Are we there yet? Thoughts from the road.

The Blind Squirrel's Monday Morning Notes, January 8th, 2023.

Summary

As ever, being in listening and watching mode for the first week of the new year feels like a good discipline as bold themes and predictions of strategists hit the rocks of chaos of (sometimes eccentric) new year fund flows.

The start to 2024 has been no different. A good time to be (mostly) away from the buy and sell buttons.

A musing from the ‘Ole Chestnut’ gets the 🐿️ thinking about long duration assets once again (as we enter a massive week of inflation data).

The audio companion to this week’s note will be uploaded to Substack on Tuesday to allow me to incorporate comments and feedback from this note. It will also be available as a podcast on Apple, Spotify and the other usual podcast apps.

Are we there yet? Thoughts from the road.

The 🐿️s got back to Melbourne last night. With a national speed limit of 110kmph (yes, that’s 68mph!), covering the 1,500km journey took 2 full days of driving. The bad news is that I am running late on this week’s note. The good news is that I was able to consume about 10+ hours of podcasts that I might not normally get to.

Road trip etiquette has changed a lot from the 1970s and 1980s. The era of individual screens and devices has mercifully consigned ‘I Spy’ to the history books and ensures that the driver does not have trade podcast time for an occasional interruption from Taylor Swift or the The Wiggles. The “Are we nearly there yet?” refrain from the back seat sadly continues to this day.

The journey north was dominated by a ‘tour de force’ binge of the outstanding 'Empire' podcast’s History of the Ottoman Empire. The southbound return was fueled by a different form of ‘back to school’ material as the 🐿️ gathered his thoughts for 2024 markets.

As ever, being in listening and watching mode for the first week of the new year feels like a good discipline as bold themes and predictions of strategists hit the rocks of chaos of (sometimes eccentric) new year fund flows. The start to 2024 has been no different. A good time to be (mostly) away from the buy and sell buttons.

We wrote last Monday about stock / bond correlations: “If the past 2 months are anything to go by, Treasuries and stocks, which have been moving in lock step, look to me like the same bet.” They were certainly the same bet last week. This time moving down together (with pretty much everything except the dollar and oil (which may finally be paying attention to the Middle East?).

With energy back in the front of mind, the narrative of week 2 of the year looks set to revolve around inflation. Data from Japan, Australia, India as well as CPI and PPI in the US will give us plenty to chew over.

I am probably not alone in finding the combination of ‘soft landing’ victory dances and kite flying around the potential tapering of quantitative tightening to be a little contradictory. Week 1 saw about half of one rate cut priced back out of the market. Any signs of renewed strength in inflation could see further progress in that direction.

Out of the many hours of conversation that I listened to over the weekend, there is definitely one moment that is reverberating in my little brain. Regular readers will know how much I love listening to Morris Sachs and Liam Allen chatting about markets on ‘Inside baseball with Old Chestnut’.

Morris has forgotten more about the Treasury market than this rodent will ever know. He admits to having a “school of Dr Lacy Hunt” bias towards deflation and is therefore more often a buyer than a seller of long duration fixed income paper. After his traditional eulogy to the 2-Year note (“4.38% in yield feels ok”), what he had to say about long bond yields had me hit the recap button. Twice! (Listen from minute 18).

I may be reading too much into this. To be clear, if you listen to the whole conversation Morris is categorically not talking about the yield being off by hundreds of basis points. However, if the ‘spidey senses’ are tingling in a bond market OG like him, you need to sit up and take notice.

So, let’s take stock.

If the ‘soft landing’ narrative is correct, then there is (i) no anticipated downward force on wages and (ii) energy prices have very little reason to be languishing where they are now.

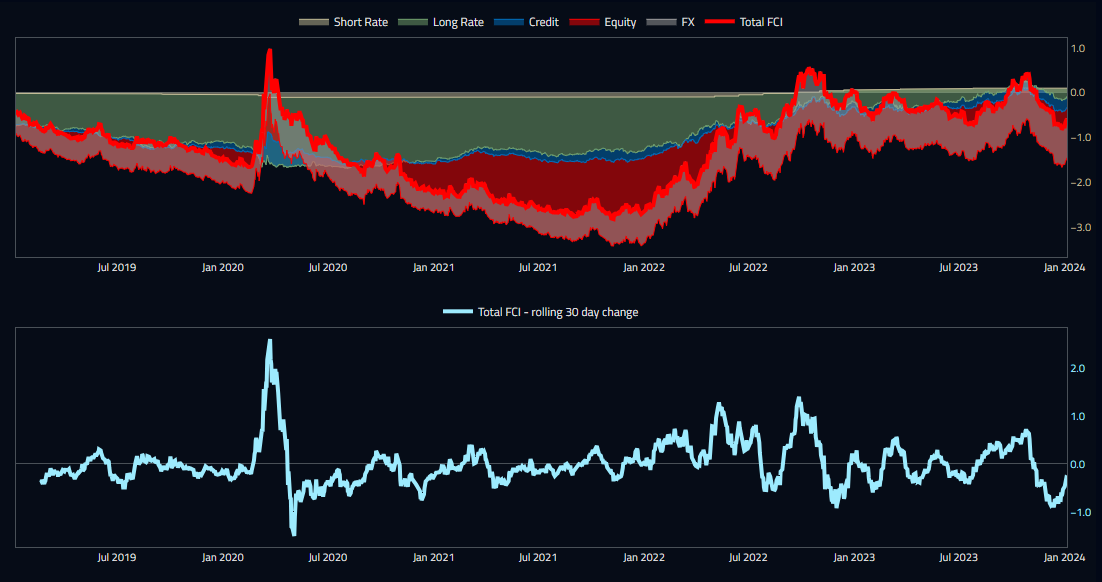

Back to my favorite breakdown of financial conditions. The past 10 weeks have seen some extremely volatile movements in conditions, but we remain firmly in ‘easy’ territory. And these conditions will only get easier if the Fed slows down the pace of quantitative tightening (as suggested by the Dallas Fed on Saturday).

We suggested last week that monetary policy is starting to be inextricably linked with political polling. My friends Le Shrub and Concoda are very clear that Mrs. Yellen is the architect. Last year, Jim Leitner famously styled the Treasury Secretary as the ‘Games Master’ who smart investors should watch like a hawk.

The ‘tin foil’ calculus goes as follows. It has been decreed that the risk asset party is going to be extended even if easy financial conditions risk triggering a resurgence of inflation. ‘They’ are going to ‘run it hot’, and that is before considering other ‘one-off’ inflationary inputs - container rates anyone?

Inflation is the ‘number 1’ enemy of the long duration bond investor. Absolutely not a rodent’s place to put words into the mouth of Ole Chestnut, but this 🐿️ just wonders whether or not that this is the risk that has Morris musing that the long bond yield “feels too low”.

I already knew that I was not in the market to own long duration assets (of either the fixed income or equity variety). The question remains, faced with a barrage of easy monetary policy (not to mention some treasury market plumbing shenanigans), when will it be safe to be short them? I think the short answer is not yet. In the meantime, hard assets (i.e. things that hurt when you drop them on your foot) look better by the day.

Final Thought(s)

A couple of final thoughts from this weekend’s road trip.

Thought #1 - A submarine in rural NSW: At about the half-way mark on the Hume Highway between Melbourne and Sydney you start passing tourist signs advertising a tourist attraction in the form of a World War II submarine installed in Holbrook, a rural New South Wales town that is 430 kilometers away from the nearest port. In the days before smart phones, the truly bizarre tale of how a ‘duck’s arse’ (shh - it’s a technical submarine term!) ended up in the middle of the bush would have probably remained a mystery.

Thought #2 - CAT 797s: My first boss in banking, the brilliant DH, was a former oil man (ex BP). He used to joke about “barge mounted docking facilities” (‘BMDFs’). We used to do a lot of work in emerging markets where there was always a cement company. Asking cement companies about BMDFs was always seen as a smart ‘inside baseball’ question. In a joke against himself (and other generalist investment bankers), BMDFs became code for that one scintilla of specialist knowledge that might give a prospective client the idea that you had some specialist knowledge of their industry.

Listening to Brandon Beylo’s excellent discussion with Chris Martenson yesterday, I acquired my new BMDF for the mining industry: The ‘CAT797’, aka those $5m, 400-ton beasts that haul coal and iron ore. I shall never use the generic term “giant dump truck” when discussing mining industry ever again!

That’s all for the front section this week. In the second section, for paid subscribers, we go through our latest Acorn and portfolio updates.