This weekend, we talked about carry trades. Hindsight is wonderful thing, but it is hard to argue that there was a superior risk-adjusted investment strategy anywhere on earth that compared to the simple carry trade of borrowing Japanese Yen to buy short-term local currency money market instruments in Brazil and Mexico since January 2021. It’s not even close!

Latin American equities (especially Brazilian and Mexican) have been a core holding for the main 🐿️ portfolio throughout that period. Mexico, via the iShares EWW 0.00%↑ ETF) has been a complete “beast” (technical term!).

By comparison, Brazil has been disappointing. However, I have felt better about my exposure largely as a function of a very overweight position in (still very cheap) Petrobras PBR 0.00%↑ alongside my position in EWZ 0.00%↑, the iShares Cap-Weighted Brazil ETF.

The Petrobras effect is even more obvious when looking at a year-to-date relative chart:

Mexico is ‘a keeper’ for the 🐿️ and looks like it wants to break into new all-time high territory. A story for another day - not the topic for today. Today, we Samba! The outline for this Acorn has been sitting in my ‘drafts’ folders since late August when the Bank of Brazil reaped the rewards of an early assault on inflation that allowed them to be the first (with apologies to Chile) major global economy to embark on an easing cycle.

Textbook prudent central banking has paid off. Growth data and sentiment surveys are turning up. As the soccer commentators would say, “Gooooooooooooooooool do Brasil!”.

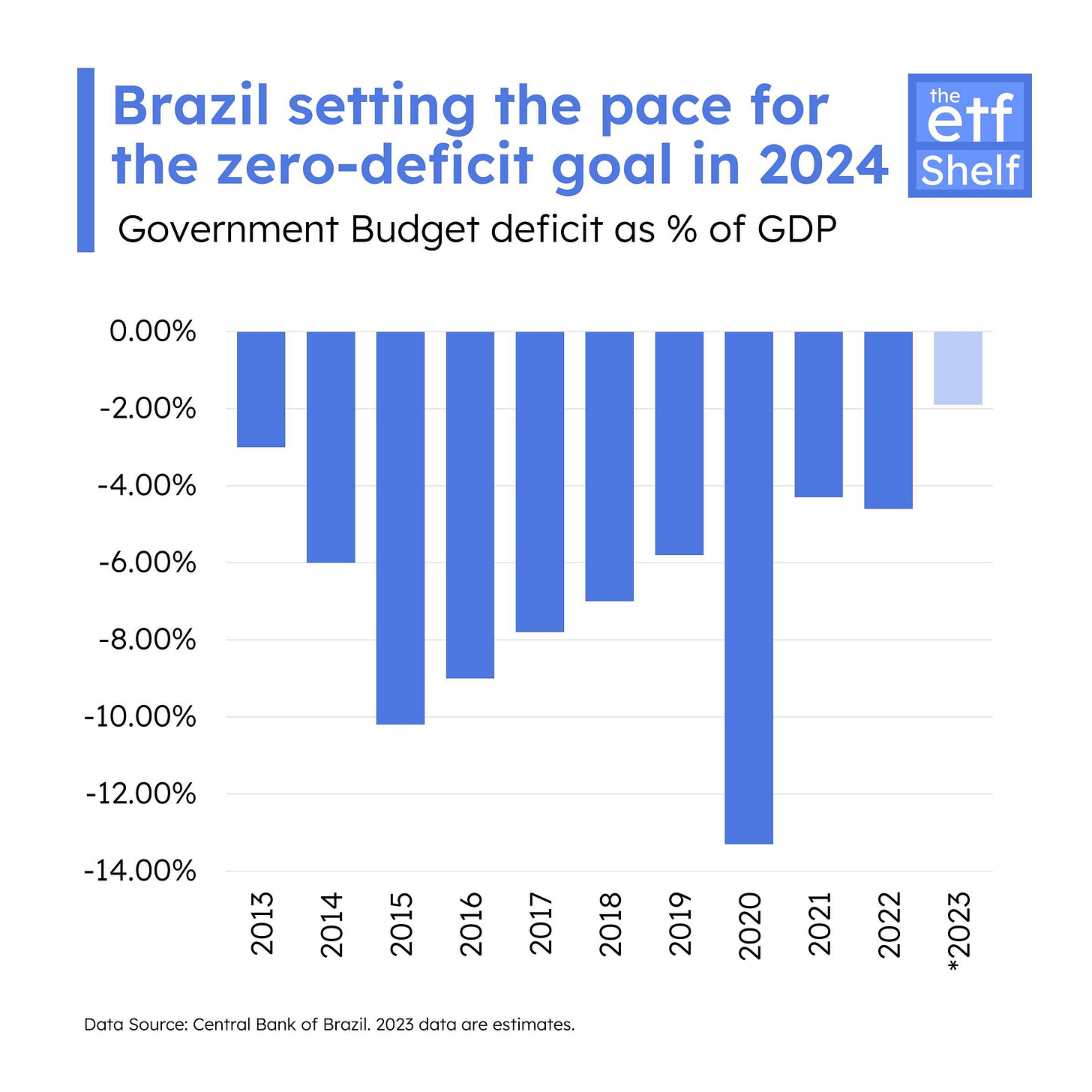

The central bank’s task has been assisted by the lack of fiscal incontinence seen dominating many of the economies of the ‘developed world’ since the pandemic. Foreign capital’s fears of a possible populist spending spree by Lula were firmly kept in check by the other branches of government, evidenced by the impressive budget deficit trends show in the chart below from

below.So 🐿️, why the delay? I’m British, so I am going to blame the weather! As you know, we are bullish on the grains complex largely on the back of a non-consensus weather thesis (set out in Refocusing the 🐿️'s Ag Positioning and Rounding out the grains book) whereby we expect Brazilian corn and soybean yields to fall short of current market expectation. Agriculture’s share of Brazilian GDP is significant.

Under-performance by the agriculture sector would surely hit growth but, more importantly, food inflation is an important component of Brazil’s CPI basket (and a political ‘hot potato’!). Food and beverage inflation for Brazil in November was 0.63% (more than double the 0.31% figure for October). Any further acceleration could potentially give pause to the Bank of Brazil’s easing path.

This is still nagging in the back of my mind as a risk. However, increasing our weighting in Brazilian equities could provide a natural counterbalance to our positioning in corn and soybeans.

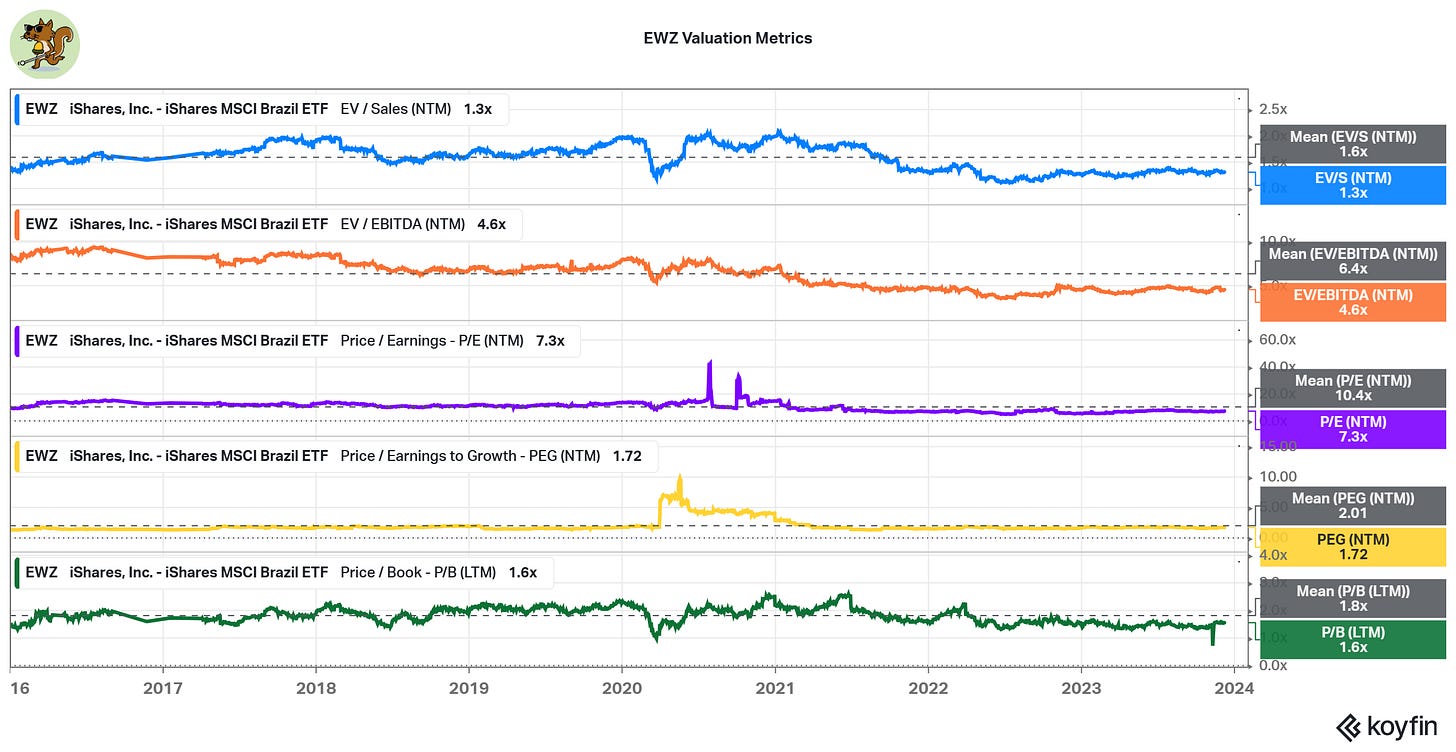

Additionally, local valuations provide a meaningful margin of safety. Brazil is extremely cheap relative to other DM and EM equity markets…

…and trading at a discount to long-term averages on multiple (NTM) metrics: EV/Sales: 20%; EV/EBITDA: 29%; PE: 30%; PEG: 14%; and P/BV: 13%.

Judging by the limited inflows to EWZ 0.00%↑ the iShares Brazil ETF, there is still plenty of capital that is yet to join the party.

Are things about to change?

As I have mentioned in the past, the 🐿️ is no stranger to emerging markets and started his career in finance at the late, mighty House of Barings (yes, that one).

Barings made a name for itself (as well as fortunes for certain of its directors) in the late 1980s and early 1990s for being at the forefront of bringing emerging markets investing to a broader institutional audience. In the ‘gun slinging’ days of modern emerging markets investing, Barings’ highly successful play book was very straightforward:

Recruit a small team of equity research analysts in say, Taipei or Seoul.

Publish ‘the Bible’, a glossy covered ‘country initiation’ research piece. This was a long shelf-life, posh, magazine-style document; 20-30 pages of macro containing ‘hockey stick’ shaped forecast GDP charts and then 4-page profiles of the top 15-20 listed companies. Mandatory stock image of a temple/ rickshaw/ construction crane [delete as applicable] on the cover.

‘Have a word’ with the partners over at Baring Asset Management who would then launch a closed end country fund to invest in said new market (investor access to emerging markets - even for institutions - was quite tricky in those days).

Unleash the broker’s global salesforce on the pension funds and other money managers of Europe and North America with the exciting new story.

Dispatch teams of ‘suitcase’ investment bankers from Hong Kong, London or New York (the LatAm hub - the team that a young 🐿️ was planning to go and join but somehow ended up in Asia - a story for another day!) to go and start winning new capital markets business. These teams would woo potential issuers of how Barings had originally underwritten the bonds that financed the construction of the Argentine rail network back in 1855.

Rinse and repeat in Jakarta, Santiago, Bogota, Manila etc. etc.

The best bit, however, was the unwritten step between Step 2 and Step 3, when senior directors would meet with local stockbrokers in the target emerging market (who were of course very keen to partner up with the great House of Baring); open personal dealing accounts with said broker; and buy (almost sight unseen) shares in the largest locally listed bank, cement company and brewery. These shares would then catapult in value as the wall of foreign capital descended on the new market.

Fast forward 30 years, and emerging markets investing has been truly democratized with US listed ADRs, London listed GDRs and ETFs. When it comes to the Brazil of today, that is just as well. While there may still be many big, listed banks to choose from, the largest cement company (Votorantim Cimentos) is a private company and the largest brewer, Ambev is inexplicably tied up with Bud Light culture wars at the moment!

So, how are we going to position for Brazil today?

Keep reading with a 7-day free trial

Subscribe to Blind Squirrel Macro to keep reading this post and get 7 days of free access to the full post archives.