Wen Trend?

June 16th, 2025. Review of the 🐿️'s BUSHY™ Multi Asset ETF Portfolio and live Acorn trade ideas. 2025, Week 24.

In case you missed it, the weekend note came out early on Sunday morning EST. It contained Part 2 (of 4) of the🐿️’s annual ‘Acorn’ stock take. For this week, we tackled Emerging Markets. Do check it out!

Writing commitments thankfully kept me off social media for most of the weekend. Always a good idea during major geopolitical events when the firehose of hot takes generally does more harm than good to the process of forming views. The Israel / Iran conflict is the latest ingredient to 2025’s heady cocktail of policy uncertainty.

Successive tape bombs certainly create a tough environment for momentum strategies, and this year has been very challenging for the trend followers (last week was no different).

The 🐿️ is the first to concede that he is not a good momentum trader. This is part of the reason that I allocate 15% of my beta portfolio (effectively BUSHY™) to the professional traders of price - a diversified basket of trend ETFs and mutual funds (Handing some cash to the Robots).

The other role that this allocation plays is as portfolio diversifier in a world in which I find myself increasingly skeptical that that role can be satisfied with the traditional allocation to US Treasuries. I do not believe that (especially long duration) fixed income currently offers attractive risk / reward as a buy and hold strategy - even if it may work occasionally as a trade.

Furthermore, I also maintain that we are entering a period of higher inflation volatility (calm down, not an outright hyper-inflation call!). That backdrop leads to a situation in which we see a lot more of what we have experienced since the Fed started hiking in 2022 - positively correlated stocks and bonds (and thus no diversification benefit).

In the past 12 months, my trend allocation has drawn down by just under 5% (versus a 2.75% drawdown in long duration fixed income, using the TLT 0.00%↑ as a proxy). The 🐿️ has been doing better than the trend index (diversifying the diversifiers) yet still paying what Katy Kaminski calls ‘The Patience Premium’ - the tax that investors in trend need to pay in return for participation in the next big move.

I do think we may have received a clue over the past few days as to where the next big trend will emerge. As the news of Middle East hostility broke last Thursday night, front month crude prices did their normal thing but where was usual rush to US dollar cash usually associated with a major ‘risk off’ moment??

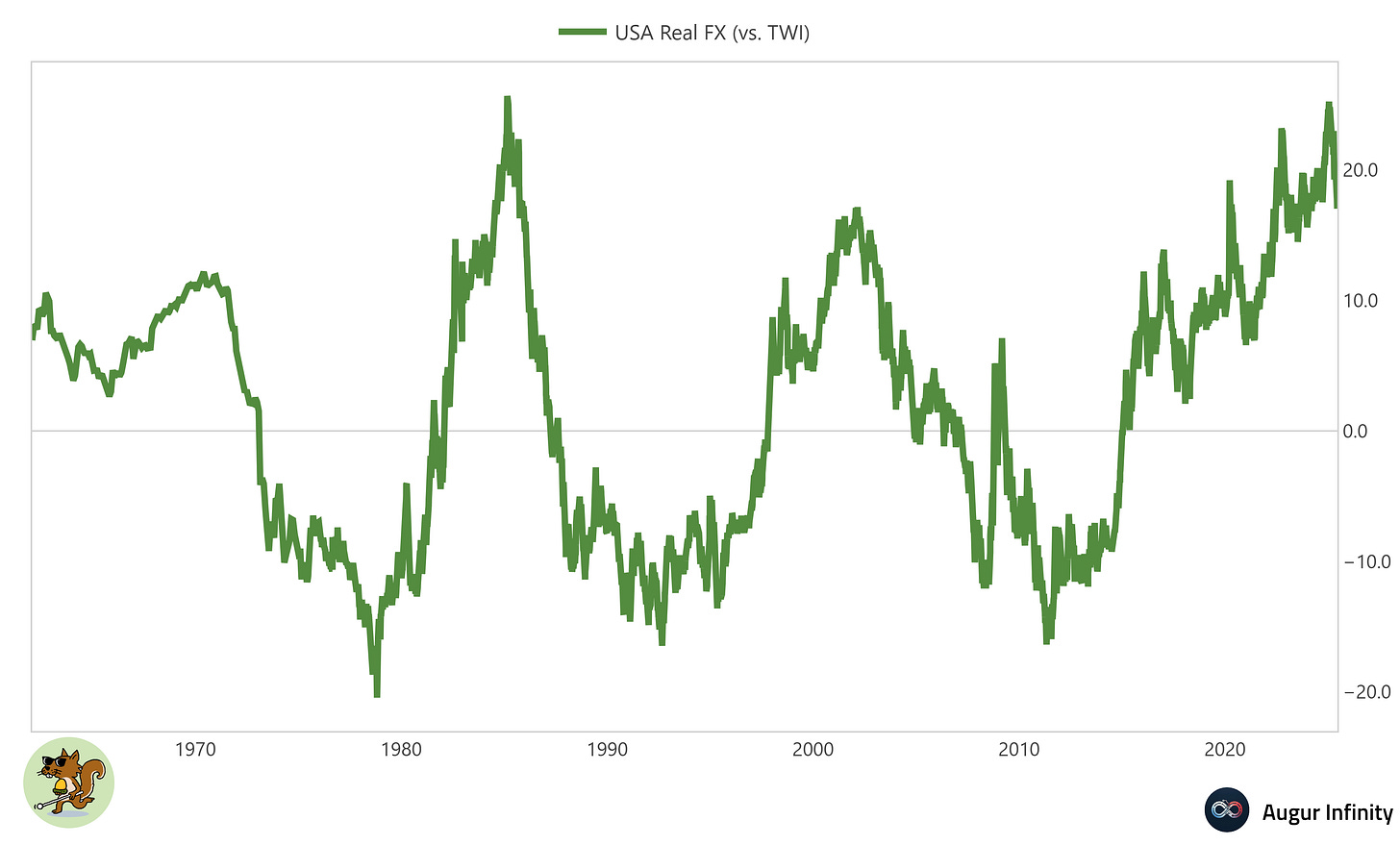

Happy to let the robots decide (that is, after all, the whole point of this portfolio allocation!) but I have a hunch that their next ‘pay day’ is coming from continued weakness in the (still very expensive on a trade weighted basis) US dollar.

Such a move would probably end up suiting BUSHY™ pretty well too.

The BUSHY™ Portfolio - Week 24

BUSHY™ continues to grind away, +0.83% for the week to set another new weekly closing high for the year (+8.46% YTD) for our beta portfolio.

Breaking down the returns at the asset level: