Filling the 🐿️'s SPR

If it works for Superpowers, maybe it could work for this rodent. August 7th, 2024.

The following section is extracted from ‘Section 2’ (for paid subscribers) of last weekend’s note. Paid subscribers can skip directly to the Implementation section below.

In Part 1 of the 🐿️’s summer Stock Take, I was very clear that the bar for this rodent to become a raging energy bull once again is pretty high. I know that I am not alone among my readers for having overstayed my welcome in the great long energy / short tech trade of 2022…

The rangebound trading pattern of the past 2 years has sat at odds with a fraught geopolitical backdrop. Crude price spikes off the back of increased Middle East tensions have been consistently faded by speculators. It has worked pretty well for them (although I am not sure the 🐿️ would want to be their risk manager!).

Whereas front month crude price action can give the casual observer a dose of whiplash, the market for long-dated futures contracts is dominated more by compliance activity rather than by price speculation. The price of these contracts is largely driven by producers hedging forward production to satisfy their lenders’ requirements and certainly does not represent a subjective view of where price should be in 3- or 5-years’ time.

Back in July, I touched on the potential role of long-dated crude futures contracts as a portfolio diversifier that should keep up with any inflation in the system. The crude futures strip is priced in nominal dollars. In theory, these contracts should operate as an effective hard asset.

The long-dated contracts also significantly benefit from significantly lower volatility and shallower drawdown profiles.

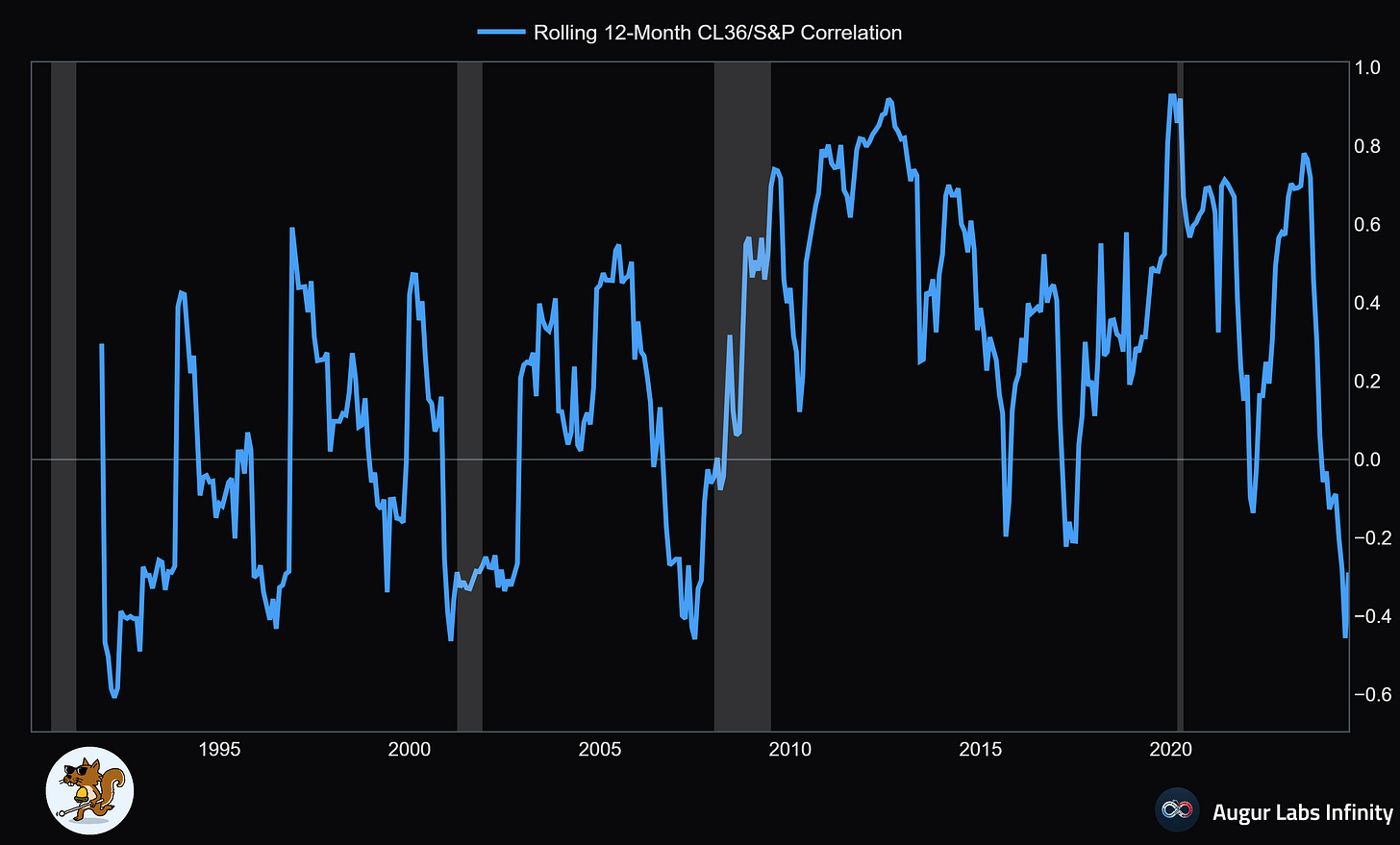

As an added diversification benefit, the rolling 12-month returns of long dated crude contracts also exhibit very limited correlation with equities.

All these portfolio benefits, yet the commodity is still spectacularly cheap! Crude oil’s failure to react to the current geopolitics has seen the market reach for alternative narratives to justify continued lower prices. Examples include everything from technological advances in extraction and NGL conversion to displacement by other fossil fuels (coal and natural gas) in Asia.

My friend Louis Vincent Gave has a terrific mental model that goes along the lines of economic growth simply representing ‘energy transformed’. With energy at current prices, countries and commerce will always find ways of converting that cheap fuel into economic growth from good and services.

I still believe that the long-term supply demand dynamics for crude are exceptional. As I wrote last month, “the efforts by Western politicians to contain investment in oil and gas production assets are going to age as poorly as the IEA estimates of energy demand from the ‘Global South’.

Some of the most succinct work on this dynamic has been put together by Arjun Murti on his Super-Spiked site. His estimates of future demand growth from India and Africa alone based on per capita barrel requirements seem pretty plausible to me. Demand destruction from the effects of EV adoption or economic soft patches in the developed world do not ‘touch the sides’ when measured against the reach for partial energy equality from the emerging world.”

There is no doubt that I have a bias that sees a higher crude price in the medium term. However, I think this allocation also makes sense at the portfolio level as a ‘hard asset’ diversifier. In the course of the next month, I am going to average into strategic (‘no touch’) portfolio allocation to long-dated crude oil futures contracts.

I think it’s time for the 🐿️ to build his own Strategic Petroleum Reserve! Although if oil does get back to $125/bbl in a hurry, I might be tempted to mimic the former Senator for Delaware and let go of a few barrels up there…

Implementation

First up, let me stress that I am treating this allocation entirely separately from any tactical or medium-term allocations to energy themes such as the US refining and offshore services stocks. Neither will this allocation prevent the 🐿️ from looking at tactical trades in oil futures and related ETFs at the appropriate time. This is NOT a recession / no recession call.

Long term hold investment strategies in commodities are traditionally quite challenging. I am assuming that most of my readers do not have storage capacity at home for a few thousand barrels of crude oil or metric tons of copper! In the futures market exposures, roll costs for commodities that are in contango (obviously not the case currently with crude oil) will eat away at investors returns over time.

A few months ago, I highlighted a fascinating conversation between Niels Kaastrup-Larsen and SCT Capital’s Hari Krishnan (links: pod; transcript; Recall.ai summary). I have listened to it several times. His observations as to how the well understood playbook of commercial hedgers (from grain farmers to airlines) create potential arbitrage opportunities in the futures options markets is fascinating.

Hari has developed a strategy that uses a combination of futures and futures options to allow his investors to participate in the long-term growth of commodities in a lower cost / lower vol manner in a way that makes it easier to hold positions for extended periods of time.

He does not reveal the full recipe for his ‘secret sauce’ on the podcast but his observations on the relative value of (expensive) close to the money call options versus (much cheaper) deep out of the money call options in say, corn are fascinating and give you a very good idea of how the strategy works. Have a listen. It is fiddly, so I do hope someone persuades him to put the strategy in an ETF one day!

For the 🐿️’s crude strategy, however, Hari’s rocket science is mercifully not required!

Keep reading with a 7-day free trial

Subscribe to Blind Squirrel Macro to keep reading this post and get 7 days of free access to the full post archives.