Hear me out! Leveraged Finance, but no marks!

The Blind Squirrel's Monday Morning Notes, November 27th, 2023.

Summary

The news last week that Citi was planning to break into the private credit markets in an attempt to reclaim territory from the shadow banking world raised the eyebrows of the 🐿️.

On the same day, the terms of the $15bn LBO of Adevinta, the Norwegian online classified advertising business, hit the tape. Have we hit ‘peak’ private asset market excess or, in the words of Chuck Prince, is the music still playing?

This week’s portfolio update and Acorn review (for paid subscribers) covers #uranium #Ags #Energy #Offshore #PrivateEquity #AUDUSD #ChIndia and #Argentina.

The audio companion to this week’s note will be uploaded to Substack on Tuesday to allow me to incorporate comments and feedback from this note. It will also be available as a podcast on Apple, Spotify and the other usual podcast apps.

Hear me out! Leveraged Finance, but no marks!

Regular readers will be aware that the 🐿️ is somewhat skeptical about the breathless coverage being given to the exponential growth of private credit markets. As you can imagine, I nearly choked on my Vegemite toast when I read this Bloomberg headline last week.

I will spare you the snark about the “shock horror” of a commercial bank entering the lending business. We all know that the long-term warehousing of sub investment grade credit risk has not been a core activity for big banks for years.

We have got to stage in the private credit hype cycle when one of the leading players in global syndicated leveraged finance markets tacitly acknowledges that public bond and conventional loan markets cannot compete with the terms on offer from the private credit arms of ‘Big PE’. Sounds healthy.

“The push follows similar moves this year by Wells Fargo & Co., Barclays Plc and Societe Generale SA to break into the fast-growing market for private debt, where risky borrowers bypass the high-yield bond and leveraged loan markets to get financing.”

In a comment that will send a shiver down the spine of several bank regulators around the world (or at least it should!), a ‘person with knowledge of the matter’ was cited saying “Citi may or may not use its balance sheet to win deals”.

The prospect of a G-SIB lender getting stuck warehousing (arguably mispriced) private credit deals could lead to some very embarrassing distressed sales in the secondary market when panicked risk managers start tapping debt capital markets senior leadership on the shoulder.

But I guess it’s only human that Citi and the other commercial and investment banks entering the private credit business are trying to protect their home turf:

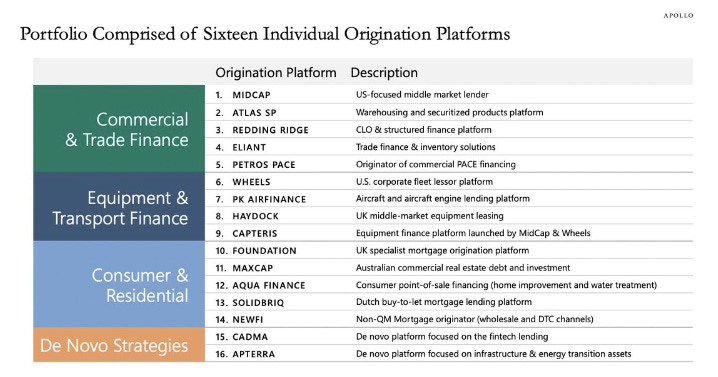

Enter an incestuous world in which private lenders are growing in-house credit origination platforms while traditional investment bank intermediaries try to stay relevant as corporate capital markets are subsumed by the shadow banking sector. What on earth could possibly go wrong?

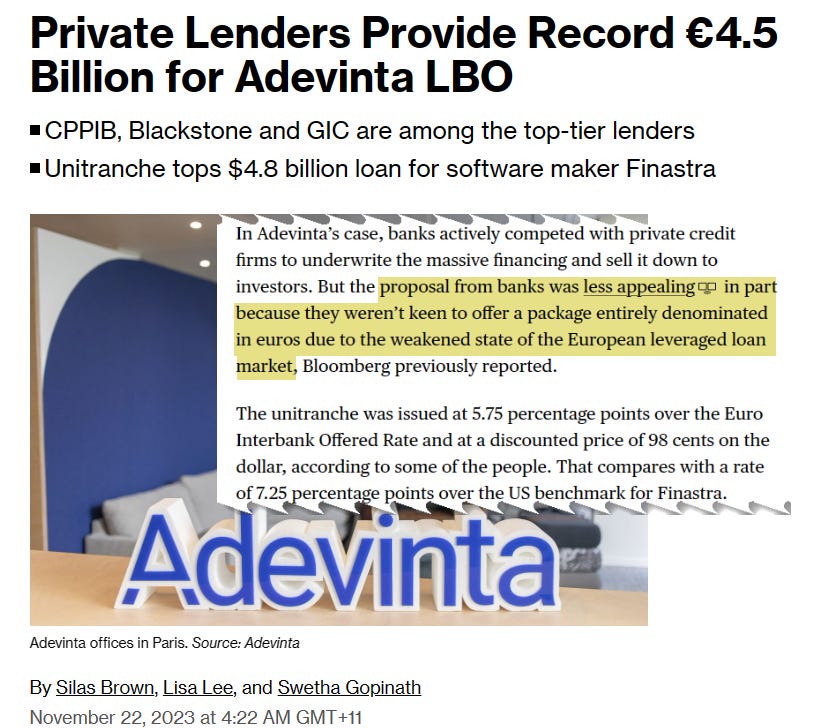

I had only just cleared up the toast crumbs from the carpet when I stumbled on this jaw-dropper of a headline:

Normal market forces seemingly need not apply to the world of private asset financing. The sponsors of the Adevinta LBO effectively acknowledge the lack of market capacity (“due to the weakened state of the leveraged loan market”) for a conventional ‘levfin’ deal. And then provide that capacity themselves…

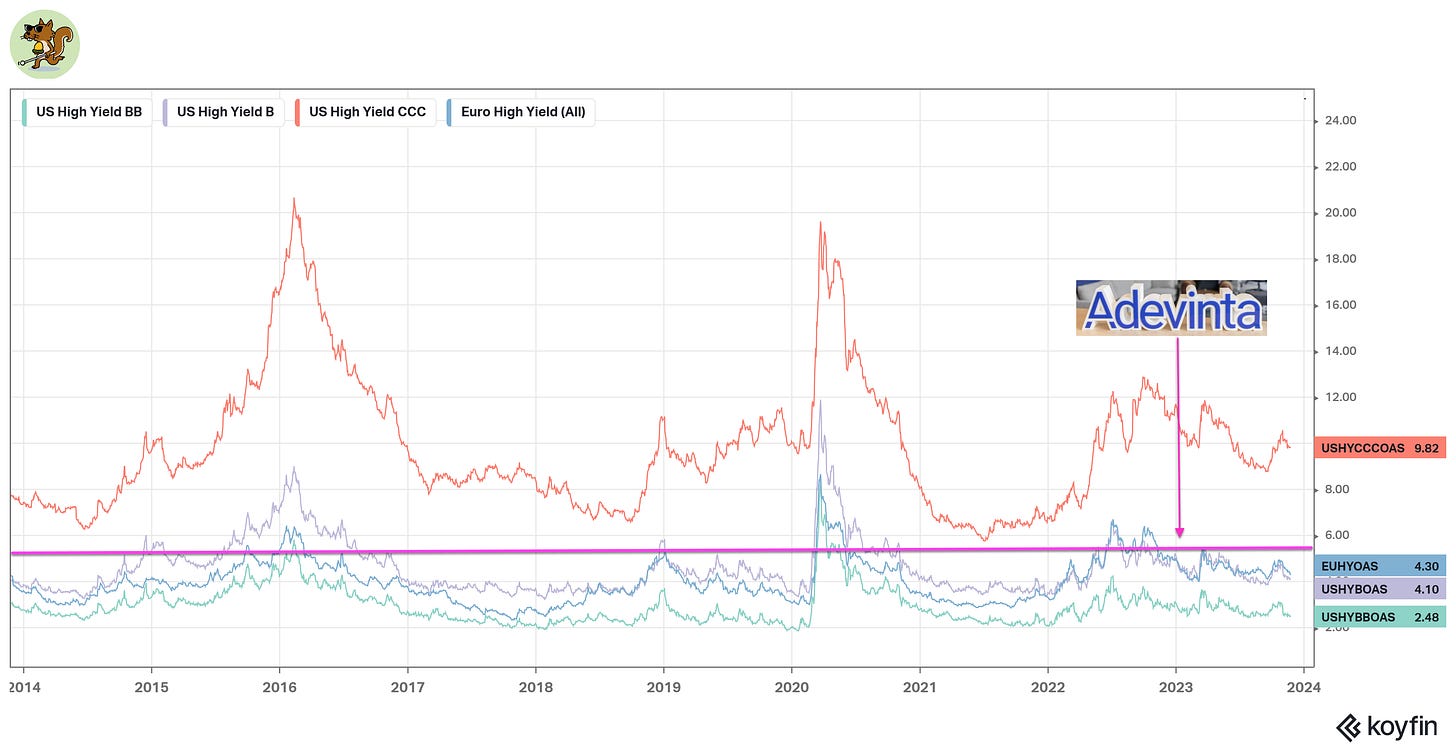

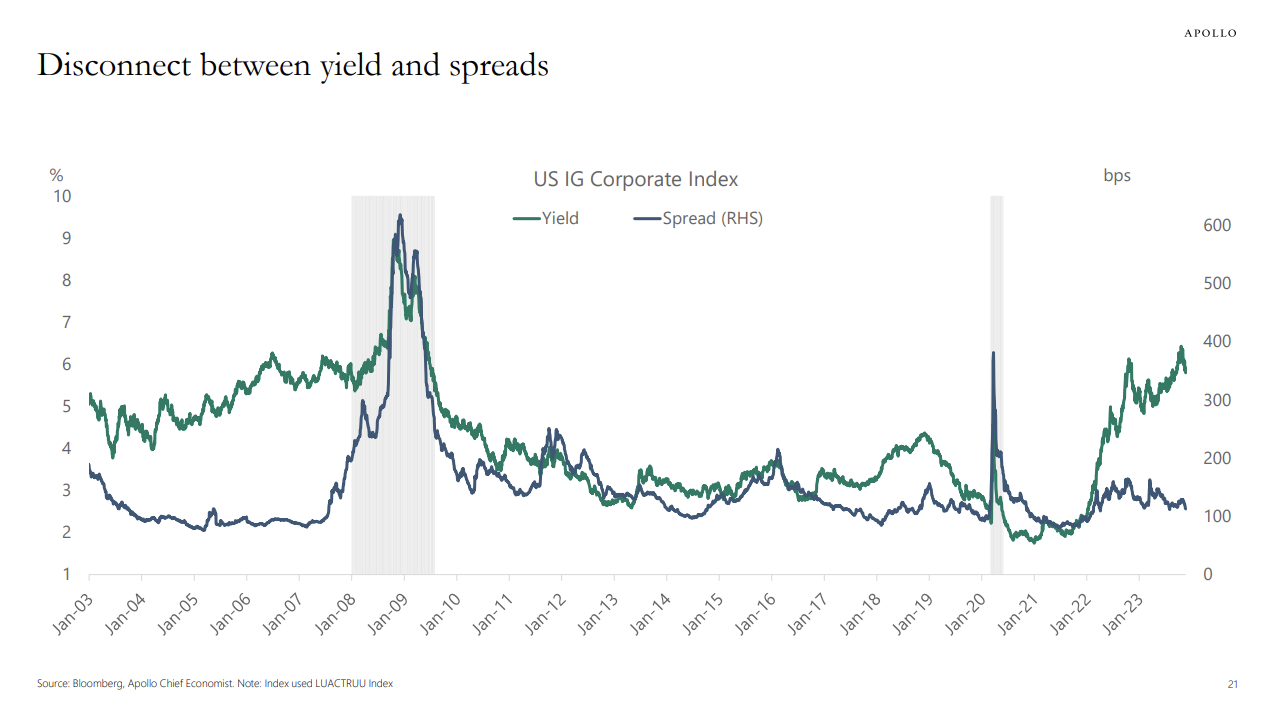

It looks as though a Blackstone-led syndicate of private lenders is prepared to swallow the whole Eur4.8bn deal at a credit spread barely 145 bps wider than the European High Yield benchmark and 150 bps tighter than the cited comparable, the recent jumbo software LBO deal from the US for Finastra.

To make that crystal clear, credit investors in Euro High Yield market currently on average earn a credit spread (over risk free rates) of 4.3% - for bonds that trade freely in the market, with daily liquidity. Blackstone’s private credit LPs are going are going to receive a pick-up of less than 1.5% over that level on this Adevinta debt package and that is before deduction of management and performance fees (which I suspect would eat up more than half of that margin uplift).

In return for a modest spread premium of, say 0.8%, these LPs are locked into a private credit agreement until maturity (or a credit event) in a deal led by Blackstone which also happens to be leading the equity component of the deal (together with the European PE shop Permira).

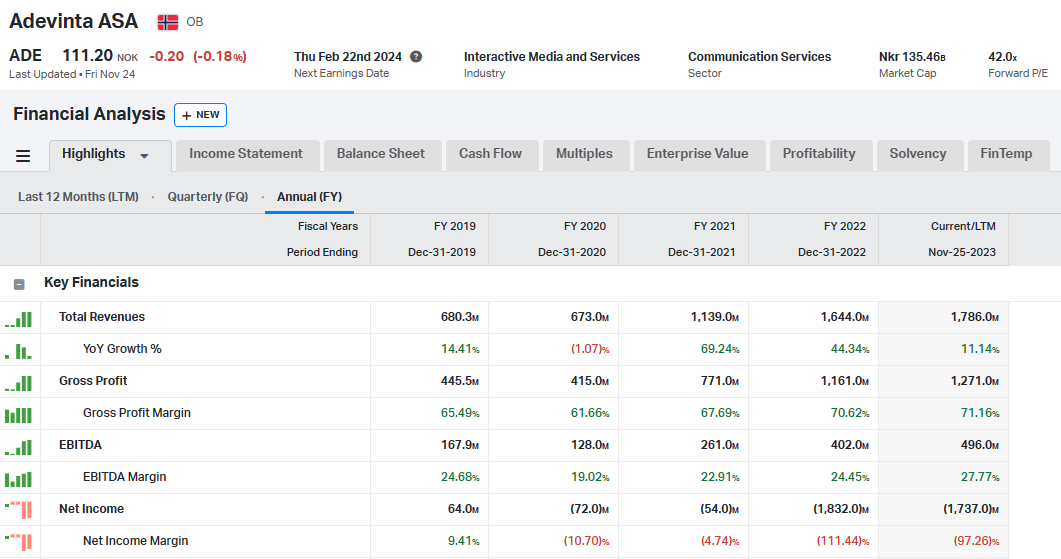

Adevinta’s products and services include generalist classified, specialist real estate, motors, and jobs sites. Great. What usually happens to this type of consumer sensitive business at the first whiff of an economic downturn? And it is not as though the company is going into the downturn in a position of robust financial health.

To make matters worse, this Eur4.5bn debt package (not including the Eur250m revolving credit facility!) will boost the amount of debt being supported by the company’s Eur496m of EBITDA by a casual [*checks notes] 227%! The annual interest rate bill on the base amount of debt (pre revolver) will be Eur425m.

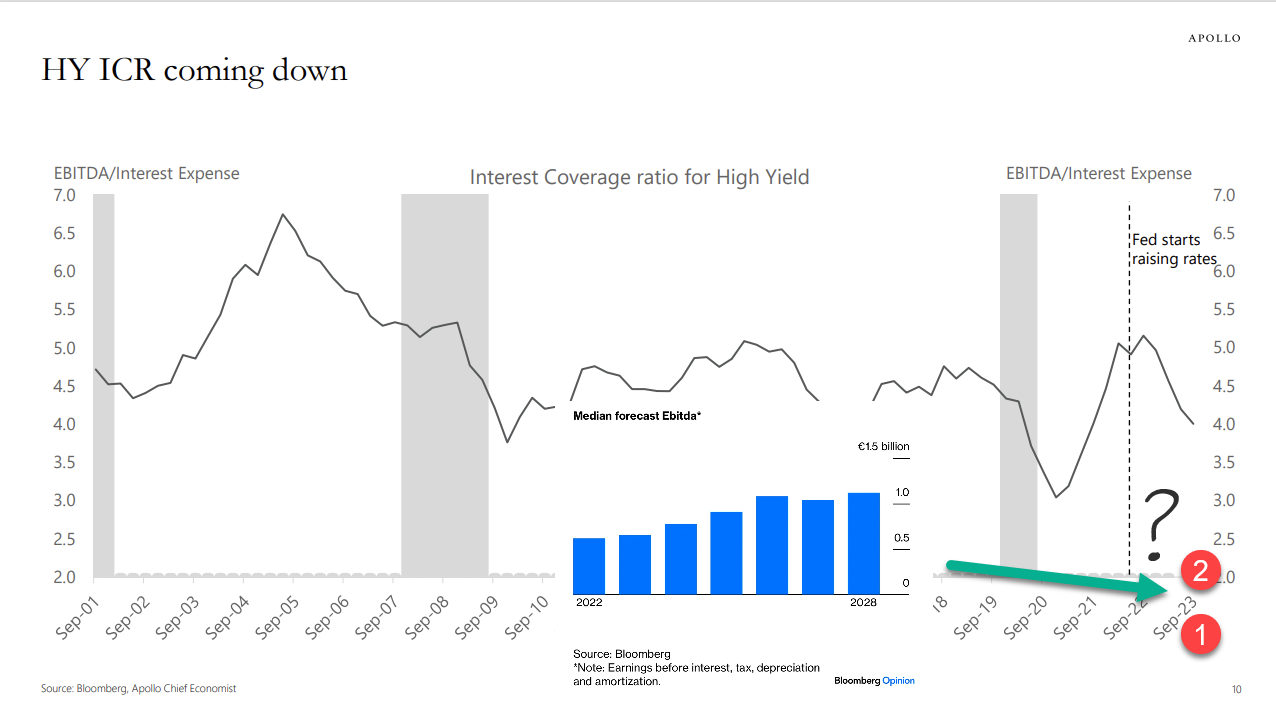

With the interest bill equal to 86% of trailing 12 months’ EBITDA, there is minimal margin for execution error. Let’s put that interest cover in some context:

According to Apollo’s data (terrific chart book here), interest coverage for the public high yield universe has just fallen back to an EBITDA / Interest Expense multiple of 4x. Analyst consensus EBITDA for Adevinta is at Eur657m for CY’23 and Eur779m for CY’24. It is not until 2026 per the (probably over-optimistic) consensus analyst forecasts that Adevinta’s forecast interest cover multiple gets to 2x EBITDA!

Frankly, it is tough not to view this entire deal as not much more than a gargantuan ‘Hail Mary’ bet on falling interest rates (with a side order of hope that a future refinancing might come at a lower spread than 575bps over).

If falling interest rates is your bet, there are far more liquid and convex ways to take that view in the short-term interest rate futures market (as we set out last week in “Sorry Harley, the 2 Year note is not for babies!”).

If I was a lender in that group, I would want a proper seat at the table in the event of any potential restructuring.

Permira and Blackstone’s bid for Adevinta has been accepted by majority shareholders, Schibsted and eBay (who own 72.3% of the shares collectively). EBAY 0.00%↑ sold its classified advertising business to Adevinta in a part cash, part stock deal back in 2020. Christmas just came early for them.

The company’s board of directors amazingly felt unable to wholeheartedly recommend (for legal liability reasons?) the 115 kroner per share offer (a 54% premium to the pre-bid Adevinta share price) to minority shareholders.

In their heart of hearts, I suspect that the targeted Q2 2024 completion date cannot come quickly enough! The financial press is being persuaded by the PR firms that the ‘Big PE’ barons are potentially getting some kind of ‘Black Friday’ bargain.

Nope! If I was in the risk arbitrage business - which of course I am not as it’s a short vol strategy! - I would most certainly be passing on trying to capture the 4 kroner per share spread to the public offer price represented by Friday’s close.

To be honest, having spent over 25 years as a sell side deal junkie in his past, your 🐿️ is getting a bit of PTSD from reading about this deal. This type of transaction bares all the hallmarks of the existential desperation for relevance that bankers (on both the buy and the sell side) feel during periods of an extended deal drought. I remember very much how it felt. It’s horrible. To be clear, this is categorically not Schadenfreude.

In addition to the direct participation by the CPPIB and the GIC, the Canadian and Singaporean wealth funds (at least their beneficiaries won’t have to pay those performance fees), the credit deal was also joined by a whole laundry list of other asset managers seeking to justify the existence of their newly raised private lending vehicles. If the deal markets carry on looking like this, I feel even worse than I already did about the outlook for returns for this vintage of private equity or credit funds.

I remember (through gritted teeth) the times when my own public equity capital markets teams were forced to (thanklessly) get involved in private ‘growth equity’ investment rounds for private companies in order to ‘stay close’ to PE sponsors and issuers while the IPO market was stubbornly stone-cold shut.

Perhaps Citi’s leveraged finance teams are playing a clever long game, seeking to stay relevant such that they are still ‘around the hoop’ when markets (or regulators - don’t hold your breath for that moment) determine that corporate financing terms should be determined by normal, Darwinian forces rather than by the Alice in Wonderland-esque, volatility laundered norms of current private financing markets.

It was great to hear Capital Allocators’ Ted Seides on the other side of the microphone last week. Ted started his career working for the late (and great) David Swensen at the Yale Endowment. Listening to Ted, I got the clear impression that Swensen, in many ways the founding father of mainstream alternatives investing, would not have made any sense of all the hype around the private asset markets of today.

He regarded illiquidity as the “unfortunate cousin of diversification". The game has changed from the late 1980s/ early 1990s. So much for diversification these days! All the allocators are seemingly crowded into the same trades, and, in the opinion of this 🐿️, these trades almost certainly printing at the wrong price…

That’s all for the front section this week. This week’s portfolio update and Acorn review (for paid subscribers) covers how to react to this Adevinta news #uranium #Ags #Energy #Offshore #Gold Miners #AUDUSD #ChIndia and #Argentina.

🐿️ subscribers also received a new fixed income Acorn last week (paywalled link below). Details of our subscription service here.