Trade War Cancelled

May 12th, 2025. Review of the 🐿️'s BUSHY™ Multi Asset ETF Portfolio and live Acorn trade ideas. 2025, Week 19.

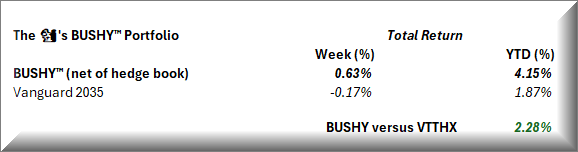

The BUSHY™ Portfolio - Week 19

In case you missed it, the weekend note focused on Waymo and the economics of robotaxis after some crazy valuations for the business were being thrown around last week. The 🐿️ is also struggling to get his head around the valuation of that one-time robotaxi aspirant, Uber.

Scott Bessent called his weekend trade conversations with Chinese officials “productive”. The Chinese official read out described the talks as “candid, in-depth, and constructive, resulting in important consensus and substantive progress”. No details available yet but the de-escalation vibes are gaining momentum and equity futures at the Sunday night open love what they hear, and the Hong Kong cash equity market has opened firmer.

Plenty to unpick in markets at the moment. The key questions to answer would appear to be:

Trade headwinds may be abating but how much supply chain damage has been done since ‘Liberation Day’? Are we still looking at empty shelves in Walmart risk?

Can CEO confidence return and if so, how quickly? Recession odds have already ticked down markedly. This makes sense if realpolitik determines trade war pain is about to be replaced with our old friend - more fiscal largesse!

When are markets going to switch their focus from trade to US budget negotiations where agreement seems a long way off as deadlines loom?

Without tariff income, the deficit is clearly heading in the wrong direction and that is before adding proposed tax cuts. 10-year yields are now only a few basis points away from the 4.5% pain point level that was enough to trigger the 90-day pause on reciprocal tariffs. CPI had better not come in hot on Tuesday!

BUSHY™ Review

A solid week for the BUSHY™ portfolio, +0.63% on the week. BUSHY™ is now only 7bps away from its high for the year and is extending its lead over the Vanguard ‘Target Date’ fund benchmark which gave back 17 basis points on the week.

Once again, the hedge book was the biggest drag on performance for the week with a 0.32% headwind driven mainly by the EURUSD puts and the December SOFR calls.

The bulk of weekly returns were driven by: