Week 18 - CTAs say 'Buy my Drawdowns'

Should you? May 5th, 2025. Review of the 🐿️'s BUSHY™ Multi Asset ETF Portfolio and live Acorn trade ideas. 2025, Week 18.

The BUSHY™ Portfolio - Week 18

Plenty going on this week besides the usual BUSHY™ update. A bumper edition! This week’s focus is on the BUSHY™ (ETF) implementation of the 🐿️’s new Canadian energy idea as well as a dig into how the portfolio’s CTA / trend allocation is handling current markets. We also take a quick look at the hedge book and write up the ‘recall’ of some legacy positions from the ‘bull pen’.

The 🐿️ will be back on CNBC at 10am Hong Kong time on Tuesday (10pm EST Monday) as China equities reopen after the long May Day weekend. Please join me live if you can. Last time CNBC had me on was on the Monday morning (pre-open) after ‘The America First Investment Policy’ targeting Chinese investments was announced by Washington late on a Friday night. This time I get to guess the China equity market’s reaction to this weekend’s trade war developments and wild moves in Asian FX. Reckon they go up!

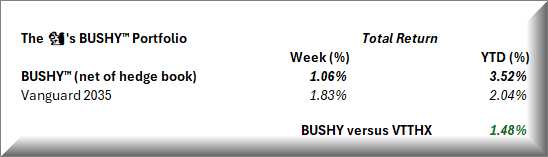

Another good week for the BUSHY™ portfolio, +1.06% on the week. With the continued surge in US equities, the Vanguard ‘Target Date’ fund benchmark was again strong and is now +2.04% for the year (1.48% behind BUSHY™).