Did the Grim Reaper miss his bus?

The Blind Squirrel's Monday Morning Notes, November 6th, 2023.

Summary

Has the combination of no surprises from Wednesday’s Fed meeting; a market-friendly refinancing plan from the Treasury; and a ‘soft’ payrolls number on Friday started the firing pistol for a classic year-end rally?

Risk assets were up ‘across the board’ but the moves from the ‘trashier’- a technical term (!)- end of the equity market were nothing short of spectacular.

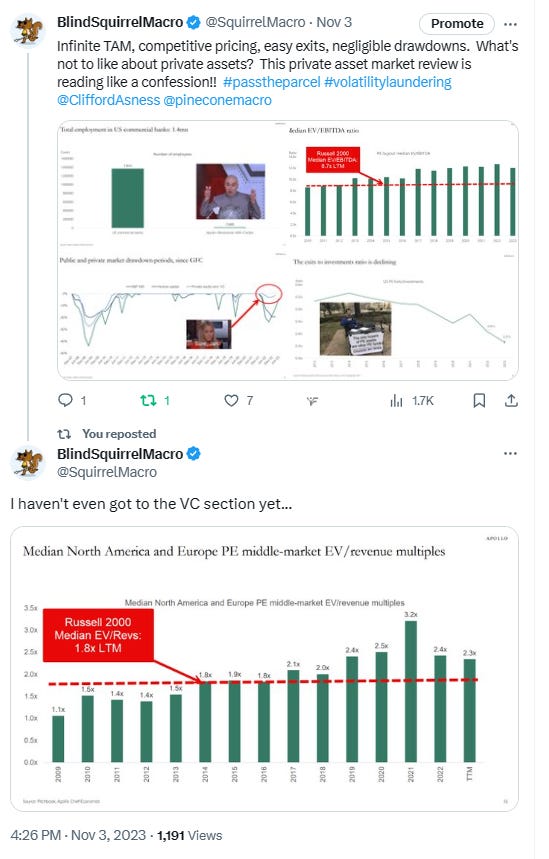

We complete our recent survey of private asset markets with a closer look at VC markets and their unicorn offspring in the public markets. We may be getting close to a target rich environment.

This week’s Acorn review covers #Energy #Offshore #AgCommodities #PrivateEquity #Prosus #AUDUSD #Doordash #Coinbase #Occidental and #uranium.

The audio companion to this week’s note will be uploaded to Substack on Tuesday to allow me to incorporate comments and feedback from this note. It will also be available as a podcast on Apple, Spotify and the other major podcast apps.

Did the Grim Reaper miss his bus? (Yes, but he’s coming back later).

Risk assets just had one of their strongest weeks of the year. So much for ‘Halloween macro hell week’! The extremes in bearish sentiment and positioning seen in the days going into last week served as tinder for the seasonal ‘Santa’ rally that the bulls had been praying for, and Mrs. Yellen’s QRA provided the spark.

For now, it looks like the combination of no surprises from Wednesday’s Fed meeting; a market-friendly refinancing plan from the Treasury; and a ‘soft’ payrolls number on Friday has started the firing pistol for a classic year-end rally. It looks as though we are returning to the Pavlovic reaction function of ‘bad news’ (for the economy) equating to ‘good news’ (for risk assets). 😔

The Janet and Jerome double act is reminding the 🐿️ of Doctor Dolittle's Pushmi-Pullyu, the fictional twin-headed creature that, as its name suggests, tended to pull in opposite directions. Attempts by the Fed to tighten financial conditions are being directly undermined by the Treasury’s refusal to test appetite for longer-dated US Government paper, as they fund the deficit and refill their checking account via the issuance of short-dated paper.

If this momentum continues much longer, short sellers are fast going to become as much of an endangered species as Hugh Lofting’s mythical Pushmi-Pullyu. However, I suspect that the situation is self-resolving. The Fed has now clearly linked future interest rate decisions to broader ‘financial conditions’. After this week, those conditions are loosening fast.

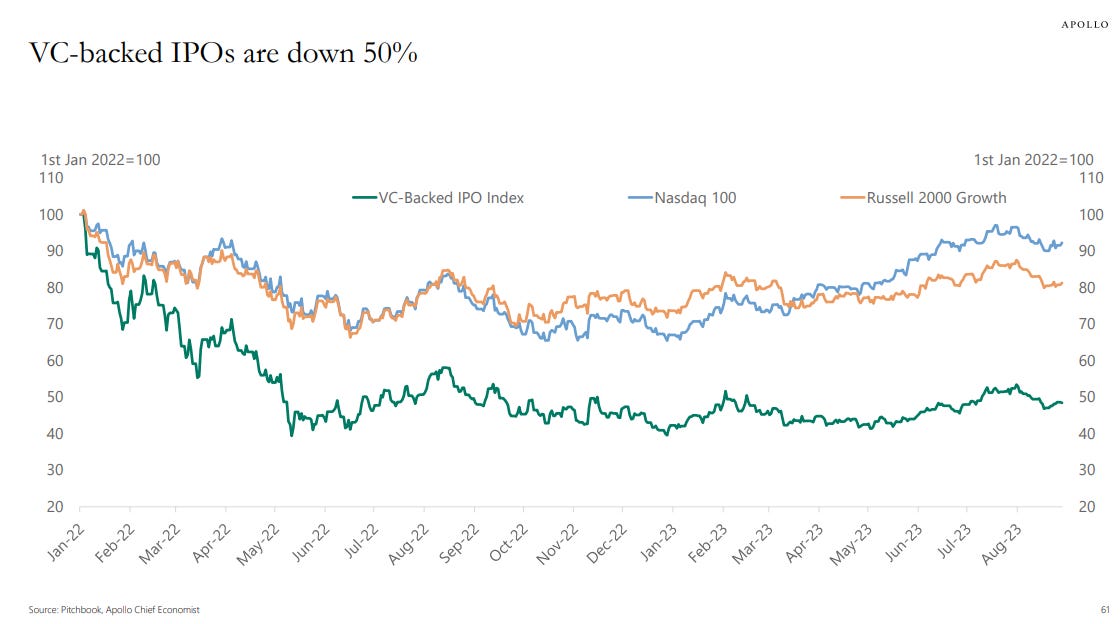

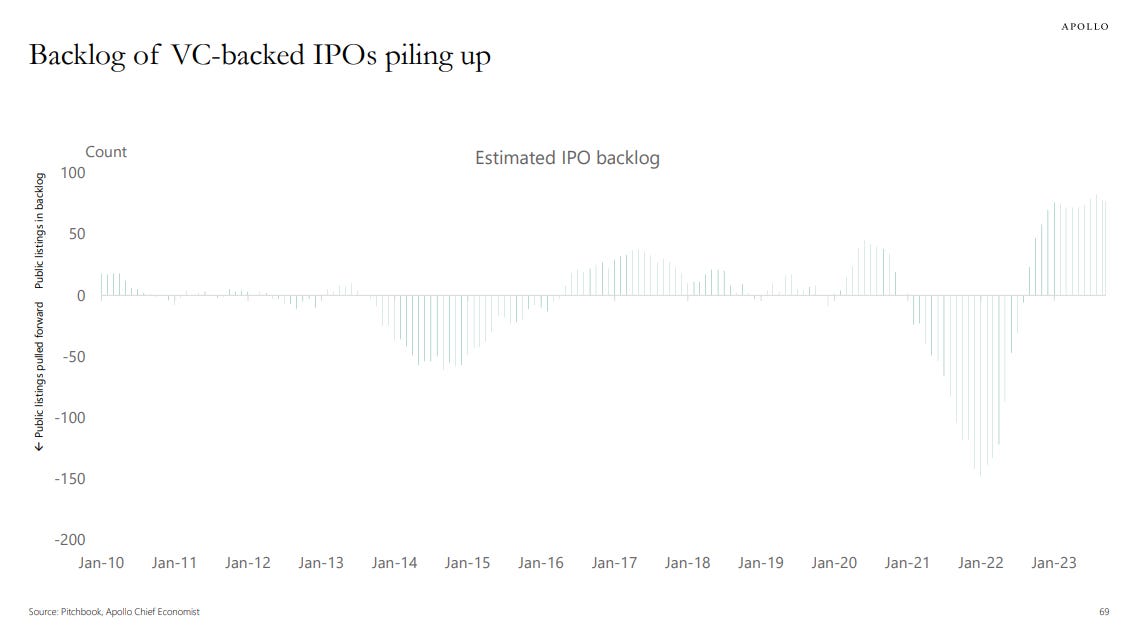

I suspect that we may be seeing a ‘last hurrah’ in some of the names that represent the worst excesses of post-GFC equity markets. It is possibly too early to step in front of the momentum freight train, but we could be setting up for some superb entry levels for fresh ‘ponzi-tech’ shorts as we enter the new year.

It turns out that we were prudent to wait to see what happened last week before starting our new bet against ‘Big PE’. Again, we could end up with superior entry levels on that trade. In preparing that theme, my focus was primarily on classic private equity, credit and real estate.

With the massive squeeze in the unicorn stable so loved by Cathie Wood’s ARKK 0.00%↑ last week, I thought it might be interesting to dig a little deeper into venture capital.

I am firmly in the camp that is finding the economic (and geo-political!) ‘hot takes’ coming from the ‘All-in Pod’ crew in Silicon Valley to be pretty hard to take. And please don’t get me started on the disingenuous claptrap contained within The Techno-Optimist Manifesto!

See the 🐿️’s reports on Instacart, Doordash and Regulatory Capture to get an idea of our views on the general state of health in the Palo Alto unicorn stable.

This week’s fraud conviction of ‘SBF’ provided a timely reminder of the quality of some of the standards of capital stewardship within Silicon Valley:

The images from my initial tweet above are taken from Apollo’s (APO 0.00%↑) latest ‘Outlook for Private Markets’. The recent IPO flop from Instacart was possibly predictable when one considers the track record of the VC-backed IPOs that preceded it.

The problems with these companies are not restricted to their dire lack of follow through on growth. In fact, they have gone a bit quiet on that front and the new mantra in the tech community is that old-fashioned concept of cost-cutting and margin expansion. They have a new catchphrase for it (they always do). It’s called “Lighter is faster”. Catchy.

However, for many of this cohort, no amount of paper clip parsimony is going to enable these companies to become profitable on a sustainable basis. Without the ‘blitz scaling’ sales and marketing spend, strong top line growth is, in many cases, a fantasy. Seemingly the only line of their cashflow statements with a hint of sustainable growth is the one titled ‘stock-based compensation’.

Once the sugar rush triggered by the recent easing of interest rates wears off, we shall be entering a target rich environment of ‘ponzi-tech’ short selling opportunities. Just make sure that you do not get run over trying to fight the trend too early!

That’s all for the front section this week. This week’s Acorn review covering #Energy #Offshore #AgCommodities #PrivateEquity #Prosus #AUDUSD #Doordash #Coinbase #Occidental and #uranium and portfolio update are below.

+++

Quick Reminder: Blind Squirrel Macro has just launched its subscription service. Details here.

Keep reading with a 7-day free trial

Subscribe to Blind Squirrel Macro to keep reading this post and get 7 days of free access to the full post archives.