Back in the Straddle

The Blind Squirrel's Monday Morning Notes, 19th August 2024.

Popular narratives are getting run over by the very same price action that they are supposed to be explaining. Times are tough for the pundit class.

The speed with which the market has dusted off the volatility shock of 2 weeks ago is intriguing this rodent.

The market’s return to the Nasdaq dominant trend of the past 18 months has prevented an unruly unravelling of the dispersion trade. For now. I think that the risk is still being warehoused.

We revisit the 🐿️’s ‘Dispersion Bust’ trade and celebrate Mel Brooks’ finest!

Back in the Straddle

In a strong boost to the bank balances of orthopedic specialists, these markets are delivering their fair share of whiplash. Popular narratives are getting run over by the very same price action that they are supposed to be explaining. Times are tough for the pundit class.

10 days ago, JP Morgan and others were keen to reassure all that would listen that 75% of the Yen carry trade had been unwind. Now we read that the Yen shorts are being strapped back on. Apparently, the billions of dollars allocated to trend and volatility targeting strategies have just completed epic positioning 360 degree round trips in the past 2 weeks. Can y’all hear me at the back?

“The best explanation I have heard for this remarkable snap back is ‘the computers want their stocks back.’” James Aitken quoting one of his clients made the 🐿️ laugh out loud!

The launch of a 1.75x levered Microstrategy ETF makes for great journalistic copy and certainly riles the financial justice warriors. Then you check and see that it barely has a million dollars of AUM.

And just like that, the great summer bear market of 2024 is over with a whimper. The Nasdaq is no longer even in correction territory. To the relief of many a concerned citizen, Wharton’s Jeremy Siegel has now walked back his views on the needs for emergency rate cuts.

It is also 13-F season! The reactions to the quarterly release of (very stale) 13-F filings always make this rodent smile. This week’s chatter has not disappointed, with Stanley Druckenmiller apparently further cementing his 🐐 status by nailing the tech (Nvidia) / small cap (IWM 0.00%↑) rotation trade.

However, much much more entertaining was the ‘doomer’ reaction to Michael Burry (yes, the ‘Big Short’ one with the glass eye) selling all his PHYS 0.00%↑ (physical gold ETF) to load up on those ‘un-investable’ Chinese tech stocks. Absolute scenes!

The only ‘13-F porn’ in which the 🐿️ indulges is his quarterly inspection of the filing from that famous Zurich-based technology hedge fund, the Swiss National Bank. Q2 was yet another quarter in which the SNB continued to dribble out his holdings of large cap US technology stocks. Keep a close eye on this trend.

The speed with which the market has dusted off the volatility shock of 2 weeks ago is certainly intriguing this rodent.

Implied volatility never hangs around at its highs after a spike. However, the quants at Barclays put together the chart below to illustrate just how rapid this settling down of the VIX has been relative to volatility spike events in the past.

Regular readers will know that the 🐿️ has been thinking a great deal about the crowded volatility dispersion trade over the past few months. We closed our ‘Dispersion Bust’ hedge very profitably on Monday 5th after adding to it at the end of July (sometimes better to be lucky than good).

I have unlocked (from behind the paywall) the report that set out the original thinking behind that hedge in early March.

It is tough not to have the feeling that the pace at which implied correlation has been smashed down in the past 9 trading sessions has something to do with the extent of crowding within the dispersion trade by and the needs of the multi-strategy hedge funds and those of their counterparties on the sell side.

My mate PauloMacro wrote a great note in early July in which he commented on market speculation that some very large dispersion positions had migrated from the ‘pod shops’ to the dealer community (investment banks) following the mini spike in volatility and correlation in early April (when these funds may have got a ‘tap on the shoulder’ from their risk managers).

If this is indeed the case, there would be a very clear vested interest in seeing S&P implied volatility sharply lower after the recent spike. I do not think that the 🐿️ was venturing too far into tin-foiled hat territory when I responded to the following question in Kevin Muir’s excellent (and free to join!) Substack chat.

Kev followed up with this comment: “When in doubt get out, when in trouble double….”. We have not discussed this live yet, but I think we may be thinking along the same lines. The market’s return to the Nasdaq dominant trend of the past 18 months has prevented an unruly unravelling of the dispersion trade. For now. I think that the risk is still being warehoused.

The 🐿️’s ‘dispersion bust’ protection is going back on the books this week. I have had messages and notes from a number of subscribers asking for more color on how to manage the hedge over time (i.e. when to roll). I am going to go through this in ‘Section Two’ of this week’s note (for paid subscribers).

On a related point, Dean Curnutt’s guest on this week’s Alpha Exchange podcast was Oliver Brennan, Barclay’s volatility strategist. While talking in the context of FX carry trades, Oliver was fascinating on the topic of how the tight risk management strategies of the multi-strategy funds make it hard for them to capture alpha from views on longer term themes.

As such, the pod shops are essentially forced to crowd into long carry / short volatility trades as the daily / weekly / monthly P&L focused business model is highly intolerant of any trade expression with a negative carry.

While equity volatility has calmed down very rapidly, you will have seen in the earlier chart that treasury implied volatility (as measured by the MOVE index) still remains in relatively elevated territory.

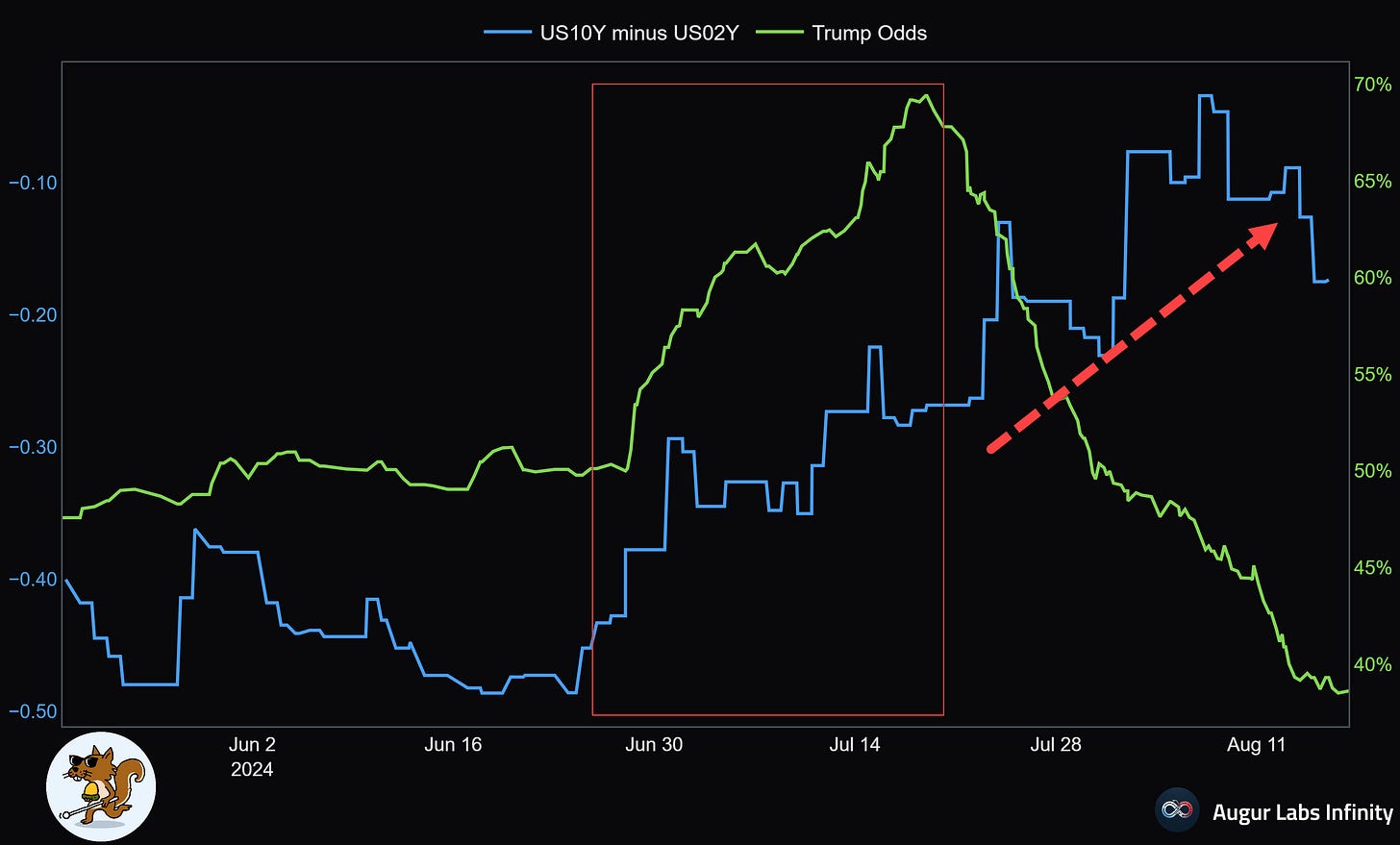

While I think that the bond market is over-pricing rate cuts in the near term, it also clearly has its eyes on US politics and inflation risks. In early July in ‘You can't face it, but bonds are watching’, this rodent speculated that the emerging ‘bear steepener’ in yields was bonds pricing a ‘Red Wave’ outcome for the Republicans in November.

The equity market was very much in ‘cheer mode’ this week. As such, the ‘glass half full’ interpretation of this week’s CPI and PPI inflation data is as understandable as the brushing off of those relatively perky retail sales numbers on Friday. The market is still in ‘cut mode’ but will the Fed be cutting in September ‘because it can’ or ‘because it had to’?

I tend to agree with ‘Inflation Guy’ Michael Ashton (latest piece here) that the rapid deceleration in ‘Shelter’ CPI than many have considered “foreordained” may not be pulling through as expected. If median CPI is going to settle in the high 3% area, a sub 4% 10-year yield sadly does not feel high enough to this rodent.

The title of this week’s piece is more than just a rhyming play on words and the 🐿️’s desire to refocus on the dispersion trade. It is also an opportunity to remind you of one of coolest non-sequiturs in cinematic history - Count Basie’s 30-second cameo at the end of Mel Brooks’ 1974 gem Blazing Saddles.

As mentioned above, in Section Two this week we are going to start with a review the ‘dispersion bust’ hedging strategy.

Don’t miss out! Please consider becoming a paid subscriber to receive the other 60% of the content the 🐿️ produces, member Discord access (The Drey) and even merch!

Last week, paid subscribers received a write-up on Swire Pacific, a deep-value China play:

Check out some feedback below from happy readers that have already taken the leap.