Thoughts on Dumb Money (I did it for Cliff!)

The Blind Squirrel's Monday Morning Notes, November 13th, 2023.

Summary

On Friday evening, Mrs. 🐿️ and I went to go and see Dumb Money so that Cliff Asness would not have to.

There is more to the GameStop story than the easy “David versus Goliath” headline. A missed opportunity.

The market will miss the short sellers if they cease to exist. Regulators never miss the opportunity to focus on the wrong thing. It is interesting to look at the source of ‘the noise’ that encourages them to focus on the wrong things.

This week’s portfolio update and Acorn review for paid subscribers covers new trades in the agricultural commodity and crude oil space. We also cover #Offshore#PrivateEquity #Prosus #AUDUSD #Doordash #Coinbase #Occidental and #uranium.

The audio companion to this week’s note will be uploaded to Substack on Tuesday to allow me to incorporate comments and feedback from this note. It will also be available as a podcast on Apple, Spotify and the other major podcast apps.

Thoughts on Dumb Money (I did it for Cliff!)

On Friday evening, Mrs. 🐿️ and I went to go and see Dumb Money so that Cliff Asness would not have to. Regular readers will know that the 🐿️ is a huge fan of the AQR Founder and CIO, especially his advocacy on the topic of volatility laundering in private asset markets.

I had always been suspicious of the ‘David vs. Goliath’ / ‘Continuation of Occupy Wall Street’ narrative that had been adopted by the mainstream press around this story. I covered it and related topics (such as gamma squeezes in options markets) back in September in our Acorn report on Doordash. Please take a look if you missed it. I have released the note from behind the paywall in the 🐿️ archive.

In the note, I reflected on the positive impact that short sellers can bring to the broader health of the equity market, as well as the increasing professionalization of the ‘short squeeze’ business (TLDR: this is categorically not just well-organized retail traders on a mission to ‘stick it to the man’).

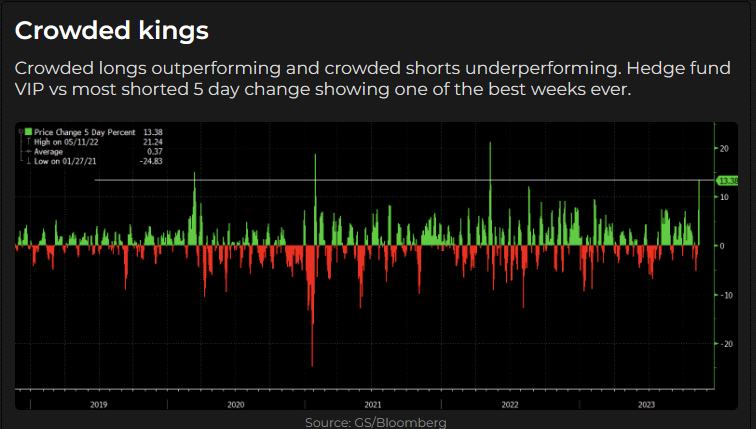

Short selling is hard (ask anyone on the wrong side of the Goldman Sachs “Most Shorted Basket” last week!). So much so that many of the best have either given up on it or no longer share their research with the market (for fear of being targeted for a squeeze).

One more thing (and thank you for a timely reminder from the Ole Chestnut), don’t “do an old Billy” and advertise your large short positions to the street (or Carl Icahn!): “He who sold what isn’t his’n, must cover it or go to prison”.

Can we also clear up one other annoying trope from the movie. The ‘diamond hands’ of UT Austin student Harmony (played by Talia Ryder) were partially attributed to her desire for vengeance for her ‘ShopCo’ area manager father’s redundancy at the hands of ‘Wall Street asset strippers’.

Bona fide short sellers really should NOT be bucketed alongside the dividend recapping strategies of the ‘vulture’ capitalists. Those guys already had their moment of Tinseltown ‘glory’ with Richard Gere’s Edward Lewis in Pretty Woman - “so it’s sort of like stealing cars and selling off the parts…but legal”.

I won’t spend any time rehashing the populist “system is rigged” narrative covered by most of the press reviews. The movie has the benefit of mercifully being almost 2 full hours shorter than the latest Scorsese epic.

I do however want to pull on a couple of interesting threads prompted by Friday night’s viewing ‘pleasure’.

The first one is regulation. As I walked out of the cinema, the first notification to flash up on my phone was the Bloomberg headline captioned below.

The final scenes of Dumb Money are dedicated to the rushed House Financial Services Committee hearing into the GameStop affair. Who can forget this farcical moment from the ‘Roaring Kitty’ himself, Keith Gill?

Nearly three years on, regulators and, more significantly, their political masters are still failing to prove that they have even a basic understanding of how markets operate. Did last week see the return of short-selling bans? I hope not.

Other attempts by regulators since the 2008/9 financial crisis to remove fragilities in securities markets have created unintended consequences. Corey Hoffstein has written that “Risk cannot be destroyed, only transformed”. The clearinghouses mentioned above are a case in point.

Russell Clark has written on several occasions (here-$) how further centralizing risk in clearing houses (as opposed to having banks carefully manage their own counterparty risk exposures) has created a new financial order in which regulators have been placed “at the center of market pricing”.

His thoughts on recent incidents involving the LME, LCH and ICE are fascinating. This centralization of risk by the regulators may give the illusion of control, guarantees to create entities that really are too big to fail and probably ultimately increases the likelihood of taxpayer-funded bailouts.

There is a memorable scene in Dumb Money when the slippery CEO of Robinhood HOOD 0.00%↑ gets his $3 billion margin call from the clearing house while in a crowded night club. The focus from the politicians is all about why the GME 0.00%↑ ‘buy’ button did not work on ‘the Apes’ Robinhood app rather than the risk management failings of Silicon Valley’s stockbroking ‘disruptor’ (that favorite VC word again) or why the button was gamified in the first place.

Rep. Alexandria Ocasio-Cortez (AOC) may have a been pulling on an interesting thread when wanting to understand the true economic cost to consumers of ‘Payment for Order Flow’ but to suggest that some kind of refund of brokerage commission might compensate retail investors for the loss of their GameStop ‘tendies’ is beyond parody.

All of this is hardly surprising when one considers the identity of the chair of that infamous hearing… none other than Rep. Maxine Waters. Yes, this Rep. Waters, modern Titan of financial markets regulation…

Best ‘til last (and filed under things that I only learned last week) was the fact that the executive producers Dumb Money were those billionaire (for now 😉) ‘champions of the retail investor’, the Winklevoss twins of crypto exchange Gemini fame.

The Winklevoss brothers, assorted crypto activists and other upstanding market citizens such as Musk and Palihapitiya were quick to use the GameStop saga as an opportunity to stir the pot and preach the “beginning of the end of centralized finance”. CNBC usually plays soft ball on interviews. This interchange, however, was an absolute master class and is worth watching in full.

There’s more! “Hey Siri, define irony”: it turns out that the NY prosecutors don’t believe that these upstanding young men have the back of retail investors after all…

To be clear, the collapse of Plotkin’s Melvin Capital was a LTCM-style case study in hubris and risk management failure. No tears from the 🐿️ on that count, but the market will miss the loss of another active short selling fund for different reasons.

In the days of ‘narrative’ financial accounting (e.g. non-GAAP adjusted numbers, aka earnings after stock-based compensation ALL costs that make us look bad), the market will sorely miss the antiseptic of short seller scrutiny on disingenuous disclosure practices and fraudulent or underperforming companies.

While none of the names we have been short recently are featured on this list, one does wonder what possessed any investor that was part of the cohort still short 36% the free float of an (almost officially bankrupt) WeWork, after the shares had already experienced a 99% fall from all-time highs. This strikes the 🐿️ as the trading equivalent of Russian Roulette.

The powerful rally in risk assets we witnessed up until a messy 30-year Treasury auction last week certainly chased this rodent out of a few of his bearish positions in unprofitable (likely never to be profitable) technology stocks. It feels like the opportunity to re-enter those positions at better levels may be just around the corner.

That’s all for the front section this week. This week’s portfolio update and Acorn review for paid subscribers covers new trades in the agricultural commodity and crude oil space. We also cover #Offshore#PrivateEquity #Prosus #AUDUSD #Doordash #Coinbase #Occidental and #uranium.

+++

We have just launched our subscription service. Find out more → Details here.