Who is feeling Moody?

May 19th, 2025. Review of the 🐿️'s BUSHY™ Multi Asset ETF Portfolio and live Acorn trade ideas. 2025, Week 20.

The Friday evening US sovereign ratings downgrade by Moody’s made for some terrific social media banter, but the extent of its importance is probably limited to the fact that it finally forces markets to pay attention to ‘One Big Beautiful Bill’ discussions taking place in Washington. 🐿️ note - I feel like I lose a couple of IQ points every time I type that phrase.

I was on Maggie Lake’s show on Monday evening after the close. Even if you do not have time to listen to or watch the whole show, she always puts together a great write up of the points covered in her interviews (link for my one below).

We obviously had to discuss the US / China trade war ceasefire that had taken place the previous weekend, but we did spend time talking about the fact that the market was willfully ignoring the budget reconciliation log jam in DC.

Up until after the close on Friday evening, the S&P 500 was doing a pretty impressive encore of the Greatest Hits of 2023-24 as the Magnificent 7 casually tacked a few hundred billion dollars back on to their collective market cap over the week.

S&P 500 futures are softer as I write this (Sunday evening EST) - cue jokes about ‘Moody Spooz’ but I do not think that the ratings headline is what is impacting risk assets at this Sunday night’s futures open. Other weekend news flow would seem much more problematic.

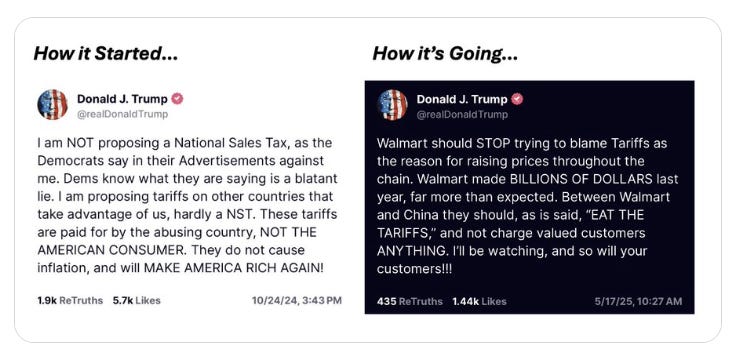

The standoff that is emerging between corporate America and the Trump Administration as to who ‘eats’ tariffs.

Secretary Bessent’s ‘Sunday talk show’ round highlighting the fact the latest approach to deficit reduction is tilted towards running the economy hot, rather than indexing on fiscal spending restraint. Cue Moody Blues (as in the old CME color code shorthand for interest rate futures referencing short rates 3 to 4 years out in time).

The Moody’s report has clearly been

tossed in the trash‘cylindrically filed’ by the Treasury Secretary and long bond yields have rewarded this tour of the Sunday studios with a 5% yield handle as I write - in line with levels that were previously described as “yippy” by his boss.

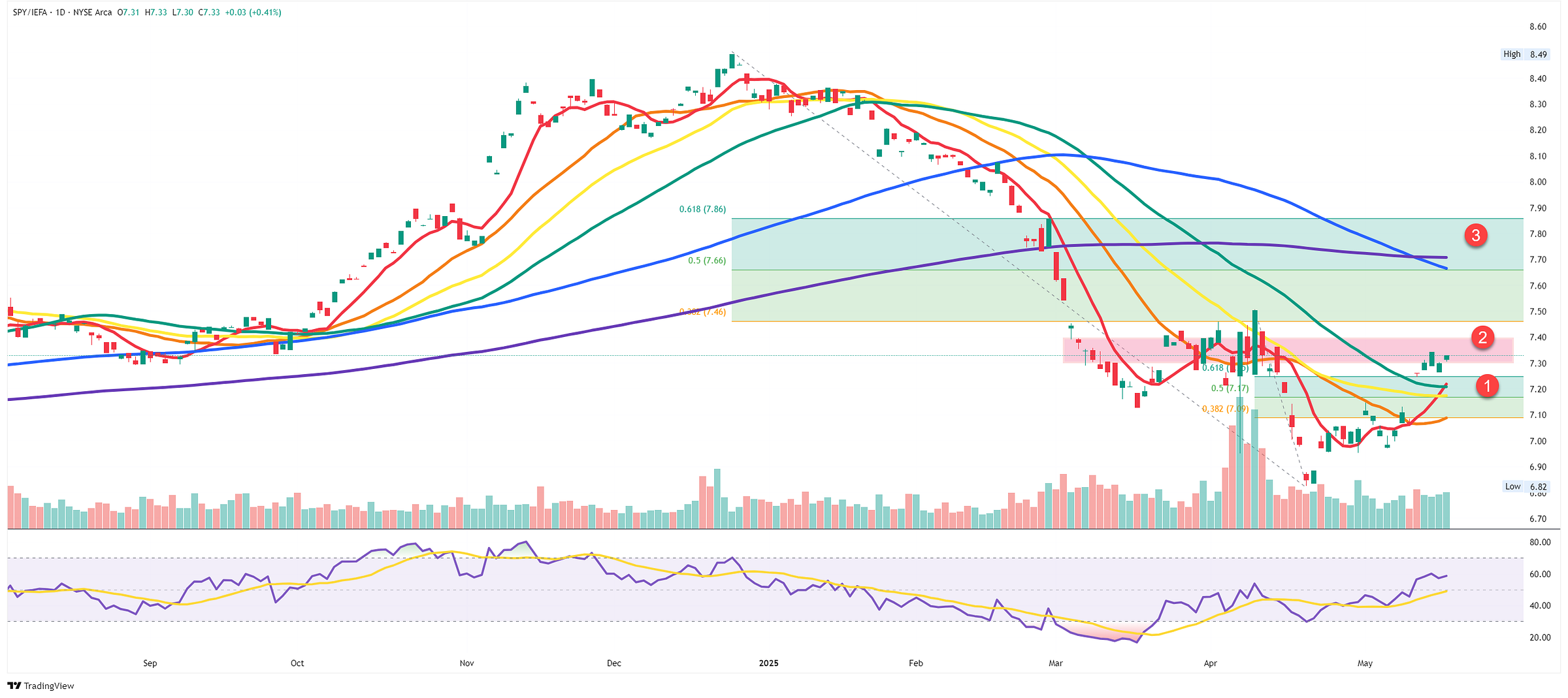

Last week was a proper test for the advocates of the ‘great rotation’ of equity allocations (away from the US). Let’s revisit the 🐿️’s favorite ‘chart of truth’ on this - the ratio of the S&P 500 SPY 0.00%↑ to the MSCI EAFE (developed markets ex-US) IEFA 0.00%↑:

The chart has cleared the Fib retracement of the pre-’Liberation Day’ high (1) and is now attempting to clear resistance from late March ((2)-pink box) which if cleared, needs to do battle with the Fib retracement zones from the late December ‘Peak US Exceptionalism’ highs.

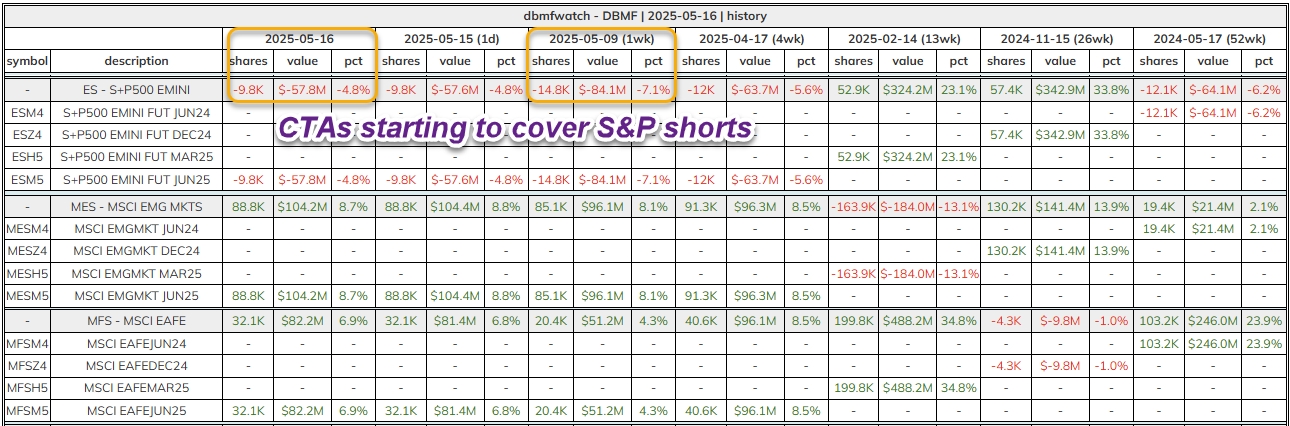

There are plenty of technical factors that offer tailwinds to the rally in US equities. Active managers are underweight, and corporate buyback, vol control funds and trend-following fund flows are likely to be supportive. The rally could have legs, and we may have to endure more ‘breadth thrust’ chat.

The BUSHY™ Portfolio - Week 20

In addition to the BUSHY™ review this week, the 🐿️ is going through a detailed review of the long and short ‘acorn’ positions. Some thoughts on Canadian Energy, US refiners, a new volatility hedge and the CATL Hong Kong IPO which starts trading tomorrow.

The BUSHY™ portfolio is positioned underweight US equity and fixed income assets versus the rest of the world. The portfolio had a decent week +0.5% to a new weekly closing high for the year.

However, our (S&P-heavy) benchmark, the Vanguard target date fund had its best week of the year and has now narrowly pulled ahead of BUSHY™.

The Vanguard benchmark is up 12% from its ‘Liberation Day’ lows (which were an 11% drawdown from peak). Judging by the way the (ES and MFS) futures are trading right now; I am fairly confident that BUSHY™ will be back out in front of benchmark by Monday’s cash close.

Once again, BUSHY™’s hedge book was a headwind for performance (but only by-0.14% this week), principally from a drawdown in the December (Z5) SOFR calls. Let’s break the asset sleeves down by type: