Car Company 😉

The Blind Squirrel's Monday Morning Notes, 7th October 2024.

The 🐿️ is ‘touching the stove’ again with that

AI and roboticscar company.

Car Company 😉

The rules on equity research independence have evolved significantly since the 🐿️ first started his career in the finance industry. In the early 1990s it was not unusual for the first draft of IPO pre-deal research report (permitted outside the US) to be penned from within the investment banking department by the same team that had just written the prospectus!

After all, the rockstar equity research analysts were far too busy pitching for the next banking deal! Eliot “Client 9” Spitzer’s crusade against research independence took place several years later. However, memories of ‘bag carrying’ for Salomon analyst Jack Grubman on a tour of Asia as he lectured (to the extreme discomfort of the accompanying relationship managers) the region’s national telco management teams on how to be ‘more like Worldcom’ in early 2000 are seared into this rodent’s memory.

Fast forward to today. There is an old adage that you if you owe a bank $10,000 dollars, you have a problem but if you owe that same bank $100 million dollars, the bank has the problem. Now try (a 27% share of) a $13 billion loan to a Quixotic billionaire to buy a website with which so many of us have a love/hate relationship.

Pour a large one out for Morgan Stanley. Not only do they have to sweat about recovery on the senior loan against Twitter’s fast depreciating assets, but they have also lent $12.5bn against Musk’s personal stake in Tesla. This margin loan is understood to be structured with a 20% initial ‘Loan to Value’ and a 35% margin call ‘trigger’. ‘Hey Siri, define concentration risk.’

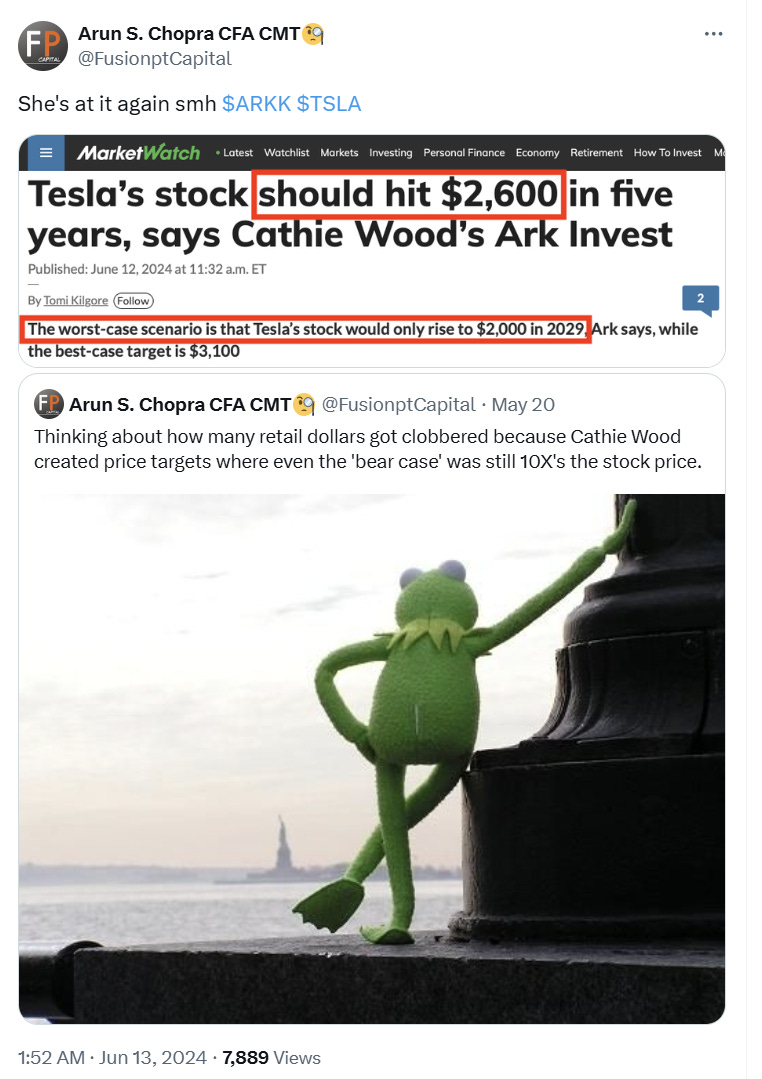

ARK Invest’s Cathie Wood gets her (deserved) fair share of criticism on social media for her (frankly, attention-seeking) share price targets for Tesla.

These statements may or may not get her into hot water (probably not) with her regulators down the line. ARK’s forecasts are typically constructed from a ‘sum of parts’ analysis of businesses that are either (charitably) conceptual or, like Musk’s ‘xAI / Grok’ initiatives, not currently owned by Tesla itself.

Private Eye, the UK-based satirical (and sadly stubbornly analogue) magazine, is happy to call out grift emanating from both ends of the political spectrum.

One of The Eye’s long-standing columns is ‘O.B.N.’:

You would have thought that the scar tissue from the fines of ‘Client 9’ would still twitch in the research compliance departments of the major Wall Street brokerage houses such that blatant ‘O.B.N.’ applications by senior industry analysts might raise multiple red flags.

However, when looking at what emanates from one of Wall Street’s preeminent investment banks and potentially the largest individual creditor to the ‘Muskonomy’ [sic], Morgan Stanley, you have to imagine that, with hindsight, Messrs. Grubman and Blodget might be beginning to feel pretty hard done by!

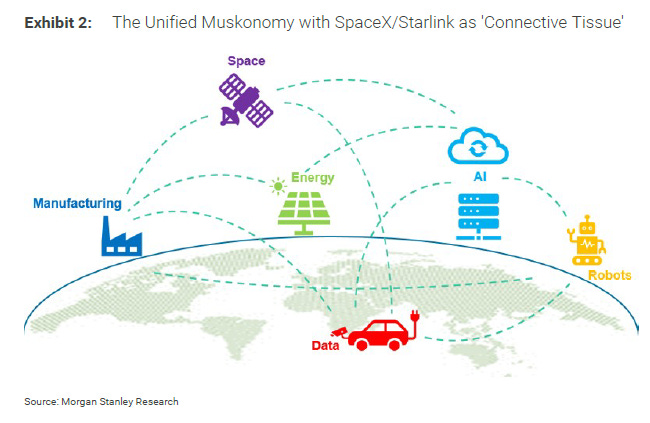

Morgan Stanley’s Adam Jonas has gone ‘all in’ with his fawning Musk cheerleading in recent years. Value justification dispensed with mundane, conventional metrics such as sales volumes and gross margin some time ago.

This is just as well. Sales growth at Tesla has flatlined since mid 2022 and the company’s acrobatics to achieve (carefully managed) consensus delivery numbers at the end of each quarter are worthy of consideration by ‘Cirque du Soleil’ (h/t Brad at Motorhead for the final month % data, part of his excellent ongoing Tesla / auto research coverage on Substack).

Not to worry. The automotive business accounts for less than 20% of Mr. Jonas current $310 per share sum of parts valuation / price target for TSLA 0.00%↑ .

Idiots like this rodent apparently simply do not ‘get it’. Tesla is an ‘AI and robotics company’, not a car company. The 🐿️ stubbornly remains in the camp of ‘if it quacks like a duck…’. We should now instead be wowed by the ‘TAM-enomics’ of Tesla as an autonomous ride share company (aka ‘Tesla Mobility’).

I do not wish to debate the merits of Tesla Mobility’s potential ‘go it alone’ strategy with respect to ride sharing (but do read the WSJ article linked above). Neither do I feel the urge to weigh in on the technical capabilities of Tesla’s ‘Full Self Driving’ (not as competent as Waymo (or some of the Chinese OEMs), it would appear).

However, for Tesla Mobility to exist, surely the fundamental issue of ownership of assets and liabilities for this imaginary fleet of ‘robotaxis’ must first be settled? Last time I checked, capital is no longer ‘free’, and someone also needs to shoulder the legal liability for 4,000lbs of unsupervised metal and plastic trundling around at 40 miles per hour (and for whatever a passenger might do inside it after that ‘one more for the road’ Friday night Martini!).

If that is not enough, splash on some of Tinkerbell’s pixie dust and dream about ‘Tesla Aviation’, a $9 trillion addressable market for eVTOL and drones which could tack on “up to” another $1000 per share to Adam’s price target. All you have to do is think ‘happy thoughts’ and believe!

Since starting this publication, the 🐿️ has steered clear of the topic of Tesla and Musk for a number of reasons relating to (i) the billionaire’s peculiar fan base (check out the comments from when I made the mistake of calling Tesla a car company on Jack Farley’s Forward Guidance show on YouTube back in April!)…

…and (ii) the failure of the stock to comply with conventional laws of capital market physics and fundamental analysis.

The 🐿️ has had a few wins on ‘the dark side’ (short) of Tesla but has also experienced his fair share of scorched digits from touching that particular hot stove (cover art explained!).

This is because for every ‘sneering headline’ from ‘the suits’ / ‘non-believers’ / ‘don’t understand tech’ / ‘they just hate Elon’ crowd…

…there is invariably a wall of liquidity lining up to play at the hottest (well, at least until Nvidia came along) table at the Wall Street casino - namely low delta Tesla call options!

Next Thursday (October 10th), we have the (delayed from August) ‘We, Robot’ event to unveil the latest plans for Musk’s Robotaxis. There will be no shortage of hype. The event even takes place in a movie studio, the Warner Bros. lot in Burbank for heaven’s sake! Musk has a lot riding on it.

To cite Brad ‘Motorhead’ Muchen again, “Tesla may show several mock-up models to excite its fanbase: Tesla fans have been enduring a period that Musk explains as Tesla being “in between two growth waves”. It was clear that Musk announced Robotaxi Day in a fit of rage after a Reuters scoop saying that Tesla scrapped its $25,000 Model 2 EV.”

Just please never forget that any robotics expert will tell you that any robot with anthropomorphic characteristics (e.g. humanoid) is created for the benefit of the marketing and capital raising departments, not for reasons of utility.

Back to the options. On Friday of last week alone, nearly 50,000 contracts (5m shares, $1.25bn notional) of sub 20% delta call options that expire the day after ‘We, Robot’ Day exchanged hands at the Wall Street casino.

The most actively traded ‘teenie’ contract on Friday was the $300 strike call that expires next Friday. Let’s walk through the economics of owning that option. Click the image below to link to the profit and loss worksheet.

In order for these options not to be worthless before the market even opens on expiry day next Friday morning, Tesla’s stock needs to be up over 15% from this past Friday’s close.

One charitable interpretation of this activity is that buyers of these $300 calls are seeking to profit from anticipatory excitement ahead of the event on Thursday.

The next 30 days contain one further risk event for the Tesla share price. That is of course the US Presidential election in November.

This summer has seen Musk clearly align himself with a potential future Trump administration. The most recent rally in the Tesla share price has coincided with a stagnation in Trump’s polling. What could this divergence be telling us?

Either this is the market discounting the fact that a Harris administration will not seek vengeance for Musk’s partisan pre-election activity or instead that the risk of Musk exercising the ‘Government Sachs’ clause (and selling his Tesla stock tax free so that he can take that ‘cost cutting’ job within the Trump administration) is more remote. Now, that would certainly be an auto-da-fé for the ‘Cult of Musk’.

The 🐿️ touches the Tesla stove once again with extreme trepidation. However, the risk / reward this time is sufficiently appealing to pull this rodent off the sidelines. This game requires asymmetric odds and some (very) careful risk management. In Section Two of this week’s note, we lay out that plan.

Don’t miss out! Please consider becoming a paid subscriber to receive the other 60% of 🐿️ content (including this Tesla idea), member Discord access (The Drey) and even ‘limited edition’ merch!