Rounding out the grains book

Increasing evidence of Brazil weather problems

Summary

As we have been intimating in our notes over the course of the past couple of months, we are getting increasingly bullish on the grain complex.

We are rounding out the grains book with a new position - a 2-leg option strategy in soybean futures.

Rounding out the grains book

Back in October we repositioned our entire Ag Acorn book. At the time, we felt that soybeans offered the least interesting convex opportunity in the grain complex and pressed ahead with wheat and corn trades only. Link to original report embedded below.

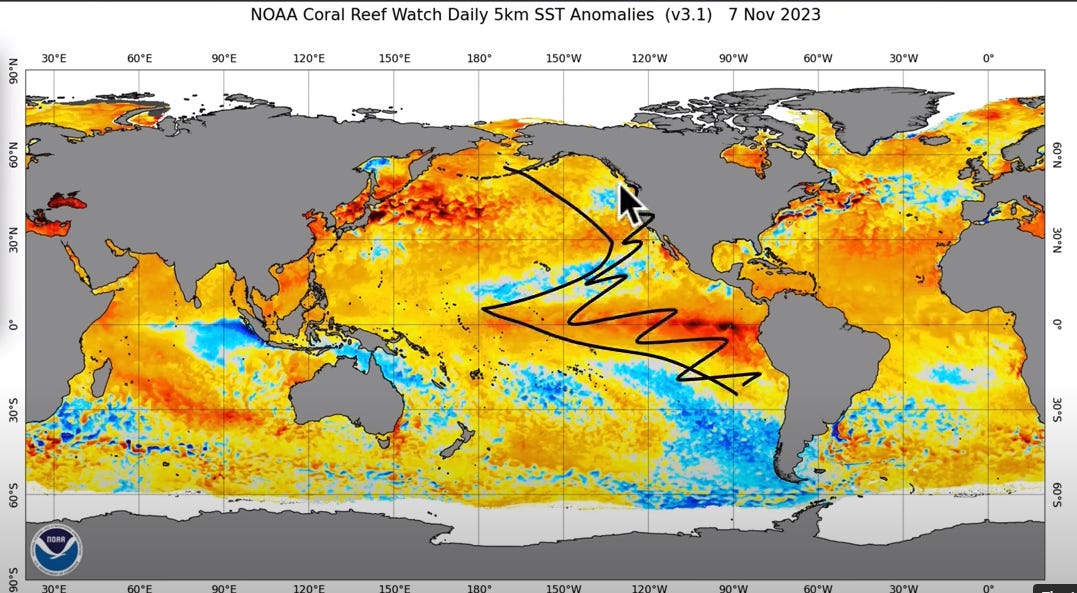

The 🐿️ has changed his mind. Central to our bullish thesis around corn was the thesis that there was a possibility of the current El Nino transitioning into an El Nino Modoki. The bulk of ‘Big Weather’ is quite dismissive of this view. As such it is simply not priced.

One resource that I follow closely is the excellent Eric Snodgrass at Nutrien Ag Solutions. He has very much been in the classic El Nino camp, but he posted one of his great videos on YouTube on Thursday.

Early in the video (first couple of minutes), Eric highlights the extent and persistence of water vapor concentration in the stratosphere from the 2022 volcanic eruption in Tonga. We discussed this back in February. Water vapor acts as a greenhouse gas, cooling our outer atmosphere and creating increased weather volatility.

The next 6-8 minutes are focused on the Brazilian weather situation (too hot and dry in the center and north of the country, flooding in the south).

Soybean futures have staged a mini breakout in the past couple of weeks, but the general consensus from the pundits on the usual Iowa PBS farming updates is that it is just a matter of time until Brazil gets some precipitation and they can get back on with growing their forecast ‘record’ soybean crop.

The weather situation in Brazil is being dismissed as transitory (remember that word?!). Eric is seeing a “disaster” (his words) in the southern states unless the current situation reverses quickly (i.e., too much rain for planting in a high crop yield variability region).

You can skip the next 15 minutes (short term North American forecasts) unless you are trading NatGas! However, I found the last 2 minutes (from minute 21) of the presentation super interesting. This is where Eric talks about the Pacific Decadal Oscillation (PDO) being “out of synch” with what he would normally expect from a classic El Nino.

We had another USDA report on Thursday. The Federal agency’s excel goal seek function (Reuters’ Karen Braun’s irony in full evidence below) determined that Brazil’s soybean crop would increase (from prior estimates)! Even with this bullish ‘view’, soybean ending stocks will remain at their tightest levels in eight years.

Then let’s talk about demand. Have the Chinese got a similar view to us on the weather in Brazil (China’s ‘go to’ supplier of beans in recent years)? ING wrote last week that the latest trade numbers out of China saw soybean imports rising by 25% year over year (to 5 million MT in October).

A reminder of Brazilian planting schedules (via Shawn Hackett). We are going to have a very good idea of the shape of the Brazil soybean crop in the next 4 weeks.

Further follow through on the poor start to the planting season down there could see prices aggressively on the move by mid-December. Looking at futures positioning, while managed money is not short soybeans to the same extent as they are in wheat and corn, speculators are certainly not long!

We have bought some beans! Full details below (for paid subscribers).