Introducing the 🐿️'s BUSHY™ Portfolio

The Blind Squirrel's Monday Morning Notes, 6th January 2025.

The launch of BUSHY™ - a Long-Only Multi-Asset portfolio comprised of US-listed exchange traded funds (ETFs).

Introducing the🐿️'s BUSHY™ Portfolio

As indicated in last Friday’s note, 2025 brings a fresh new product to Blind Squirrel Macro. The🐿️'s BUSHY™ Portfolio is a Long-Only Multi-Asset product comprised of US-listed exchange traded funds (ETFs). The goal of this portfolio is to be a low-turnover, easy to execute expression of the rodent’s core macro and thematic views.

More on that later, after a week of Q1 2025, let’s take stock of where we are in macro assets:

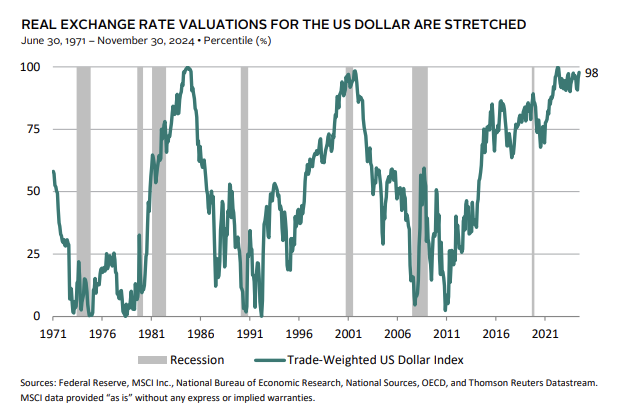

In anticipation of the inauguration of ‘The Tariff President’ on January 20th, bullish positioning has driven dollar FX crosses aggressively higher in the 2 months since the election of a leader whose core electoral economic policy messages were decidedly dollar negative. Yet, FX markets would appear to be priced up for maximum tariff bomb angst. Is history about to rhyme?

In US equities, Wall Street strategists appear confident that the S&P 500 will tack on another 10-15% return for 2025. Interestingly, the most bearish price target on the street comes from Cantor Fitzgerald the firm led by Howard Lutnick, the incoming Secretary of Commerce. Now, that would be ironic…

The US Treasury market has had a pretty rough month after the initial post-election view (misplaced?) that the new administration would be staffed with fiscal hawks. Regular readers will be familiar with the 🐿️’s bearish view on the long bond. This rodent certainly sees higher yields in the medium term. However, with such extreme short positioning, some kind of bear market rally (higher bonds, lower yields) would not surprise in early 2025.

At the policy rate end of the curve, the market continues its year-long rally of hard/soft/no landing tennis. This rodent struggles to see a 2025 in which some kind of growth scare does not build a few rate cuts back into market expectations from the ‘1 and change’ currently priced. Could the construction jobs that

and Warren Pies focus on so intently be the early warning signal for that wobble?

My friends

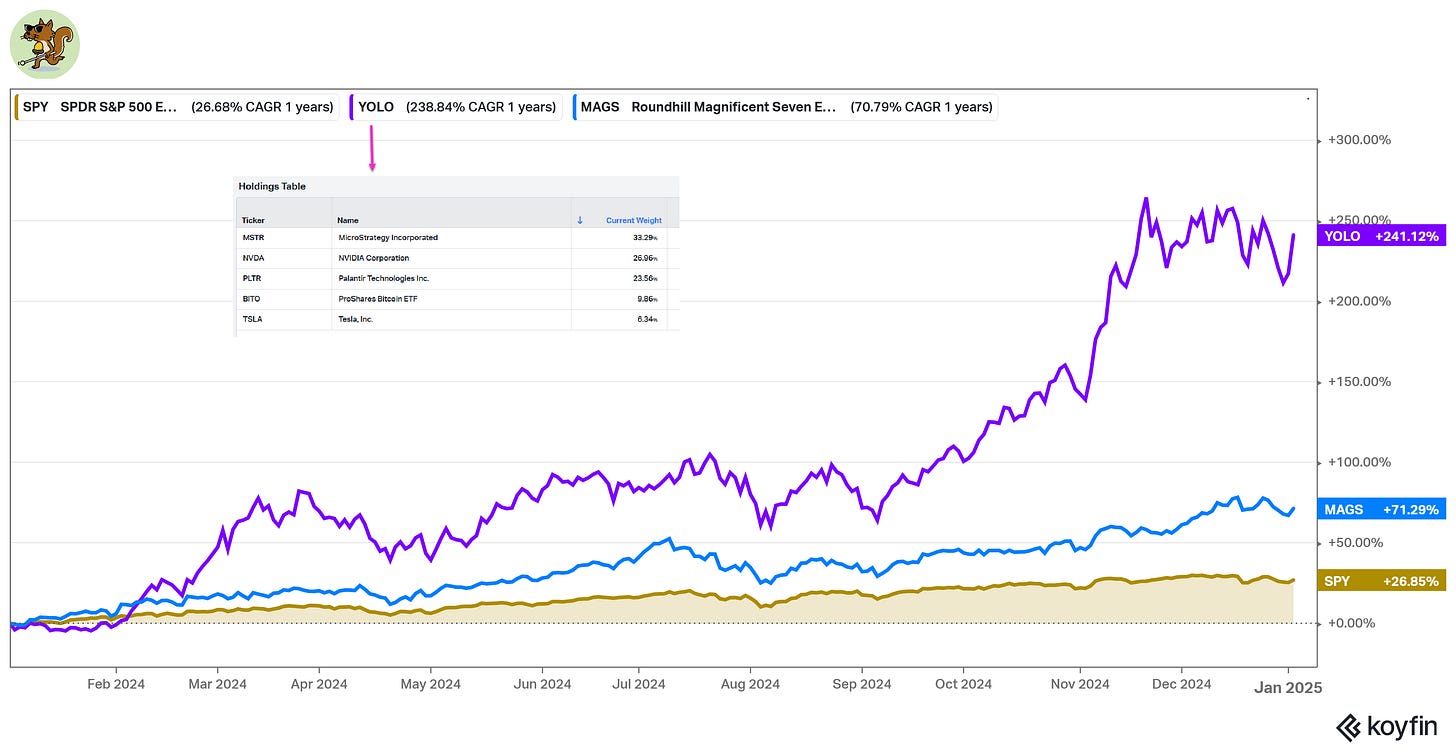

and have been chronicling the eruption of speculation that has returned to market since the election. Time to check back in on the YOLO™ portfolio (the new ‘risk parity’ portfolio (minus the meme coins) for your average financial nihilist). Healthy stuff indeed!

Finally, I love it (as it feeds into this rodent’s biases) but some of the market commentators I respect the most are making pretty compelling cases for the end of the ‘exceptionalism’ of US cap weighted equity indices.

- , already an avowed ‘Canadian ‘Mag7’ Grizzly’ makes some terrific ‘Inside Baseball’ comments about the compilation methodology at the Russell indices.

He almost certainly now thinks that the 🐿️ is a stalker, but AQR’s Cliff Asness’ memo describing an Asset Allocators imaginary 2035 Post-Mortem / Mea Culpa is an utter gem. Team Saddlebags should be sweating too!

The 🐿️ may also need to go and see the chiropractor after nodding so vigorously while reading

’s piece on ‘The South Africanization of the US’. He sure took some heat in the comments section but puts together a compelling thesis.I may not agree with Russell Napier on matters China-related but his call to own global equities ex-the S&P 500 is poetically articulated and tough to counter.

The only word that could accurately describe the performance of international equities versus US equities in the years since the Euro banking crisis is abysmal. The charts below plot the relative performance of IEFA 0.00%↑ (which tracks the MSCI EAFE (ex-US) index) and the EEM 0.00%↑ (MSCI Emerging Markets) versus the IWB 0.00%↑ (the Russell 1000 index).

The meme above is probably deserved, but the fact of the matter is that owners of US equities (many of them foreign) are no longer being properly compensated in terms of risk premium. I get that many have called for a rotation out of US equities (especially at this time of year!) for a while. However, as we enter 2025, the risk premium on offer for owning US equities is now effectively zero.

The BUSHY™ Portfolio will indeed be anchoring on opportunities that are ‘further afield’. But first I need to explain the name. In your favorite rodent’s distant past, some time was spent creating structured financial products for the corporate and institutional clients of the 🐿️’s employers.

I hasten to add that I am not talking about the kind of toxic waste described in Frank Portnoy’s excellent book FIASCO such as levered bets on the Mexican Peso FX rate dressed up as AAA-rated bonds so that the wrong people (think Municipal treasurers) could own them.

Anyway, the derivative world loves a good acronym. FIASCO itself was the acronym for Morgan Stanley’s annual client junket, the Fixed Income Annual Sporting Clays Outing. It was the infantile goal of many a junior structurer to trick their boss into one day pitching a permanent equity net interest swap to a client. I shall not be spelling that one out.

Most of the time, the acronyms were pretty labored to ensure that the product content did not get in the way of a catchy marketing name. With that, I give you the Blind Squirrel’s Ultimate Strategic Holdings (with some Yield) Portfolio, the BUSHY™ Portfolio to its friends. There will also be tail hedges (geddit?)!

BUSHY™’s initial (long only) portfolio will be made up of approximately 30 US-listed ETFs, reflecting the core medium to long term views and themes from Blind Squirrel Macro (the 🐿️ will continue to publish and track separate ‘Acorn’ thematic trade ideas).

The portfolio’s ETFs will range from simple country and sector index-based products to the more sophisticated derivative-based strategies that recent SEC rule changes have allowed to be placed within ETF wrappers.

There will also be a suite of suggested (and tracked) hedges for readers that may want to dampen exposure to some of the portfolio’s larger asset allocation calls such as longer-term US dollar weakness or an end to US Large Cap Tech / ‘Magnificent 7’ relative market outperformance.

The portfolio will be tracked in a Koyfin model portfolio which can be shared in real time with subscribers (allowing users a detailed review of sector, factor and geographical exposures). I will report on allocation changes in real time and conduct a full portfolio review once a quarter.

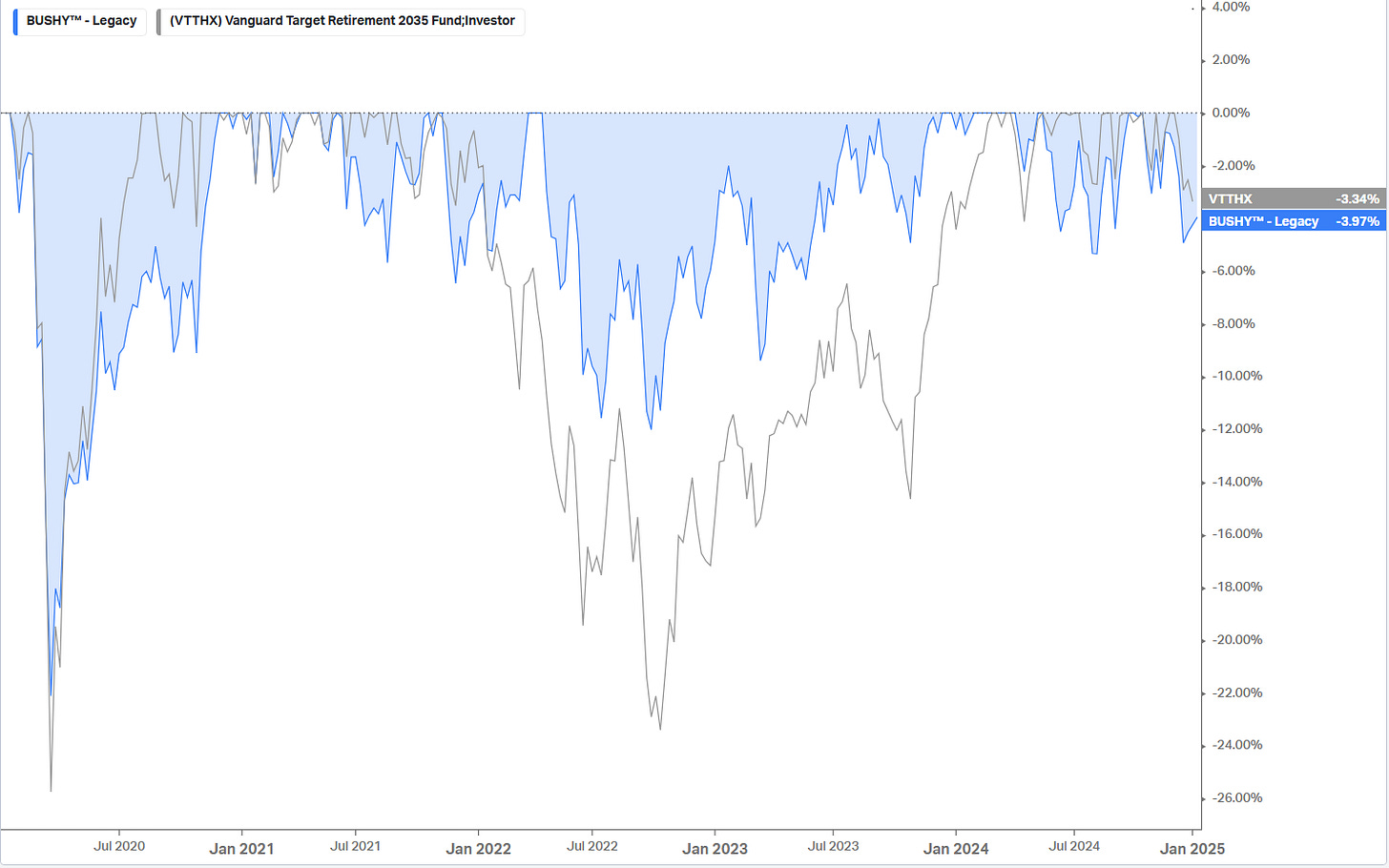

Many of the launch constituents of BUSHY™ have been created in the past 12-18 months. As such, I constructed a ‘legacy’ version of the product replacing some of the launch constituents with more established ETFs in order to create an (imperfect I grant) longer-term track record for the portfolio.

Given BUSHY™-Legacy’s significant underweight position in market cap weighted US equity indices, underperformance versus a ‘classic’ ‘Big Retirement’ portfolio over the past 5 years is hardly surprising. However, BUSHY™-Legacy still compounded at 5.55% versus the 7.16% 5-year CAGR for the Vanguard product.

I am really excited about this launch. In Section Two (for paid subscribers), we do a deep dive on the structuring and philosophy behind BUSHY™. Hopefully this is a trigger for some more of you to support my work and join the 🐿️’s ‘circle of trust’ as a paying subscriber by hitting the button below. What a great way to start the year!

Join hundreds of smart investors and market watchers by becoming a paid subscriber to Blind Squirrel Macro and receiving the other 65% of 🐿️ content (including full BUSHY™ details, members’ Discord access (The Drey) and even ‘limited edition’ merch!).

Keep reading with a 7-day free trial

Subscribe to Blind Squirrel Macro to keep reading this post and get 7 days of free access to the full post archives.