Commodities are not Sardines

The Blind Squirrel's Monday Morning Notes, 20th January, 2025

I guessed that you did not want a 9,999th opinion on tariffs. You are not getting one!

But commodities do cross borders. As such, we are talking about them. The fact that commodities have come out of the gate strong this year with the backdrop of a rampaging US Dollar is twitching the whiskers of the 🐿️.

Commodities are not Sardines

In case you had not been paying attention, commodities have been enjoying a pretty robust start to 2025. Not FartCoin-style, but enough to keep a few grumpy old men with a preference for atoms over bits quite happy! The 🐿️ stands guilty as charged. Content, but on edge!

The fact that commodities have come out of the gate strong with the backdrop of a US Dollar that has been rampaging since October of last year is a major contributor to my nervousness. It is just not supposed to work like that traditionally.

Markets are braced for the volatility that will inevitably arrive with the new Trump administration on Monday. Bidding up the dollar would indeed be a logical move for investors looking to hedge or speculate on the prospect of significant and early action on the tariff front.

For what it’s worth, the theory goes that major exporters will seek to weaken their currencies to partially offset the economic impact of any tariffs. But we no longer live in normal times.

Polymarket is matching bets in a number of tariff-related markets. It is interesting to see that speculators on this platform would appear to be fading the more aggressive potential trade-related moves. Seems odd, given the volume of rhetoric on the topic from the transition team and from the concerned leaders of America’s largest trading partners.

Opinion is one thing. Those with real skin in the game are clearly taking decisive action. Any PADD 2 or PADD 4 oil refinery boss is not going to be taking any chances about wearing a 25% premium (at best) or embargo (at worst) when it comes to his or her key cost input, West Canadian Select crude oil (brilliant explainer here).

Investors in Canadian energy companies are certainly not taking the risk and have been actively voting with their feet. The basket of the 🐿️’s favorite (but do not currently own) Canadian oil and gas companies has underperformed the XOP 0.00%↑ (the popular US E&P ETF) by more than 15% since the election. That’s real money.

In the metals market, we have seen frenzied short covering in the gold and silver futures pits. The shorts have zero interest in taking the (remote? who on earth knows?) risk of having to pay a mark-up at expiry if forced to cross the US border in order to satisfy physical delivery of their bars at the COMEX-designated depositories in New York.

Below is the hourly chart of front-month gold and silver futures contract relative to spot prices since November 7th (the lower panel plots steeply rising path of the futures premium). This premium has accelerated in recent days as shorts are squeezed higher.

Target, timing and level of any tariffs are frankly a guessing game at the moment. The 🐿️ is now in ‘watch and wait’ mode when it comes to risk assets. When it comes to commodities, both the buy and sell buttons are firmly locked in the desk drawer until we get some further clarity!

This week’s piece is not intended to be the rodent’s 2025 commodity ‘outlook’. There is, however, plenty to think about. It feels too early to position for how any potential trade wars might impact broad economic activity and specifically how they might alter the behavior of China, the world’s largest consumer of commodities.

Then there’s the other types of war. As of January 2025, there are approximately 20 significant kinetic wars or armed conflicts taking place around the world. About 25% of the world’s population lives in conflict-affected countries (either direct or as a result of forced migration).

The tragic LA fires and Polar Vortex freezes, that we are already witnessing in 2025, are a salutary reminder that we are also in a period of extreme weather volatility with major potential consequences for numerous energy and agricultural markets. There is going to be plenty of noise in the commodity markets of 2025.

I have had plenty of questions in the past few weeks about how to add commodity exposure to portfolios. In a world in which there is an ETF for almost anything, there is an expectation that the 🐿️ might simply point folk in the direction of some kind of ‘one stop shop’ product to add commodity exposure with the click of a mouse.

The trouble with most ETFs is that they are only as good as the (often flawed) index they replicate or, in the case of active ETFs (almost non-existent in commodity world outside of trend-following) the portfolio manager that they employ. Regular readers will know that the 🐿️ is borderline obsessed with ETF and index construction. There is (of course) a back story.

By coincidence, last week I was forwarded a video celebrating the 25th anniversary of the launch of the Tracker Fund of Hong Hong (TraHK). This was the deal that took an unsuspecting 20-something rodent to Asia back in 1999.

Back then, most of the deal team thought that an IPO of a Hang Seng Index ETF would never manage to find broad appeal with investors. We were hopelessly wrong. The power of retail incentives (discounts and bonus shares) and the healthy thirst of the few of the index arbs and (“evil”1) hedge funds that managed to successfully run the gauntlet of TraHK’s institutional allocation process ensured that the deal was a complete blow-out! We bankers obviously tried to take the credit anyway!

One of the reasons that a young 🐿️ had been tagged to relocate to Hong Kong to work on the deal that turned into an ETF launch was the fact that I was one of the few Barings bankers at the time that had any familiarity with the product.

We knew that the HKMA wanted to exit its stake via a passive route (rather than sell stakes in individual companies in a piecemeal (inevitably ‘political’) - fashion. Frankly, the team’s hope was that we would be able to change their minds. To do that, at least one person on the deal team needed to sound (half!) credible on the product in question.

The 🐿️’s (sort of) credibility stemmed from his work on ‘Project Timebomb’, the restructuring of BEMIT, the Barings Emerging Markets Investment Trust. Project Timebomb was christened by BEMIT’s Chairman, the late (and rather brilliant) City of London ‘grandee’, Anthony Loehnis. ‘Timebomb’ was BEMIT spelt backwards (if you ignore the ‘omb’!). Well, the name tickled the Anthony’s impish sense of humor, so went with it!

BEMIT was a closed end mutual fund designed to track the total return of the Barings Emerging Market Index (“BEMI”) (ultimately acquired by the FTSE index group in 2000). BEMIT was trading at a steep discount to NAV and the 1990s trust-busting versions of Boaz Weinstein were calling for the fund’s liquidation.

Anthony was keen to explore whether or not we could restructure BEMIT into “one of those clever spider things”. He was not of course referring to arachnids, but rather to the SPDR (or Standard & Poor’s Depositary Receipt), which had been launched a few years earlier in 1993 (with less than $7m of assets - yes, that is million with an m!). This SP’y’DR is now what we all know as the SPY 0.00%↑ ETF2.

The reason that BEMIT was angering the ‘trust-busters’ was not just the fund’s wide trading discount relative NAV (the value of its underlying shares). BEMIT’s NAV was also struggling to track BEMI, its underlying index, a universe of EM stocks across 20 markets from Santiago to Seoul that were both hard to access (often requiring local foreign institutional investor IDs) and expensive to trade. You often hear wealth management disclaimers about ‘indices referenced herein’ being ‘un-investable’. Trust me, BEMI was one of those for real!

We pounded the pavements of the City of London trying to find 3rd-party brokers that might sign up as authorized dealers for our new ‘SPyDR’/ ETF structure for BEMIT but could not even persuade our own equity traders at Barings to raise their hands. BEMI was too tough to trade.

Which brings us back to commodities and, specifically, commodity indices.

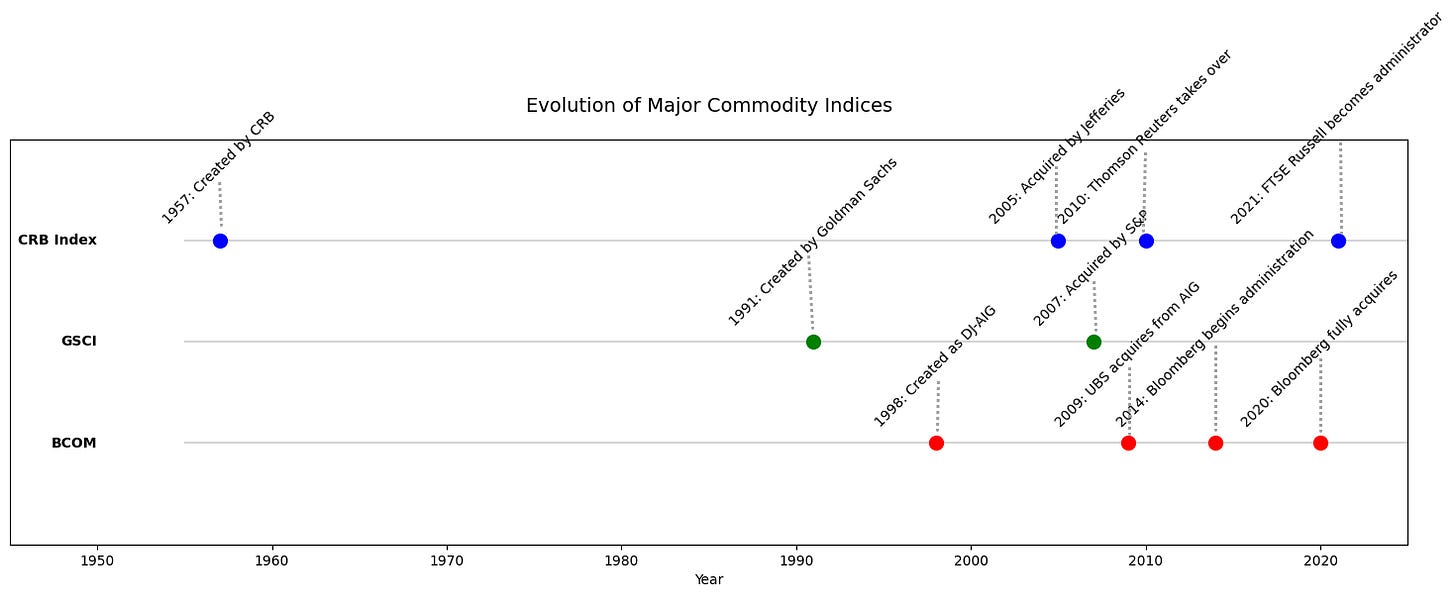

The concept of a commodity index was not novel. The CRB (Commodity Research Bureau) had established one back in 1957. A modest improvement on the ‘paper and pencil’ version created by The Economist back in 1864! These indices served as useful tools for economists, journalists and the chatterati but were wholly impractical for traders to attempt to track.

Just as we have just seen recently with Wall Street’s co-option of crypto markets to create ‘Another Table at the Wall Street Casino’, the 1990s saw Goldman Sachs (GSCI) and AIG (now BCOM) create investable indices over which they could launch investment products and start collecting fees and commissions.

The compilation philosophy behind these indices indexed heavily (sorry!) on invest-ability. This meant that the compilers focused on the largest commodities in terms of production (and futures liquidity) without giving any consideration to the demand (or rather future expected demand) side of the equation.

The winners of the commodity index game have been established. BCOM and GSCI’s focus on liquidity metrics above all else allowed for the listing of index futures on those indices and has ensured that they have attracted the greatest volume of benchmarked financial products (and associated fees).

Meanwhile, the first-mover CRB’s inclusion of a larger spread of agricultural contracts, including some of the less liquid ones, allowed it to participate (even though the index rebalances monthly) in the great ‘right tail’ moves in what the 🐿️ likes to call the ‘23/24 breakfast commodity revolution’ (cocoa, coffee and that favorite for all fans of Trading Places, frozen concentrated orange juice) and thereby comprehensively outperform its more popular cousins over the past 5 years.

It is worth noting that one of principal attractions of commodity investing is exposure to these types of tail events. The major trend moves are what delivers the bulk of commodity returns. You have to be a participant. But almost by definition, you are less likely to encounter those types of extreme moves in the largest and most liquid commodity markets.

As it is, most investors that are looking for commodity exposure as a portfolio diversifier and an inflation hedge via these indices risk finding themselves just taking an outsized bet on energy prices.

Of course, oil dominates the inflation basket of today and of the last century, but (by way of example) most of the ‘themes for the future’ that we discuss here - from AI datacenter growth to the energy transition - point in the direction of explosive copper demand. Both BCOM and GSCI have copper weightings of around a measly 5%. Feels like too low an exposure to this rodent (just simply for the sake of liquidity).

The next problem for owners of products tracking these indices relates to the trading practices of the futures market as well as the shape of the futures curve for individual commodities.

Notwithstanding what I have written above, billions of dollars of collective investment assets track the leading GSCI and BCOM indices and in so doing advertise their flow to the wolves of Wall Street. These indices roll their positions from one contract to the next in a highly transparent fashion. This is a gift for the arbitrage community and represents a constant erosion of returns for indexed investors.

The index compilers are forced by superior ‘front-month’ liquidity (after all, they have licenses to sell to those asset-hungry ETF and UCITS sponsors!) to focus on those contracts and ignore the shape of the individual futures curves.

Notwithstanding all of the above, the 🐿️ believes that having raw exposure to commodities (not just to the equities of the companies that produce, process and sell them) makes sense as we live in these times of inflation volatility. But I think you can do way better than owning an ETF or UCITS fund benchmarked to the BCOM or GSCI. These are not the trading sardines you are looking for.

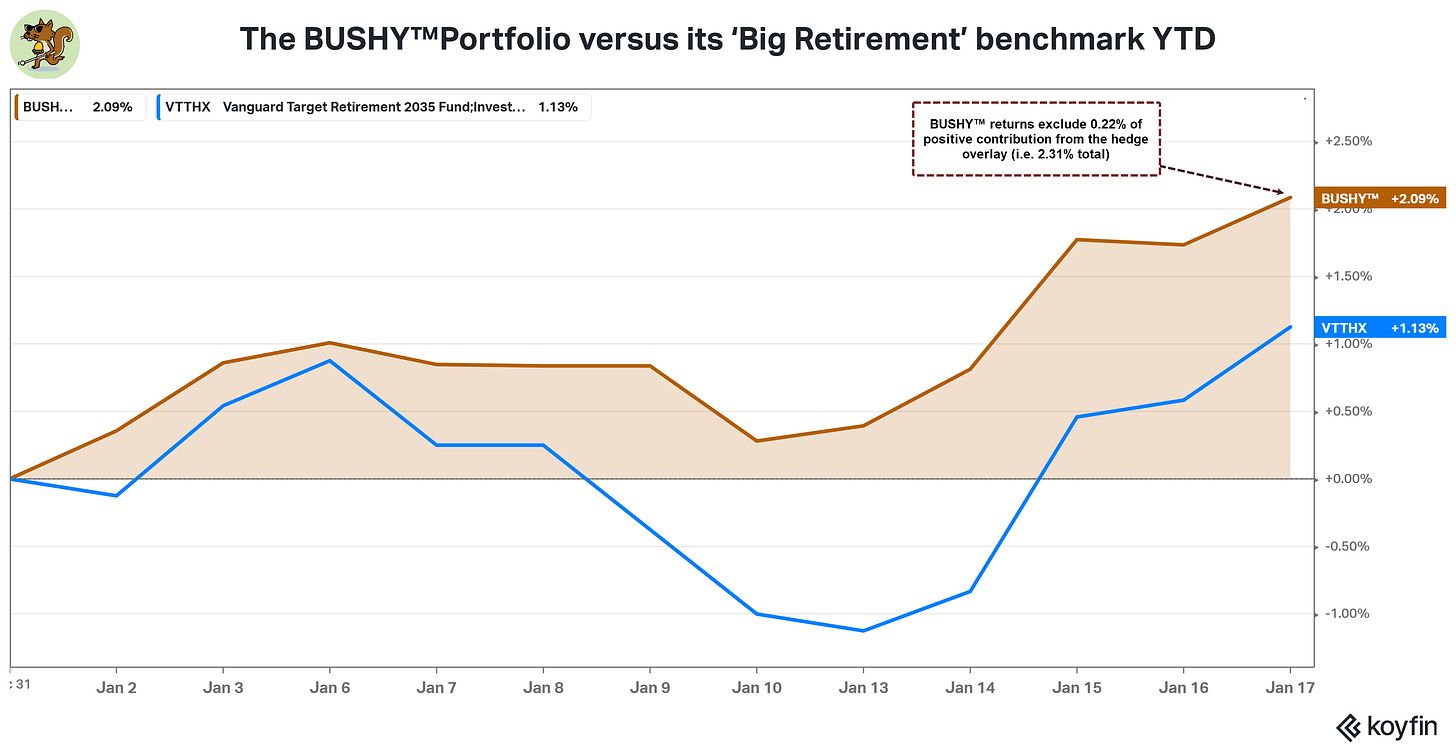

In Section Two, I break down one rodent’s approach. We also discuss how this approach is factored into our new BUSHY™ Multi-asset ETF Portfolio.

Join hundreds of smart investors, market watchers and upstanding citizens by becoming a paid subscriber to Blind Squirrel Macro and receiving the other 65% of 🐿️ content (including our commodity tools, members’ Discord access (The Drey) and even ‘limited edition’ merch!).