Sell in May? LOL!

June 2nd, 2025. Review of the 🐿️'s BUSHY™ Multi Asset ETF Portfolio and live Acorn trade ideas. 2025, Week 22.

In case you missed it, the weekend note laid out the 🐿️’s short thesis on Salesforce CRM 0.00%↑. It also contained an important message for free subscribers to the newsletter. More details to follow later this week.

We mercifully do not trade tariff headlines at Blind Squirrel Macro. Judging by anecdotal evidence, much of the professional active investment community, shaken by the policy uncertainty and volatility of April, did indeed follow the old ‘sell in May’ adage and started their summers early.

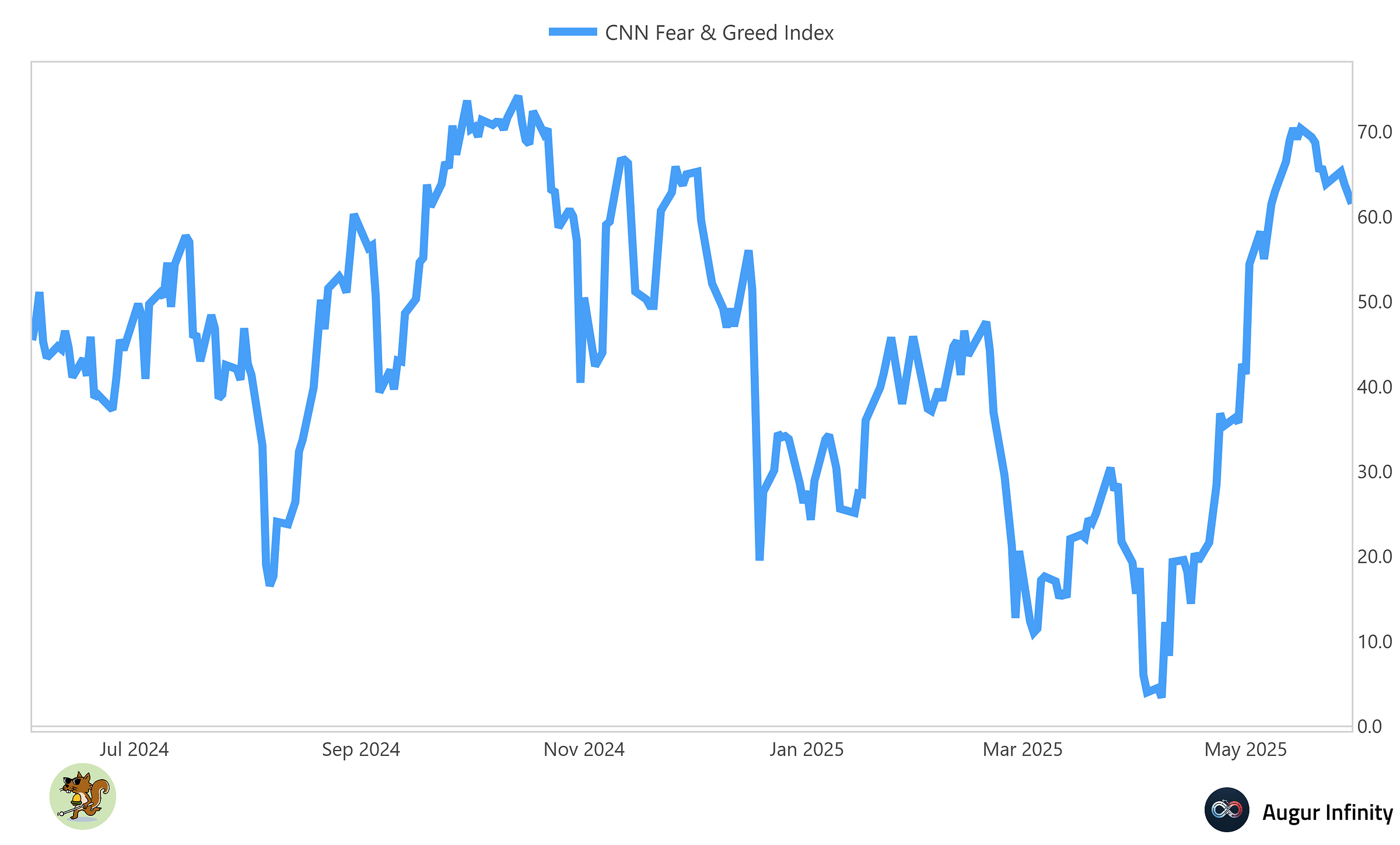

It was a decision that many are regretting as animal spirits returned to risk assets pushing the CNN Fear and Greed index back to levels last seen in the immediate aftermath of the November election.

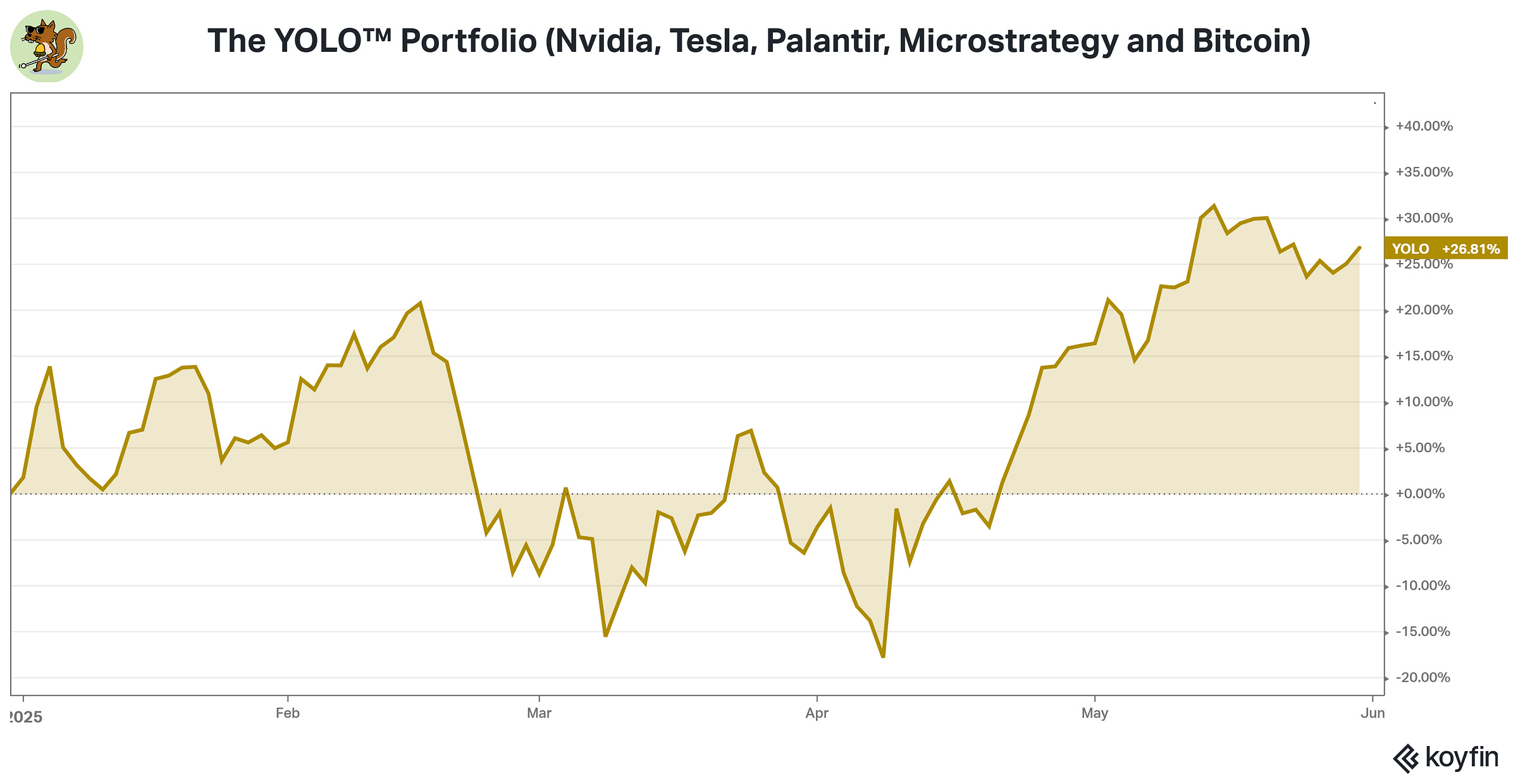

May was a month that rewarded 2 categories of investor, namely (i) those that never open their brokerage statements and (ii) Team YOLO™ (the 🐿️’s proxy for most ‘Robinhood’ retail portfolios) who bought the April dip in their favorite names like it was 1999 or 2021, and they carried on chasing in May!

Looking more broadly at US equities, the key contributors to May US equity returns were a flashback to the AI markets of 2023/4 - surging large cap tech stocks with Nvidia (aka ‘The Highlander’) accounting for just over 22% of S&P 500 total returns for the month.

Apple was a notable absentee among the ‘Mag 7’ and was the largest negative contributor to 1 month index returns. Unless Tim Cook can produce some AI magic at next week’s WWDC event (consensus is for disappointment - so probably not fade-able yet - the 🐿️ does not make the rules), I suspect that the ‘Cupertino rent seeker’ could be setting itself up as everybody’s favorite funding short for several quarters - if not years. Short interest in AAPL 0.00%↑ is at 0.7%.

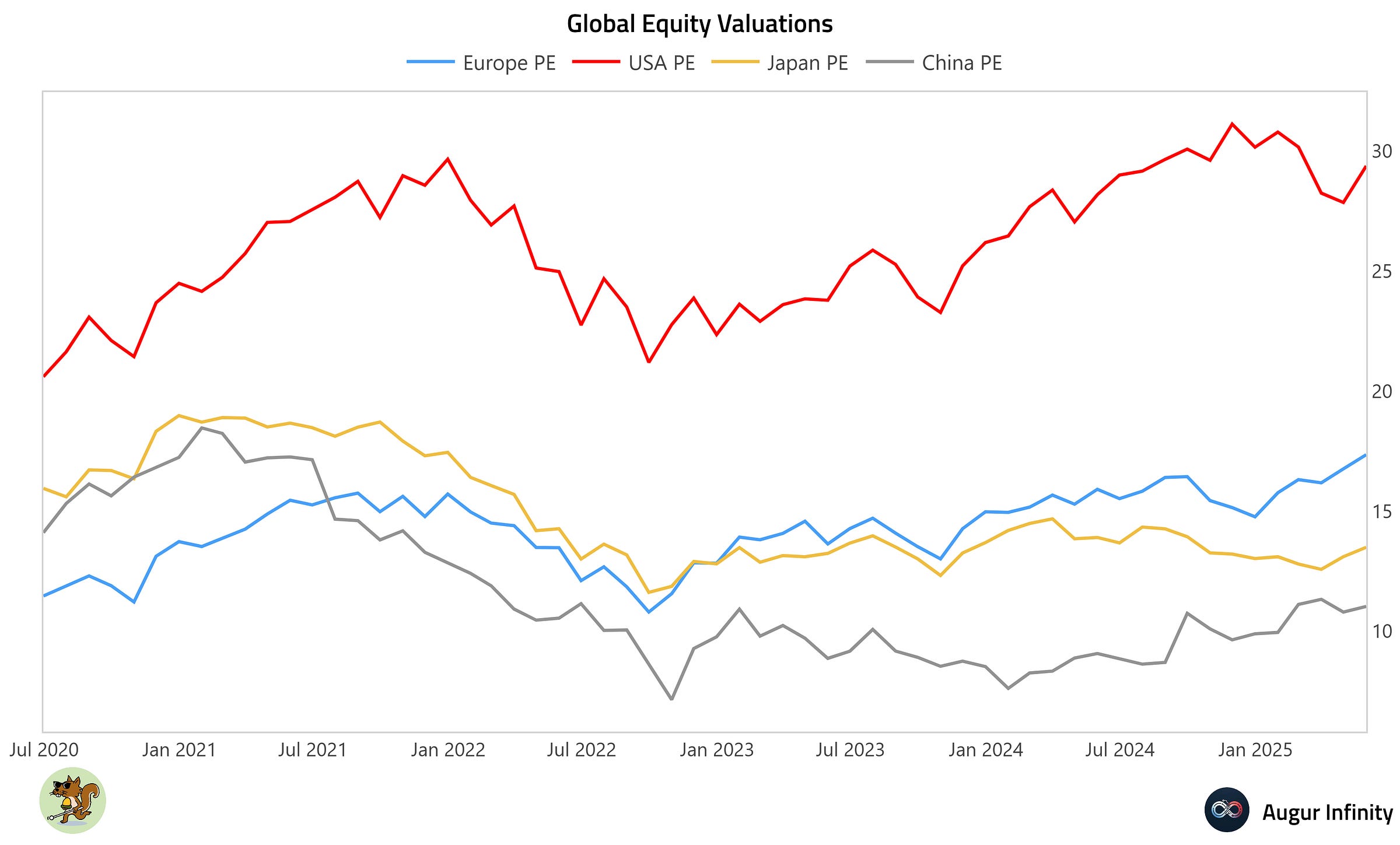

The 🐿️ is being reminded everywhere that - even with that missing general - the S&P 500 just had its best May since the 🐿️ was a teenager back-packing in Peru in 1990. Surely that would mean that my favorite 2025 ‘chart of truth’ - the ratio of the S&P SPY 0.00%↑ versus the MSCI EAFE IEFA 0.00%↑ would have put in a meaningful countertrend rally. Not so much.

Well, if you zoom in you can just about see some modest outperformance - but it is pretty weak sauce. This is not just about a weaker dollar headwind, international equities had a strong month of upward re-rating. The valuation gulf (with US equities) remains enormous.

The 🐿️ is still a firm believer in the ‘Great International Rotation’. I very much enjoyed listening to Marko Papic’s chat with Jack Farley on this topic on my dog walk this morning (specifically from minute 20).

The BUSHY™ portfolio, which is defensively positioned, and VERY underweight US equities and fixed income actually outperformed its ‘Target Date’ Vanguard benchmark by 0.28% over the course of the month.

The BUSHY™ Portfolio - Week 22

In addition to the BUSHY™ review (where we walk through some changes to the hedge book), we cover our new auto related acorns (one of which is fast becoming the 🐿️’s highest conviction single stock idea); some #COM M&A action; and a new trade in Korea.

Another solid week for BUSHY™ (+0.66%), with another new weekly closing high for the portfolio (now +6.46% YTD).

Let’s break down the returns at the asset level: