2 Weeks to go. Don't mess it up, 🐿️!

Weekly review of the 🐿️'s BUSHY™ Multi Asset ETF Portfolio and live Acorn trade ideas. 2025, Week 50.

In the weekend note, we covered an interesting opportunity in the smart glasses value chain. Link below in case you missed it.

My great friend Kevin Muir joined us on Benny & The Squirrel on Thursday evening. We covered a whole load of topics that you will not want to miss. Link to the recording on YouTube below 👇:

Market and BUSHY™ Review

An interesting week in markets. The ‘fully priced’ rate cut was accompanied with a much less hawkish narrative than was expected. US stocks, bonds and the dollar all ended the week lower.

We saw some powerful sector rotation. Nervousness returned to AI infrastructure story, allowing some oxygen to return to the “Forgotten 490”. The equal-weighted S&P (RSP) outperformed the cap-weighted index (SPY) by a meaningful 1.69%. The “Zombie Beta” of small caps (IWM) had a very strong week, while the precious metals miners mocked my timidity for not buying them back.

A weaker dollar should have been a tailwind to emerging markets. This was not the case - a steep sell off in China large caps in particular. Latin American stocks bounced back from the ‘Bolsonaro Junior’ scare of the previous week. Ex-US developed market equities (MSCI EAFE / IEFA) were only marginally higher once you factor in the 0.62% of negative dollar move on the week.

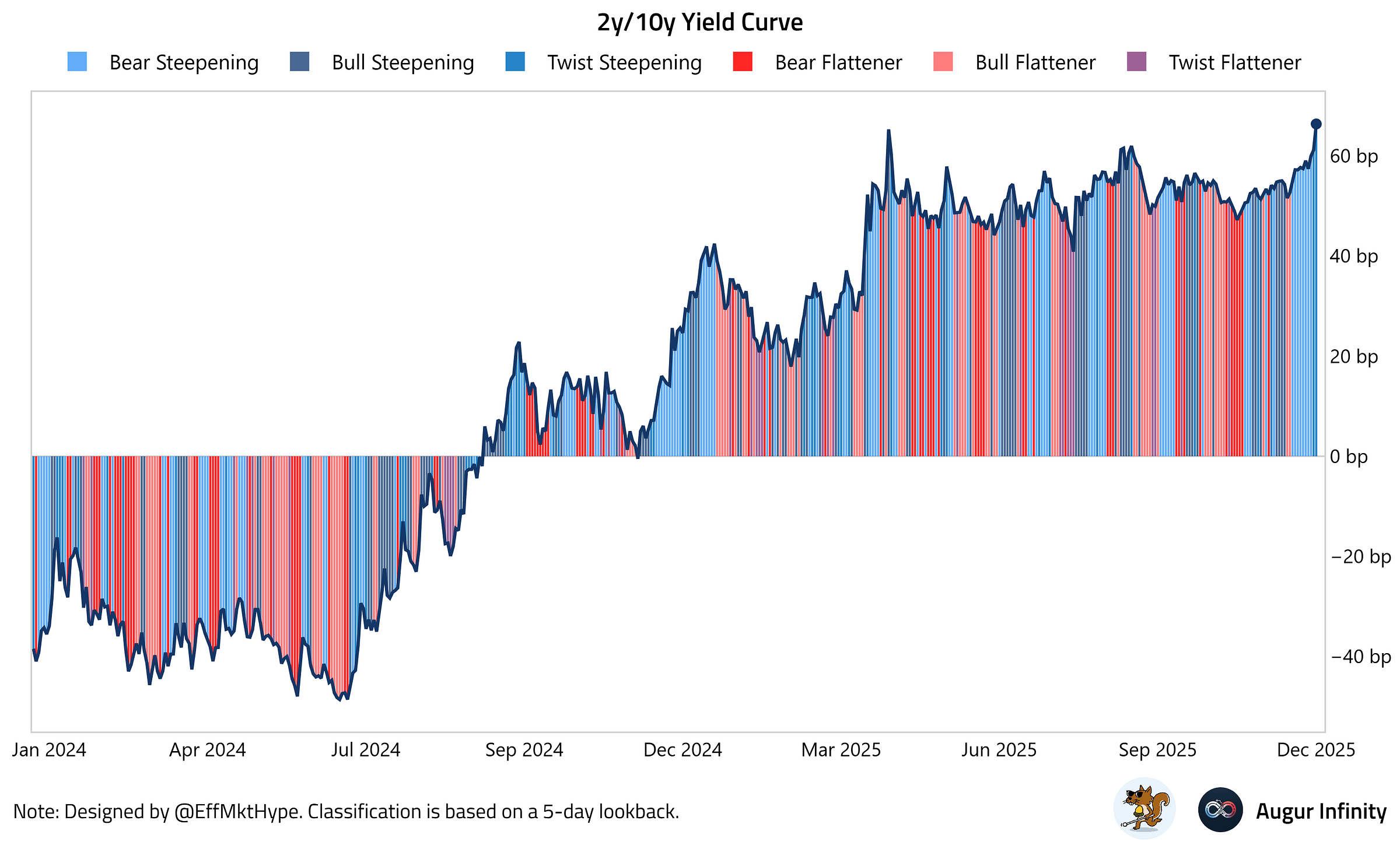

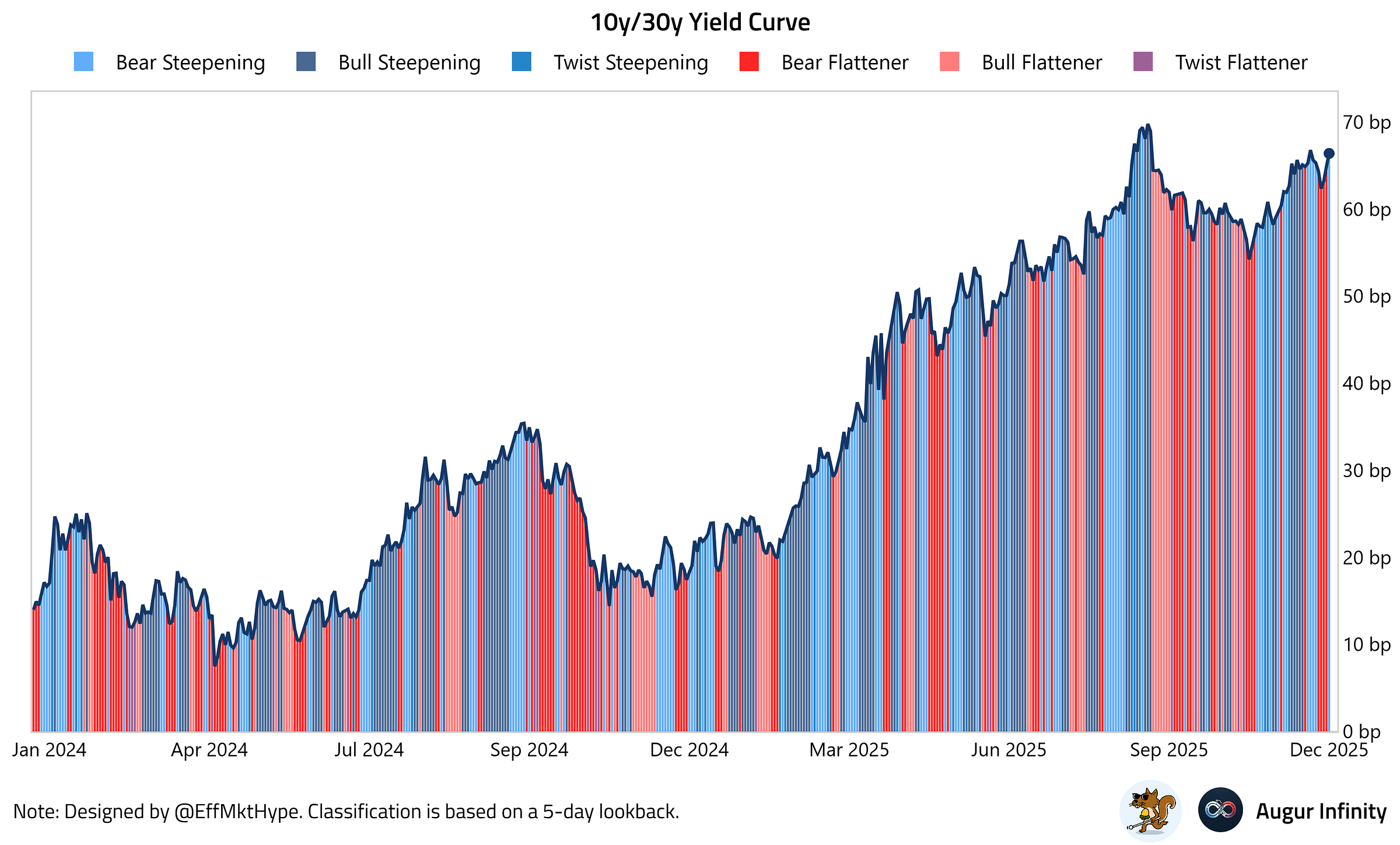

US financials were the pick of the sectors. They appear to be eyeing up those steeper yield curves.

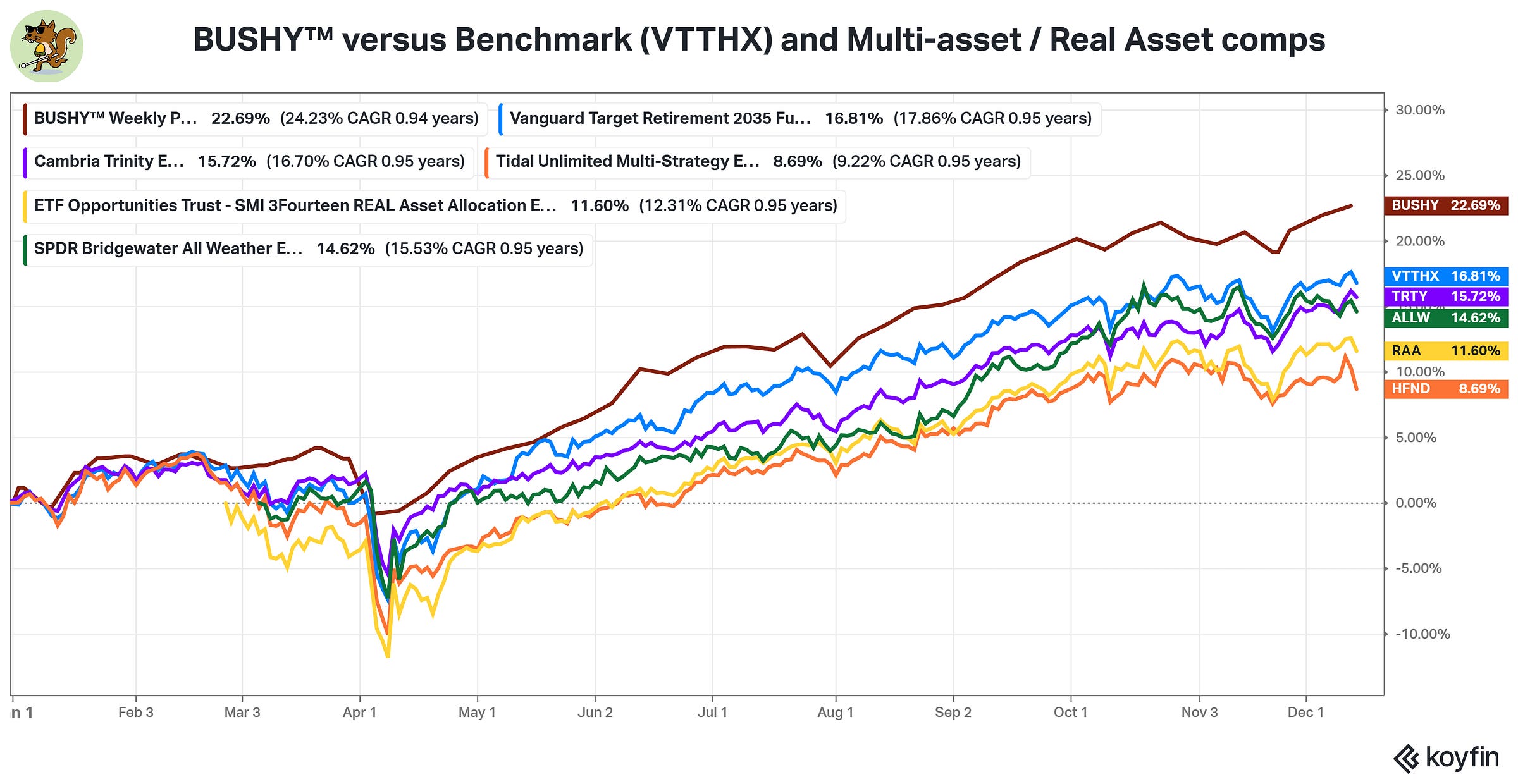

With less than 2 weeks until year-end I am wary of getting overly excited about these sector rotations and divergences in traditional cross-asset relationships. BUSHY™ remains defensively positioned (20% of the book in cash and hedges). Am not inclined to risk what has been a decent year on fresh themes in low volume holiday markets. BUSHY™ has plenty of the stuff that is working.

The beta portfolio’s bias towards international equity and fixed income exposures certainly ensured that it had a better week than its Vanguard ‘Big Retirement’ benchmark. BUSHY™ closed on Friday at a weekly high for the year but I freely acknowledge that most of the absolute return for the week was driven by that weaker dollar.

Precious metals (10.4% of the portfolio - with the gold now unhedged) did most of the heavy lifting. A pullback in the energy exposures (and uranium) cost the book 14bps. The trend allocation continued what has been a solid positive quarter thus far.