Refining the SaaS Long Short Opportunity

The 🐿️'s 'Start the Week' note. This week we drill down to next level on the SaaS thesis. Also our regular review of the BUSHY™ Multi Asset ETF Portfolio and live Acorn trade ideas. 2026, Week 3.

A combined note - we have a long weekend to mark the end of the southern hemisphere equivalent of that mid-June to late August period in Paris - and the 🐿️s are on the road in the Blue Mountains of New South Wales.

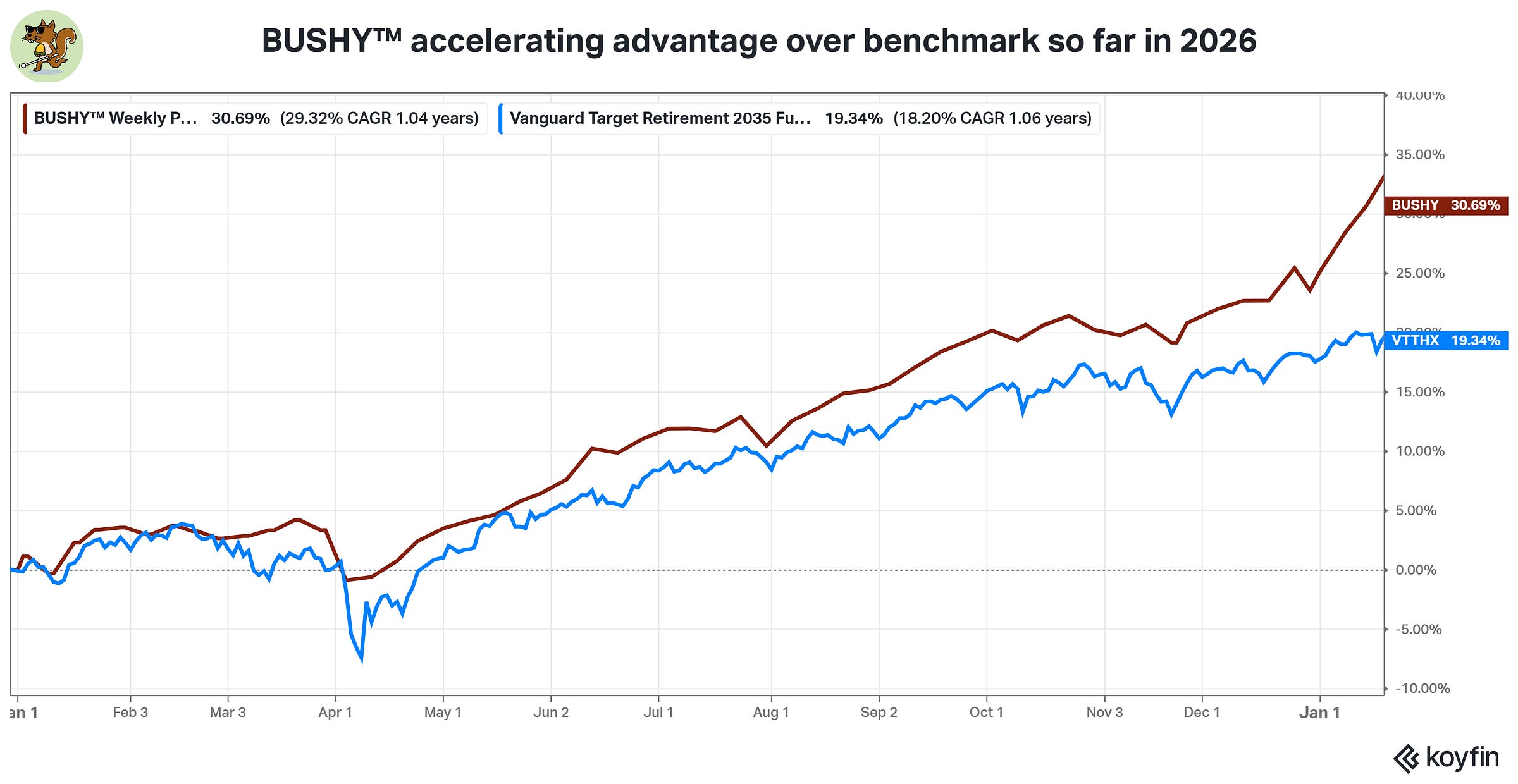

Precious metals, emerging markets and energy equity strength drove a Week 3 of solid outperformance by BUSHY™ versus benchmark and the S&P 500.

BUSHY™ has now added over 11% in excess of benchmark since the beginning of 2025, with significantly reduced volatility and smaller drawdowns.

The normal BUSHY™ and Acorn portfolio review will follow below but I first wanted to expand my thinking on the unravelling of the software world over the past 3 months.

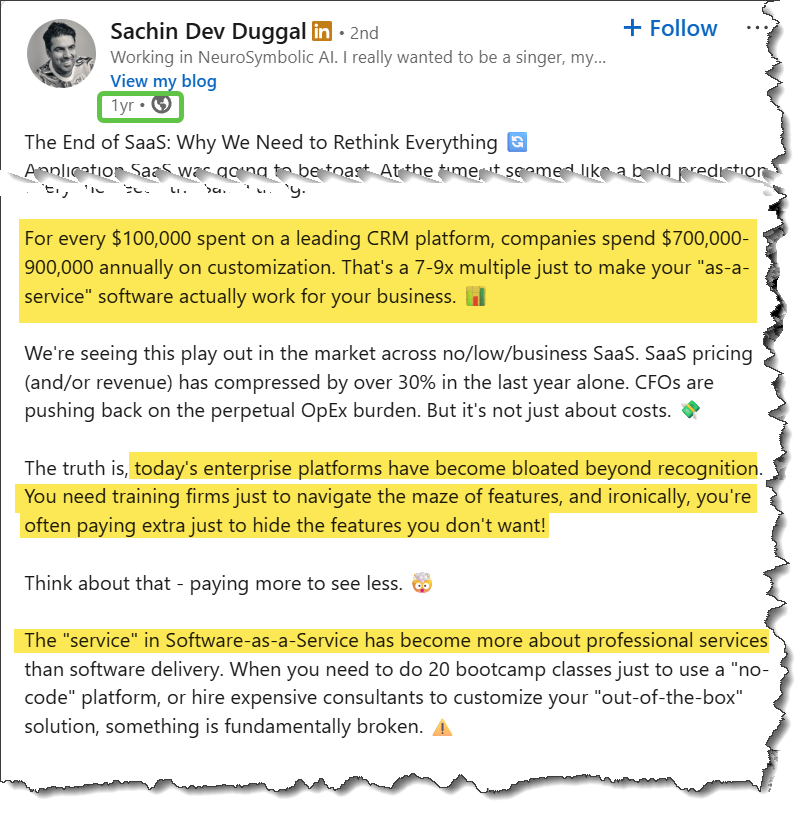

Last weekend, I flagged an old blog on the topic of SaaS “compression” by my podcasting partner Ben’s old friend, Sachin Dev Duggal, founder of SeKondBrain.AI. It turns out that the SaaS ‘compounders’ weren't compounding utility - they were really just compounding administrative bloat and keeping IT consultants busy!

Ben and I had been planning to interview an experienced power / energy trader at the end of last week. However, time zone clashes and an important PJM auction got in the way. Instead, we decided to take advantage of the fact that Ben was in Dubai with Sachin and that it would be hyper-topical to get him on the show.

We spent the most fascinating hour with Sachin - incidentally please do subscribe to his blog or follow him on LinkedIn - I learned a ton! The full show is up on YouTube but one of the segments most relevant to this (and last) week’s piece is clipped below.

The 🐿️ had an agenda! I wanted Sachin’s help in refining my basket of SaaS shorts! It’s time for the ‘Sachin Screen’!

Nuance is required. Some SaaS business are under serious threat from developments in AI. Some businesses could end up doing much better! A perfect scenario may have been created that long/short equity investors and traders can take advantage of. Let’s dig in.