Steepening Ahead

A look at bonds, the National Security Strategy and a general risk update. Weekly review of the 🐿️'s BUSHY™ Multi Asset ETF Portfolio and live Acorn trade ideas. 2025, Week 49.

A combined note this weekend. The 🐿️s moved house last week and the rodent has been wrestling with packing cases and flat pack assembly jobs. I have also been trying to stay focused on the existing portfolios with markets displaying some ‘squirrely’ tendencies - that really should be a compliment from me, but really is not!

Some sector and factor trends reversed sharply this week. Bonds, the US dollar, gold and recent equity defensive winners (healthcare, staples, utilities) gave back ground.

This rodent has been as guilty as many in seeing signs of weakness in the US consumer in recent months. To see XRT, the retail sector ETF, add almost 14% since its pre-Thanksgiving lows certainly caught my eye.

One man who was not surprised by this move was Jeff “Mr. Retail” Macke. In fact, he nailed the call! As such, I was delighted that Jeff joined as the first guest on “Benny & The Squirrel” last Thursday evening.

Jeff both shot a lot of narrative foxes and gave us a masterclass in how to think about the retail sector.

“Like a Hallmark movie”, Christmas spending “always surprises to the upside”. Consumer survey data always indexes toward the negative and “folk were too busy shopping to fill out a form!”

The retail spending pie does not shift that much in size in real terms - essentially it’s a zero sum game - you have to find winners and losers of the wallet share game. Note to self: this ‘win/lose’ set up means that being long or short the retail index (or XRT ETF) is not an active bet.

Contrary to the gallons of ink spilled by social scientists, human desires do not change much. ‘Gen Z’ are NOT a new species - it’s essential to fade popular narratives such as “they all want experiences versus stuff”.

Provided you still fit in them (and for that there will always be Ozempic!), never chuck away your old clothes - they will always come back into fashion (denim versus ‘athleisure’).

My podcasting partner Ben Brey came into shopping season long some retailer equities as a hedge against his long fixed income position. Ben is an unashamed bond bull, but we remain good friends!

How to think about bonds

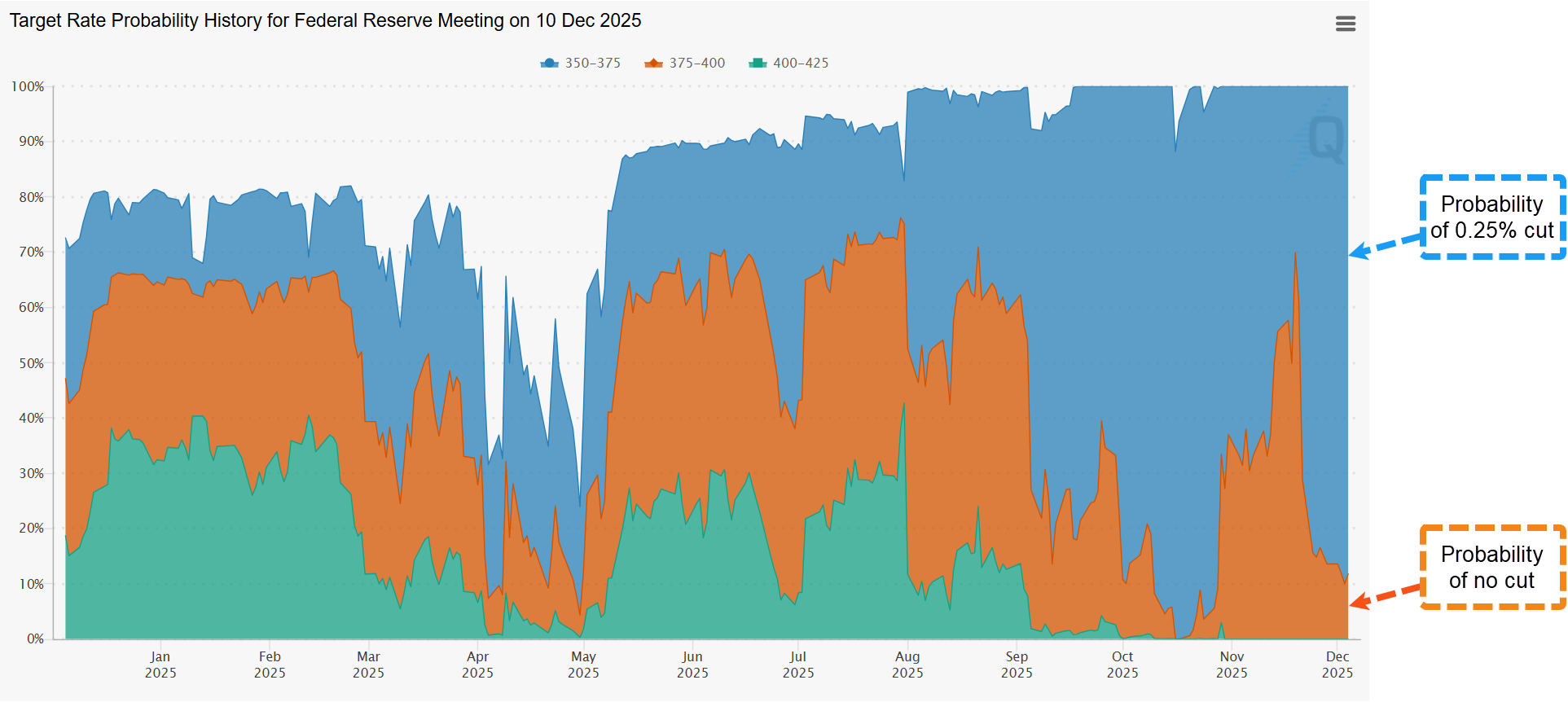

The way bond markets are trading at the moment reminded me a bit of Jeff’s “Hallmark movie” analogy. Instead of Santa always managing to deliver the gifts on time, the attempts by the market (from mid October to late November) to price out a rate cut at December’s FOMC have been sharply reversed in the past fortnight.