FIAT Money!

Not another piece on de-dollarization. I promise!

FIAT Money!

The 🐿️ returns to the topic of luxury. In the paid section of Monday’s note, we considered the overhaul of the luxury sector in the past 18 months. During this period, pricing for the truly scarce consumer brands has decoupled from the brands targeting the mass affluent. Since the beginning of 2023, the performance divergence has been nothing short of spectacular.

The 🐿️ took a look at an equal-weighted ‘UberLux’ basket of Ferrari and Hermès versus a cap-weighted ‘AlsoLux’ basket of LVMH, Kering, Richemont, Moncler, Mercedes, BMW and Salvatore Ferragamo [note to paid subs: I have slightly changed the composition of this basket from Monday - it is now roughly market cap weighted].

The divergence between ‘UberLux’ and ‘AlsoLux’ really started in mid 2022 during the acceleration of the global interest rate hiking cycle. It has further accelerated in the past 12 months to the extent that ‘UberLux’ names trade in ‘a league of their own’ versus the ‘AlsoLux’ when it comes to valuation.

I am pretty confident that this delta is related to the difference in terms of which customer base is meaningfully impacted by the move in interest rates.

Beyond a brief period in 2020/21 (stimmy checks on Chanel bags anyone?!😉), AlsoLux has been nuked in terms of relative performance month after month.

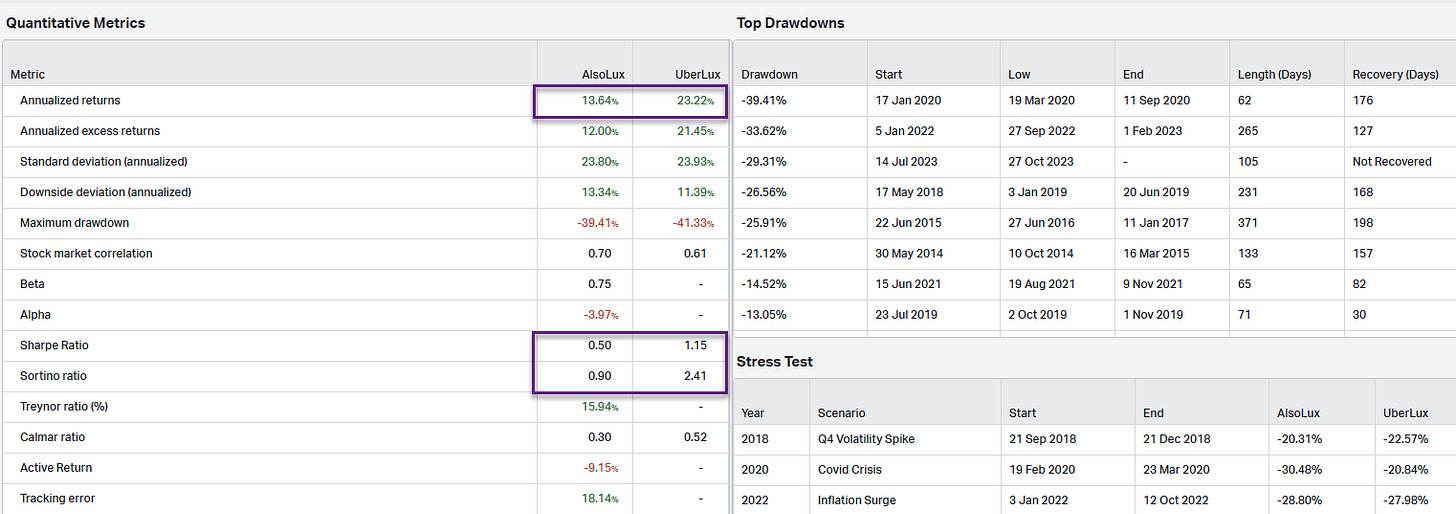

Looking at drawdowns over history, ‘UberLux’ has had a couple of enormous ones (such as Q1 2022) but on average drawdowns for ‘AlsoLux’ (blue shaded below) have been much more brutal.

For the more quant-inclined of my readers, the Sharpe and Sortino ratios for ‘UberLux’ are particularly impressive.

As stresses on disposable incomes rise up into and through the upper percentiles of wealth and income, I see a scenario in which ‘UberLux’ continues to outperform.

Fascinating 🐿️, but how is this actionable, are you really suggesting that we should be piling into Ferrari and Hermès at 12.6x revenues and 48.7x PEs with the current market backdrop?!

You do you, but I am not going to do that. This rodent freely confesses to being a poor momentum trader. I am also on high alert to the risk of a broader correction in markets. We need to be smarter about we structure the play.