Mind 'The Gap'!

Review of the 🐿️'s BUSHY™ Multi Asset ETF Portfolio and live Acorn trade ideas. 2025, Week 29.

In case you missed it, the weekend note came out on Sunday morning EST. In it, the🐿️ developed a new idea in the agricultural commodity space. Do check it out!

The 🐿️ has a beef

When I first moved to Australia, the 🐿️ was barely allowed to touch his own barbecue let alone get anyone near anyone else’s! Apparently, the application of direct heat to raw meat is the exclusive birth right of Aussie blokes! The good citizens of Melbourne also think that they invented artisan coffee…

Mind The Gap!

Dollar hedges were insufficiently sized to help us avoid a small drawdown in BUSHY™ last week.

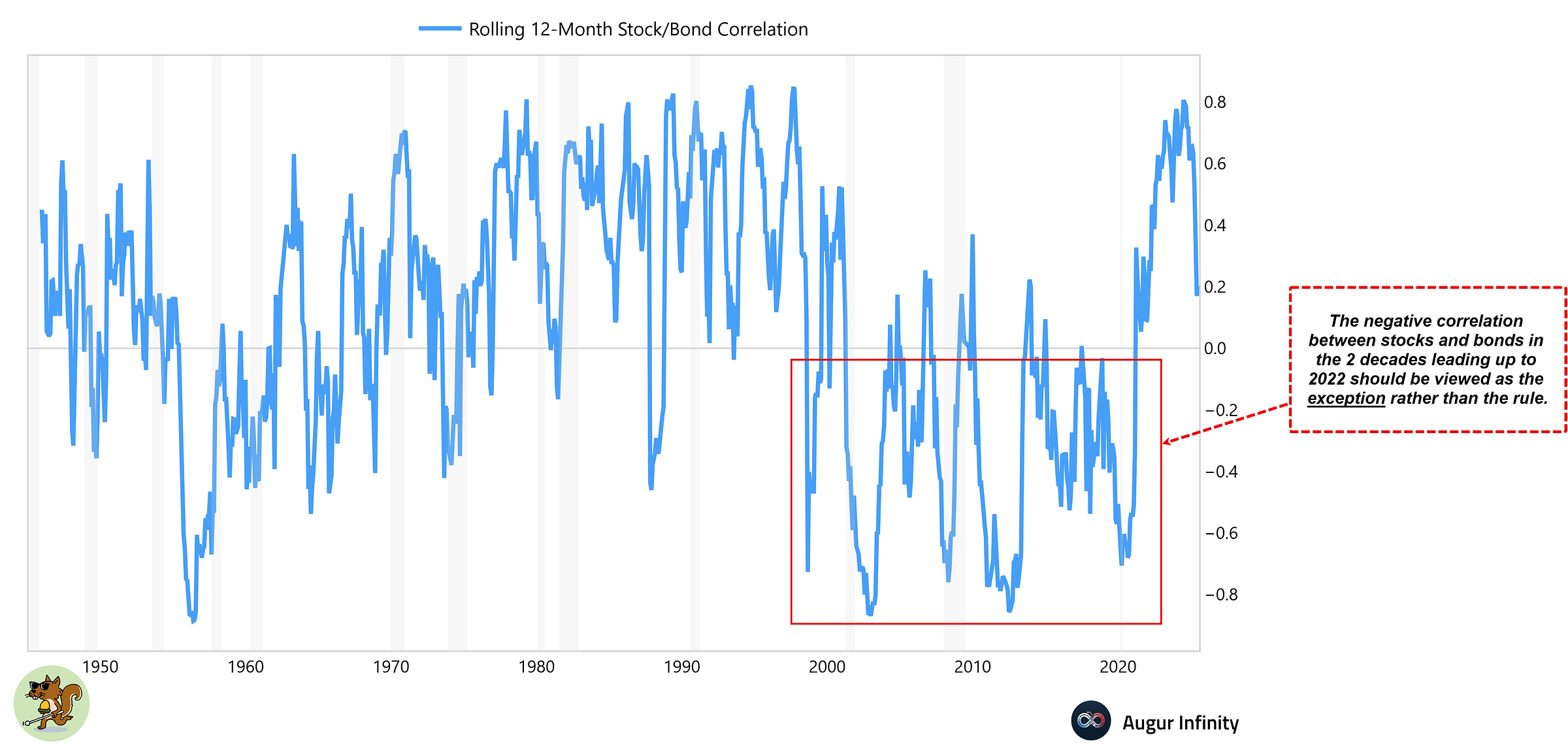

But before we get to the portfolio review, we need to spend a moment thinking about the risk of something funky happening with the most important number in modern finance. I want to ponder the risk of a short squeeze in 10-year US Government bond paper.

At risk of stating the bleeding obvious, the 10-year Note is the lynchpin of global financial markets. Notes are the reference global reserve asset (the BoJ and PBoC ain’t rolling T-bills!), and the 10-year yield is the reference rate for the global fixed income markets.

Regular readers of the 🐿️ will know that the rodent is no fan of long duration fixed income exposure. I believe that we are entering a period of inflation volatility that will rob the reference reserve asset of its anti-fragile hedging properties.