The end of lithium's manic episode

The Blind Squirrel's Monday Morning Notes, 14th October 2024.

The splash of ‘Big Mining’ M&A has woken up the lithium market after 18 months of extreme pain. The 🐿️ considers his options.

The end of lithium's manic episode

Lithium’s use as a psychiatric medication first started in the 1870s. The short-term side effects from taking it can include nausea and diarrhea, muscle weakness or a dazed feeling. To be honest, that sounds a bit like the lived experience for the past 2 years for investors in the lithium miners!

Then, to the relief of the lithium bag holders and the picture editors of finance media bored of decorating mining articles with the same old pictures of CAT 797s (even if the 🐿️ does have a massive soft spot for them!), along comes Rio Tinto last week with a 90% premium all-cash bid for Arcadium Lithium.

Does this deal mark the end of the lithium winter that investors have endured since the heady days of excitement around this theme as the ultimate ‘picks and shovels’ play to the electric vehicle revolution?

In March of last year, in Ben Graham’s Electric Car, I wrote that “The electric vehicle investment theme fast became the preserve of stock promoters and carnival barkers…and I am not just talking about everyone’s ‘favorite’ aspiring Mars colonist. The electrification of passenger vehicles is a broad topic, and I wanted to take a step back to figure out how to make money in a way that is not reliant on the greater fool theory that is the buying of narrative stocks. In the ‘story’ category I include pre-production lithium miners as much as car companies that do not yet sell cars.”

This was a view that allowed the 🐿️ to (largely) stay out of trouble. The investment in Mercedes Benz (on a ‘pivot to luxury’ thesis) did not really work out but leaning into lithium miners (even the producing ones) or the broader EV battery complex would have fared significantly worse!

The acquisition of Arcadium by Rio may be a small consolation prize having failed to land that merger with Anglo American (and its wealth of assets in the other ‘green metal’ - copper) earlier this year.

The 🐿️’s whiskers had been twitching for a few weeks before the announcement. Part of the initial premise of my invitation to discuss the uranium market the other day on CNBC had been to discuss the divestment by Rio of its Wyoming uranium assets to UEC (as well as Microsoft’s deal to reopen the Three Mile Island nuclear plant).

The segment that contained my view on the Rio deal ended up on the ‘Street Signs’ cutting room floor. In it I opined that the uranium mining sector, with its current aggregate market cap of just over $60bn was possibly too small a sector to ‘move the needle’ for a mining giant with a market value of almost twice that amount.

However, an expansion into lithium does not necessarily (yet?) offer up a larger pool of value for Rio:

But, presumably off the back of the M&A whisper mill (and there are always breadcrumbs!), a few weeks ago this rodent’s inbox, news websites and social feeds started featuring - for the first time in a while - a lot of lithium content.

Then this week (albeit post the Arcadium announcement) we find that lithium had even become a ‘lunatic fringe’ issue in the US Presidential election.

All in all, quite a lot of ‘airtime’ for what is - let’s face it! - a fairly abundant mineral on our planet! Nevertheless, the hard-core lithium bulls certainly think that Rio has called the bottom for the battery metal.

The argument for a higher “$8bn+” valuation for Arcadium (9-11x 2028 EBITDA, discounted back to present) revolves around the geographical diversification of its assets; a vertically integrated (and ex-China) supply chain asset; and its commercial relationships with major auto and battery OEMs. The research team at Citi reckons it would cost more than $US7.7 billion to recreate Arcadium’s portfolio of assets, technology, expertise and growth options from scratch.

However, given that there does not appear to be a competing bidder for Arcadium alongside Rio Tinto (itself not known to have an M&A track record that could necessarily be classified as ‘black belt’), it strikes the 🐿️ that the ‘hold out’ shareholders might potentially be a tiny bit out over their skis.

Rio’s $5.85 per share bid values Arcadium at $6.7bn. The miner’s management team hopes to double revenue by 2028 and grow EBITDA to $1.3bn (from $525m in the 2025E financial year, a 34% CAGR). Let’s look at some trading comps.

That promised $1.3bn of Arcadium 2028 EBITDA is still 4-5 years away and is also predicated on a lithium price significantly higher (85+%) than current spot.

As of Friday’s close, ALTM 0.00%↑ is sitting at a 5% discount to Rio’s $5.85 cash bid price - a fair financing spread for a transaction that is expected to close in mid-2025 and which is subject to multiple international regulatory approvals. The 🐿️’s message to Arcadium minorities would be clear. Take Rio’s cash and…

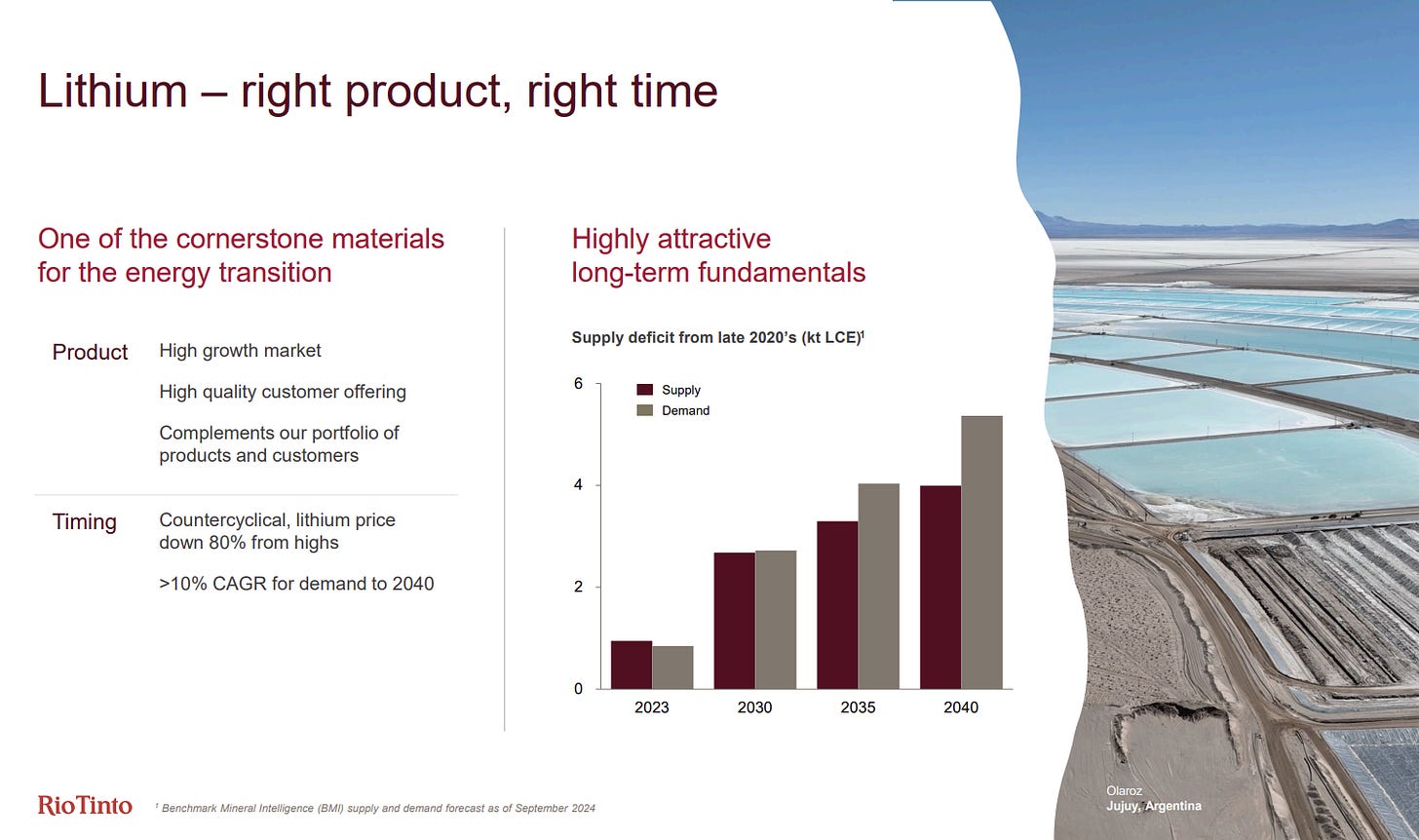

However, does Rio’s strategic move mean that we should be hunting elsewhere in the sector? Rio’s acquisition slide deck forecasts a market that moves into deficit by the end of this decade, and they clearly think that they are catching the bottom of a multi decade bull cycle.

Let’s take a step back. Notwithstanding its importance to the energy transition, the absolute size of the lithium market is still small relative to other industrial and technology metals. Lithium’s “white gold” nickname is frankly a bit of a stretch. Earth’s crust is estimated to have c.89m MT of lithium, even if only 25% of that is considered economically viable to mine.

It should be noted that BHP, Rio’s metals giant competitor, is on record as considering that lithium’s abundance is a negative. BHP has also voiced concerns about the ‘flatness’ of lithium’s cost curve, with the resilience of the best assets being not sufficiently superior to more marginal plays.

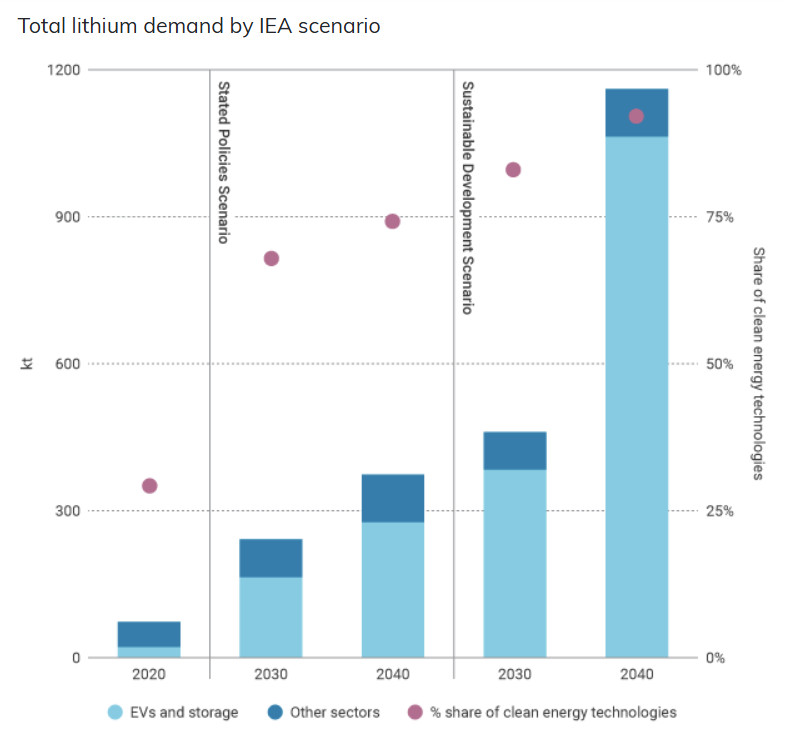

However, the IEA thinks that we are going to need plenty of the white stuff, whatever you may think of that particular organization’s forecasting track record! In the scenario consistent with their ‘SDS’ sustainable development goals, annual lithium demand reaches 1.16 MT by 2040. However, this assumes that EV adoption and energy storage use cases account for about 90% of that volume.

The 🐿️ has covered the thorny topic of slowing EV penetration rates and the rapidly increasing consumer preference for hybrid (‘HEV’) powertrains for vehicles in previous notes. I will not re-rehearse the arguments here, but the portfolio is long platinum and palladium (via Sprott’s SPPP 0.00%↑ trust) chiefly for this reason.

I do believe that HEV adoption (for passenger cars) will surprise to the upside for the balance of this decade. With this in mind, we do need to consider the potential impact of competing battery technologies when thinking about lithium’s role beyond that timeframe.

While lithium-ion batteries dominate today’s market, alternatives like sodium, zinc and iron-based solutions are advancing rapidly. Sodium-ion batteries are cheaper but have lower energy density. Zinc-air batteries offer higher energy density and improved safety but face limitations in power output. Iron-based battery solutions would appear to be most promising for static grid storage solutions.

In any event, lithium technology continues to evolve and get better. A wholesale switch away from the metal is unlikely in the near term and lithium supply demand imbalance in the next 3 to 5 years is key to the investment case for lithium miners right now.

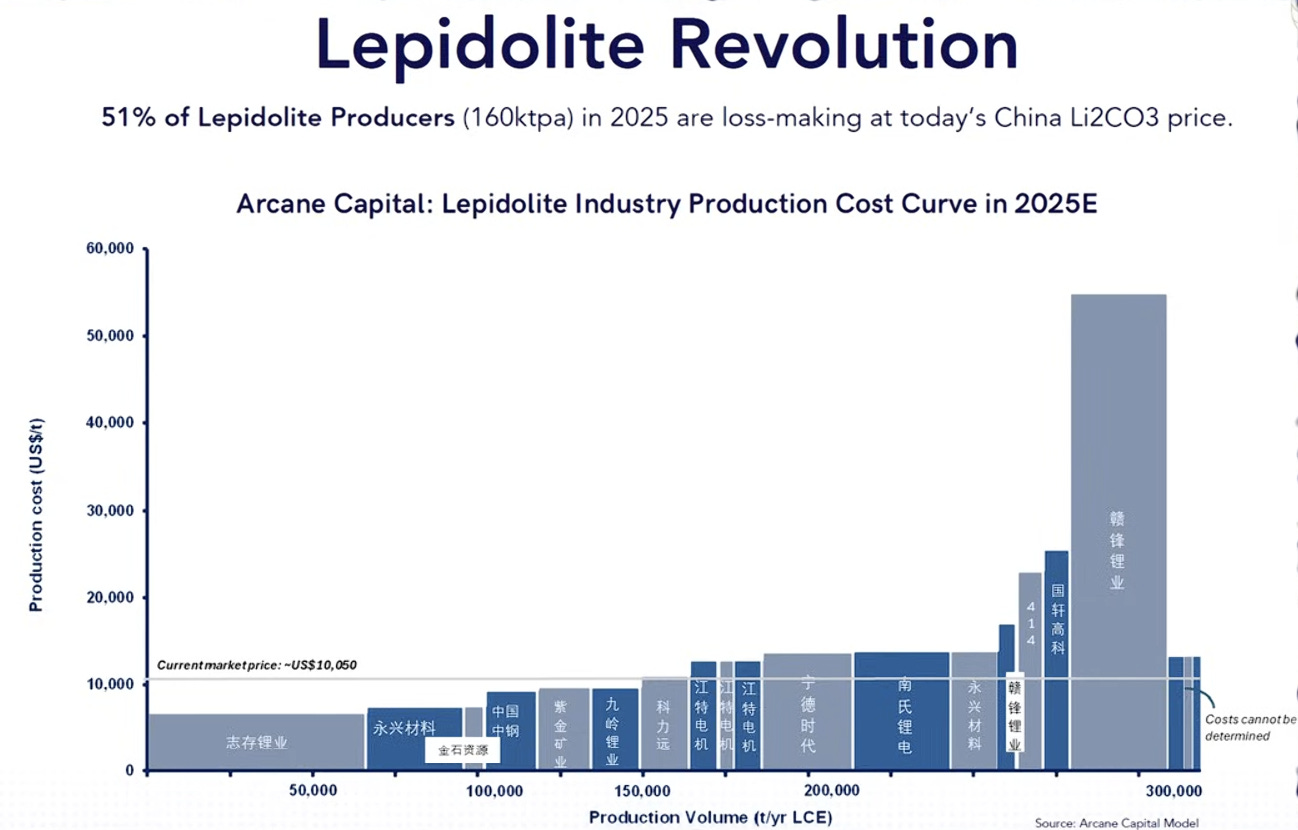

The battering of spot lithium markets (and their miners) in the past 18 months has largely been attributed to upside supply surprises from African lepidolite resources and to aggressive production by Chinese players which Marin Katusa calls a “cut to kill” strategy reminiscent of Kazakhstan’s historical attempts to kill off junior mining competition in uranium markets.

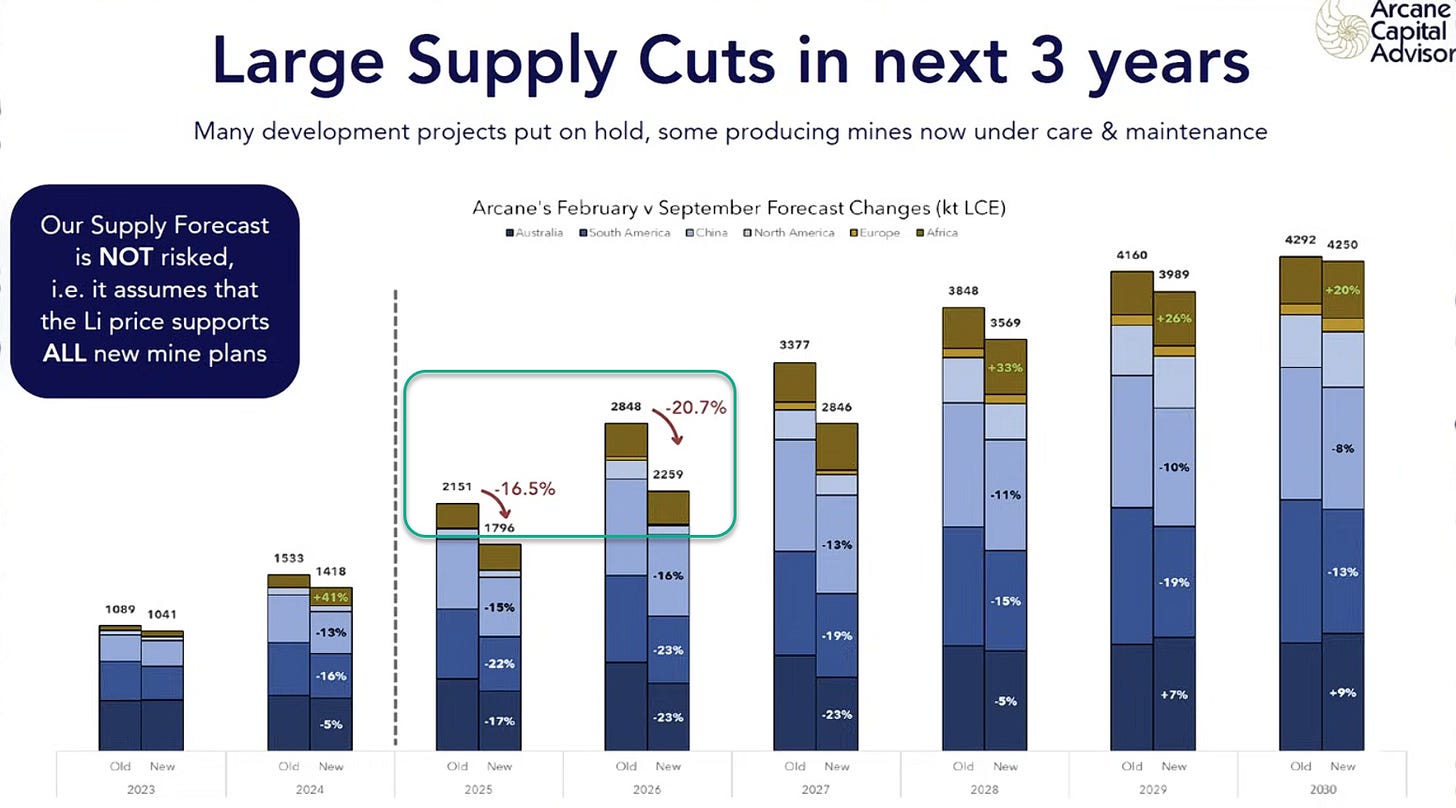

Arcane Capital’s YJ Lee argues forcefully that the market has bottomed. He feels that the recent downgrades of lithium demand by the market fail to appreciate the growth of electrification trends in renewables storage, commercial vehicle and mass transit applications. He also feels that industry estimates on the supply side of the equation have failed to take into account the impact of planned production cuts by the main Chinese players. UBS has also been creating some hope for the bulls on a similar theme.

YJ has built a compelling bottom-up analysis of supply and thinks the lithium market deficits could be a reality within the next 12 months. A deficit which could last for the “next few years” and see prices back at $30,000/MT by 2028 to 2030.

Minor digression, but for the silver bulls among you, YJ also paints a compelling (and quantitative) picture for industrial demand (principally from solar) for the other white metal emerging in the coming years - a view echoed by a number of other analysts in recent weeks (including this excellent piece from

on Friday).Back to lithium. What worries me about YJ’s take on supply curtailment is what happens to the assets currently in ‘care and maintenance’ as soon as lithium spot prices recover back above those ‘flat’ production cost curves.

It strikes me that much of the attraction for the industry relies on the politics of supply chain security. The process of re-/near-/friend-shoring driven by populist policies in the West appears to lie at the core of the arguments of some of the more vocal promotional voices in the lithium mining value chain.

The 🐿️ worries that lithium supply chain duplication/ diversification becomes a fragile bedrock for a new bull market if a new resident at the White House decides that a ‘beautiful shiny deal’ with China is preferable to yet another source of inflation pressure.

However, it is important to remind ourselves never to ‘go full geo-macro’ and there may well be an interesting trade here in the near-term. In Section Two this week we look at some alternatives. You may need some lithium (pills) to calm your ‘white gold’ miner mania.

Don’t miss out! Please consider becoming a paid subscriber to receive the other 60% of 🐿️ content (lithium pills not included), member Discord access (The Drey) and even ‘limited edition’ merch!

IMPORTANT NOTE: 🐿️ subscription prices will be rising at the end of October. Existing annual and monthly subscribers will be grandfathered at their current rates.

Keep reading with a 7-day free trial

Subscribe to Blind Squirrel Macro to keep reading this post and get 7 days of free access to the full post archives.