Acorn: Ben Graham’s Electric Car

Our play on passenger vehicle electrification. Probably not what you were expecting.

3rd March, 2023

Summary

For someone that has never had any interest in cars, the 🐿️ surprisingly managed to find himself as an automotive executive for a few years. In an electric vehicle start-up. Those years are informing this view.

Tesla or other EV-only start-ups? Leaving them to the Robinhood crowd.

Copper? It’s a great related trade and we already have it on as a core position in the portfolio.

We look at the EV battery supply chain.

Battery OEMs? The ‘big 3’ in China / North Asia are the obvious candidates. Market leader, CATL, is tough to buy (China listed) and not cheap.

Battery metals and related technologies? Liquid lithium plays, SQM and ALB probably the best bet but not for us for now. We also give a quick shout out to an existing EV battery tech position in the portfolio, NANO.

So, what’s the Acorn? We are buying Mercedes Benz (‘MBG’). Yes, after a long-winded tour of battery chemistry, high technology and supply chains, buying the 97-year old German OEM is the idea. This is an EV play for Ben Graham, the “Godfather of Value Investing”.

We believe that MBG’s refocus on electrification and the luxury end of its offering justify a move away from traditional automotive multiples (towards luxury). If not, it is still an inexpensive stock by it own historical norms.

As our new Acorn trade, we have purchased a strip of December 2023 call options on MBG, that offer a leveraged exposure to an upside rerating of the stock.

Background

For someone who historically never had a remote interest in cars, the 🐿️ surprisingly managed to find himself as an automotive executive for a few years (yes, a real job 😉). Three years at the heart of an ‘Smart EV’ start-up in China took me up a very steep learning curve in an industry that touches on multiple areas of expertise from marketing, manufacturing, natural resources and battery chemistry to machine learning and smart cities.

The electric vehicle investment theme fast became the preserve of stock promoters and carnival barkers…and I am not just talking about everyone’s ‘favorite’ aspiring Mars colonist.

The electrification of passenger vehicles is a broad topic and I wanted to take a step back to figure out how to make money in a way that is not reliant on the greater fool theory that is buying narrative stocks. In the ‘story’ category I include pre-production lithium miners as much as car companies that do not yet sell cars.

I think we can safely say that we are probably (thankfully) over the ‘SPAC phase’ of the electric vehicle revolution. I am sure that there is still tons of fun to be had in the event driven world of Fisker, Lucid and Nikola short squeezes but we shall leave that for the Reddit / Wall Street Bets crew (and for Ken Griffin to take their money). Enough ink has been spilled over Tesla (very much not a stock for the 🐿️) and if you want a pure(ish) EV play in China, there is no point in looking much beyond BYD (sorry guys, NIO, XPeng and Li Auto are just trading sardines - detailed view is not for publication, but I would be happy to elaborate over a beer or a glass of decent wine).

Then there is the supply chain. Stripping out the elements that are specific to EVs, you have:

Copper. Largely as a function of the copper coil within an electric motor, the average EV requires about 4 times that of an fossel fuel-powered passenger vehicle. Copper also plays a massive role in the infrastructure aspect of electrification (e.g. grid redevelopment) as well as it’s conventional role elsewhere in construction and manufacturing.

We see strong arguments for higher copper prices even absent demand pressures from an EV industry which will only account of 20% of annual production at the highest estimated levels of penetration of the new passenger vehicle market. We have a large core position in the main portfolio (principally futures and $CPER, the futures backed copper ETF, which we favor over the miners). We love copper, it’s just not the focus of this Acorn.

Cobalt. The EV industry’s dirty little (not so) secret (working conditions and child exploitation in the dominant DRC mining industry). It will sadly be some time before cobalt can be designed out of an EV’s bill of materials. Until then, the ‘few hundred dollars’ of associated cost largely removes the risk of battery pack overheating (and associated recall risk) and is therefore effectively irreplaceable.

Most cobalt mining and production takes place within the large resource conglomerates (BHP, Vale, Glencore). CMOC (3993.HK), formerly China Molybdenum, is the closest thing to a pure play. Be warned, that stock comes with plenty of hair. No easy way to play cobalt directly.

Nickel. The Ni alloy is a critical component to the two most common EV battery chemistries, NCM and NCA. Currently, Indonesia is the “Saudi Arabia” of the nickel industry, and will probably account for around 60% of global output by the mid 2020s.

Chinese battery OEMs and their suppliers have been early to invest and dominate the market there. Tough to find a pure play investment expression. Indonesia’s role in the global energy transition will, however, be significant. Probably best way to play nickel is via owning the Indonesian Rupiah or by having local currency sovereign bond exposure.

Important to note that pig iron production practices in Indonesia are highly carbon intensive. In the future, ESG requirements on Western Auto OEMs are likely to put a premium on sources of ‘clean’ nickel. This will be an emerging investment thematic. Again, not the Acorn, but I would not be true to my newly adopted country if I did not mention an Oz-listed micro-cap play on the ‘clean nickel’ theme. Adavale Resources ($ADD.ASX) is developing a Tanzanian clean nickel play with BHP. It also has a uranium prospect north of Adelaide (what not to like 😉!). Market cap sub A$10m. No 🐿️ position, but we are keeping an eye on it. If you are ‘down under’, you can put it on your Hot Copper watch list!

Lithium. Alongside cobalt, lithium is where mass adoption of EVs creates a MAJOR mineral resource bottleneck. By some calculations, a fully scaled EV market will require almost 6 times the amount of lithium currently mined annually. Realistic replacements for lithium in the battery manufacturing process are at least a decade away, however much Musk (and others) shill about ‘solid state’ or Sodium-Ion technologies.

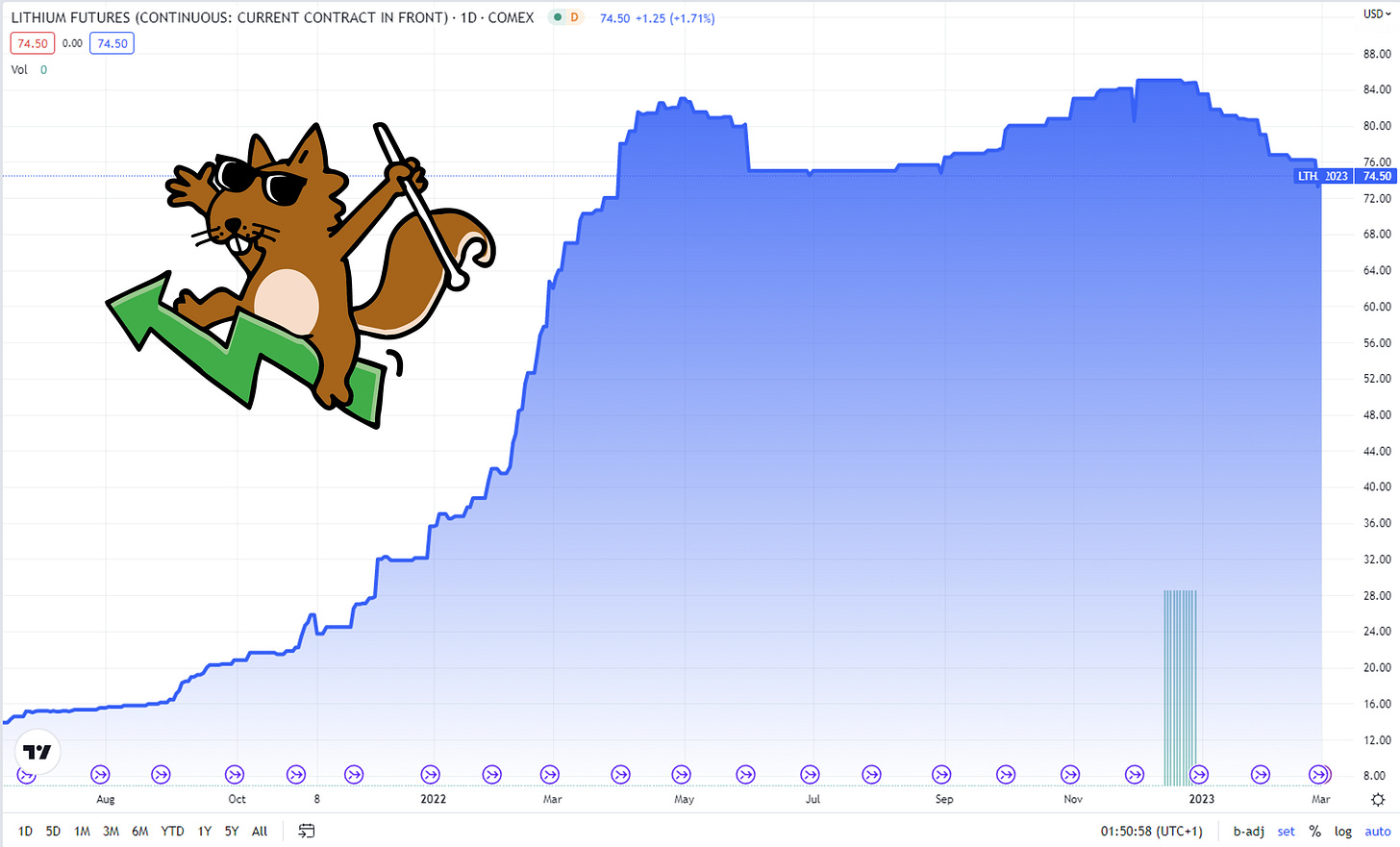

Early in 2022, the market really woke up to that fact (but it has not done a lot in terms of price for the past 12 months):

The lithium miners have also been on a wild ride. The 2 ‘grown-ups’ (i.e. institutional names) in the lithium mining business are SQM and Albemarle. Lithium Americas Corp is the largest and most liquid of the cohort of pre-production lithium miners, a veritable hotbed of stock promotion, but where you go can shopping for ‘torque’ when the market is hot - but count your fingers!

The 🐿️ has owned both SQM and ALB in the past and will reconsider them again when and if they start trending properly (both are currently chopping around beneath their 200-day SMA but beginning to look interesting on longer timeframe (weekly and monthly) charts) 👀 (will keep you up to speed on this).

Next you need to consider the battery manufacturers, where there are basically only 3 publicly listed games in town (as well as a bunch of privates): CATL, China’s 800-pound gorilla of the sector, Panasonic of Japan (Tesla’s original cylindrical cell partner) and Korea’s LG Chem.

These 3 major battery players are undoubtedly strategically important businesses, especially CATL - arguably the TSMC (on steroids) of the battery world. However, I have a hunch that they risk becoming geopolitical footballs in our increasingly multi-polar world. Potential for state-sponsored competition from the West? Probably. They are also certainly not cheap stocks.

For those readers looking for a ‘one stop shop’ for the EV battery supply chain, Global X manages $LIT, its Lithium & Battery Tech ETF. Koyfin overview via this link. Not a perfect product (contains a couple of Auto OEMs) but a decent proxy for the overall value chain.

At this point, I also want to give a shout out to a related EV battery play that we have owned in the main portfolio for a while and which we have been working on with Will at Nutstuff. This is TSX-listed small cap, Nano One Materials Corp. Nano produces high performance battery cathode materials, based around their patented ‘one pot’ process. Strategic Investment from Rio Tinto and some some very smart ‘clean tech’ money. Industrial partnerships with BASF and Umicore. Non-dilutive government grants. Nano also recently picked up Johnson Matthey’s Canadian manufacturing facility and is already working with 3 large automotive OEMs in North America. A highly speculative VC-style bet, but do get in touch with me or Will if you want the full story.

So 🐿️, what’s the actual idea?

We are buying Mercedes Benz (‘MBG’). Yes, after a long winded tour of chemistry, high technology and supply chains, buying a 97-year old German OEM is the idea.

Mercedes’ Electric Future

While I was working for that EV start-up in Shanghai, one of the most common questions I dealt with from potential investors and stakeholders was “how are you going to cope when the Germans come to get you?”.

Our responses confidently cited arguments along the lines of:

“Their sunk investment in legacy Internal Combustion Engine (‘ICE’) technology and platforms makes them unwilling and unable to embrace and re-invest in the electric revolution”

5 years on, the message from Stuttgart is a resounding Halte mein Bier….

“They are unwilling to embrace the technology / connected car / ‘smartphone on wheels’ aspect of the EV story”

Well, that didn’t take long…

“The service revenue supported business models of the distribution / dealership networks of the legacy OEMs will not support / be sustainable in a world of EVs with de minimis servicing requirements and will not allow for direct sales”

Oh! I guess they figured that out too…

“We are years ahead in ADAS and Autonomous Driving technology”

Achievable goals (SAE L-3) promised and delivered using the right technology (yes, you need LIDAR Elon!)

“The new consumer is looking for new brands”

I see your mando-pop star and raise you a Janis Joplin and Netflix’s ‘Drive to Survive!’

You don’t have to look hard on Twitter to find the Chinese EV ‘fan-boyz’ (or are they PR bots?) touting the same lines.

The 🐿️ is more than happy to take the other side of that bet.

Mercedes’ embrace of luxury is key

The battery supply chain bottlenecks described above are going to be a complete nightmare for the automotive industry. CEO Ola Källenius plans to take MBG above the fray to a market segment where higher margins can happily support a manufacturing bill of materials bloated by restricted supply of battery metals and cell manufacturing capacity: the luxury segment.

This makes perfect sense. MBG are taking themselves out of the volume game to focus on the core and top-end luxury segments. The older, wealthier consumers in these segments have the ability to withstand the bumpy economic road likely to be ahead of us. These wealthy consumers are also likely to be the early adopters of EVs, especially outside of China. Let’s be clear, outside of China, EVs ARE a luxury item.

The ASPs (and margins) of these segments will insulate MBG from the costs arising from tightness in the battery cell supply chain. And those costs can definitely be passed on. This feels like a very sensible strategy to us.

And did I tell you that the stock was cheap and that the company had just announced sensible guidance with a meaningful dividend bump (now indicated at over 7%) as well as a EUR4bn buyback plan?

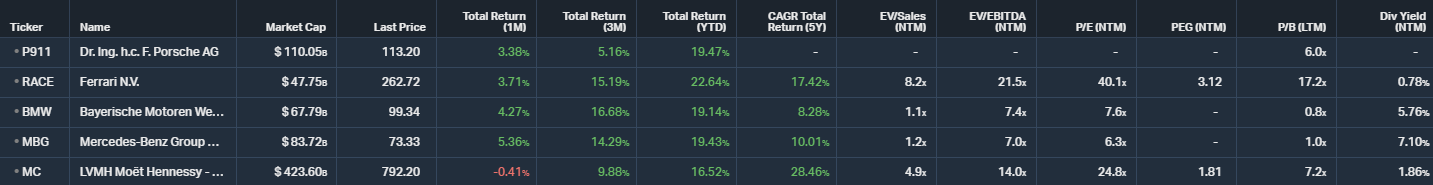

In the table below, I chart MBG versus Ferrari, BMW, Porsche and the crown jewel of luxury stocks, LVMH.

Why LVMH?! We sold LVMH out of the portfolio over 250 euros ago in share price terms. We got shaken out when we thought that their wealthy Chinese customer base might be locked in China forever. Luxury has been a fabulous asset class in recent years but the ‘nosebleed’ valuation has never let me back in. How about buying luxury on a mid-single digit PE multiple (25% of LVMH’s multiple)?

I grant that this is a bit of a leap of faith, albeit I hope informed! Without this faith, you are contending with the multiple ‘trap’ history. As you can imagine, raising money for a car company forced me to look a lot of trading ‘comps’ tables for car companies. One thing jumps out when you look at them - pretty quickly you realize that typical, mature automotive OEMs consistently trade on an EV/Sales multiple of 1x to 1.3x over time. Can a newly positioned (as a luxury play) MBG break free from these shackles?

If it cannot break free from the ‘multiple trap’, MBG is still trading towards the low end of its historical range in terms of EV/EBITDA, PER and P/BV. At the very least, reversion to the mean or high end of this range would seem justified in the context of Källenius’ restructuring plans. A transition to a luxury multiple would be ideal, but we can make money on a regular re-rating.

Time to break out the crayons for a quick technical overview. MBG has been trending beautifully (stacked moving averages) since it broke out and re-tested is 200-day SMA in November (circled in pink below).

On a shorter timeframe, it has pulled back to the middle of a channel (21-day EMA) that has been well defended since the November breakout.

Implementation

We like the long term MBG story and it will undoubtedly take some time for the market to start awarding the company a luxury multiple. We would happily own the shares outright or paired against a European mass-market automotive OEM (e.g. Renault (RNO) or Stellantis (STLA)). At a low single digit PE, with a high single digit dividend yield, MBG is certainly something to happily tuck away at the back of your value book.

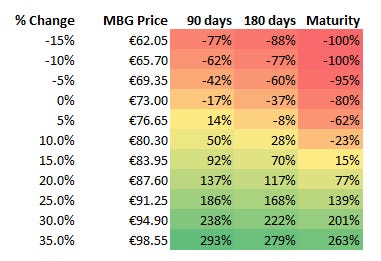

We are choosing to take a more leveraged exposure to the story via a strip of call options struck at EUR68, 76 and 84 per share in a ratio of 3/5/5. The options all have an expiry of 15th December 2023 and are pretty liquid (thousands of contracts of open interest). We are investing 1.5% of portfolio NAV in this strip. The goal of the structure is to have a meaningful exposure to the underlying MBG price from day 1 (via the high deltas of Leg 1 and Leg 2) with some additional upside leverage from the ‘Leg 3’ out-of-the-money strike calls.

Unfortunately, our friends at OptionStrat do not yet cover listed options on European underlying securities. A numerical illustration of the P&L of this strip as at 2nd June 2023 from the “Performance Profile” function on Interactive Brokers TWS.

Illustrative return profile under a range of price and time assumptions.

Final Thought (with apologies to Janis Joplin)

🎵🎵Oh Lord, won’t you buy me a Mercedes Benz,

The ‘fan-boyz’ have Teslas, and I must make amends🎵🎵

If you act on anything provided in this newsletter, you agree to the terms in this disclaimer. Everything in this newsletter is for educational and entertainment purposes only and NOT investment advice. Nothing in this newsletter is an offer to sell or to buy any security. The author is not responsible for any financial loss you may incur by acting on any information provided in this newsletter. Before making any investment decisions, talk to a financial advisor.