Handing some cash to the robots

This rodent still feels like a little bit of a traitor to the ‘narrative’ cause after publishing Monday’s morning embrace of systematic investing. I hope it does not age as well as the annual general meeting of the Turkey Union when they vote in favor of Thanksgiving and Christmas! 🦃

Rest assured, the 🐿️ is not out of the storytelling business. As my old friend

says, “humans aren’t done yet”. In fact, this is even the motto for his research business! My ‘trend-curious’ journey has, however, now evolved to the extent that we are going to be sending a proper allocation of dollars in the direction of the quant robots (i.e. the systematic trend-following models).I have had a number of super helpful comments and suggestions from readers since sending out the Monday note. Since publishing, I have also caught up on this terrific discussion between Meb Faber, Jason Buck and Eric Crittenden on the topic of trend and the rise of ETFs in the space that was flagged to me.

This discussion was particularly powerful on the topic of the diversification benefits of trend. I particularly enjoyed Jason’s description of Herschel Walker Syndrome as a mental model for portfolio construction. Be more like the Dallas Cowboys!

One reader (thank you Wes!) kindly pointed me in the direction of an October 2021 paper from AQR (‘When Stock-Bond Diversification Fails: Managing inflation risk in investor portfolios’) which contained the following ‘Frown, Smirk and Smile’ chart which I wish I had included in my original piece on Monday.

Expecting US Treasury holdings to underperform in an upside (inflation) surprise scenario is to be expected (and we know that the reality of 2022 for government bond markets was a great deal worse!). However, the powerful excess returns from trend strategies in all 3 inflation scenarios truly jump off the page (if we are headed towards a period of elevated inflation volatility - the 🐿️’s base case).

As a bonus, if you fill in the quick accreditation form linked in the e-book, Niels can grant you access to DUNN’s web-based portfolio builder (‘DBP’). This allows you to back test multi-asset portfolios over any time period since 1984, the actual DUNN WMA Program track record is used as a proxy for your chosen percentage allocation to trend following.

Quick compliance note: while I am hugely appreciative that my pal Niels made himself available to chat, gave me an early sight of his new book and access to the DBP, the🐿️ has no association or business relationship with DUNN and all scenario analysis and commentary below is the work of a rodent and not Niels or DUNN.

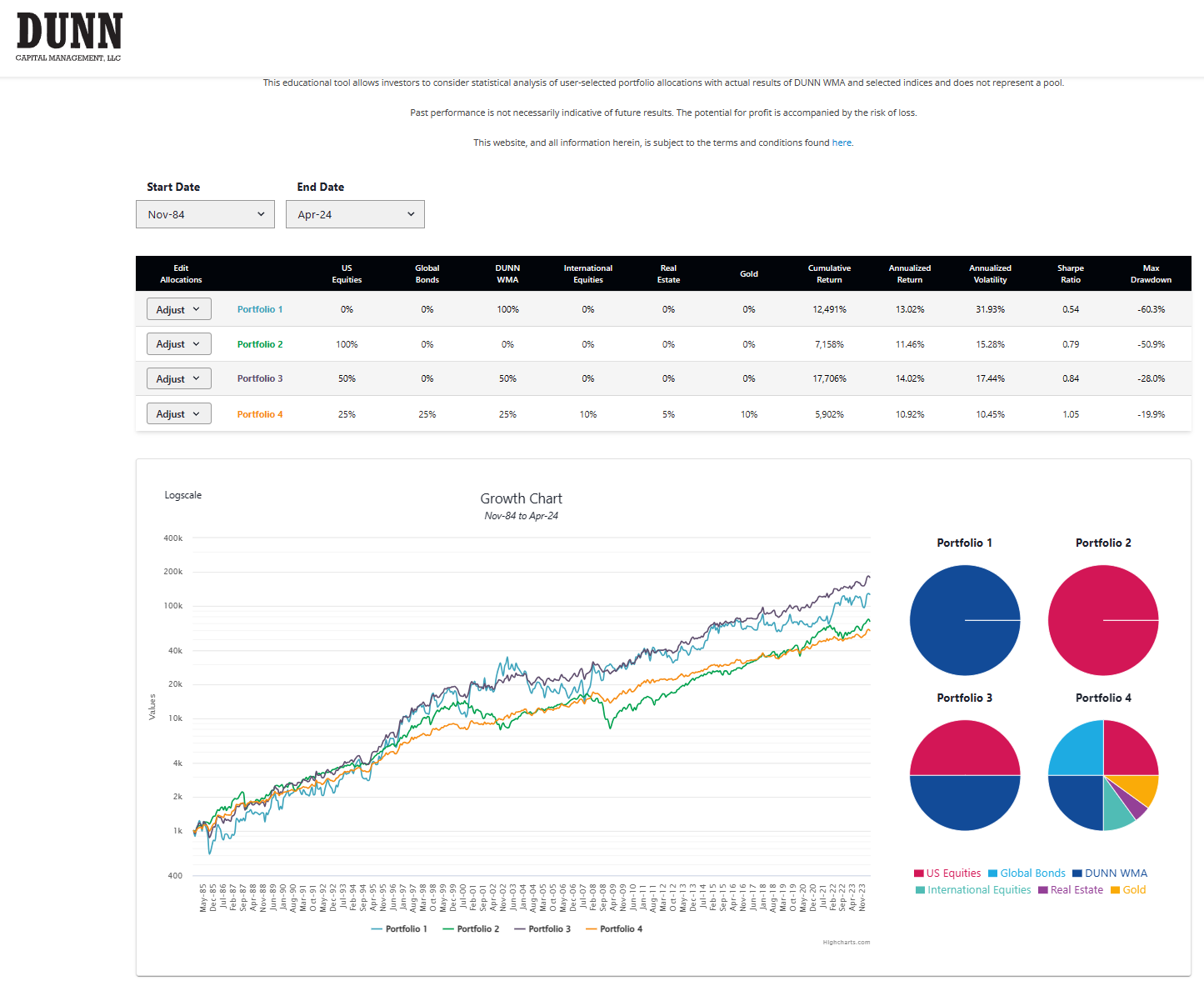

The 🐿️ has spent many happy hours playing with this tool. The DPB defaults (as per screen shot above) to a time period that starts in November 1984 (a time when The Terminator was #1 in the US box office and also the beginning of the DUNN WMA track record) with four illustrative portfolios that range from a 100% allocation to trend (Portfolio 1) to a broadly diversified allocation across equities, fixed income, real estate and gold (Portfolio 4).

I wanted to use the DPB to help me think about how to optimize my allocation to a trend following strategy. There is a danger with selecting arbitrary time periods and I do wish that the DUNN WMA track record extended back far enough so to that we could do more of a deep dive into the asset class’s relative performance during the last bout of inflation volatility during the 1970s.

However, I would make a few observations: (i) four decades is still plenty of data; (ii) market structure (particularly in equity markets) has changed significantly since the ‘70s (for example, there were no ‘0DTE’ SPX options around when the 🐿️ was in short trousers); and (iii) 2022 provided a pretty relevant test case for a textbook upside inflation surprise.

The name of the game was to find an optimal asset allocation that solved for solid annualized returns, with contained measures of annualized volatility and maximum drawdown. Over a variety of different timeframes. If you had closed your eyes and allocated 100% to DUNN WMA in 1984 your returns would have annualized at an impressive 13.03% but you would have lived through a maximum drawdown at one stage of over 60%! Fine for those that never open their brokerage statements!

However, trend’s non-correlated return streams start to work ‘magic’ in combination with other risk assets. I started by (over) simplifying the back test exercise, by just looking at a standard 60/40 US stock/ global bond portfolio (over, 40, 30, 20 and 10-year overlapping periods) adjusted for an incremental sliding scale allocation to trend following.

In section 2 of the note, we summarize the findings from this exercise and construct a ‘no touch’ portfolio of readily accessible listed products with which the 🐿️ is building his allocation to the robots.

In a note related to systematic investing, I thought it would be fitting to tip the hat to the greatest that this game ever saw and who sadly passed away, aged 86, at the end of last week. I was touched by this tribute below. RIP Jim Simons (April 25, 1938 – May 10, 2024).