Milkshakes and Coins

A post-dollar milkshake hedge review as we move into 2026 plus a convex Acorn stocking filler! Then the usual weekly review of the 🐿️'s BUSHY™ Portfolio and the live Acorn trade ideas. 2025, Week 51.

Time to reflect on some of the most important portfolio tweaks as we look ahead to 2026. A combined note this weekend (will be the same next weekend).

The timing could not have been better for Brent Johnson of Santiago Capital to join Ben (Capital Misallocation) and myself for a fascinating discussion on the dollar and the US’s 21st Century ‘Manhattan Project’. The discussion around stablecoins also helped to cement an idea from a reader that I have been thinking about. New ‘Acorn’ ‘stocking filler’ below.

If you missed the show live, please catch and the highlights on the “Benny & The Squirrel” YouTube channel (please also remember to subscribe there - we are already lining up a content blockbuster for 2026!).

FX Hedges

Spending an hour in the company of 2 dollar bulls like Brent and Ben always focuses the mind. To be fair, a ‘milkshake moment’ or ‘dollar napalm run’ is a risk that the 🐿️ has been at pains to hedge throughout the past 12 months.

Even if I believe that overseas dollar debtors and central bankers are likely to be better prepared (for a dollar liquidity squeeze) than they have been in the past, the muscle memory impulse for investors and traders to reach for US dollar cash during “risk off” moments is likely to remain strong.

Both BUSHY™, my beta portfolio, and the individual “Acorn” trades have had a significant ex-US bias throughout the year. This will not be changing as we enter 2026.

As a reminder we set out the philosophy for BUSHY™ and its hedge book in January (link to full note).

“The composition of this initial portfolio embeds some pretty out of consensus (with ‘Big Retirement’) bets on factor, asset class and geographic exposures:

The BUSHY™ only owns large cap US tech stocks via their (tiny) equal weighting in the RSP 0.00%↑, long S&P futures within the trend portfolios, or if 3Fourteen’s factor and trend screening model (FCTE 0.00%↑) decides that it wants to rent them.

BUSHY™ is structurally short the US dollar relative to the average “Big Retirement” portfolio.

BUSHY™ is massively underweight duration risk (no long bonds unless the machines happen to own them, and they don’t currently); no profitless tech stocks; and no exposure to the financial nihilists’ YOLO™ portfolio).”

In January, a risk budget of 2.5% of NAV was allocated to:

Out of the money calls on the XLK 0.00%↑ (Tech) and ARKK 0.00%↑ ETFs, to hedge the underweight to US equities (especially MAG7) and

shitcosprofitless tech stocks.Puts on the Canadian Dollar (vs. USD) via CME Futures options (a USD hedge with an energy angle).

Call options on 3-month SOFR futures to hedge BUSHY™’s lack of exposure to long duration fixed income.

Over the year, we made the following changes.

We transitioned from a CAD-based FX hedge to a EUR-based one in March (in response to the political shifts in Ottawa). We replaced the EUR hedge with DXY/DX/UUP call spreads in June and added outright calls on the same underlying in September.

In September we sought to protect the portfolio’s (global) equity risk with cheap (even if they got cheaper) Nasdaq 100 put spreads (via QQQ 0.00%↑), rolling into a similar position in early October.

In early October, we also collared the portfolio’s gold exposure, closing this protection 3 weeks ago.

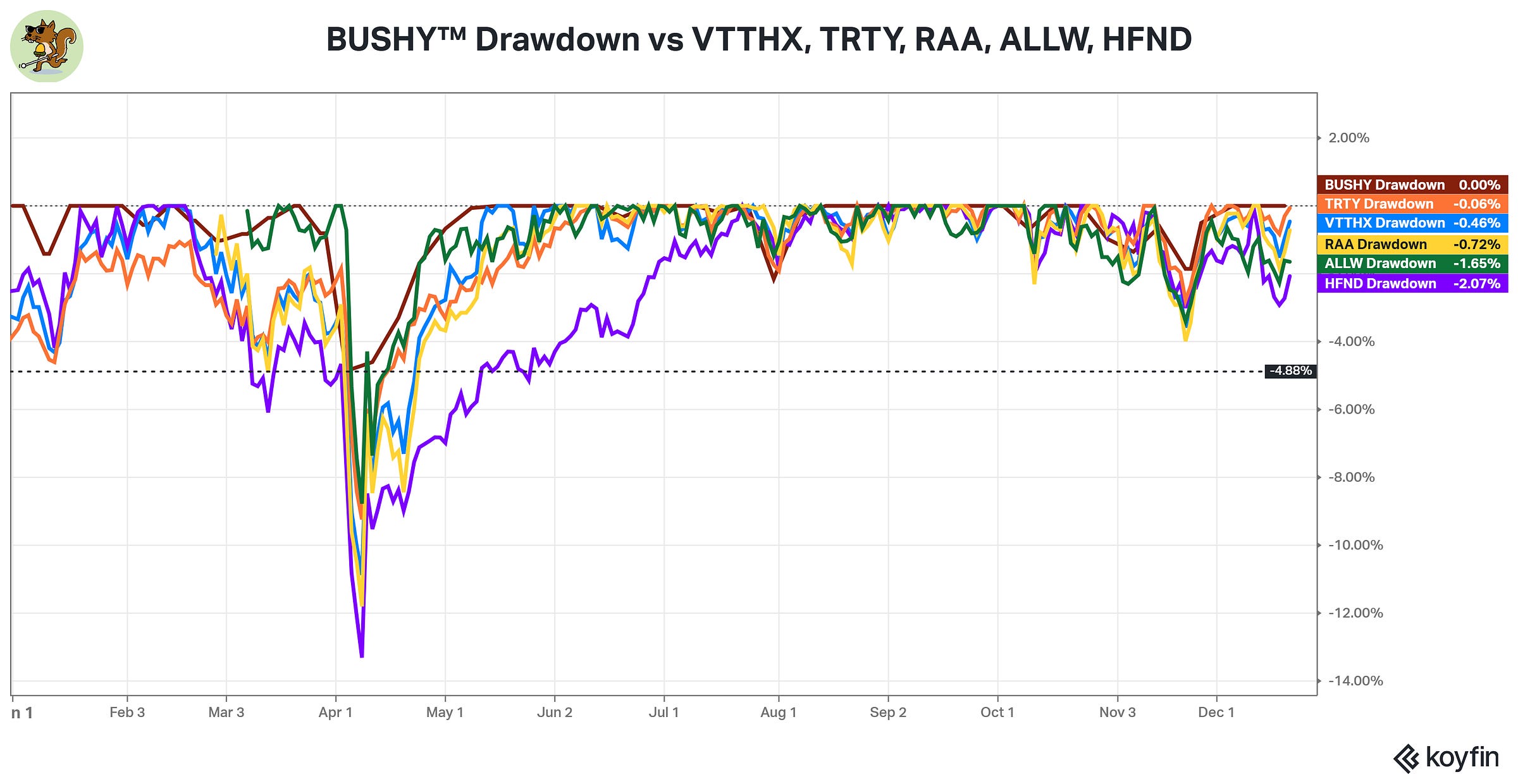

BUSHY™’s hedge book has ‘cost’ the portfolio 2.29% year-to-date. No regrets about that whatsoever. It was the prudent way to approach our non-consensus macro positioning versus my benchmarks and helped to manage periods of drawdown effectively.

BUSHY™ hedge book over 2025 and plan for 2026

Unsurprisingly, the exam question regarding hedges is not dissimilar to the one facing the 🐿️ last year. But the challenges require further thought…