Together in Electric Dreams?

The Blind Squirrel's Monday Morning Notes, January 22nd, 2023.

Summary

Having worked in the sector I follow themes in the car industry closely. The current narrative ‘see-saw’ around electric vehicles is peculiar. Something odd is going on.

‘EV negative’ articles are everywhere, and it is not just from the usual suspects. The 🐿️ has some thoughts.

Welcome! I'm Rupert Mitchell aka The Blind Squirrel and this is my weekly newsletter on markets and investment ideas. If you've received it, then you either subscribed or someone forwarded it to you (add yourself to the list via the button below). Please also consider becoming a paid subscriber!

The audio companion to this week’s note will be uploaded to Substack on Tuesday to allow me to incorporate comments and feedback from this note. It will also be available as a podcast on Apple, Spotify and the other usual podcast apps.

Together in Electric Dreams?

I usually find that some of the best investment ideas come when numerous prompts from multiple sources hit me at roughly the same time. Having worked in the sector I follow themes in the car industry closely. The current narrative ‘see-saw’ around electric vehicles is peculiar. Something odd is going on.

Early last year, in Ben Graham’s Electric Car, I was wary of the direct EV plays and discussed various alternative investment approaches, ranging from cell manufacturers to battery metals miners and commodity currencies.

“The electric vehicle investment theme fast became the preserve of stock promoters and carnival barkers…and I am not just talking about everyone’s ‘favorite’ aspiring Mars colonist. The electrification of passenger vehicles is a broad topic and I wanted to take a step back to figure out how to make money in a way that is not reliant on the greater fool theory that is buying narrative stocks. In the ‘story’ category I include pre-production lithium miners as much as car companies that do not yet sell cars.

I think we can safely say that we are probably (thankfully) over the ‘SPAC phase’ of the electric vehicle revolution. I am sure that there is still tons of fun to be had in the event driven world of Fisker, Lucid and Nikola short squeezes but we shall leave that for the Reddit / Wall Street Bets crew (and for Ken Griffin to take their money).

Enough ink has been spilled over Tesla (very much not a stock for the 🐿️) and if you want a pure(ish) EV play in China, there is no point in looking much beyond BYD (sorry guys, NIO, XPeng and Li Auto are just trading sardines - detailed view is not for publication, but I would be happy to elaborate over a beer or a glass of decent wine).”

The final offer at the end of the 3rd paragraph still stands. In the end, I chose to play the theme via Mercedes-Benz (‘MBG’). Sure, MBG had a strong electrification story to tell, but I was motivated more by the possibility of the German OEM repositioning itself as a luxury play. I had sold my LVMH position way too early the summer of 2022 and suspect I was really on the hunt for a ‘value’ angle to rebuild my luxury exposure!

Shortly before Christmas, my friend Le Shrub slid into my DMs. I first met Twitter’s favorite piece of greenery during my days as an automotive executive when he came to watch me debate the future of EVs on a panel with former Formula 1 Champion Nico Rosberg at a UBS conference in Monaco. Pretty certain he was not there to hear the 🐿️ waffle on about battery chemistry!

I promised him I would give the question some proper thought. In the “stock promoters and carnival barkers” phase of the EV story, I always had a bit of a soft spot for Rivian and its beautiful electric pick-up trucks. Its thoughtful and charismatic CEO, RJ Scaringe, was a truly welcome antidote to some of the other thought leaders in the space. Yeah, looking at you Messrs. Musk, Milton and Fisker!

Pulling in strategic investments from Ford and Amazon in Q1 2019 was a masterstroke and certainly raised the bar for a certain rodent in Asia who was trying to raise money for his fledgling EV company out of Shanghai!

I well remember attending Deutsche Bank’s ‘flagship’ Auto Conference that ice cold January in Detroit. RJ’s presentation was a ‘standing room only’, ‘box office’ event in the cavernous MGM Grand Ballroom. The 🐿️ was green with envy as he scurried back upstairs to his hotel-bedroom-converted-to-meeting-room to take care of the visitors to his threadbare ‘one on one’ roadshow schedule!

The Shrub was looking at the ‘everything rally’ of November and December last year and was effectively (and perhaps correctly) wondering if lightening could strike twice! We all remember Tesla’s moments on ‘life support’ in the dark days before those miraculous share price returns.

Was Rivian to be the ‘next Tesla’ or was it to continue languishing in the capital incinerating cohort of EV start-ups?

The reference above to repairing Rivian trucks must have been top of my head as I had just been reading a terrific note from 🐿️ subscriber David Selko discussing the spiraling insurance and maintenance costs facing US drivers. $40,000 to replace a Rivian truck panel! He mentions Copart CPRT 0.00%↑ as an interesting play on this theme in his note. Not a cheap stock but great story with what looks like a fortress balance sheet. I am doing more work.

Bottom line. Lighting rarely strikes the same point twice and the 🐿️ remains doubtful that the auto sector gives us another Tesla. I struggle to understand Rivian’s path to ‘per unit’ profitability and Scaringe does not appear to be playing the narrative shift games (robots, driverless cars, energy storage, AI etc.) that are necessary to distract cult followers investors from those critical KPIs.

I would own a Rivian R1T truck over a Tesla Cybertruck any day of the week, but Mr. Scaringe probably needs to brush up on his stock promotion skills! I am sure there are courses available from the junior mining community in Vancouver, BC or Perth, WA.

While on the topic of narratives, have you also noticed how they have been shifting lately? ‘EV negative’ articles are everywhere, and it is not just from the usual suspects. I have stumbled on borderline EV-skeptic commentary in the Financial Times, New York Times, Bloomberg and CNN in the past few weeks. Viewpoints completely at odds with the traditional editorial narrative of those outlets when it comes to the energy transition.

The fact that Epsilon Theory’s Ben Hunt, the high priest of (media) Nudging Narrative Studies, commented on this as well last week definitely triggered the 🐿️’s ‘why am I reading this now?’ klaxon. To be honest, if a narrative shift is coming from the top via ‘fiat news’, it is not clear to me why.

Are the hard realities of physical commodity markets finally colliding with the lofty ambitions of the energy transition? Faced with the reality that China has taken full advantage of its 10-year head start in vehicle electrification, is geopolitics possibly playing a role here in an election year (on both sides of the Atlantic)? No country (or politician seeking re-election) stands idly by when their domestic car industry is under threat.

Never underestimate the iconic importance of the auto industry to national psyche. Down here in Australia you will often see grown men go misty eyed in contemplation of the demise of (local auto champion) Holden (even though it had been a subsidiary of GM since 1931!).

In our original Mercedes piece, we observed that “MBG are taking themselves out of the volume game to focus on the core and top-end luxury segments. Wealthy consumers are also likely to be the early adopters of EVs, especially outside of China. Let’s be clear, outside of China, EVs ARE a luxury item.”

Ford’s Jim Farley said the quiet bit out loud last week. Chinese OEMs (thanks to a great deal of state assistance let’s be honest) are the only players that have cracked the code to low cost EVs. China also pretty much has a monopolistic position as regards the EV supply chain (batteries, rare earths etc.). As such, the feat is unlikely to be achieved elsewhere.

Farley also acknowledged that the customer base for its ‘6-digit sticker price’ electric F150 Lightnings was pretty much tapped out and that mainstream customers “are not willing to pay the same premiums as the early adopters".

So, let’s consider the ‘3 Cs’ that challenge the broad-based adoption of EVs. Cost, Capacity and Convenience. Cost: aside from what Chinese exports potentially offer, affordable EVs are not mainstream. Capacity (aka range anxiety) is closely connected to cost. Longer ranges = bigger battery packs = higher costs. Convenience: the lack of high-speed public charging infrastructure remains a significant barrier to consumer adoption in most markets Ex-China.

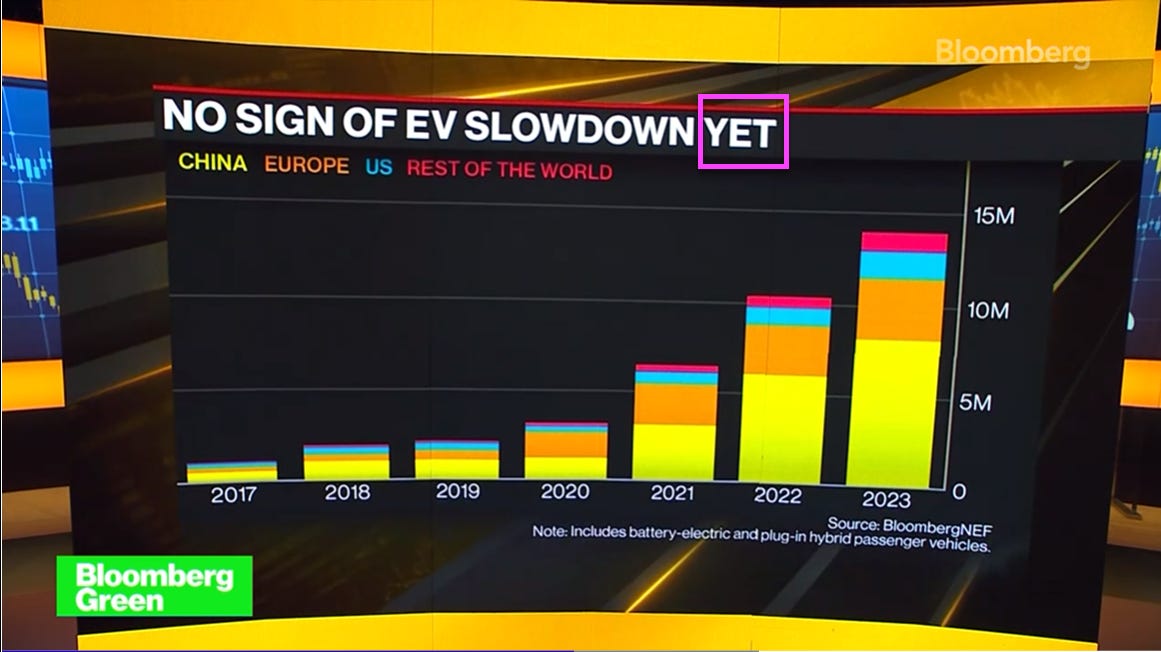

Those ‘hockey stick’ forecasts are looking way too steep to this rodent! Where are the investment opportunities if indeed these charts are too optimistic? Which brings me to my next prompt.

My friend Erik of YWR: Your Weekend Reading and I have been discussing the automotive sector for several months (we are fellow Mercedes-Benz bag-holders). His factor screening model scores global stocks on the basis of earnings momentum, price momentum and valuation. Auto OEMs and automotive suppliers have been shooting up the leaderboards of late.

We have also discussed the EV conundrum and kicked ideas around along the lines of taking contrarian positions in platinum / palladium. Have these metals been sold off too aggressively if it turns out that we will need catalytic converters for many years to come?

These conversations led us to record a really interesting discussion last week with Stephen Schlegel from Gray Oak Capital Management. Link to the full conversation (no paywall) via the Substack link below 👇:

Stephen has done some really fascinating research looking at the connections between the US automotive depreciation cycle and earnings upturns for the automotive sector and its suppliers (on a lag). Some of the sub-sectors look really attractive.

I have about 20 pages of notes from our conversation (which also pulled on threads from a lot of other themes I am looking at currently). This is where we are doing the digging for our next acorn. Should be hitting inboxes later this week.

Final Thought

I know that many of my readers are just here for the 🐿️’s 1980s cultural references (looking at you Kevin Muir !). Now that EV companies are being rebadged as AI companies by sociopathic leaders looking for a cap table ‘do-over’, the skeptical title of this week’s note was inspired by the last sentient computer / AI mania to hit the collective consciousness 40 years ago.

2024 is the 40th anniversary of the 1984 ‘B Movie’ ‘Electric Dreams’ which features a love triangle between an architect, a cellist, and a - wait for it - PC damaged by a Champagne spill. It was not a one-off. The previous year gave us another sentient supercomputer with attitude with the premiere of War Games (“What is the primary goal? You should know, Professor. You programmed me. Oh, come on. What is the primary goal? To win the game.”). The year after, 1985, was the real treat! Our dreams were stalked by the magnificent Kelly LeBrock as ‘Lisa’ the teenage boy’s idea of a computer-created female perfection.

I leave you with the trailer and its (synth-heavy, annoyingly-stick-in-your-head-y) theme tune. Are we ‘Together in Electric Dreams’? I think perhaps not.

That’s it for the front section this week. If you are not already a paid subscriber, please consider joining the 🐿️ on the ‘other side’ of the velvet rope where this week we will be discussing some important changes to our bond, uranium and broader energy positioning.