Everybody's Stan!

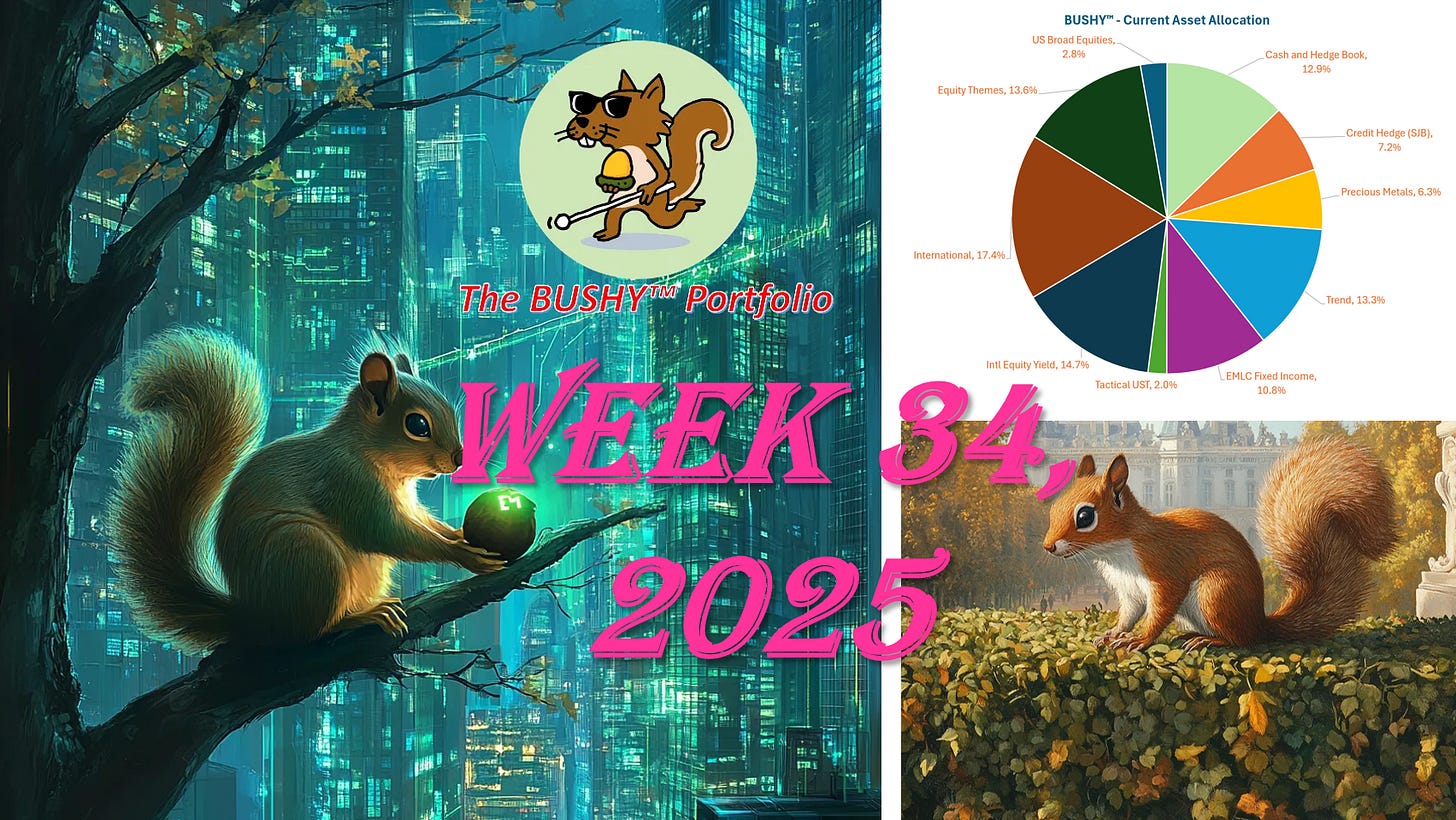

Review of the 🐿️'s BUSHY™ Multi Asset ETF Portfolio and live Acorn trade ideas. 2025, Week 34.

In case you missed it, the weekend note came out on Sunday morning EST. In it, the🐿️ rants about his least favorite fruit stock. Do check it out!

The BUSHY™ Portfolio - Week 34

So, Friday was one of those days in the market when everyone gets to feel like Stanley Druckenmiller. Speaking for the BUSHY™ portfolio, the majority of last week’s 1.26% total return came after Jerome Powell had decided to give risk assets what they craved. For now, there shall be no fist-pumping.

I will be honest. The Fed chair’s cautious openness to September rate cuts took me (and many others it turns out) by surprise. As indicated last Monday, I felt that interest rate markets had got over their skis in terms of pricing in these cuts. BUSHY™ cut back its exposure to short duration fixed income (TUA 0.00%↑) ahead of the release of the FOMC minutes mid-week (flagged real time in The Drey).

This turned out not to matter that much. The equities ripped and the US dollar dumped hard (which is very BUSHY™ positive).