Pennies in front of the Steamroller

The Blind Squirrel's Monday Morning Notes, September 11th, 2023.

Summary

The 🐿️ is no fan of short volatility trades. Possibly a stance shaped by a past life.

What could be a better time than the 25th anniversary of the demise of the hedge fund Long Term Capital Management (LTCM) in 1998 to consider the topic and review how ‘short vol’ positioning lurks in the corners of many asset markets today.

Oil volatility currently stands out as looking particularly cheap and becomes the seed of a new Acorn trade in the offshore oil services sector.

Plus ‘Acorn’ thoughts on #ChIndia FXI 0.00%↑ INDA 0.00%↑ TLT 0.00%↑ DBA 0.00%↑ WEAT 0.00%↑ $FCOJ CANE 0.00%↑ GS 0.00%↑ and #uranium

The audio companion to this week’s note will be uploaded to Substack in a couple of hours. It will also be available as a podcast on Apple, Spotify and the other major podcast apps.

Pennies in front of the Steamroller

Last week we touched on the fate of short sellers and their battles with the (professional) community of short ‘squeezers’. The outright short selling of equities is a strategy seldom employed by your 🐿️. It is another manifestation of short volatility, which is a risk position to which I have a bit of an allergic reaction.

I often joke with my friend Kevin Muir that he has never seen an option that he does not want to sell. He gets enough teasing on that front from another renowned ‘short vol’ hater, the Old Chestnut (retired bond market guru and now current podcasting legend Morris Sachs), so I will not pile on.

Kev’s attitude no doubt comes from his background as an institutional derivatives market-maker. If you are not prepared to sell options from that seat in a broker dealer, it is safe to say that you have made an incorrect career choice!

My attitude towards short volatility is also almost certainly a product of my roots. My first job in finance started in September 1994 at the venerable British ‘merchant bank’ Barings. In February 1995, this 233-year-old institution was taken down by the trading losses of a 28-year-old trader called Nick Leeson. Leeson had been selling options (short volatility) on Japanese equity futures in order to raise cash to disguise losses in his infamous ‘88888’ error account.

I then went on to spend much of my banking career in the capital markets business. The word ‘underwriting’ is a bit of a misnomer when it comes to most equity and equity-linked capital markets activity. For example, the only risk that Goldman and JP Morgan will be taking with the Instacart CART 0.00%↑ IPO next week is reputational. If they cannot find buyers for the shares (not a forecast - the deal has to work for the sake of Palo Alto and Wall Street), the deal will simply not happen.

This is most certainly not the case when it comes to the equity block trade business. These institutional offerings of shares are mostly executed ‘on risk’ by the bankers, who underwrite the shares (at a usually pretty narrow discount to last sale) with hope expectation of re-selling them to investors overnight at a slightly higher price. Lots of risk for a relatively small reward. Just like selling a very short dated put option really. To this day, PTSD from those long white knuckle ride nights has been enough to swear this rodent off most short vol strategies.

To continue the theme, the Gwyneth Paltrow in ‘Sliding Doors’ moment in the 🐿️’s career was indirectly connected to the most famous misadventure in short volatility of all time. That was of course the demise of the hedge fund Long Term Capital Management. The moment ‘When Genius Failed’ took place 25 years ago this month in 1998. Fun fact: 1998 was also the same year that the Sliding Doors movie came out!

The collapse of LTCM saw a collection of hubristic multi-millionaire PhD’s play fast and loose with their theoretical option models and an insane amount of leverage. Dean Curnett’s conversation with Roger Lowenstein, author of the ‘reference’ book on the topic is a must listen. Dean also released a great ‘retrospective’ pod on LTCM over the weekend.

LTCM’s collapse in ‘98 was triggered by a rapid expansion in volatility created by massive deleveraging in financial asset markets. That event was in fact a series of emerging market crises culminating in Russia’s sovereign debt default in August of that year. Less than a week earlier, Hong Kong Monetary Authority had started the “stock market operation” component of its HK dollar peg defense that saw the central bank end up owning nearly 10% of the domestic equity market post intervention.

My move to Asia was triggered by this event, as Barings was one of the 3 banks hired by the HKMA to help them manage their exit from the position (which I spent the first year of my life in Hong Kong working on). This short account of that time by Norman Chan, the 🐿️’s first client in Asia and eventual HKMA Chief Executive, is well worth a read.

As ever, there is always an ‘Uncle’ Warren quote, and Buffett’s take on short vol (when asked about LTCM in ‘98) is a gem:

“99% of the time it works, but you know 83.3% of the time it works to play Russian Roulette with one bullet and six chambers. But neither 83.3% or 99% is good enough when there is no gain that could offset the [enormity of the] risk of loss [on the other side]”

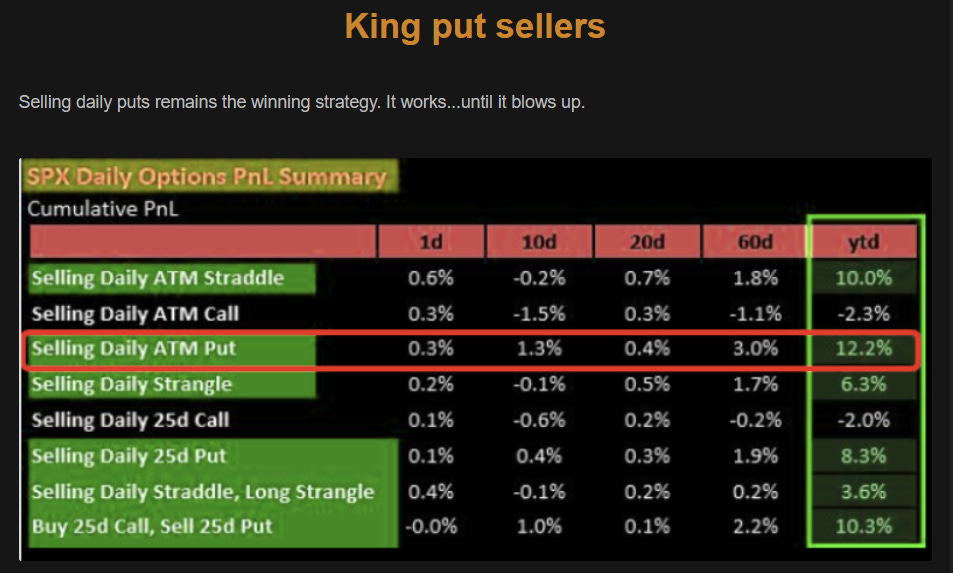

I prefer the age-old analogy of picking up pennies in front of the steamroller. Fast forward to today’s markets and this 🐿️ can see short volatility trades everywhere he looks!

The 🐿️ honestly does not understand how that market maker sleeps at night! For those that do not know what I mean, click the image above and carefully read the comments tweeted by Kris Sidial and Jimmy Jude. This line from Kris needs to ring in your ears: “Sell the VIX 180 calls for .05 when VIX is at 15 Now tell me what those are worth when it [VIX] is at 50?”

With the help of our friends at OptionStrat (which now covers VIX futures options), I have put this wannabee-The-Next-Big-Short trade into their option calculator. Link to model. A quick 2-minute video run-through below:

So what, 🐿️? Well, most of the commentary on that jumbo VIX trade has been centered around whether or not the next Apocalypse-predicting Michael Burry has just placed his winning bet. We all know that famous truism:

This is more a story about risk management and complacency. Complacency is infectious right now, as the world of volatility is well (over)supplied (for all of the reasons described above).

We have mentioned this before, but this has the further effect of dampening realized volatility in cash equity markets (attracting even greater equity allocations from ‘vol targeting’ funds!).

Kevin Muir wrote a great article on these funds back in May. He closed by writing “If we happen to get a quiet summer with a relentless bid, I don’t want to hear about how it makes no sense — you might not like it, but it will likely be those pesky “vol control” funds. Wait until they get max long to really stuff ‘em!”.

Is now that time? I don’t know. The positioning ingredients are certainly there for a dynamic move in markets, but it is not clear to me what event will catalyze the unpinning of all this short volatility positioning. There is certainly plenty of bear focus on potential event risk around several of the ‘Magnificent Seven’ (‘Mag-7’) large cap tech leaders right now. As a group, are they showing some signs of vulnerability?

The ‘Mag-7’ are the joists arguably propping up the entire equity complex. Right now, Amazon and Google are certainly having to do a LOT of heavy lifting. The ‘Mag-7’ have fought through plenty of headwinds of late. Positioning and sentiment indicators have also pulled out of the danger zone and back to neutral. Do I really want to burn more Nasdaq 100 put premium betting that they will not do so again?

It does not look as though corporate credit is going to be the vol unpinning bogeyman either. Treasury volatility, though elevated by historical standards, is on a gentle glidepath downwards. Corporate credit spreads are even more sanguine about economic conditions.

What about an economic ‘shock’ to unpin vol markets? What if signs of re-accelerating inflation come with this week’s CPI reading? One thing that would contribute to a resurgence there would be energy prices. On that note, and getting back to our starting topic of volatility, oil volatility looks very cheap to us indeed.

News of the 3-month extension of production/ export cuts by Russia and the Saudis was absorbed by the market this week. The front of the curve is tightening fast. Bearish ‘recession-bro’ bets in the oil futures market are also being reversed. Data below from CommodiFly (🐿️ annotations in pink boxes).

The question to get right is how China reacts. Its seems that they are now finally on the (economic) stimulus track. At what price point do the Chinese slow down their buying and instead draw down on the strategic reserves they have accumulated since Covid?

We have no idea but as the US administration has already played most of it supply side cards (US SPR releases, softening of Iran and Venezuela embargos etc.), we think this move in oil has further legs, as described in our Crude-ilocks ‘Acorn’ BNO 0.00%↑ trade idea report from early August.

I mentioned last week that we have recently added energy equity exposure in the offshore services sector and that we had a semi-written Acorn report on the sector. I was concerned about publishing on the sector for fear that the trade might be getting a bit crowded.

That was until a buddy of mine forwarded me this tweet / picture from Judd Arnold (he is very good on the sector) of OFS names not even being able to fill a room at the Barclays energy conference in New York this week. Literally crickets! Was everyone listening to AI hype at the Goldman tech conference instead?

Also heard at the Barclays conference from the CEO of a major driller re. newbuilds (h/t Nutstuff): “every time I try to speak to a shipyard, they hang up on me, this is a distraction and abstraction, no one knows what it costs and no one is going to build one, maybe $1 billion and 3-4 years to build one, we have a baseball bat at the office and we use it to hit people if they say newbuild, we need $1million a day or $1.2 million day rates on a terminal to justify one”.

I think that we have found a way to capitalize on cheap energy volatility. A convex trade on OFS equities shall be our next Acorn trade. Expect a report to hit your inboxes during the week.