The '60/40' Portfolio doesn't work anymore. The Murdoch Effect.

The Blind Squirrel's Monday Morning Notes, September 25th, 2023.

Summary

We can debate central bank ‘policy errors’ as much as we want but the reason that the OECD bond component of your retirement portfolio has stopped doing its job is not really any longer the fault of Powell, Lagarde or Bailey.

The problem is politics and populism. To the horror of the neoliberals, the populist / culture war Trojan Horse that brought them power has backfired. It turns out that fiscal largesse and ‘big government’ is really popular with voters.

The OECD bond market does not like the look of the economic implications. This has major implications for the typical 60/40 (stock/bond) retirement portfolio. We look at alternative allocations. Hint: it’s not private credit!

This week’s Acorn review covers #Offshore #Energy BNO 0.00%↑ DBA 0.00%↑ WEAT 0.00%↑ $FCOJ CANE 0.00%↑ #Mercedes DASH 0.00%↑ and #uranium

The audio companion to this week’s note will be uploaded to Substack in a couple of hours. It will also be available as a podcast on Apple, Spotify and the other major podcast apps.

The '60/40' Portfolio doesn't work anymore. The Murdoch Effect.

Blind Squirrel Macro does not ‘do politics’. If you are interested, the 🐿️ identifies as a politically homeless raging centrist. While this may be no good for my blood pressure in the current political climate, I try to ensure that it has zero impact on my thoughts on investment and markets. You trade and invest in the reality that is in front of you, not the reality that you would prefer!

As such, writing a note on a character as divisive as Keith Rupert Murdoch is done with a high degree of trepidation. Whatever your politics, the degree of control that an unelected billionaire has over the levers of power (in several countries!) is something that, frankly, should trouble everyone.

It is also a golden opportunity for me to talk about my favorite TV show, Succession. If asked what my 3 favorite TV shows were, I would answer Succession seasons 1, 2 and then 3! The theme tune is even my mobile ringtone!

Murdoch’s note to staff last week was certainly straight out of the Logan Roy playbook: “When I visit your countries and companies, you can expect to see me in the office late on a Friday afternoon” are not the words of a leader that has truly given up the reins of power. To quote Logan this time, “Anyone who believes that I am getting out, please shove the bunting up your arse!”

However real the retirement Murdoch announced last week turns out to be, it is an opportune time to reflect on the impact of his media empire on Western politics and what this means for your retirement portfolio.

To get there, we are going to channel the work of two of my favorite strategists, Clocktower’s Marko Papic and TS Lombard’s Dario Perkins. Marko’s analytical model, set out in his book ‘Geopolitical Alpha’1, revolves around the concept that democratically elected politicians are constrained by the wishes of the ‘median voter’ that (re)elects them.

Dario and his team have been pulling on a similar thread. The electoral popularity of fiscal largesse and protectionism that was unearthed around the West during the pandemic, has given elected leaders a taste for large scale economic intervention that is creating a nightmare scenario for the neoliberals.

What started with ‘stimmie checks’ has now morphed into an explosion of deficit spending with governments seeking to even get directly involved in industrial policy (e.g., Inflation Reduction and Chips Acts). ‘Big Government’ has never been bigger! And it is popular with the electorate!

The problem with neoliberalism is that its core economic mantra of low taxation and un/ lesser-regulated corporate activity does not really pique the interest or support of the median voter. That voter requires additional ‘nudging’. To create a broader electoral coalition, the populist playbook has worked wonders in recent years.

The rise of populist politics in the West accelerated in 2016 with the UK’s Brexit referendum and the election of Donald Trump. The economic merits of cuts in US taxation or the UK ‘breaking free from the regulatory shackles of the EU single market’ would never have carried either vote in their own right. That is where Mr. Murdoch and the ruthlessly efficient culture war machinery of his media empire came into play.

You could argue that a backlash against globalization and the 30-year triumph of capital (corporate profits) over labor (employee wages) was ultimately inevitable. However, it takes more than pure economic arguments to drive such a rapid change and economic populism now looks like it is here to stay.

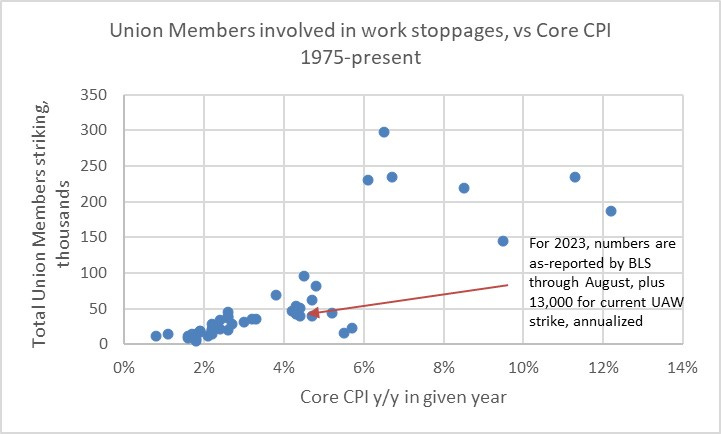

It is also inflationary. The autoworkers’ unions certainly think so. ‘Inflation Guy’ Michael Ashton’s blog was brilliant on this topic last week. In his study, inflation and inflation expectations are the biggest driver of union wage demands.

Another (even scarier) entity does not like what it sees. The bond market. Last week’s weakness in the US Treasury market was really only the latest chapter in the drawdown in OECD government bond markets that started last year. There are plenty of bond bulls still out there, but the 🐿️ not think that the bond market’s problems are over.

There are plenty of cries of ‘central bank policy error!’ in the air. The 🐿️ is increasingly unsure as to whether the central bankers in fact have the choice (to lower rates) if they are to stick to their inflation control mandates.

Which brings us on to bonds and their role in the 60/40 retirement portfolio. Andrew Beer (of DBMF 0.00%↑fame) was back on the Top Traders Unplugged podcast earlier this month. As ever, an excellent listen. He observed that a world in which bonds can lose value at the same time as stocks creates an existential problem for the savings industry.

“The thing is that the entire asset management industry; every pension plan, every family office, every RIA, every wealth management firm has built their businesses around an inverse correlation between stocks and bonds, and it looks like that’s over.”

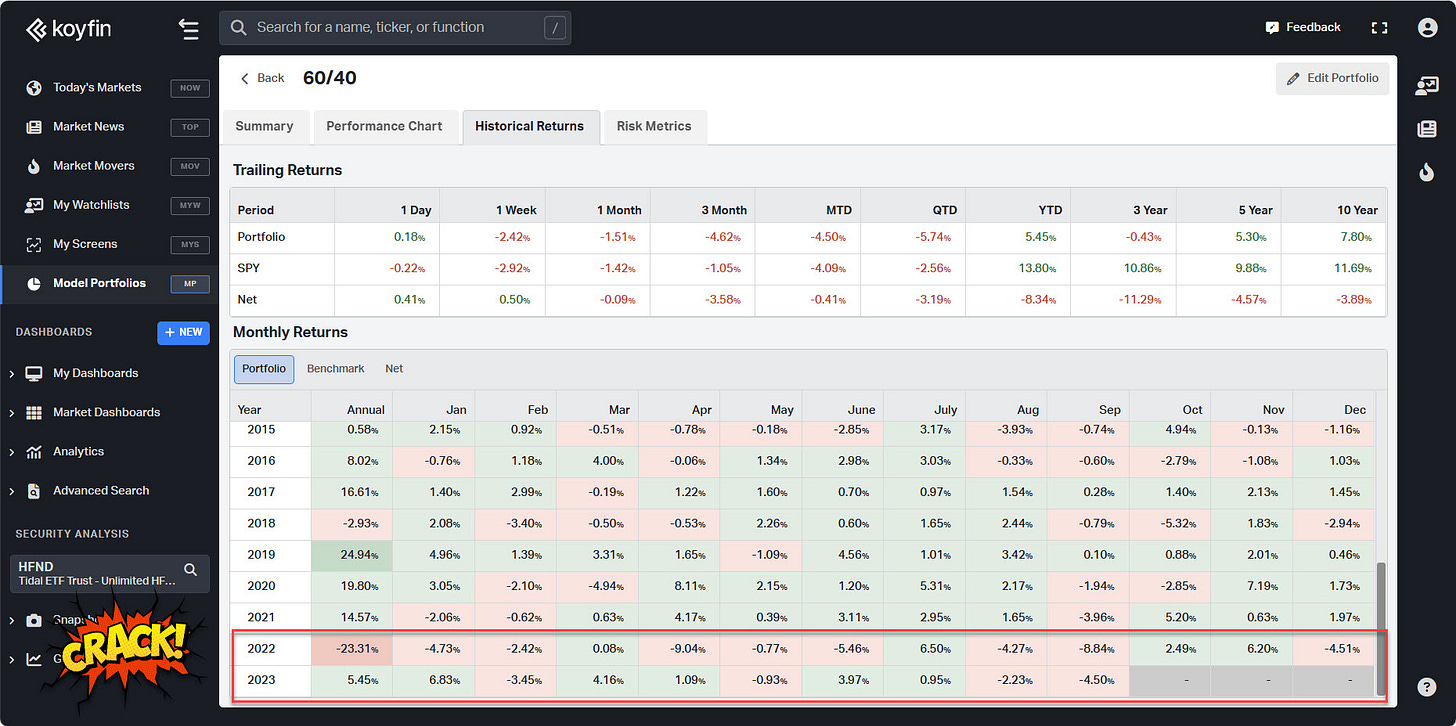

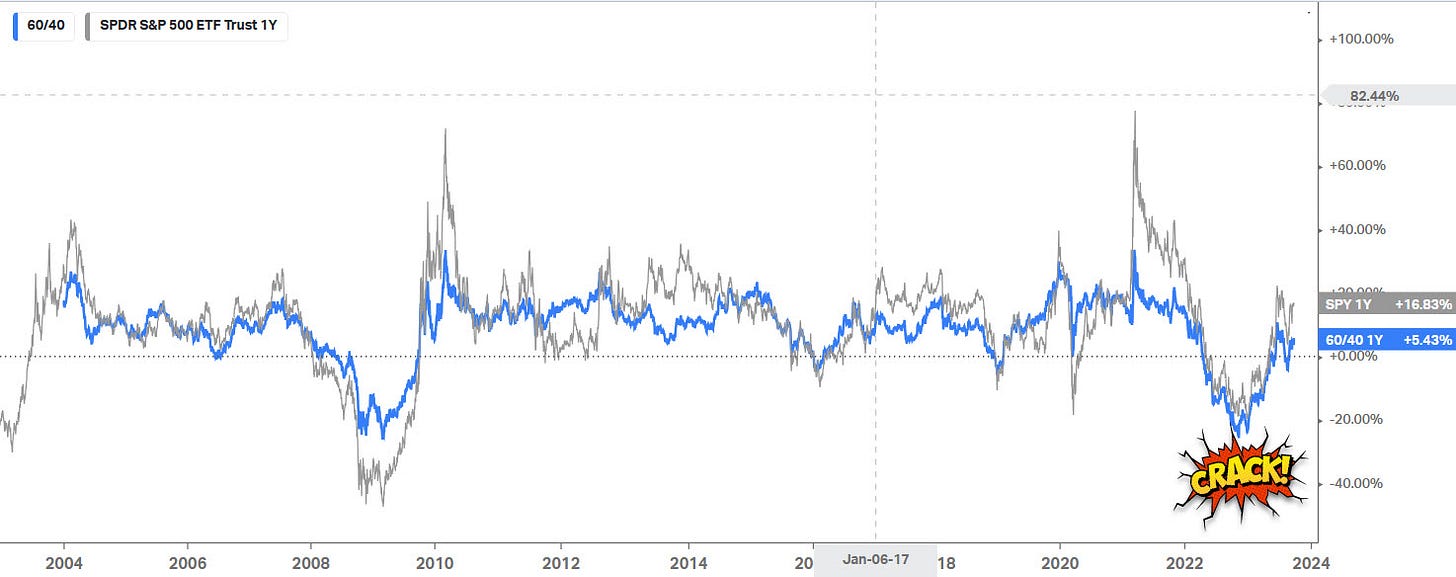

To illustrate this, I created a (very!) highly simplified 60/40 portfolio via Koyfin’s new Model Portfolio function. A portfolio of 60% SPY 0.00%↑ and 40% TLT 0.00%↑ delivered precisely what its ‘all weather’ nature was supposed to avoid, a bone crunching drawdown of 23.31%.

The inverse correlation between equity prices and bond prices that has been dominant since the early 2000s appears to have flipped. The bond element of 60/40 protected portfolios during the tech bust of the early 2000s, the GFC and the early days of the Covid pandemic. Then 2022 came along. With a couple of brief exceptions, bonds and stocks have been moving in lock step ever since.

I do not buy in to the thesis that this is merely a temporary aberration. In fact, history tells us that for most of the 30 years leading up to the 2000s, bonds and stocks observed a positive correlation (in price). This was also a period of global geopolitical tension; the occasional commodity shock; and with high inflation and growth volatility. Ring any bells?

If bonds are not going to provide their accustomed ‘drawdown buffer’ service, portfolios need a new risk diversifier. But what could that be? The asset gathering behemoths at Blackrock and Blackstone would like to have us believe that the private versions of stocks and bonds (i.e., their private equity and private credit funds) could fill that gap with their ‘dependable, low volatility’ returns.

Well, you are familiar with the 🐿️’s view on those vehicles and their self-marking of homework (AQR’s Cliff Asness remains unbeaten on the topic). I suspect that Logan Roy would be more direct:

The other great pitch for ‘low vol’ returns is the giant ‘Multi-Strat’ hedge funds (such as Millenium, Citadel, Point 72 etc.) - access to these funds is not really an option for a retail portfolio and I am also not so convinced that they continue to perform in a higher interest rate environment. Again, Andrew Beer is interesting on the topic:

“Everyone is obsessed with multi strategy hedge funds today. And they have been magicians. Who would have thought, in early 2020, that you would have a series of multi deca-billion funds out there leveraged 5 times, 10 times, or something, that would skate through COVID, the recovery, inflation, etc. and bang out returns. They’re like 12% CDs. I mean, they’re like hippopotamuses doing pirouettes in ice skates on the bow of a ship in a hurricane. You can’t believe they’re pulling this off.”

He mentioned a blog that he had recently written (link to it here) on how these funds could be ‘dead money’ for a while. So, what’s left as an option? The rest of the Beer’s conversation with Niels is focused on the role of trend-following / managed futures / CTAs as a portfolio stabilizer. I have written about the 🐿️’s CTA-curiosity before. I am an owner of both Beer’s CTA replicator ETF, DBMF as well as Simplify Asset Management’s CTA ETF.

This exposure is something that I initially owned only as a way of ensuring that I kept a close idea on the markets where the trend following funds had notable long or short positioning. I am now becoming increasingly convinced that this exposure provides me with a valuable portfolio risk diversifier. I have also spent a great deal of time playing with back tests on Dunn Capital’s model portfolio builder2.

My plan is to allocate a meaningful “Do Not Touch!” core (c.20%) exposure to the strategy via these ETFs for the next few years. This is something that I know that I have to outsource as I do not have the temperament or discipline to execute a pure trend-following strategy by myself and have been sufficiently brainwashed by the experts to understand that the 🐿️’s discretionary macro views are likely to be a counter-productive overlay!

When it comes to fixed income, for all the reasons cited above I really struggle to get excited about exposure to long duration in the OECD bond market, especially with the front end of the curve now yielding over 5%. Even Interactive Brokers will pay you 4.8% on your US dollar deposits with them!

I continue to like local currency fixed income exposure in emerging markets (especially Latin America). For retail investors this can also be pulled off easily via ETFs or closed end funds. I wrote about this and other sources of yield in The dilemmas facing Garfield's "Barbell" back in April.

What else? In an inflationary environment, hard assets and commodities have proved to be reliable in the past. There will certainly be plenty of focus on that area at Blind Squirrel Macro! My friend Louis Gave and

had a fascinating chat on Realvision last week. Louis has been advocating the idea of energy as the goalkeeper / stabilizer for your portfolio. The 🐿️ finds himself nodding his head vigorously!Final thought

The final thought this week is a quick Public Service Announcement to fellow Succession fans: If you love the show, you will love the following:

Short Vanity Fair video in which composer Nicholas Britell beautifully explains the thinking behind his mesmerizing theme tune to the show. 14 minutes of your life well spent.

Felix Salmon of Axios’ post-game podcast dropped the morning after every show aired during the 3 seasons (including some occasional guest hosting from 🐿️-favorite, J Smith-Cameron aka Gerri). You need to be a complete Succession nerd (it is 31 hours worth!) but the show has a good shelf life.

+++

That’s all for the front section this week. For those new to Blind Squirrel Macro, the Monday note comes in 2 parts - a front section covering a current finance or markets topic and a second section containing a review of our ‘Acorn’ trade ideas and a portfolio update.