The 🐿️ must be on drugs!

The Blind Squirrel's Monday Morning Notes, 4th March 2024.

Summary

With half an apology for the ‘clickbait’ title, this week the 🐿️ takes a look at the building momentum in biotech stocks.

If there is one area where the processing power of AI’s Large Language Models should be truly transformative, that sector would be pharmaceutical R&D.

Until recently, biotech stocks, for the most part, have missed the AI party. This may be due to the fact that AI-driven drug discovery is not a new concept.

The recent big moves, however, have a worrisome companion. Profitless technology stocks. The (profitless) biotech sector is every bit as dependent upon cheap money and liquidity as the cash flow incinerators within Ms. Wood’s ARK portfolios.

To the 🐿️, you have 2 options when it comes to biotech investing. You either ‘buy the market’ or else you leave it to the experts. Fortunately, the modern world of ETF investing allows you to do both! We dig in.

In an extended Section Two (for paid subscribers), I am writing up a new ‘Acorn’ volatility hedge, inspired by some great work that Kevin Muir has recently done on potential emerging risks in the US equity options complex from a crowded dispersion trade. We also review the latest developments with some our other live ‘acorn’ positions. A new idea in autos is bubbling up.

Welcome! I'm Rupert Mitchell aka The Blind Squirrel and this is my weekly newsletter on markets and investment ideas. If you've received it, then you either subscribed or someone forwarded it to you (add yourself to the list via the button below). Please also consider becoming a paid subscriber!

The audio companion to this week’s note will be uploaded to Substack on Tuesday to allow me to incorporate comments and feedback from this note. It will also be available as a podcast on Apple, Spotify and the other usual podcast apps.

The 🐿️ must be on drugs!

Your 🐿️ has been guilty of not committing fully to the AI feeding frenzy of the past 18 months. I have a small amount of indirect exposure to the runaway train that is Nvidia but regret that I am part of the large cohort of investors that just could not get their heads around the valuation entry ticket to the game.

No regrets. Our recent foray into an alternative ‘picks and shovel’ play on AI-related datacenter capex via coherent optics (‘Seeing the Light’) is now working well. It now seems clear that the ‘hyper-scalers’ of large cap tech are going to spend the necessary billions of dollars to build the architecture. It’s time to focus on the second and third order effects of this emerging technology.

Are AI ‘co-pilots’ going to deliver the type of tech-enabled productivity boom that is the fantasy of the arch deflationists or are they just a turbo-ed version of Microsoft’s original ‘Clippy’ desktop ‘assistant’? This week it even appears that Large Language Models (LLMs) have managed to open up yet another new front for societal culture wars! 😔

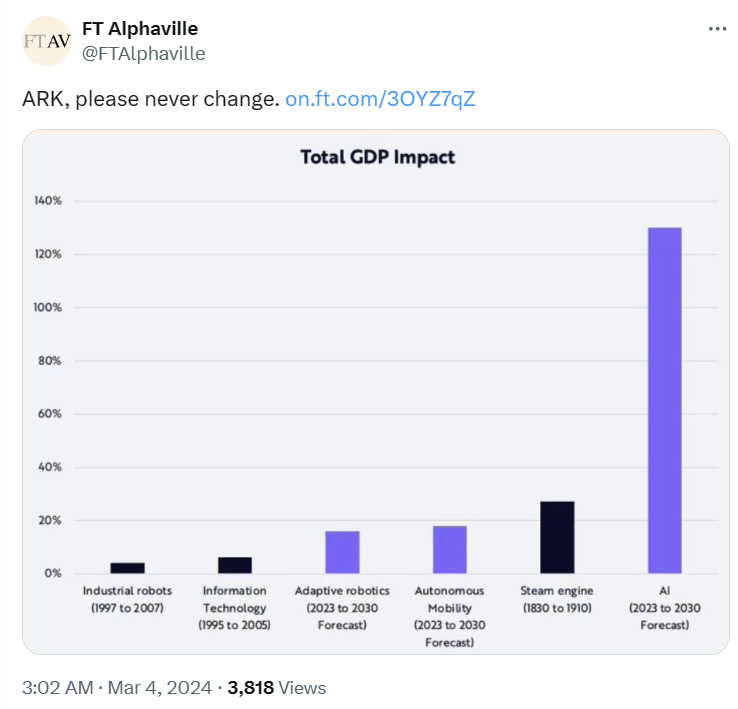

I have no doubt that the technology will streamline and accelerate millions of daily tasks and process. How can that not have a major impact on productivity in the economy? I was therefore fascinated to read in ‘Inflation Guy’ Michael Ashton’s E-piphany blog last week that the ‘lookback’ impact on productivity and economic growth from the introduction of the internet in the 1990s was actually not as massive as many assume. He also talked about this in his latest podcast.

Michael concluded that as a result of the 7-year boost to productivity growth from the World Wide Web revolution between ‘95 and ‘05 “our standard of living moved permanently higher by about 10% during that period, over and above what it would have done anyway”. Is that all?! Even if AI is the equivalent of 2, 3 or 4 internet revolutions are we adding too many zeros to the economic opportunity?

Once again, are we humans in danger of over-extrapolating the impact of the new ‘new thing’? For sure, AI co-pilots seem likely to create major disruption for certain industries and economies. Take Indian equities for example. They are currently priced for economic perfection. But how are the economic planners of New Delhi thinking about the impact of LLMs on the livelihoods of the nation’s low-skilled IT workers?

There is one sector where the processing power of AI’s LLMs should be truly transformative, and the market is only just starting to apply its slide rule to the implications. That sector is Biotech.

The roll that LLMs can play in analyzing protein structures, genomic data and research literature promises to accelerate traditional pharma R&D processes and potentially transform the speed and cost of both new drug discovery and the repurposing of existing compounds.

This is not just excited researchers in university laboratories. A recent study (Jan 9th) by Mckinsey puts some pretty big numbers around the economic opportunity.

Yet investor excitement, at least until recently, has largely been focused elsewhere.

The biotech sector has, for the most part, missed the party. Part of this may be due to the fact that AI-driven drug discovery is not a new concept. OpenAI’s public launch of ChatGPT in November 2022 may have sparked mainstream public and investor excitement about the AI opportunity. However, the opportunity for generative AI in pharma R&D has been attracting investor dollars for almost 15 years!

Come the Q4 ‘everything rally’ of last year, biotech finally started to participate.

We are seeing examples of biotech company share prices double simply off the back of announcement follow-on stock offerings. Companies announcing some promising FDA Phase 1 data are behaving like meme stocks. Historically, that news would barely garner a headline. Probably largely in response to the price jumps of late 2023, the AI-narrative-volume-dial has done a Spinal Tap and been ‘turned up to 11’ in drug world.

Merger and acquisition activity in the sector has also taken off with a vengeance as ‘Big Pharma’ seeks to (i) acquire some growth and (ii) attract the investor love that has been comprehensively lacking since the vaccine bonanza of the COVID pandemic (outside of course the GLP-1 / anti-obesity drug mania).

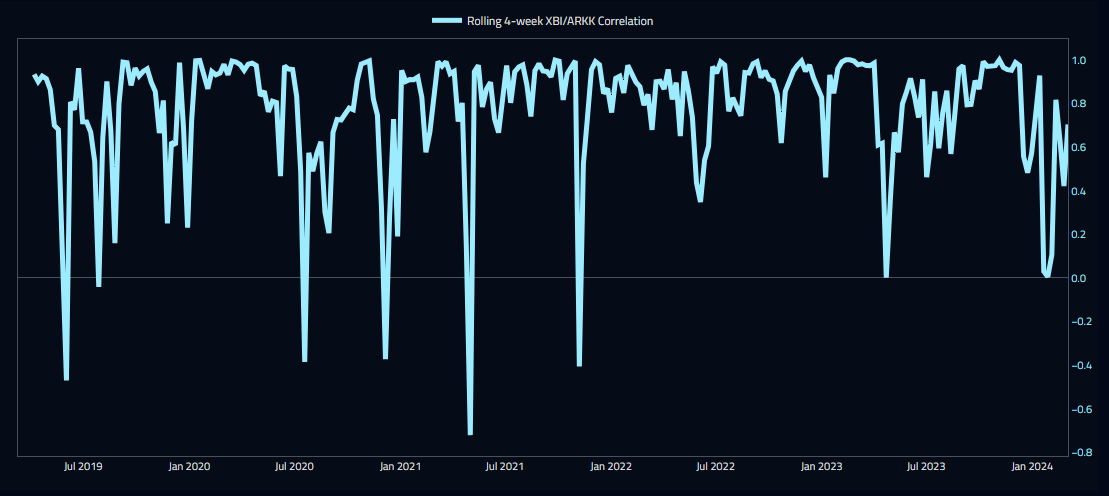

Before we get too excited about the crowd having found the next bubble to chase, one word of warning from the 🐿️. The narrative really only started last year once the sector had already started to move. NARRATIVE ALWAYS FOLLOWS PRICE! We need to remain conscious of what else started to move at the same time (once the central bankers started to promise an easing cycle for 2024). Profitless technology stocks…

I am afraid that this is a correlation that has been in place for a long period of time. The (profitless) biotech sector is every bit as dependent upon cheap money and liquidity as the cash flow incinerators within Ms. Wood’s ARK portfolios. There is ‘punch bowl removal’ risk here too folks!

How to buy drugs(tocks)!

AI excitement in the sector may make the risk of tightening liquidity conditions irrelevant. Who knows? We will just need to get comfortable with managing that risk. Central banker activity at least has the advantage of being relatively easy to monitor and gauge on a real time basis.

Picking winners in the biotech sector, however, is notoriously hard. In the late 2000s, I spent an ‘entertaining’ time running an equity financing business in London where two of the most successful investment banking teams that I supported specialized in energy E&P (with a focus on the ‘E’) and pre-revenue pharmaceutical companies, respectively. I used to moan to the healthcare team that at least the oil and gas boys had the benefit of 3D seismic when it came to picking their winners!

My personal experience of listening to experts talk about “promising” pre-clinical data on individual drug stocks has been pretty completely miserable. I am sure that many of you have the PTSD and scar tissue that comes from owning stocks with fast evaporating cash reserves as they await the binary ‘hero or zero’ outcome of a regulatory approval.

To my mind, you have 2 options when it comes to biotech investing. You either ‘buy the market’ or you leave it to the experts. The biotech investment specialists may be gambling on those regulatory outcomes but they at last know how to count the cards! This rodent certainly does not.

Fortunately, the modern world of ETF investing allows you to do both! Your 🐿️ has dug into the some of the alternatives. For pure biotech exposure, the largest and most liquid passively managed ETFs are Blackrock’s IBB 0.00%↑ and State Street’s XBI 0.00%↑.

If you are looking for the support of an expert card counter (i.e., active management!), but with less of a pure play exposure biotech, Mike Taylor at Simplify’s PINK 0.00%↑ healthcare ETF has outperformed the healthcare sector since inception (using State Street’s Heathcare ETF XLV 0.00%↑ as a benchmark).

All of $PINK’s profits are donated by Simplify to the Susan G. Komen breast cancer charity. The 🐿️ likes that and the Australian cricket fans among my readers will instinctively understand the fund’s colorful choice of ticker symbol.

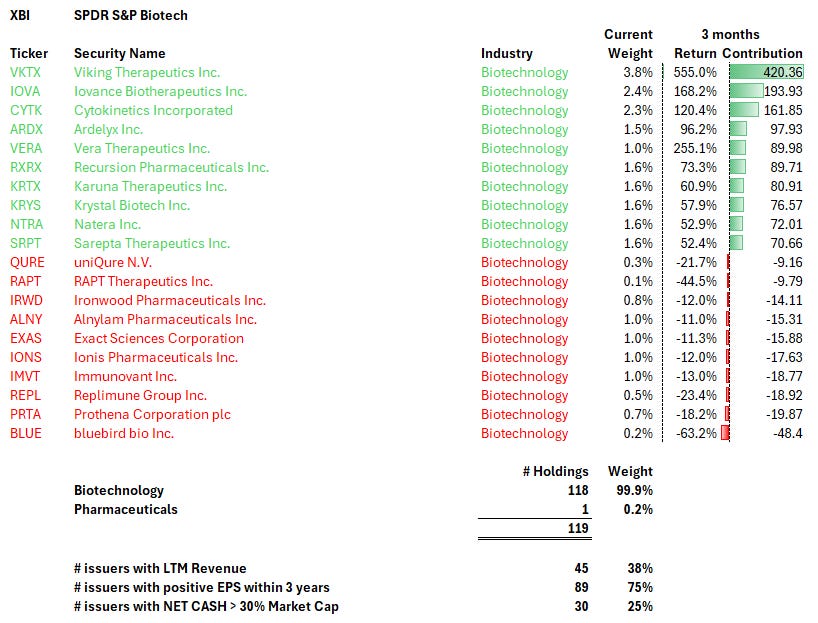

Using the fund holdings data from Koyfin I decided to ‘lift the hood’ and look at the key portfolio characteristics and return attributions for these 3 ETFs over the past 3 months.

State Street’s XBI 0.00%↑ is your ‘pure nitro’ exposure to biotech.

The ETF has assets of $7.9bn, has been seen trading volumes at a massive $1.6bn per day and also has a liquid options chain. It holds c.120 underlying stocks with less than 20% allocated to its top 10 names. Most holdings are between 0.25% and 1.5% of the fund. 62% of its holdings are pre-revenue companies (!), although 75% of them have consensus forecasts of positive earnings within 3 years (am sure that there is a conditional element to many of those forecasts!). 25% have net cash on their balance sheet that is greater than 30% of their market capitalization.

Blackrock’s IBB 0.00%↑ has an 80% weighting in pure biotech, the balance of the holdings in MedTech and services.

It has assets of $7.6bn, trades (a more modest) $350m per day and has a liquid options chain. It holds over 200 underlying stocks but with a concentrated 49.5% allocation to its top 10 holdings (Vertex, Regeneron, Amgen and Gilead). As such, the average weighting of the smallest 100 holdings is only 0.06%. Only 29% of its holdings are ‘pre-revenue’. Curiously, only 35% of IBB’s holdings are forecast to have positive net earnings within 3 years according to Koyfin’s consensus analyst data. 31% have net cash on their balance sheet that exceeds 30% of their market capitalization.

IBB is probably more representative of the fortunes of the broader biotech sector, but many of the holdings are too small to make a massive difference to the portfolio in the event of a blockbuster discovery. XBI’s ‘modified’ equal-weighted exposure to the sector means that some hot names (last week it was Viking Therapeutics VKTX 0.00%↑) can move the needle on performance.

I can give arguments in favor of either ETF as to which fund is best placed to benefit from the AI effect but suspect that it is the better-funded large cap biotech names (i.e., within IBB 0.00%↑) that are better positioned to exploit the benefits of generative AI.

Alternatively, you can take the active management approach with Mike Taylor’s PINK 0.00%↑, the Simplify Health Care ETF.

PINK is still relatively small, but AUM has grown significantly this year, and it now has assets of over $100m with about $4m of daily trading volume. This fund is only weighted 31.4% in pure biotech and is reasonably concentrated (55% in the top 10 stocks). Very few ‘pre-revenue’ holdings and nearly all holdings are forecast to report positive earnings within 3 years. There are some listed options available, but with very low open interest.

Mike has managed to latch on to a few of the recent ‘big winners’, like Sarepta Therapeutics. These have made a meaningful contribution to performance. Active management has also ensured that the top 10 losers in PINK 0.00%↑ have done less damage than the losers in the 2 passive vehicles.

We will be publishing our implementation plan in a new biotech acorn later this week.

Quick request. In February the 🐿️ celebrated the 1st anniversary of going live on Substack. I have put together a brief reader survey. Thank you if you have already completed it. If not, it will only take 30 seconds of your time to complete. Important: Please add your email to the comments box if you would like a reply (otherwise it’s 100% anonymous)!

That’s it for the front section this week. In Section Two (for paid subscribers), I am introducing a new ‘Acorn’ volatility hedge, inspired by some great work that Kevin Muir has recently done on potential emerging risks in the US equity options complex. We also review the latest developments with some our other live ‘acorn’ positions. A new idea in autos is bubbling up.