Holding on to the Silver Bull

Year end rebalancing for the 🐿️'s BUSHY™ Portfolio and a review of the live Acorn trade ideas. 2025, Week 52.

Merry Christmas and Happy New Year to you all. Time to reflect on some important portfolio tweaks as we look ahead into 2026. A combined note this weekend. It’s BUSHY™ rebalancing time.

Normal podcasts will resume in January but if you want to catch up with some 2026 outlooks from the 🐿️ and some of his favorite market commentators, look no further than The Market Huddle Holiday Special. Your favorite rodent joined ‘Part 2’ 👇

The funniest thing about this series of short interviews (which were recorded only a couple of weeks ago) was just how out of date the price commentary around precious metals sounded. It has been a big fortnight for the lovers of shiny rocks. We discuss portfolio implications (with respect to precious metals allocations) below.

Given that it aired at 8am Hong Kong time on Boxing Day morning, I am assuming that most ALL of you missed me live on CNBC’s Squawk Box Asia. Here’s a snippet! A quick overview of the 🐿️’s outlook for 2026.

BUSHY™ Year in Review and Rebalancing

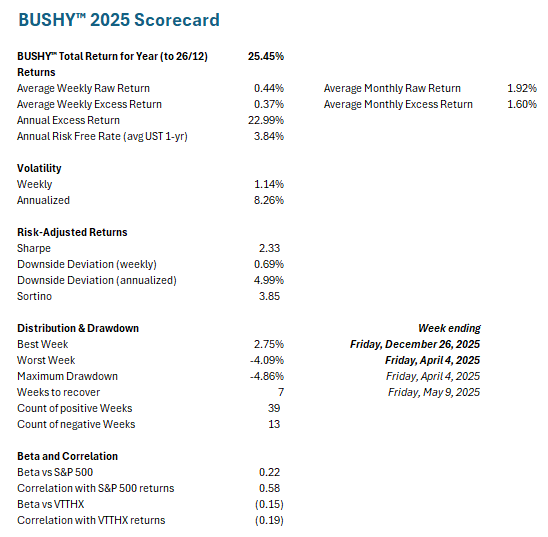

I want to start by taking a step back on BUSHY™’s performance for 2025. I will rerun the numbers below for the calendar year end. However, with 3 trading days left in 2025, the numbers for the 🐿️’s beta portfolio are set out below.

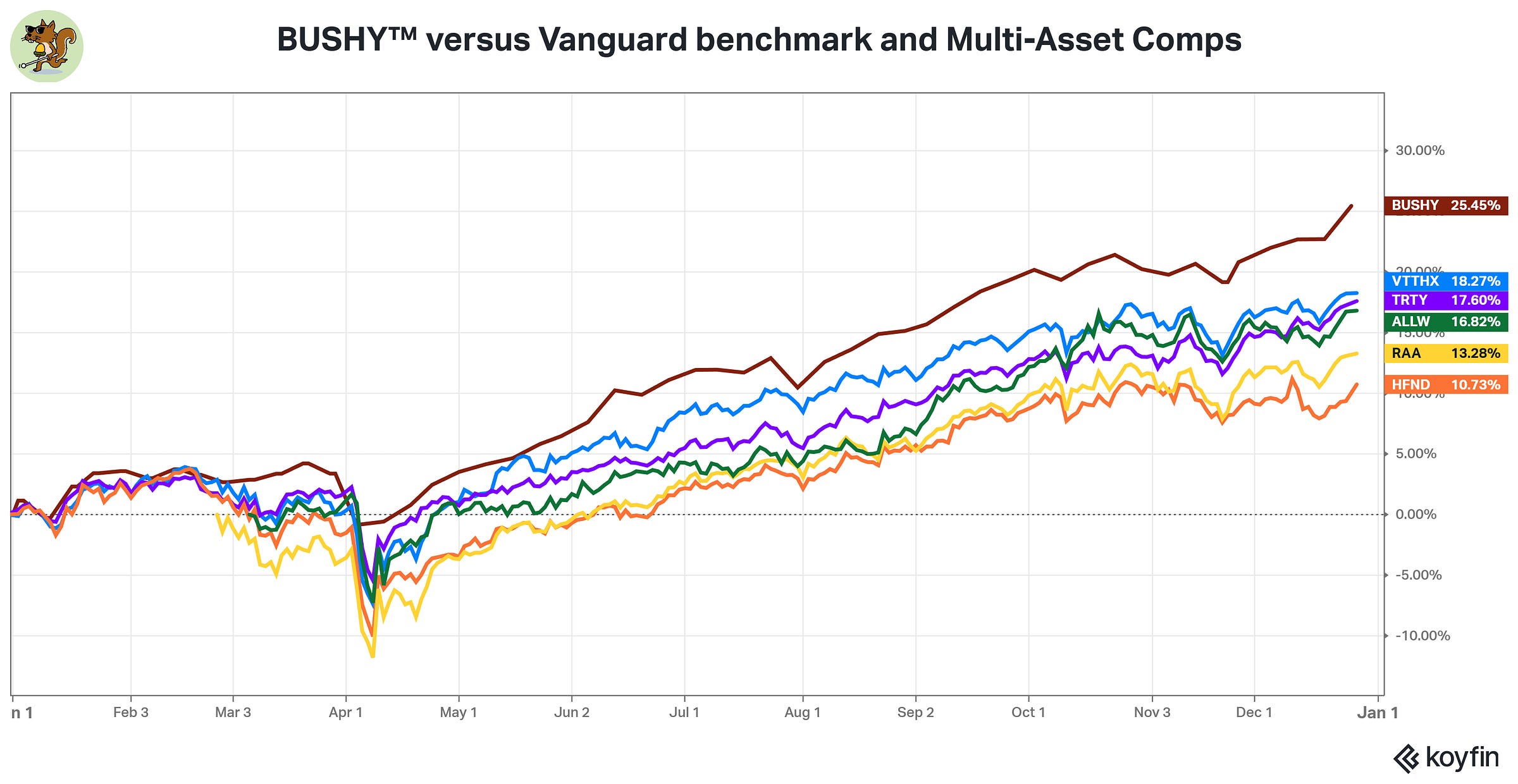

BUSHY™ is not designed to try to ‘beat the S&P’ or indeed its benchmark, the Vanguard 2035 Target Date Retirement fund (VTTHX). But it gives a nice warm and fuzzy feeling in The Drey when it does.

To riff on The Italian Job, BUSHY™’s intention is not to “blow the bloody doors off” - BUSHY™ is a fully signed up member of the “self-preservation society”! The ethos behind BUSHY™’s self-preservation is diversification and managing drawdown risk for what represents the bulk (70-75%) of my investment accounts.

BUSHY™ has returned 25.45% year to date with 8.26% annualized weekly volatility (vs. 21.4% for the SPY and 10.6% for VTTHX). The largest drawdown of the year was less than 5% (recovering its high water mark within 7 weeks) with the portfolio’s average monthly excess return (versus 1-year US Treasuries) grinding away at 1.6%.

BUSHY™ exhibited a low (0.58) correlation with S&P 500 weekly returns and had positive returns for 39 of the 52 weeks of the year. This week was in fact the best week of the year (thank you to ‘pet rocks’ and some chunky year-end ETF dividends). The 🐿️ is no fan of Sharpe ratios but I do care about drawdowns and downside volatility - as such, am delighted with BUSHY™’s 3.85 Sortino ratio.

BUSHY™’s volatility profile is what gives the 🐿️ license to probe further out the risk spectrum with the ‘Acorn’ positions. Aside from the VTTHX benchmark, I keep a close eye on a number of ‘multi/ ‘real’ - asset comparable ETFs. These include Cambria’s Trinity portfolio (TRTY), the Bridgewater ‘All Weather’ portfolio (ALLW), 3Fourteen’s RAA ETF and Bob Elliot’s HFND.

So, to next steps and positioning for 2026…