Section 2 on Mexico

Originally published to paid subscribers on 10th June 2024.

Section Two

In S2, we need to talk about Mexico! One of the best performing of the major emerging markets since the pandemic got taken out to the woodshed last week!

The pollsters messed up again! Unlike in India where they whiffed on the low side of Modi’s margin of victory, they missed ‘top side’ on Sheinbaum and the Morena Party. Those poor pollsters even had her lead shrinking in the run up to the final vote. The sooner that AI bots take over the job gauging of voting intention via spying on our online activity instead of polling firms relying on the elderly to pick up their home phone the better! Joke!

The scale of Sheinbaum’s victory was indeed a shock and the knee jerk reaction of the armchair experts was to raise the specter of a Morena supermajority in the lower and upper chambers of government that would allow them to push through changes to the constitution.

Outgoing President ‘AMLO’ had tabled a wish list of 20+ changes covering everything from bans on GMO corn to directly elected supreme court judges. While Morena’s margin of victory was comprehensive, the supermajority across the Senate and Chamber of Deputies was not achieved. They fell short in the Senate by 4 seats.

There is an inter-regnum period between now and October 1st (when Sheinbaum formally takes office) during which AMLO could theoretically try and press for some of his wish list, but he does not have the numbers!

But, as far as markets were concerned, you would have thought that the illegitimate child of Che Guevara and Greta Thunberg had just won the popular vote! A Jewish female climate scientist as Presidenta of the US’s southern neighbor was all that certain corners of financial Twitter needed to hear.

It is true that Sheinbaum does have an academic background in climate science. However, her presidential pitch was more centrist than that of the arch-populist AMLO and she is certainly seen as more pro-business than her mentor.

Am not sure that investors in Mexico’s mining and resource sector can expect an easier ride than what was endured under AMLO (h/t Mat Casey), but ‘Radical leftist’ she most certainly is not (check out her CV here)! She is a technocrat that would not look out of place in a centrist/ left of center European administration. Furthermore, she will now need to consensus build in the Senate. This is not a second Mexican Revolution. Calm down!

But what about those markets 🐿️?!

As we have discussed in our notes before, the best performing macro trade of the past couple of years has not been the Mag7-heavy Nasdaq 100. It has been the Mexican Peso ‘carry trade’.

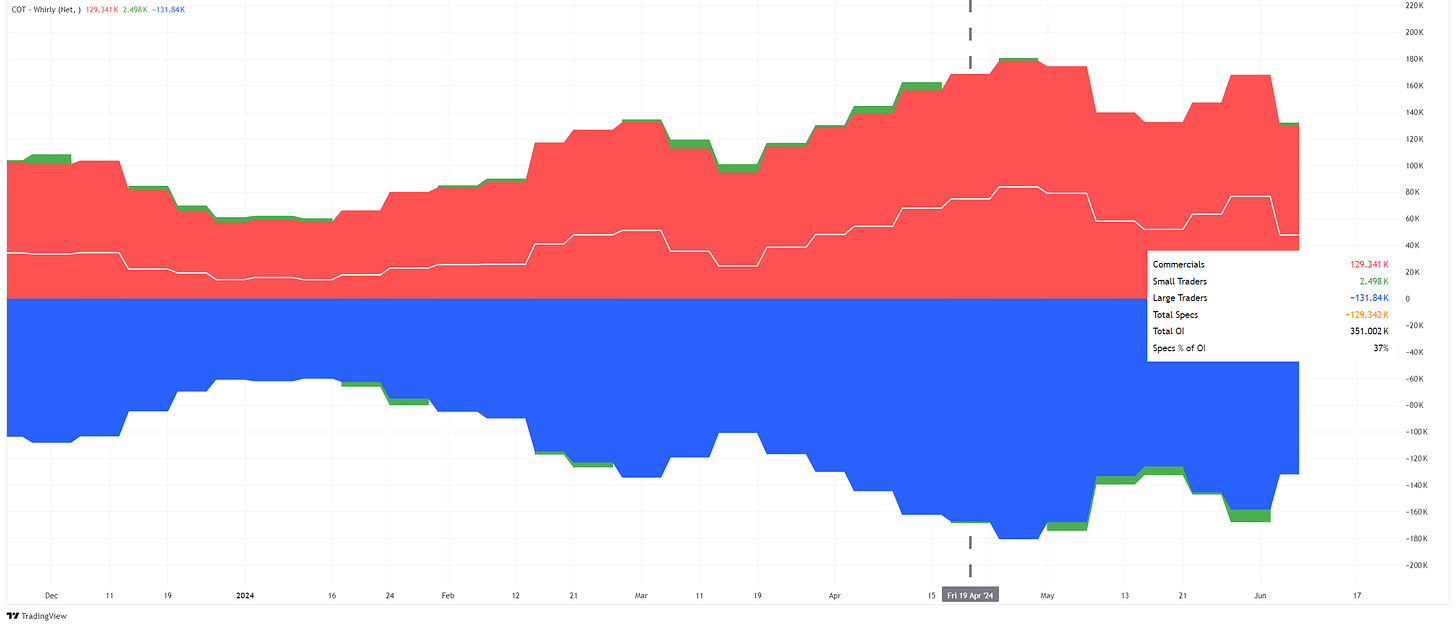

The trouble with successful trades is that they inevitably get overcrowded. In addition, and as my pal Ben Brey of Capital Misallocation and I frequently discuss, carry traders are a greedy sort. They continue to press successful positions, getting increasingly complacent about their ‘short volatility’ exposure to event risk.

Having already suffered a warning shot recently on April 19th (a 6% overnight drop in MXNJPY triggered by unanticipated announcements in Tokyo) you would have thought that the risk managers would have been paying slightly closer attention…

They were not prepared and thus managed to give back most of their year-to-date profit on the trade within 24 hours on Monday and Tuesday. For those of you nursing drawdowns on your uranium / energy equity / metals miners [*delete as applicable] this past week, blame the greedy carry traders!

The move in the world’s most popular carry trade sounded klaxons in the ‘VaR’ (value at risk) models of every hedge fund on the planet. Pretty much any trade that was not nailed down was at risk of being jettisoned as traders scrambled to trim risk. Not good news for some of the popular fast money trades (looking at you Sprott Physical Uranium Trust!).

The reaction to the vote reminds me of great story from Marko Papic. In Q4 2018, he pitched a long Mexican Peso, short Brazilian Real FX idea to a Connecticut hedge fund titan just after Bolsonaro had won in Brazil and AMLO had taken power in Mexico. Link to the bit of that chat with Kevin Muir via clicking the image below. Pure gold!

Those of you that regularly get to the very end of this letter will know that the 🐿️ has been a happy holder of Mexican equities since pandemic times. I have never written up an Acorn report on Mexico but have consistently held positions and call options on EWW 0.00%↑ the iShares MSCI Mexico ETF. Last week was of course ‘no bueno’ but we have a decent P&L ‘buffer’ on the position. In fact, I think it is a buyable dip.

Clearly the USD-denominated EWW 0.00%↑ benefits from the same strong Peso appreciation that the carry traders benefitted from. Nevertheless, the FX-adjusted returns (green line below) of EWW were still pretty solid.

I hear many cry that the Peso is massively overvalued versus the US dollar when comparing relative real GDP growth between the 2 countries. However, let’s zoom out. The symbiotic relationship that Mexico has with its northern neighbor makes the USD pair all-important but the real MXN rates versus a trade-weighted index are right back in the dead center of a 50-year range.

I also hear the arguments that Peso strength has simply been a function of a one-off ‘distorting’ dividend from the US re/near-shoring trend. Reshoring away from China only works for the US with Mexico’s young and cheap labor force sitting on its border.

China-bashing is just about the only bipartisan issue left in the US. There has been talk about a second Trump administration being negative for Mexico. Last time I checked, it was Trump’s Sharpie that signed the YMCA USMCA Free Trade Bill into law. Sheinbaum has said she will happily work with either winner in November (even if I cannot imagine her instinctively being a fan of The Donald!). Mexico’s US re/near- shoring dividend is not going away anytime soon.

Let’s let the dust from the FX carry trade shock of last week settle for a few more days but this recent move feels like a buyable dip for the 🐿️. And because your favorite finance rodent is a sucker for Latin dance themed Acorn report titles (we had Samba Time for Brazil last year). Expect ‘Salsa Time’ in your inboxes later this week!

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.