A(i) Prescription

Our new Acorn in biotech!

A(i) Prescription

In Monday’s note we discussed the opportunity within biotech created by the advances in generative AI.

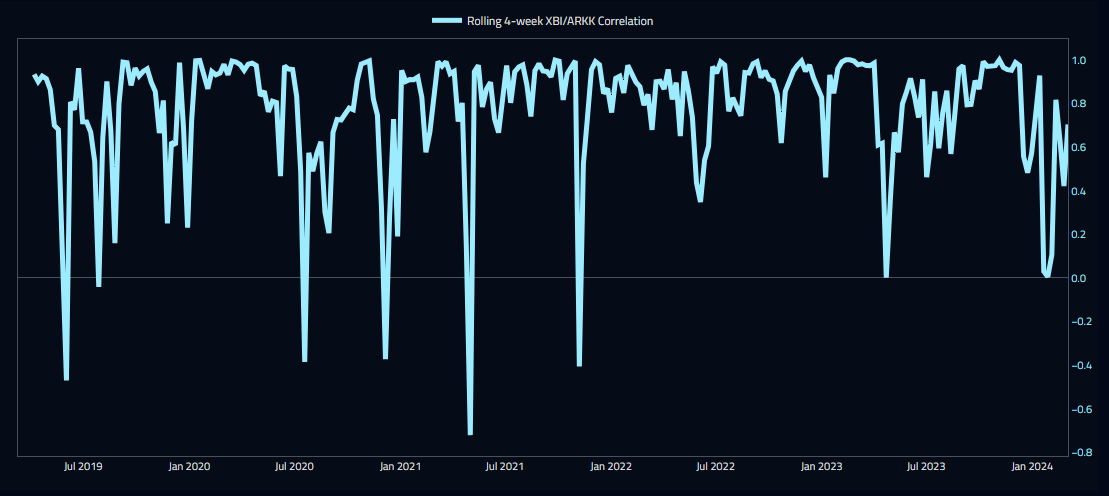

We acknowledged that while the opportunity is by no means brand new (VCs having been backing AI-driven drug discovery for over a decade), the public markets only started to latch on to the opportunity in late 2023. We do have concerns that the recent strength of the sector may be driven by same hopes of a return to cheaper liquidity that has fueled the rally in profitless tech stocks.

We reviewed a menu of potential active and passive ETF vehicles as the potential building blocks of our acorn basket.

Simplify’s Healthcare ETF PINK 0.00%↑ - actively managed exposure to the broad healthcare sector.

Blackrock’s iShares Biotechnology ETF IBB 0.00%↑ - passive exposure to the broader biotech (more market cap weighted).

State Streets SPDR S&P Biotech ETF XBI 0.00%↑ - ‘nitro’ exposure to biotech via a ‘modified’ equal-weighted exposure to the sector.

We did the fundamentals on Monday. Let’s have a look at some daily charts.

Our basket will comprise a core common stock position with a couple of option overlays. Notwithstanding the excitement about the capabilities of AI’s new Large Language Models, we would prefer some human intervention (!) when picking out the winners and losers of this new trend.

As such, the mainstay of our acorn basket is going to be a common stock allocation to Mike Taylor’s PINK 0.00%↑ ETF. Not only do we feel comfortable with the portfolio and performance characteristics of the fund, but it represents a wonderful way of giving back to a great cause.

As I mentioned on Monday, all of the PINK 0.00%↑ fund’s profits are donated by Simplify to the Susan G. Komen breast cancer charity. Breast cancer has sadly felt a bit like an epidemic down here in our community in Melbourne over the past year. Australian cricket fans among my readers will instinctively relate to the fund’s colorful choice of ticker symbol.

Let’s dig in.