An afternoon with Guenther

The Blind Squirrel's Monday Morning Notes, 25th March 2024.

‘F1 weekend’ down in Melbourne this weekend. The 🐿️ had an encounter with the true star of Drive to Survive, Guenther “#*$%-ing hell, I have to call Gene!” Steiner. It got us thinking about the value of one of global sport’s major franchises.

In Section Two (for paid subscribers), we dig a bit deeper into Formula One as an investment. There is also plenty to discuss on our ‘right tail’ hedges, fixed income, coherent optics, Brazil and the UK in this week’s Acorn Review.

Welcome! I'm Rupert Mitchell aka The Blind Squirrel and this is my weekly newsletter on markets and investment ideas. If you've received it, then you either subscribed or someone forwarded it to you (add yourself to the list via the button below). Please also consider becoming a paid subscriber or gifting to a friend!

The audio companion to this week’s note will be uploaded to Substack on Tuesday to allow me to incorporate comments and feedback from this note. It will also be available as a podcast on Apple, Spotify and the other usual podcast apps.

An afternoon with Guenther

This weekend was the Formula One Australian Grand Prix down here in Melbourne. Last Wednesday, reader, old friend and motorsports ‘insider’ Matt Marsh kindly invited me to come along to watch him ‘in conversation’ with F1 veteran Guenther Steiner. Steiner’s role was, until recently, Team Principal of Haas F1 but most know him best as the true star of the Netflix docuseries ‘Drive to Survive’.

Guenther charmed a packed (and knowledgeable) audience with tales from a pretty extraordinary career in motor racing. Before you wonder how the 🐿️ is going to segue this anecdote into a weekly letter on markets, rest assured that your rodent had been in a position to plant Guenther’s first question from Matt. “So, Guenther, how would you describe the macro headwinds facing F1?” - my friend knew that the 🐿️ is always in the hunt for new material!

The recent dominance of Red Bull Racing and its lead driver Max Verstappen has had many pundits worry that a lack of competition at the front of the grid might start to put off some of the sport’s many millions of new fans. Some have even called for further rule changes to erode Red Bull’s strangle hold over the championship. Well, at least until this weekend!

Guenther told us to relax on that front. It is not all down to money (at least as far as the racing is concerned!). In the relatively new (and now reducing) world of team budget caps, competitiveness comes down to a lot more than just capital. Fans are forgetting that it was only 3 years ago that Mercedes’s 7-year winning streak in the Constructors’ Championship came to an end.

In the insanely competitive world of F1, every margin of potential advantage is exploited. For some teams, the silver medal is not enough!

This may strike you as a tiny thing, but my host told me at lunch the previous day that he flew down to Melbourne on the same flight as the entire Red Bull support team. He had observed that every single mechanic and crew member was in amazing physical shape. They would not have been indulging in the same veal ragu that Matt and I were enjoying! Small margins (or should I say narrower waistlines!) of advantage.

The best of engineering and human capital is constantly being sought at every level of a team structure that contains as many as 1200 people. The evolutionary process by which Mercedes was ultimately toppled from its perch is almost ‘Darwinian’ - the headhunting of a garage manager here, or a software specialist or aerodynamics expert there lead to the gradual erosion of dominance by a single team.

I suspect that we can be comfortable that a different team will wear the crown before long and we can now relax and focus on the business of F1. Since its acquisition in 2017 by John Malone’s Liberty Media, Formula One has enjoyed a meteoric rise in global popularity and in its valuation.

The release of the sport from the dinosaur-like clutches of its previous owner, the diminutive, convicted fraudster Bernie Ecclestone, have provided it with a completely new lease of life.

In Ecclestone’s day, before the Liberty Media revolution, lower ranked teams were in constant financial trouble, often reliant on bailouts from billionaire benefactors on the lookout for driver seats for their offspring to avoid falling off the back of the grid. Fast forward 7 years, and even the “smallest teams are worth as much as $1 billion”.

Guenther shared this particular fact with a truly honorable (if ironic) smile when you consider the fact that he had zero equity in the team from which he had been just let go but that he had effectively created for Gene Haas. By contrast, his friend Toto Wolff, the Team Principal of Mercedes F1, owns 33% of an entity which was recently valued at $3.8 billion by Forbes.

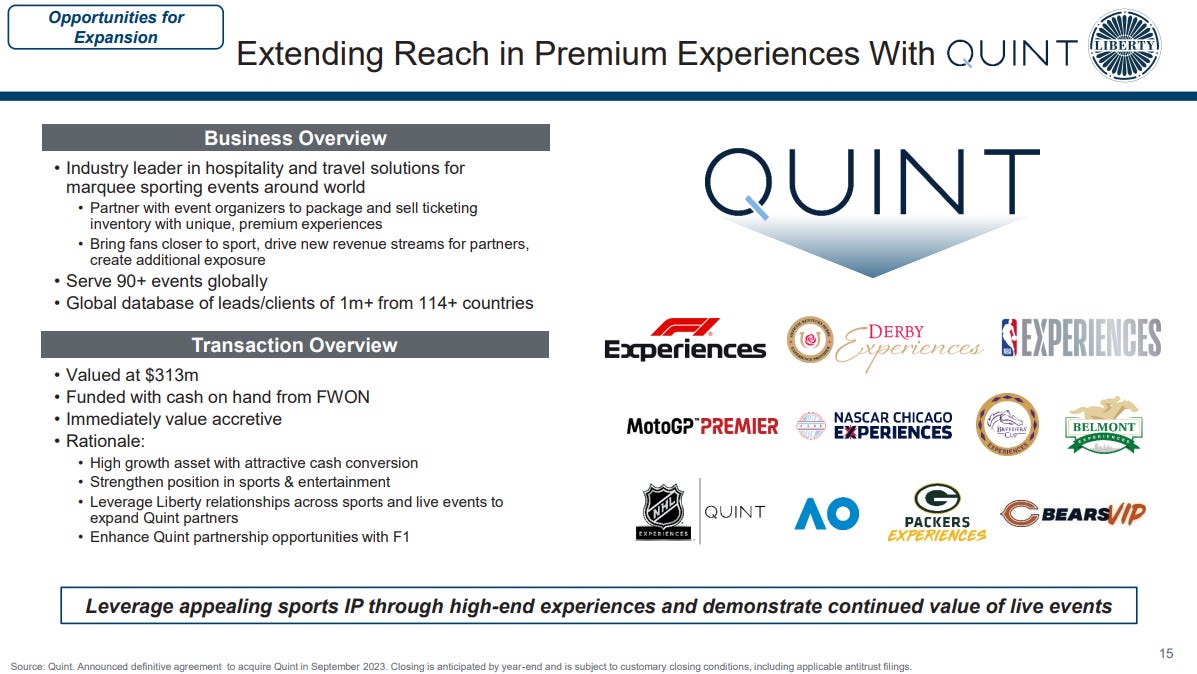

The growth in F1 team values in the past 2 years is estimated to be as much as 500%. Liberty CEO Greg Maffei credits this fact to the focus on the franchise value of the sport as a whole.

Maffei: “One of the things that we at F1 with Liberty's help have been trying to do is build a mentality that I'll credit the NFL for, which is one league, that we benefit when everybody benefits… It was critical that [small teams] had a prospect of making money.”

Liberty Media certainly also was not slow to identify the value of those clicks and tweets that were dismissed by Ecclestone. The company also understood the value in diversifying its fan base by age, gender and geography! The collaboration with Netflix was clearly a masterstroke.

Watching F1 ‘live’ at a Grand Prix event is fast becoming a ‘take out a second mortgage’ activity. Simple ‘park passes’ (an audio only experience - good luck seeing more than a glimpse of a race car!) will cost a family of 4 over $1000. Hospitality packages can stretch to tens of thousands of dollars. Not an issue. Tickets at all price brackets sell out in minutes. Clearly not a reliable recession / ‘cost of living crisis’ indicator!

However, the new growing fan base is being just as effectively monetized via an expansion of the IP into new content such as merchandise, direct TV (F1 TV) and other ‘off track’ live ‘experiences’. There will always be a massive market for Ferrari key rings among those that will never afford the super cars themselves!

Under new ownership, F1 also looks to be finally making serious inroads into a conquest of the lucrative US market that has eluded the sport for decades.

Now I am sure that the restaurants and bars of Melbourne’s ‘Little Italy’, Carlton, would have been buzzing last night off the back of Ferrari’s spectacular ‘1-2’ finish. Red Bull were nowhere near the podium. So much for another boring procession! I think we can relax about those ‘macro headwinds’ for Formula One for now.

The 🐿️ is also feels that the Haas team finally getting some championship points (placing in P9 and P10) would have probably been a bittersweet moment for my ‘new friend’ Guenther. However, this past week has definitely got me thinking that the value of the F1 franchise is only just at the beginning of the price discovery process that was kicked off by Liberty’s takeover.

FIFA and the IOC get to engage with global eyeballs once every 4 years with the (soccer) World Cup and the Olympics. F1 is on our screens (large and small) every other weekend of the year and then offers up a bingeable event on Netflix in the off-season! It is also pretty clear to this rodent that there are multiple ‘cover bidders’ (mostly from the same neighborhood) for the asset that are lurking in the wings.

That’s it for the front section this week. In Section Two (for paid subscribers), we dig a bit deeper into Formula One as an investment. There is also plenty to discuss on our ‘right tail’ hedges, fixed income, coherent optics, Brazil and the UK in this week’s Acorn Review.