Missing the Gulf

The Blind Squirrel's 'Monday' Morning Notes. Year 3; Week 30.

Missing the Gulf

Two weekends ago, I wrote about how work on strange innovations in the hybrid equity-linked capital markets of the mid 2000s took me to the lair of the ‘Wizards of Zug’ at Glencore. At roughly the same time, the 🐿️ was a frequent visitor to the Middle East. I was flying to Dubai or Abu Dhabi at least a couple of times a month to pitch deals in a brand-new field of convertible bonds…

Structuring equity-linked deals for private companies is hard enough as it is difficult to value the embedded equity option within a bond if the underlying shares are not listed. The call option element is typically struck by reference to an IPO event in the future (with a step up in yield to compensate for loss of that option if the equity event does not happen).

Step up the difficulty level by several rungs if the instrument must also be structured in compliance with Sharia Law! The collision of convertible bonds with Islamic finance was pioneered in Malaysia in 2004 when Khazanah (the sovereign wealth fund), launched a $415m sukuk (literally meaning ‘instrument’ or ‘title certificate’ in Arabic) exchangeable into (listed) shares of PLUS Expressways, a local toll road operator.

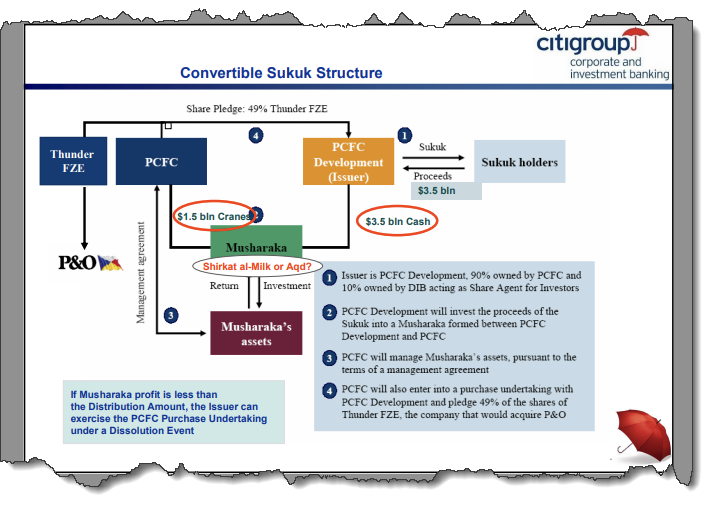

London’s equity-linked capital markets community was happily allowed to ignore this niche activity taking place in Asia until in January 2006 Dubai Ports announced a $3.5 billion pre-IPO convertible sukuk to part finance its acquisition of P&O, the UK-based ports, shipping and logistics group.

The fact that only one bank (Barclays) had collected not only an unsurmountable lead in the EMEA convertible bond league tables (by mid-January!) but also an enormous $50m fee for arranging the deal had resulted in 🐿️ and his competitors having to deal with serial ‘meetings without coffee’ with their bosses and hasty flights to the Gulf to chase the next deal, armed with freshly created ‘Introduction to Islamic Finance’ pitch decks.

Learning the difference between Musharaka and Mudarabah joint venture structures and the identity of the best Islamic scholars to engage in order to get sign off on transaction structures was a steep learning curve. In contrast to interest-bearing bonds, sukuk holders earn a return linked to profit-sharing, lease rentals, or asset performance. The bond math part is identical. Tomayto, tomahto.

The pain trade continued over the ensuing months as Barclays printed another one of these jumbo deals ($3.5bn for Nakheel Properties of Dubai) while the rest of us reeled from the market share blow (and more coffee-less meetings with the boss!) and continued the hunt for our first mandate.

The Gulf capital markets of 2006 were very different to today. While ‘lip service’ was being paid towards the diversification of the region’s economy away from energy (and a bit of tourism in the case of Dubai), there was a shortage of corporates within the region that genuinely needed to access the international markets for growth capital.

The economy was still all about the sale of hydrocarbons. Abu Dhabi, Dubai and Doha were where you visited in order to sell deals not to originate them! Finding issuers whose sukuk we could comfortably underwrite and get to market was really tough.

The 🐿️ did eventually get his first convertible sukuk mandate a few months later but it turned out to be a lemon. I’m going to save that story for the end! We need to revisit the Gulf markets of 2025.