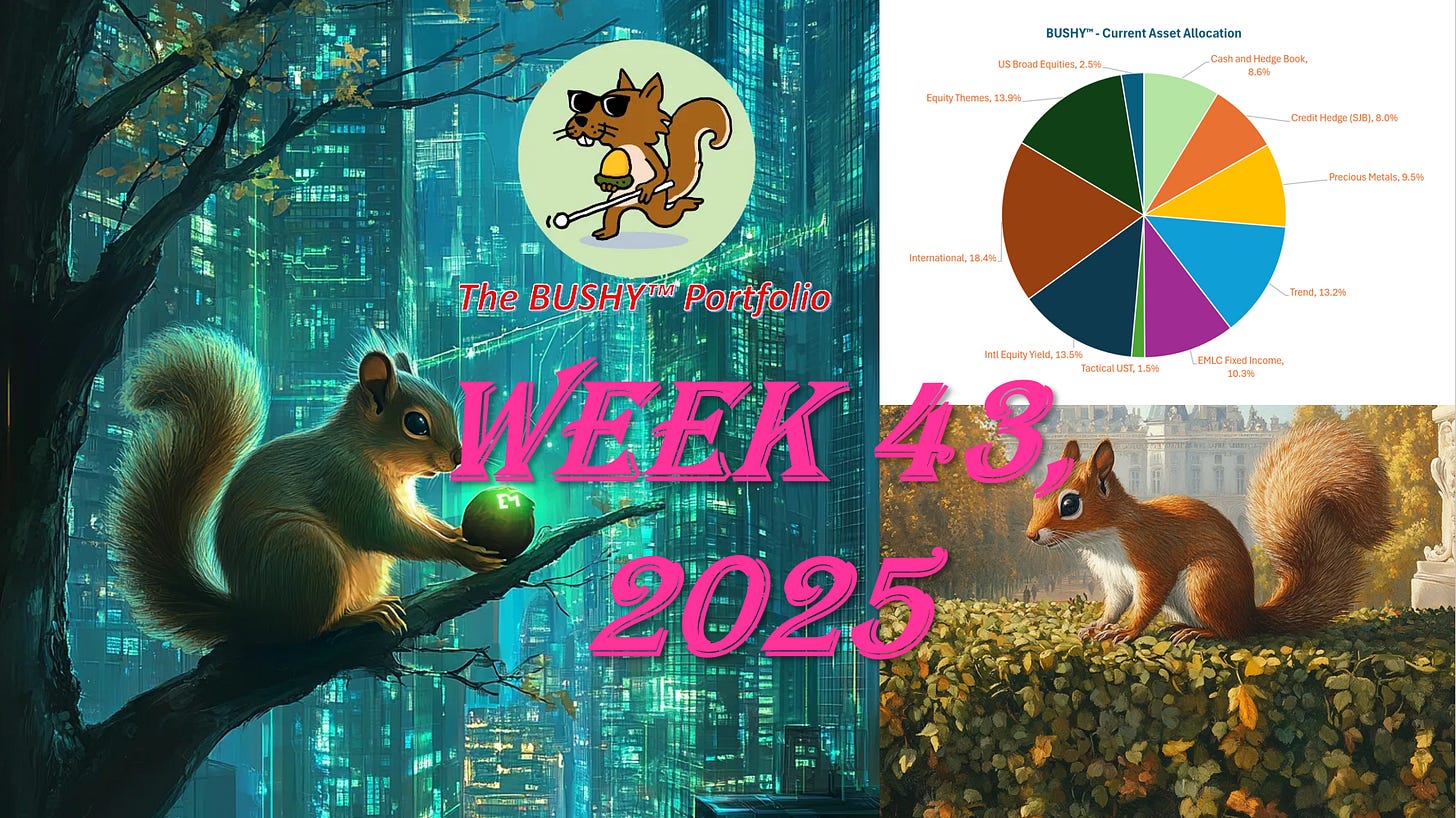

BUSHY™ Review

The BUSHY™ portfolio had a positive week, closing on Friday at a high for the year. This week, the hedge book provided some protection from continued weakness in the precious metals complex.