The Squirrel and the Leprechaun

The Blind Squirrel's Monday Morning Notes, 8th April 2024.

I was not planning to publish this weekend. However, after a bit of a roller-coaster week in markets, I wanted to get out a pre-vacation risk round-up before I head off to ‘The Bush’.

Are interest rates really still a primary driver of current equity markets? Some trend changes in correlation and fixed income and equity implied volatility have the 🐿️ feeling a little twitchy.

I will publish the next weekly note on Wednesday 17th (assuming no lethal encounter with Australian fauna!).

In Section Two (for paid subscribers), we run though a pre-holiday risk management check list for some of our live acorn positions.

Welcome! I'm Rupert Mitchell aka The Blind Squirrel and this is my weekly newsletter on markets and investment ideas. If you've received it, then you either subscribed or someone forwarded it to you (add yourself to the list via the button below). Please also consider becoming a paid subscriber or gifting to a friend!

‘Team 🐿️’ is hitting the road (in a motorhome (RV) - wish us luck!) for a week in the Australian Outback. As we will be off the grid while up there, there will not be a podcast this week. If you have a strong desire to hear my voice in the interim, I recorded a 90-minute (grab a bottle from the cellar) interview last week with Blockworks’ fabulous Jack Farley. Please forgive the ever-so-slightly-click-baity title - theirs not mine! We touched on a lot of themes that I have been covering over the past 6 months or so.

The Squirrel and the Leprechaun

I have often written about the fact that, due to time zones, the 🐿️ is usually fast asleep when major US economic numbers are released. One of my first ports of call as the coffee is being brewed in the morning is to check in on the pulse of markets via Kevin Muir’s group chat. Check it out - it’s ‘open house’!

On Saturday morning, having absorbed how some surprisingly strong US employment numbers had been greeted with a vigorous rally (!) in US equity indices on Friday, I dropped the following message into Kev’s chat.

Let’s not forget that only 24 hours earlier, global risk assets had appeared to have been comprehensively spooked by some hawkish commentary from the Minneapolis Fed’s Neel Kashkari. Markets on Thursday afternoon (EST) felt like they might be just on the brink of a ‘waterfall’ down.

Anyone in possession of the ‘hot’ non-farm payroll numbers ahead of their release on Friday might have been convinced that this would be enough to push markets over the edge and tempted to get maximum short S&P index futures. And they would have lost their shirt!

My friend Chase Taylor has a habit of describing markets that are beginning to look fragile as “squirrely”. I did try not to take this personally (!) but given that he originates from Texas and also has a military background, this rodent has now decided to embrace the phrase fully instead.

Equity markets are lower on the week, but shouldn’t they have been much lower as relief from interest rate easing appears to edge further towards the horizon? Are we making the mistake of overreacting to the headlines and various Fed speaker pronouncements when the market has actually slowed the pace at which it is pricing rate cuts out of the market?

Let’s zoom out a bit. This time plotting the same December ‘24 SOFR futures implied yield (shaded blue below) against Nasdaq 100 futures (red line below) since the beginning of 2023. Of course, we saw a massive rip up in equities when cuts were being priced in after the Silicon Valley Bank scare in March ‘23 (Box 1 below) and following Jerome Powell’s ‘Halloween’ pivot (Box 3).

However, we also have seen periods during which the market is quite happy to grind higher (Box 4) or at least not completely fall out of bed (Box 2) while higher rates are being priced back into the market. If you are trying to get a bead on risk in equity markets, it cannot all be about interest rates. We may need to find a different sort of ‘squirrely’.

We are beginning to see a break down in some traditional cross asset class relationships. For example, the recent strength in gold that we discussed last weekend continues to shrug off its traditional ‘headwinds’ of higher yields (US 10-year is back over 4.4%) and a stronger US dollar (DXY stubbornly above 104 even if it weakened slightly on the week).

So, this week equity markets appear to have shrugged off the inflation / interest rate developments. However, other risk gauges have definitely started to exhibit some “squirrely” tendencies.

Are we finally starting to see a trend break in volatility and correlation? At the beginning of March, we took a look at a hedging the risk of an unwind of the increasingly crowded dispersion trade via an actively managed straddle structure on S&P500 ETF SPY 0.00%↑.

I have unlocked the report (originally for paid subscribers) on this topic (via the link below). The (very crowded) dispersion trade needs to be understood (the piece includes a short primer), even for those readers that have no interest in going anywhere near trading volatility. I’m afraid that these ‘small print’ market structure issues really matter these days!

Perhaps I jinxed everything last week when I told Jack Farley that central bankers had become the masters of volatility compression. For markets to remain calm, we need them to remaster this game. Are they potentially losing some grip here? The ticks up in these gauges need to be watched carefully. Definitely squirrely!

The past month’s rotation into reflationary assets has drawn a smile to many of the value investors that I speak to. It has been pretty good for the home team too. We are very constructive on the energy space at Blind Squirrel Macro.

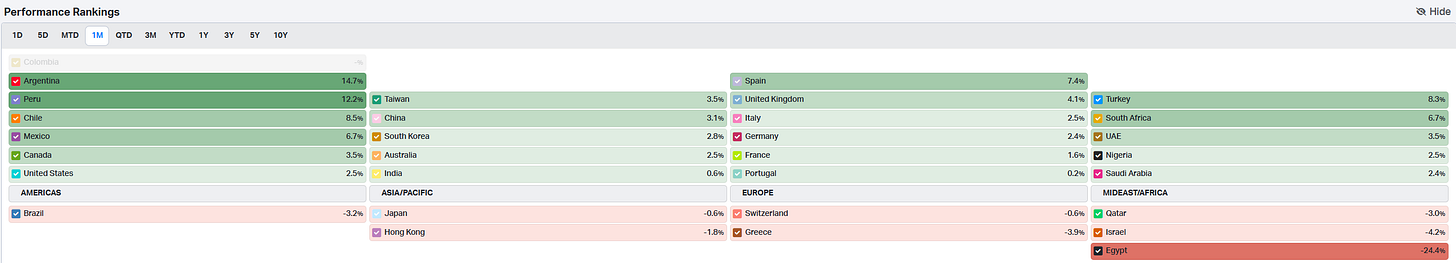

This inflationary impulse has also driven some notable outperformance in international equity markets when I keep being told that China is dead, and that Europe is now these days just a low-cost tourist attraction. 🤷♂️

A nice change from AI and ‘Mag7’ dominance but an exciting rotation could turn into a nasty ‘risk off’ moment for everything if something breaks.

That’s why we need to talk about bonds. Regular readers will know that the 🐿️ is no fan of long duration fixed income but does not fancy the ‘negative carry’ associated with being short the long end of the US Treasury curve. We remain happy with our low-cost ‘fire insurance’ on the TLT 0.00%↑ ETF.

However, the US long bond is starting to look very unwell once again. This clearly whiffs of longer-term uncertainty around inflation. Hardly surprising given recent data. 2024 has seen multiple failures by US 30-Year futures to regain their 200-day moving average. A similar shrinking of open interest in the futures preceded the May-to-October melt down last year. Something to keep an eye on.

I have a funny feeling that a rate cut with this inflationary / reflationary backdrop is in fact the last think that these hopeful owners of TLT 0.00%↑ and long bond futures should want. Any perceived ‘policy error’ could trigger a complete loss of confidence in long duration bonds. Very squirrely.

So, how does this translate into a rodent’s game plan for risk over the next few weeks and months. It feels to me that Jerome Powell and Janet Yellen still badly want to cut rates at the June FOMC meeting. Such a cut probably fuels a rally in risk assets through the summer (and into the election).

One small tweak to this view is that, as discussed before in the context of managing our ‘right tail’ FOMO hedges, I am on watch for potential weak equity market seasonals in May. With those out of the way, I continue to favor full participation with an overweight in reflationary counters such as commodities and ‘hard asset’ / short duration equities.

However, the big caveat is the bond market. Mrs. Yellen may end up having to create an entire dictionary of alphabet soup acronyms to ensure that there are enough buyers around to prevent long-end yields from spiking. She is a battle-hardened old pro when it comes to keeping the monetary plumbing running so I’m absolutely sure she has a plan. If she is not fully prepared - guess what - that would be very squirrely indeed!

That’s it for the front section this week. A brief one this week as I brace for the close confinement of an RV for the week! In Section Two (for paid subscribers), we run though a pre-holiday risk management check list for our live acorn positions.