Flying Pigs?

The Blind Squirrel's 'Monday' Morning Notes. Year 4; Week 4 of 2026.

In case you missed it, Benny and I sat down with Simplify Asset Management’s Michael W. Green on Thursday - link to the show here. Many of you may be familiar with Mike’s thesis on the impact of passive management on equity markets. Even if you are, please don’t miss this conversation as we covered a lot of fresh ground that he has not raised in other interviews.

One topic which will have to wait until next time was his ‘Long “machine food” (metals and energy), Short “human food” (grains and farmland) thesis. I certainly agree with Mike’s thesis that you should not buy commodities as a “monolithic asset class” (catch up on ‘Commodities are not Sardines’ from last January).

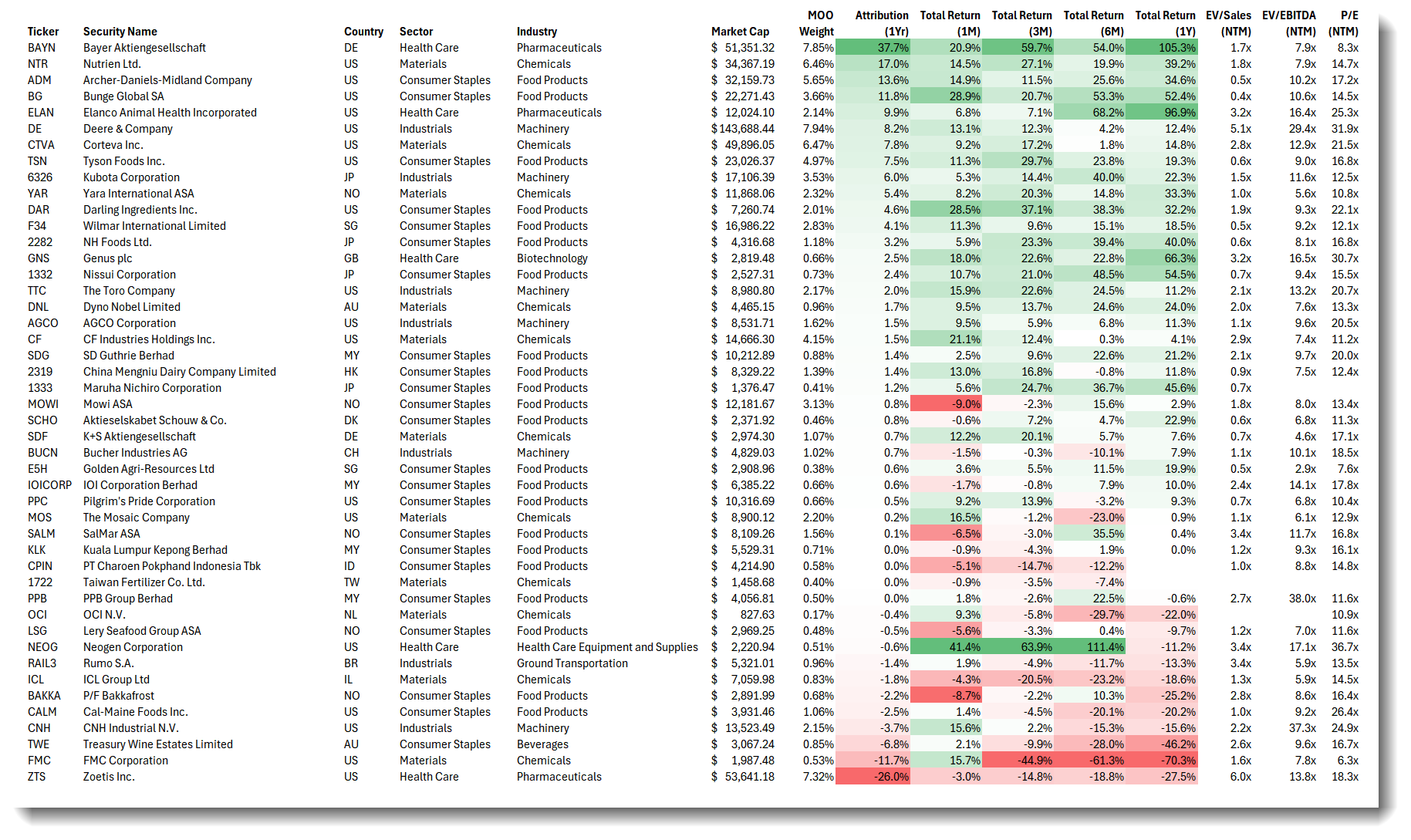

He sees farmland as a leveraged short play linked to deteriorating demographics. I understand his logic over an extended timeframe even if right now this rodent is finding it hard to resist anything that looks like a real asset. It’s not farmland, but in the past 3 months MOO 0.00%↑ - VanEck’s Agribusiness ETF - would appear to be taking the other side of Mike’s view.

MOO 0.00%↑ was party of the BUSHY™ beta portfolio until early March 2025 - when it left the portfolio as part of (further) trimming of broad US equity ‘beta’. Given its notable move in the past 3 months I decided to take a look under the hood. Some interesting discoveries and observations.

Some ‘old friends’ were leading the pack. Bayer, the German ‘seeds to pharma’ conglomerate was a value trap that ensnared this rodent back in 2023. It was summarily removed from my portfolio and watchlist (“with extreme prejudice”) at the end of that year. It has now doubled in the last 12 months. What’s the equivalent of FOMO for when you did not even notice missing out?! No regrets. Europe has been littered with 12-month 100%+ ‘large cap’ total returners.

The next names that jumped out were the Ag traders, ADM and Bunge. I delighted my Canadian readers with a ‘Tragically Hip’ reference when I wrote up those “Merchants of Grain” almost 2 years ago. Again, early = wrong!

I have been keeping a closer eye on the improving charts in this space. I have been indirectly participating in the recent run in BG 0.00%↑ via my position in Glencore (which owns a 16.4% stake post closing of the Viterra merger).

No strong urge to add exposure and chase Bunge’s impressive breakout. Glencore has explicitly stated this stake is “not consistent with our business model” and intends to sell it. Probably makes sense to wait for that supply to clear.

Next up, 20% of MOO’s total returns in the past 12 months are attributable to the chemicals / fertilizer space. Interesting. Right now it seems there are about as many chemicals bulls as DRAM / memory chip bulls in my network of fellow scribes and readers.

Back in September, we jettisoned the XLB (materials) ETF from BUSHY™ and exited some fertilizer-related single stock positions. I took the view that margins in global bulk chemicals (XLB has a >50% weighting chemicals stocks) would struggle to return with China adding so much capacity across petrochemicals. I understand the anti-involution story but hard evidence of capacity reduction in chemicals has not shown up yet.

The 🐿️ is not among the chemical bulls and not on the memory train either. Having been involved in at least 2 “rescue” recapitalizations of Korea’s Hynix in as many years in the early 2000s, the scar tissue remains raw. Certain stocks and sectors have a habit of creating PTSD.

Anyway, the reason that I wanted to interrogate Mike about the ‘short human food’ leg of his pair trade is that I was cooking up (sorry) a long food idea myself. Ironically it involves a name that does involve some 🐿️ PTSD by proxy.