Trend - back in black!

Review of the 🐿️'s BUSHY™ Multi Asset ETF Portfolio and live Acorn trade ideas. 2025, Week 38.

Am travelling at the moment so the weekend note came out at an unusual time of day this week. Linked below in case you missed it. No podcast this week.

Trend - back in black!

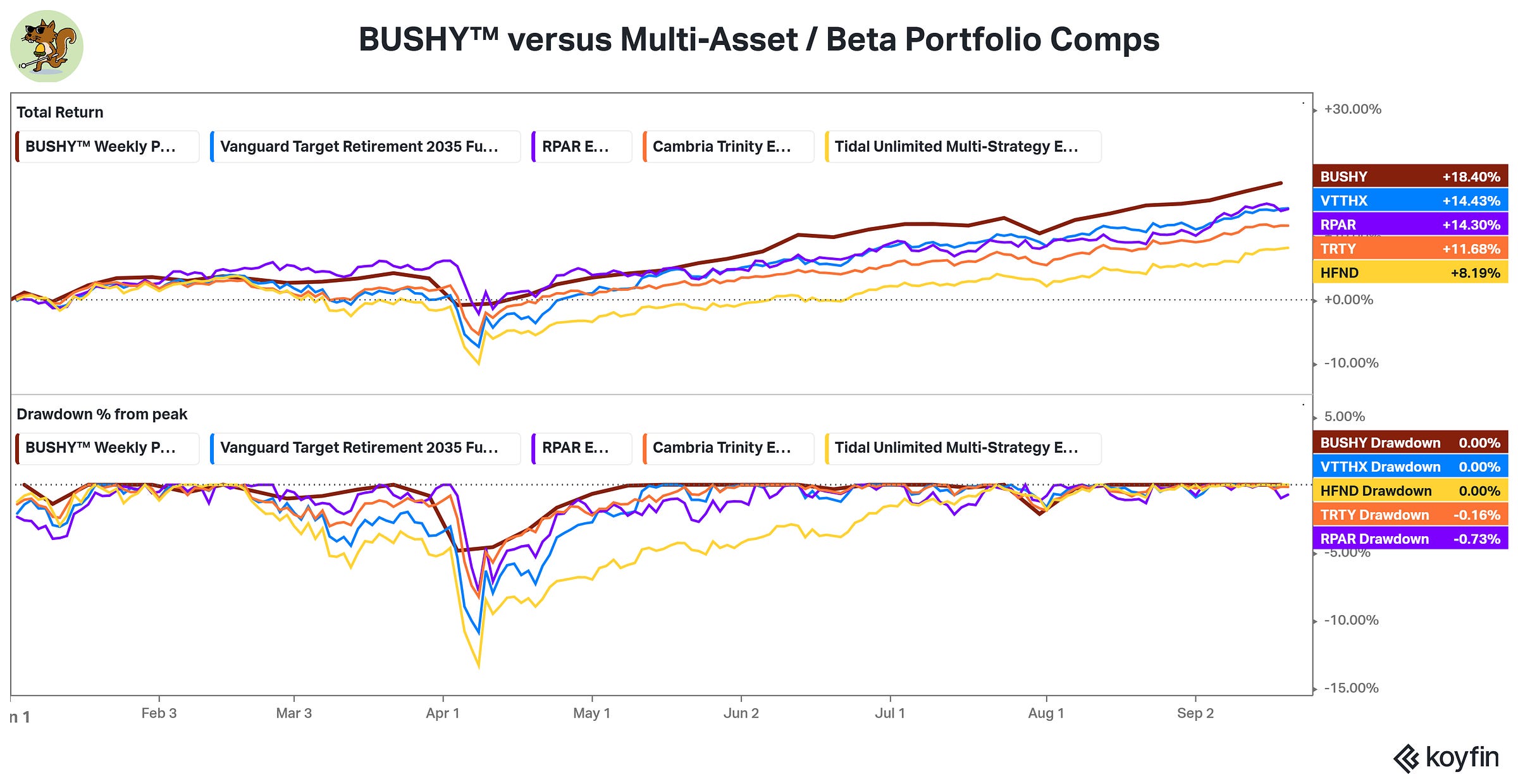

I am pleased with the way the 🐿️’s BUSHY™ beta portfolio is faring this year. The recent rally in US Treasuries to which the portfolio has limited direct exposure outside of T-Bills has not ended up costing us much of a relative performance issue.

Below sets out BUSHY™’s YTD performance and drawdown profile versus our benchmark (VTTHX - Vanguard’s 2035 Target Date fund) as well 3 other multi-asset ETFs that we track - Evoke’s RPAR 0.00%↑ (risk parity ETF), Meb Faber’s TRTY 0.00%↑ (Cambria Trinity ETF) and Bob Elliott’s HFND 0.00%↑ (Unlimited Multi-Strategy). I also keep an eye on Bridgewater’s ALLW 0.00%↑ (All Weather) and Warren Pies’ RAA 0.00%↑ (real asset portfolio) but these 2 started after January 1st 2025.

BUSHY™ has benefitted from being overweight most of the brightest green sectors, factors and geographies below.

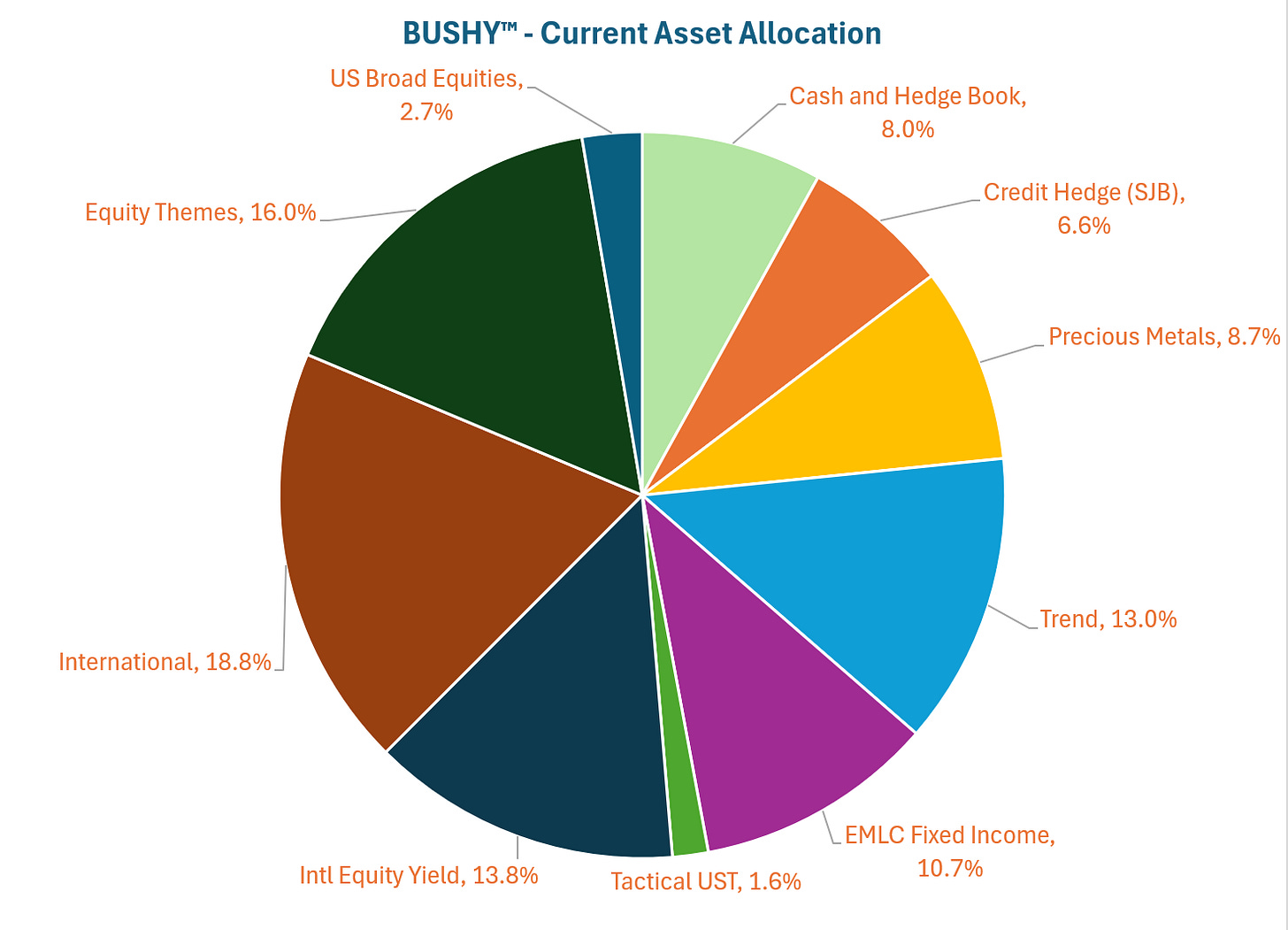

This approach has seen BUSHY™ run a significant underweight in US equities versus benchmark for most of the year. I updated the latest asset allocation pie chart this morning. US broad equity exposure is below 3% (although there are some US mining and energy names in the Equity Themes sleeve).

BUSHY™ Review

BUSHY™ added 131bps on the week. The heavy lifting came from a particularly pleasing source…