Trending: The Squirrel and the Turtle

The Blind Squirrel's Monday Morning Notes, 13th May 2024.

With inflation volatility on the horizon, bonds may be disqualifying themselves as a portfolio diversifier. Investors need to hunt down an alternative source of what Harry Markowitz famously called ‘the only free lunch in finance’.

We start with Richard Dennis’ legendary ‘turtle’ experiment from the 1980s and look at the role that systemic managed futures strategies can play in portfolios. The 🐿️ even has a free gift for readers this week!

In Section 2 this week (for paid subs), we go through sizing an allocation to trend as the (easy access) options available to retail investors. We also have some updates on our new agribusiness basket, rates trade, tires, refiners, offshore, F1 and China.

Welcome! I'm Rupert Mitchell aka The Blind Squirrel and this is my weekly newsletter on markets and investment ideas. While much of this letter is free (and I promise not to cut off any punchlines), please consider becoming a paid subscriber or gifting it to a friend!

Trending: The Squirrel and the Turtle

“If I had a dollar for every plastic turtle that people had given me, I’d be indeed rich.” Richard Dennis, Father of Turtles.

I guess I had better start with a quick explanation of the reptile references in the title and the cover art of this note. In 1983, renowned futures trader Richard Dennis carried out the “turtle” experiment to prove to his partner William Eckhardt that anyone could be taught to trade profitably.

For those interested in learning the full story, this conversation between Dennis and two of his proteges, Jerry Parker and Brian Proctor, with my friend Niels Kaastrup-Larsen is a great listen. The ‘turtle’ name that Dennis gave his traders was inspired by (the easy replication of) farm-grown tortoises in Singapore.

These turtles ideally had no prior background in trading (Dennis did not want any preconceived ideas about the techniques of trading), but the program included quite a few blackjack traders! They were given a crash course in the ‘rules-based’ system of trend following. They were then set to work in the futures markets with capital from Dennis. With notable success.

An elegant analogy that I have repeatedly borrowed from my friend

is that most types of trade in the market can be distilled down into 3 styles: ‘carry’, ‘mean reversion’ and ‘momentum’. I use the analogy so much as a mental model that I may make a claim for partial ownership!This rodent has always maintained that carry trades are only appropriate for very large pools of capital that have a high tolerance for being short volatility or ‘tail risk’. Carry traders got a brutal reminder of that tail risk with the overnight ‘flash crash’ that we saw in the Mexican Peso a few weeks ago.

Mean reversion trades are the usual preserve of the fundamental investor. They operate in the narrative arc of the market. As a writer on financial markets and an investment banker by training, the 🐿️ inevitably spends most of his time in this bucket. Mean reversion is the world of investment theory and themes, often leaning heavily on valuation analysis.

The problem with momentum trades is that they - let’s face it - feel a little bit grubby. The business of mechanically buying assets because they are already going up and selling (or shorting) them because they are already going down feels like something for one of Pavlov’s dogs rather than something appropriate for the finely tuned brains of high finance…

The somewhat embarrassing truth (for the intellectual snobs of high finance!) is that those clever folk at AQR have calculated that the momentum factor across all asset classes (equity, fixed income, FX and commodities) has dominated value and carry strategies consistently. For a century!

The days of the 🐿️ teasing the ‘crayon eaters’ about technical analysis and ‘trading the charts’ being the equivalent of ‘astrology for men’ are long gone.

Markets are driven by humans and machines that are programmed by (those same pattern craving) humans. Trends deliverer powerful returns over time.

Regular readers will also know that this rodent will rarely write up an investment idea on the basis of technical analysis thesis alone. Nevertheless, these days I would never dream of entering or exiting a position without at least checking in on my favorite technical indicators. Trends must be recognized (and respected).

Quick note: going forward in this piece, my references to CTAs, managed futures, trend-followers and systematic investment strategies will mean the ‘classic’ (longer and intermediate timeframe) trend strategies that emerged in the 1970s. This is to be distinguished from shorter timeframe trend/momentum strategies and other systematic trading strategies (such as volatility targeting funds) that are often described using similar vocabulary.

Furthermore, the growth of multi-strategy hedge funds (aka the ‘pod shops’) has seen massive growth in assets allocated to short-term momentum trading strategies. We are not talking about these either. That is a rant for another day!

For some reason, trend-following CTAs have assumed a quasi-bogeyman reputation in the CNBC financial information age in which every squiggle of a stock price chart must be justified by a narrative. The large Wall Street firms are consistently warning of a price insensitive tsunami of liquidity that is about to swamp (or be withdrawn from) individual asset markets because of the CTAs.

When you listen to actual trend managers discuss these warnings, they often sound non-plussed, confessing that that they are at a loss as to where these estimates are coming from. A cynical rodent might wonder if this noise has more to do with the ‘sell side’ trying to jawbone their active manager clients into writing more tickets…

The financial press is not much better. This line from a recent Bloomberg article about the big spike in cocoa prices this year is typical:

“A systematic hedge fund manager uses coding and algorithms to determine whether to find trades strong enough to become market trends, unlike traditional managers who decide the trade themselves.”

The implication would appear to be that the power of human discretion must be more powerful than a simple set of trading rules. As someone who sells a finance newsletter that contains opinion you can bet it is tempting to conclude that trained finance professionals make better decisions than machines!

There is also a misplaced tendency to mock the highly successful long-term strategy of trend with quips along the lines of “CTAs are always max long at the tops and max short at the lows”.

This point on positioning shows a clear misunderstanding about the trend strategy. The long-term success of the trend strategy relies heavily on capturing the outsized long-term moves (up and down) in individual futures markets. On occasion CTAs will of course suffer drawdowns off the back of events that cause a sudden reversal of trend.

This occasional volatility is the price that investors in CTAs pay in return for opportunity to participate in moves like the jumbo 2023-2024 move in cocoa futures. I have a particularly sorry tale about the 🐿️’s own failure to capture the recent ‘big one’ in cocoa.

I initiated my cocoa position in December 2022 on the back of a fundamental thesis around weather and black pod disease in West Africa (primarily inspired by Shawn Hackett and

) as well as an interesting positioning setup in the futures market. Boom! The thesis played out and cocoa had a fantastic 2023.However, suffering from PTSD due to a painful give back of gains in a (completely unrelated) sugar trade in late 2022, I got nervous about cocoa’s loss of momentum (RSI) in December 2023 and decided to book gains in January of this year after a healthy 60% gain. It was a great win for the 🐿️ and I am unable to be cross about what happened next (I followed my rules and process). However, the next 16 weeks of price action certainly taunted my timidity!

Machines and models do not suffer from sugar-trade-related PTSD issues and the CTAs (for whom that temporary glitch in momentum did not register as a shift in the longer-term trend) were consequently able to capture the MONSTER move from January that made it to the front page of the Wall Street Journal and the chyrons of CNBC. Everybody loves a chocolate story!

Furthermore, the popular narrative that the CTAs were all ‘max long’ at the top and are thus suffering the subsequent recent drawdown from all-time highs we have seen more recently is also incorrect.

If you speak to an experienced CTA manager like Niels Kaastrup-Larsen he will tell you that, driven by volatility-based risk management rules, many CTAs were actually steadily selling (ironically enough, to performance chasing and narrative extrapolating human beings!) throughout cocoa’s parabolic rise to the top. No major round trip for the machines after all!

Takeaways so far: On a 100-year view, the momentum factor in investing has offered superior returns. Long-term managed futures offer the potential to participate in the windfall gains from mega-trends in certain assets. However, this participation comes at the cost of the occasional drawdown when events cause trends to break suddenly and violently.

Regular readers will know that the 🐿️ has been trend ‘curious’ for quite some time. The reason for this is threefold.

Longer-term trend following strategies have demonstrated an outstanding track record of latching on to the big moves in asset prices. It would crazy not to have an awareness of the assets where the CTAs have significant long or short positions.

Pure CTAs represent a (confoundingly) small share of global institutional assets under management. The emergence of the ETF revolution (and associated position transparency) gives us a window on the positioning of these (historically very private) pools of capital. There is a long tail of discretionarily managed macro assets that incorporate elements of trend strategy into their processes. Understanding CTA positioning is an essential way of understanding modern markets (in which fund flows play such a prominent role).

Portfolio construction needs to find a full or at least partial replacement for the fixed income diversifier to equities that nominal bonds have provided for much of the last 25 years. This is not a new topic for the 🐿️ (I still blame populist politics by the way!).

For those with no time to re-read last September’s piece, I have updated the ‘money shot’ chart (this time showing the full post-war era):

If bonds are not going to provide portfolios with a diversification benefit, we need to think about how this asset class might perform on an absolute basis.

Harry Markowitz is famously quoted as saying that ‘diversification is the only free lunch in investing’. If bonds are not the answer, where are you going to get diversification from? 🐿️ hint: there is only so much gold that you can own, and diversification is not going to come from the latest private credit, leveraged buyout or venture capital fund being pitched to you!

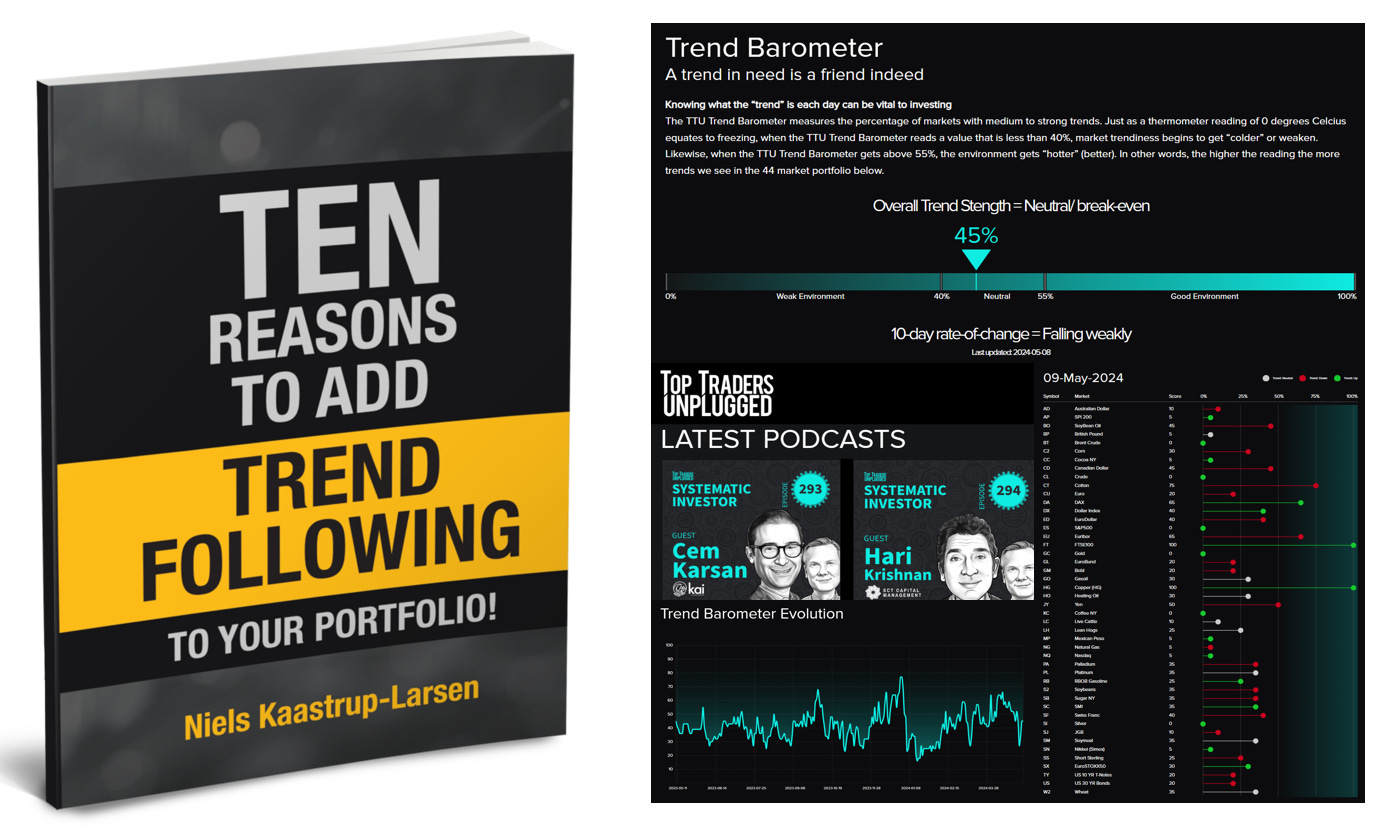

This is where I believe the role for managed futures / trend-following comes in. I am going to outsource this pitch to the experts! Niels Kaastrup-Larsen and his fabulous Top Traders Unplugged podcast is a fantastic resource for getting a better understanding of the world of managed futures and systematic investing.

DUNN Capital is one of the OGs of the managed futures world and has a stellar track record that is uninterrupted from 1984. Niels is the MD of DUNN Capital in Europe and one of the CTA industry’s most vocal advocates. Breaking News: This weekend, Niels just published a free book on the topic.

He was kind enough to give me a sneak preview. The book is only 50 (very easily digestible) pages long. I devoured it in less than an hour on Saturday. This is already becoming quite a long note, so I am not going to precis it here. Get your free electronic copy by clicking on the image below.

The 🐿️ is going to hazard a wild guess that you read this letter because either you are related to me, or that you take an active role in the management of your investments. As such, you obviously have an opinion on asset prices. But let’s be honest, we all know that even history’s most famous traders and investors will freely confess to being right only half of the time - and that is if they are lucky!

Trend-following can be your portfolio hedge against all that opinion. And I know what you are now thinking:

“But 🐿️, I loved the look of the performance of CTAs in 2022, not so much last year. Is there a way that I can be invested in trend when they are likely to have a good year and perhaps avoid a few of their drawdowns?”

“Maybe I can be smart and only own trend when Niels’ trend barometer is bullish?”

“Can I allocate to trend based on my own expected economic regime?”

“I remember reading that one of the trend-following Market Wizards said that their most successful LPs/ investors ‘always bought their drawdowns’. Should I try to do that?”

“It may sound cheeky 🐿️, but can I perhaps - heaven forbid - try to trend follow the trend-followers?”

The short answer to all of these musings is NO! I am afraid that you need to trust the process, dismiss your inner control freak and embrace your inner fatalist. Marty Bergin, DUNN Capital’s Owner and President puts it best:

“A CTA isn't a type of vehicle where you can really time your investment. Those of us that have been running CTA firms for a long time have most of our own money in the fund and we can't time it. Now, if we can't time it, I don't know how anybody outside the industry is going to be able to!”

What about avoiding (or hedging out) the trades that just look obviously wrong when the machine spits them out? I quite often take a look at the positions in the managed futures ETFs and think ‘how on earth can they still be so short Yen / corn [delete as applicable]? Again, put your narrative and intellect away - the CTAs certainly do! Marty Bergin again:

“There's a lot of times when we're sitting in our offices taking a trade that we just think is not a good trade and it turns out to be THE big one…it just goes to show that not having that emotional involvement in a trade is often very successful. It works when there is no prediction mechanism.”

This is clearly a leap of faith when you are in the narrative and prediction game. However, for portfolio construction and risk management reasons, I have made the decision that trend-following CTAs will become a permanent (‘do not touch’) component of the 🐿️’s portfolio.

That’s all for front section this week. In Section 2 (for paid subscribers), we look at the thought process that I have gone through in sizing the allocation to trend as well as the increasing number of options available to retail investors who want to make an allocation to the strategy without having to satisfy the minimum investment amounts often associated with the most established CTAs.

Your (very GenX!) thematic musical link (to trend) this week comes with the words of U2’s Bono. At least for part of my investments - I will follow! (Sorry).

Keep reading with a 7-day free trial

Subscribe to Blind Squirrel Macro to keep reading this post and get 7 days of free access to the full post archives.