The end of the $DASH for trash?

Domino's CFO: "In 60 years, we’ve never made a dollar delivering pizza...So, we’re just not sure how others do it."

The end of the $DASH for trash?

In Monday’s note we did a ‘deep dive’ on the upcoming Instacart IPO (link below if you missed it).

Our conclusion on the CART 0.00%↑ IPO was...

But the work was not wasted, as we further concluded that “if we are struggling to get comfortable with CART 0.00%↑ having a $13bn valuation, the idea of DoorDash having a market capitalization of over $30bn is borderline risible. Its 100% run up in share price from the lows looks unwarranted to this rodent. This week’s Acorn trade will be a ‘dark side’ one on DASH 0.00%↑.”

A quick reminder of the ‘charge sheet’:

So far so good. DASH 0.00%↑ is a case study in the excesses of ‘sending money to Planet Palo Alto’ that has taken place since the 2008 financial crisis. The trouble is that we are no longer trading our grandfather’s stock market.

Identifying bad, overvalued companies with rapacious executive compensation plans is no longer enough. In the age of the meme stock, short selling has become a very different game. This is not a wistful obituary to Melvin Capital, and I will spare you the lecture on the benefits that the short selling community have delivered to overall market health. Listen to the best in the game, Jim Chanos (slayer of Enron) on that topic.

We have to play the markets we have, not the markets that ‘should be’. Notwithstanding the seductive tales of ‘Roaring Kitty’ and ‘honest ‘apes’ doing a number on the suits’ in Wall Street, the process of identifying stocks that are vulnerable to a short squeeze has been entirely systematized and professionalized.

Professional traders constantly monitor situations, where short sellers can get caught in a Gamestop GME 0.00%↑ -like situation. They are able to take advantage of market structure in a number of ways:

The dominance of passive investment flows in today’s markets.

The well understood hedging requirements of listed option dealers.

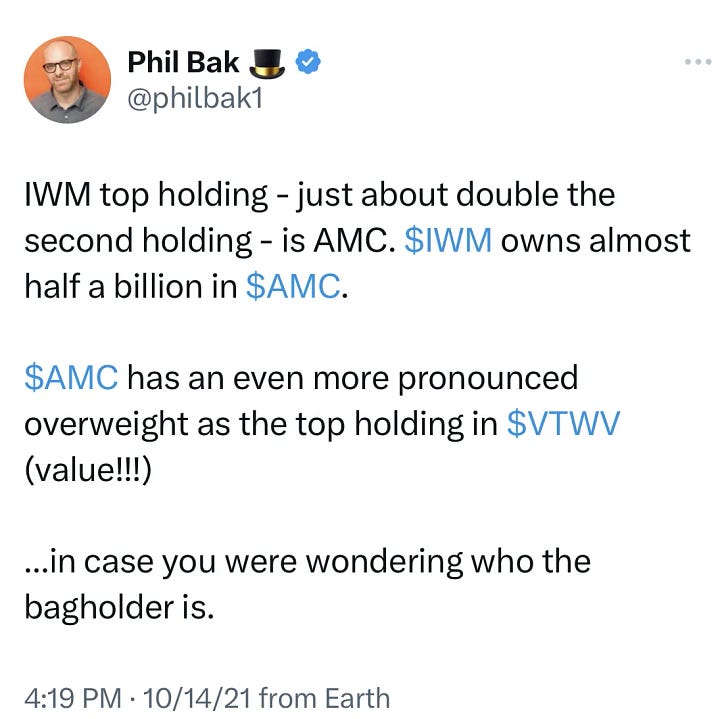

Armada ETFs’ Phil Bak has been doing a great job of late exposing the frailties (understatement) of the private REIT market (his meme game on Twitter is also best in class). His interview with Meb Faber from August is a must listen. I also discovered recently that he writes a blog called

. In his most recent piece, Gresham’s Law of Lemons, Phil summarizes points 1 and 2 so well that I am just going to quote him here directly:... “let me assure you that strangers on the internet with odd-lot orders are not capable of orchestrating a short squeeze in a liquid public market. A very deep pocketed fund with an understanding of how options trading impacts spot market-making? Sign me up for that conspiracy theory. And what became of the meme stocks? Let’s say for a minute that my conspiracy theory was right, who provided the exit liquidity for the bandits to make off with? You probably know. You should know. And the amazing thing, not only do we know, THEY know. They know and they don’t care. I am of course referring to index investors who willingly signal to anyone who will listen that they are buying the highest market caps, that they trust the market to set prices accurately (LOL), and they do it with the smug satisfaction that they have “solved” investing.”

He then adds a couple of his tweets to perfect the point:

As a function of this state of affairs, any trade on the ‘dark side’ needs to take these new realities of the market into account.

Which brings us back to DASH 0.00%↑ and some ‘DDDDD’ - Darkside DoorDash Due Diligence!

Let’s start with the shareholder register and gauging how important passive flows are to the stock.

Taking the June 30th register, I have highlighted the original PE owners in green (with a dotted line around the Morgan Stanley holding as I cannot be certain that it is related to the sponsors but it sure isn’t likely to be a mutual fund holding!). I have also highlighted the holdings by large passive (ETF) shops in yellow.

Taking the institutions holding over 1% of the company (56% of shares outstanding), 24% of the company is owned by the original PE investors, 12% by dedicated passive index shops and 20% by other institutions (some of which are very likely to have a passive component to their strategy).

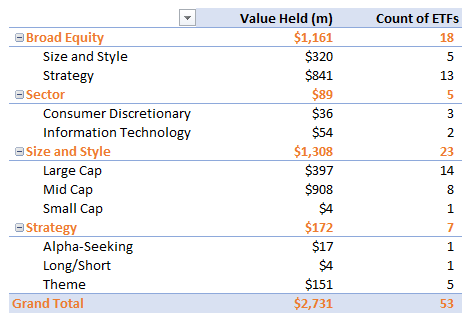

Even better, my friends at Koyfin provide of the ETF ownership of DASH 0.00%↑

That is 8.4% of the company (not including non-ETF passive funds) whose purchases and sells are determined 100% by (i) fund flows in and out of their funds and (ii) DoorDash’s share price. They could not give an acorn about the 🐿️’s rants about stock-based compensation!

I have broken down these ETFs by investment style. There are a few ETFs in there that might conceivably be looking at other fundamental factors around the company, but, as you can see below, 90%+ is down to market capitalization.

So what does this tell us? Passive flows will certainly play a major role in DASH’s share price progression. As such any confidence around a fundamental short thesis needs to be tempered against any bigger picture judgements around broad based fund flows into the equity market and whether those flows might have a factor bias towards mid-caps. You cannot ignore the machines!

The movement of the machines is one thing, but when augmented by aggressive option activity, stock price can rapidly get dynamic to the upside (and no, it is not Keith Gill and his buddies in their parents’ basements).

The option activity in DASH 0.00%↑ is subdued by comparison with the pandemic era, but not insignificant, especially around earnings (where the management team are very active lowerers of the ‘earnings’ expectation bar to manufacture ‘beats’). Q2 in August was a revenue ‘beat’ but an 8% ‘miss’ on EPS (loss)-per-share after a ‘double beat’ for Q1 back in May.

Looking at the 15th of September expiry listed options, there is reasonable out-of-the-money call open interest for the major round number ($85, $90 and $95) strikes but implied volatility for the $90 call is back at 29% after a trip to 50% in the run up to the Q2 earnings release in early August. There is still some traffic in these ‘lottery ticket’ options (even the 2% delta $95 calls). More money for Ken Griffin and his market making machines at Citadel…

Bottom line. The ‘gamma squeeze’ crew (and once again, these are professionals) are focused elsewhere.

Next up, an “ape check” - or rather a check on social media buzz around the name. One of most annoying things about researching single stocks online these days is that stock tickers keep on getting hijacked by the crypto ‘bros’ with similar sounding shitcoins altcoins. A case in point:

It would appear that there is currently much more fun to be had in the Tesla and Nvidia weekly options. The situation needs to be reviewed constantly, but for the moment, “ape” risk would seem low.

Crayon Time - A quick review of chart technicals

Big picture, DoorDash broke out of an 18-month down trend in May. It trended flawlessly up until just ahead of the August Q2 release before correcting.

Zooming in, things look more interesting for the bears. There was a clear rejection of $90 per share ahead of the mixed earnings numbers after the stock got over-extended on an RSI basis. The recent bounce from the initial correction appears to have failed at around the 61.8% Fibonacci retracement level.

It is the weekly chart that has perked the 🐿️’s interest for a long dated bearish play (and 🎩 to a certain ‘Cloud Bear’ for steering me towards it after I consulted with him). Looks like sharp reversal on the weekly RSI and a double fail to recapture the 100-week SMA.

So, where could this chart go if the down trend is about to recommence? A retest of the October 2022 lows feels plausible given time (and the absence of a broader bull run in equities energized by the machines).

Implementation

So, we are going to split this trade into 2 parts:

In the near term, we could see DASH 0.00%↑ probe for a lower low from the recent correction. The intraday low of $75.01 on Aug 21st is the target which we shall set as the lower strike of an October 20th $80/$75 Bear Put Spread.

On a longer timeframe, we are either going to carry on into Palo Alto ‘La-La Land’ or DASH 0.00%↑ is going to meet its maker on the valuation front. We are expressing this view via a Put Ratio Backspread which essentially looks for a re-test of the all-time lows in DASH 0.00%↑ by the spring / summer of next year but has the beauty of giving you an inexpensive ‘free look’.

The Walk Through

For those reading this in bed next to a sleeping partner or who cannot stand the sound of the 🐿️’s voice, links to the OptionStrat screenshots and (hopefully) self-explanatory charts are below.

Leg 1:

Leg 2:

Final Thought

This is one of those trades where I hope to be right for reasons beyond making some money on an option trade. These ‘gig economy’ creations of Palo Alto are not a fantastic contribution to civilized society. Please tip your UBER / LYFT / DoorDash / Deliveroo / JustEat delivery guy or gal as much as you can afford, as the High Priests and Priestesses of Sand Hill Road in Palo Alto are not planning to.

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.

Good stuff. The shot at CART and DASH reminds me of Petition's work on cash-incinerating e-grocers.

https://petition.substack.com/p/egrocery

Eventually all will end up in the same place.

"For those reading this in bed next to a sleeping partner"; so accurate one wonders if the Squirrel is not blind afterall and hacked into my phone's camera....