Electric Dreams x Levee Breaks

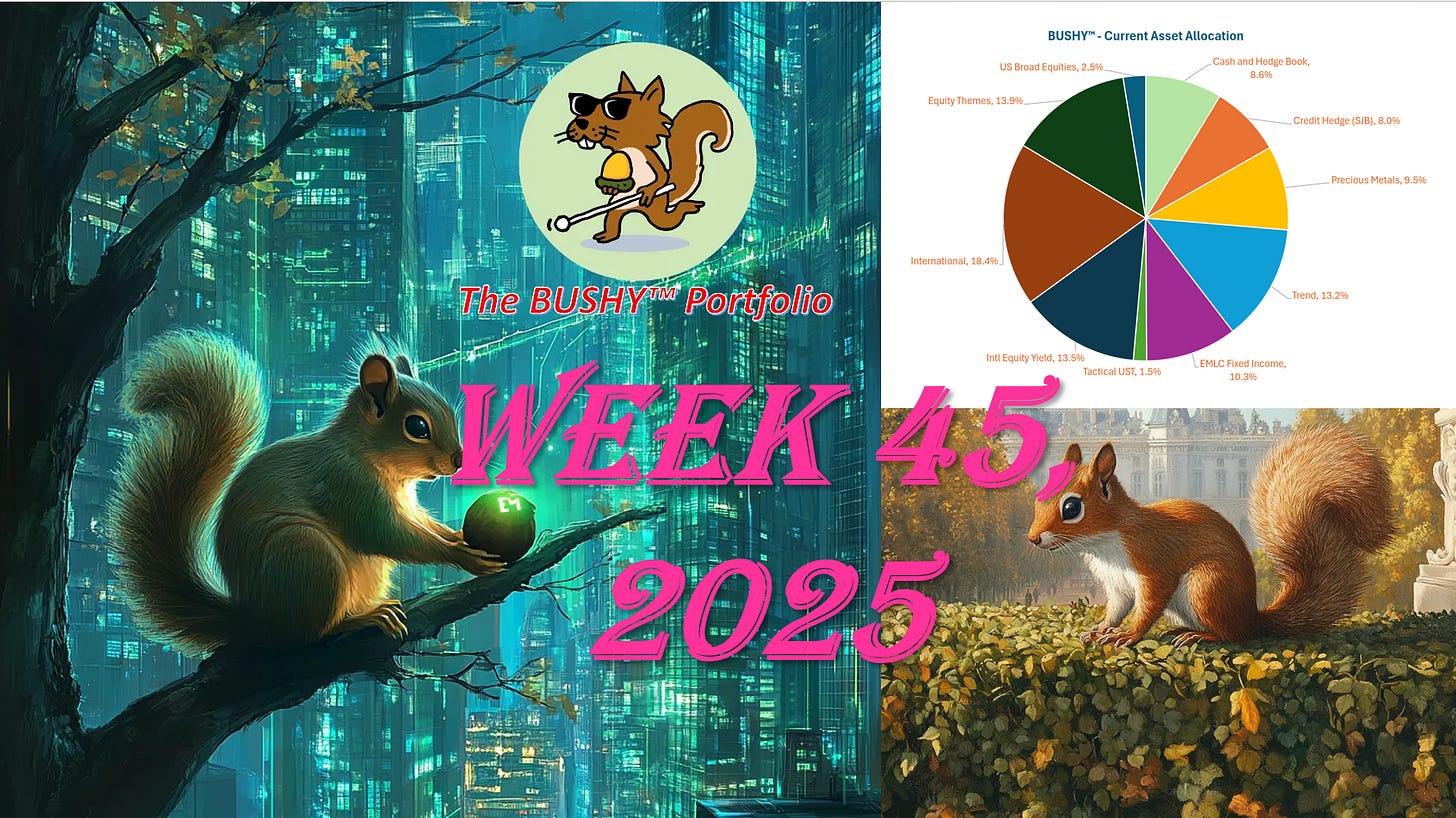

Review of the 🐿️'s BUSHY™ Multi Asset ETF Portfolio and live Acorn trade ideas. 2025, Week 45.

The 🐿️’s weekend note (published on Sunday) wrapped up the Uzbekistan work that was kicked off by my interview with Scott “Yurta” Osheroff. Link below in case you missed it.

This was one of a handful podcast outings by the 🐿️ last week - links to all of them via the article linked below.

Electric Dreams x Levee Breaks

The “while you wait” music for Sunday’s “Benny & The Squirrel” live show was too obvious - a mash-up of Led Zep’s “When the Levee Breaks” and Moroder and Oakey’s “Together in Electric Dreams”. This musical butchery is embedded below. David Guetta is not retiring any time soon!

A link to the Sunday night edition (recorded a couple of hours ago) can be found below 👇.

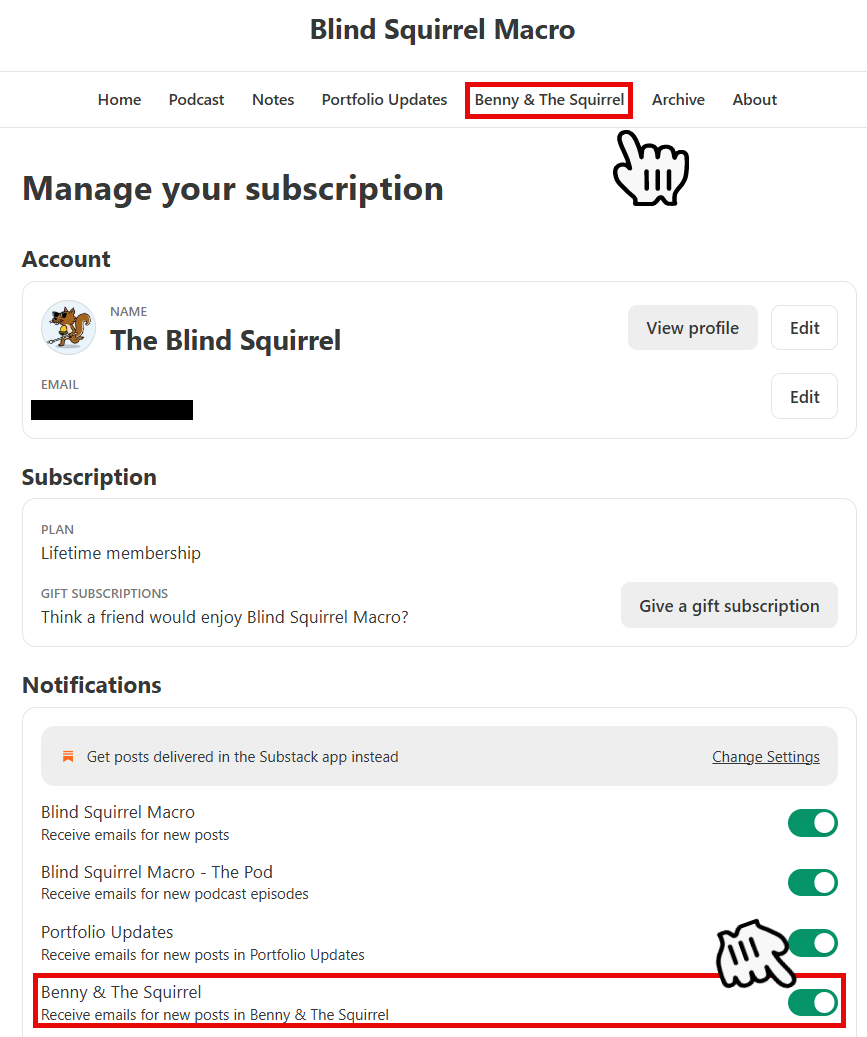

Benny & The Squirrel

Recording of the Sunday night live show with Bennie ‘Capital Misallocation’ Brey.

I did not want to bombard your inbox with an extra 2 emails per week but you can opt in to receive the email notifications with recordings of the live show via the website. You can also find these recordings on the ‘Benny & The Squirrel’ tab of the homepage. Alternatively, you can subscribe to the new channel on YouTube (which also get you the live feed on Sundays and Thursdays).

BUSHY™ Review

The BUSHY™ portfolio gave back 46 bps last week faring significantly better than the Vanguard target date benchmark.

The portfolio’s underweights in US Treasuries and cap-weighted US stocks certainly helped on that front. We also have the $QQQ put spread in the hedge book (December 19th expiry).

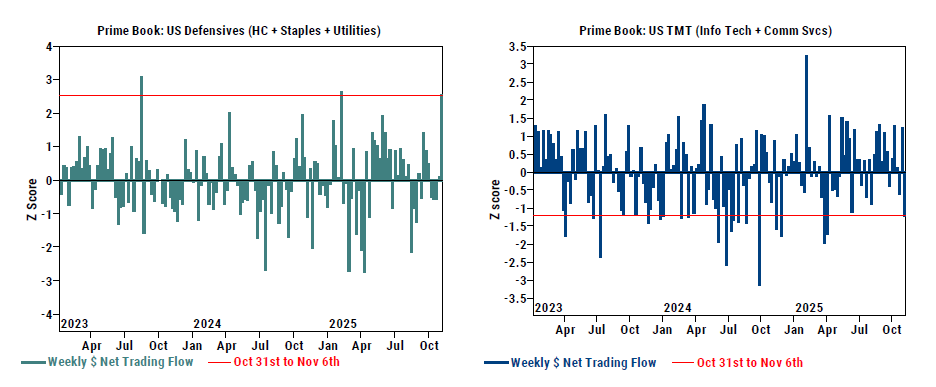

BUSHY™’s overweight in energy stocks also helped (notwithstanding the softer week in crude prices). Relative firmness in defensive names (staples, healthcare and utilities) also noted. The move certainly showed up in Goldman’s prime book flows.

Does not feel like a market that is still so close to all-time highs.