Did Ivan Buy for a Double?

The Blind Squirrel's 'Monday' Morning Notes. Year 4; Week 5 of 2026.

The thinking behind this week’s note was well underway before Wednesday’s news came through that the “GlenRio” deal had been called off.

Jumbo mining mergers are tough. Multi-jurisdiction anti-trust approval cycles are tricky enough before getting over the thorny issue of share exchange ratios, Aussie franking credits and senior management egos.

I had been wanting to update my view around ‘fair value’ for Glencore in the event that “GlenRio” was going to result in ‘decision time’. Share price action alone was telling me all I probably needed to know about the company’s copper-focused investor day in early December.

But it was time for me to read that transcript in detail and update my numbers.

I had also noted that coal stocks were beginning to run - fresh highs for the (relatively new) Range Coal ETF COAL 0.00%↑. Fond memories of the bull runs in metallurgical and thermal coal names post pandemic still echo like siren’s call in this rodent’s head. That Thungela Resources spin off from Anglo American was an “all timer”.

Time to refresh my view on the (self-styled) “world's leading seaborne energy coal business”.

The other reason for doing the coal work was to prepare for my Benny and The Squirrel show on Friday afternoon with Tom Jens, CIO of Black Oak Capital, a specialist trader of US power (electricity) markets. Tom was trained in the nuclear industry and has owned both coal-fired plants and solar facilities.

We did not spend much time on coal in the end but our discussion around the AI / Energy narrative was a must listen and had me questioning many of my priors - especially around uranium. Am going to expand on that topic in tomorrow’s ‘Start the Week’ note.

Did Ivan Buy for a Double?

The 🐿️ first wrote up Glencore last July.

Your favorite rodent has a long history with the mining and commodity trading giant. The group was a banking client in the 2000s and 2010s and I helped take Glencore public in May 2011.

As a real asset ‘fan squirrel’ for much of the past 5 years, Glencore was a favorite ‘core holding’ for the 2021/22 commodity bull run. Glencore’s market cap grew from $17 billion to over $90 billion between the 2020 Covid lows and April 2022.

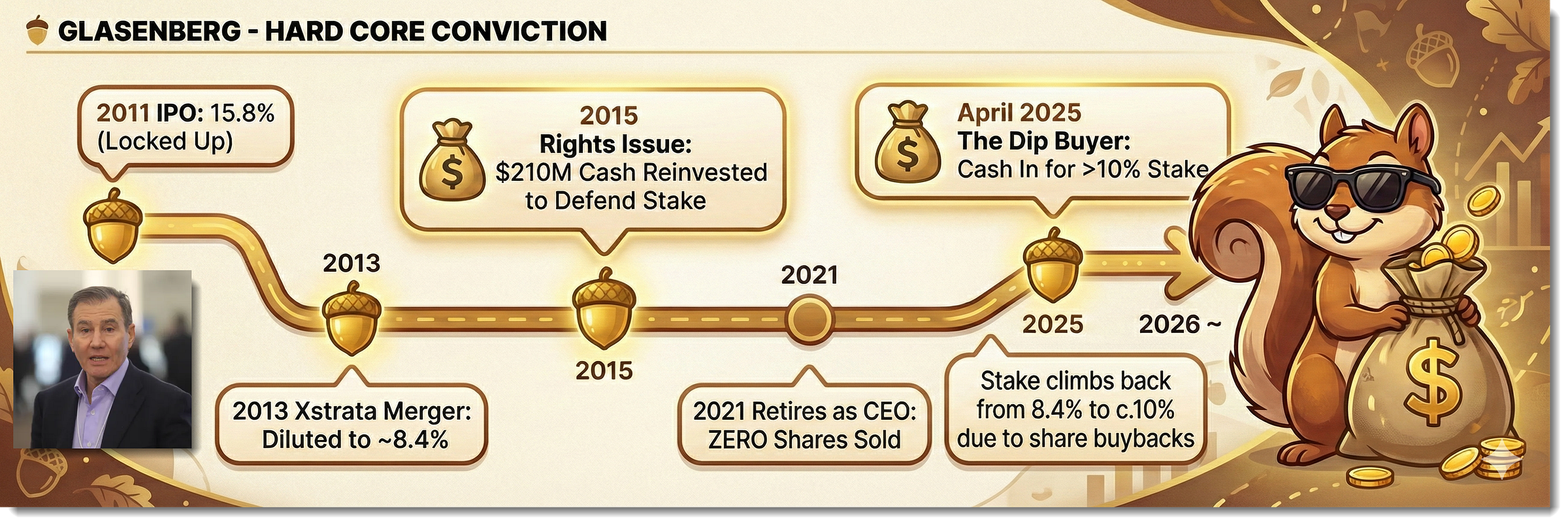

The stock then did nothing for 2 years before losing $25 billion of market cap in the 11 months leading up to ‘Liberation Day’. That was a ‘no más’ moment for retired CEO Ivan Glasenberg - he found $22 million of cash tucked away down the back of his sofa in Zug to sweep up 7.4 million shares and take his stake in Glencore up to 10.4%.

Even after last week’s “GlenRio”-related correction, the legendary commodity trader has doubled his money on that ‘top up’. Am pretty sure he is not a seller here - he has been the definition of “Diamond Hands” since the IPO 👇.

Should the 🐿️ share Ivan’s conviction? Let’s take stock…